Oracle Stock Soars On $455b AI Cloud Deals – Can Investors Bet On It Catching Google By 2030

Image Source: Pixabay

Oracle Corporation (NYSE: ORCL) is no longer just a database and enterprise software giant. It’s transforming, boldly and aggressively, into a cloud and AI infrastructure contender with ambitions to rival Amazon, Microsoft, and Google.

While many investors still view Oracle as a “second-tier” player, the latest results tell a different story: record-breaking cloud bookings, landmark AI contracts, and massive data center expansion are redefining its trajectory.

In its latest quarter, Oracle reported solid revenue growth, with cloud services leading the way. The standout figure was a surge in Remaining Performance Obligations (RPO) to a record level, fueled by a multibillion-dollar AI deal with OpenAI. Despite narrowly missing earnings estimates, Oracle’s stock soared more than 35%, a clear signal that Wall Street is focused on its long-term AI potential rather than short-term fluctuations.

Oracle’s vision is ambitious: scale its cloud infrastructure revenue nearly eightfold by 2030, putting it on track to compete directly with Google Cloud. To achieve this, the company is ramping up capital investments and building out global data centers. Partnerships with Microsoft Azure, AWS, and enterprise customers like Meta and NVIDIA are accelerating adoption, while Oracle’s entrenched database ecosystem provides a sticky base for cloud and AI growth.

AI is at the core of this strategy. As businesses shift from training AI models to deploying them in real-world applications, Oracle is positioning itself as a critical infrastructure provider. Its role in the massive “Stargate” project with OpenAI places it at the heart of one of the largest AI buildouts in history.

By offering both multi-cloud flexibility and private cloud options, Oracle is creating long-term, recurring revenue streams that strengthen its position as an AI cloud backbone.

Risks remain. Oracle’s scale still lags behind the top hyperscalers, its aggressive spending has turned free cash flow negative, and debt has climbed significantly. Much of its upside also depends on OpenAI, a customer that isn’t expected to turn profitable until later in the decade. Add in a lofty valuation, and execution risk is high.

Still, if Oracle can deliver on its backlog and growth targets, it could evolve from a legacy software vendor into one of the fastest-growing cloud platforms of the AI era.

The big question for investors: is Oracle’s $455B bet the start of a catch-up race with Google by 2030 – or a high-stakes gamble on AI hype?

Let’s break it down using the IDDA Framework: Capital, Intentional, Fundamental, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Thinking of investing in Oracle? Here are some key questions to consider:

Do you want exposure to one of the fastest-growing AI and cloud infrastructure stories, with $455B in future bookings already locked in?

Are you looking for a company making a bold push to scale its cloud revenue nearly 8X by 2030, potentially catching up to Google Cloud?

Do you believe in the long-term value of Oracle’s enterprise relationships, sticky databases, and growing role in powering AI workloads?

Oracle is no longer just a database company. Its aggressive push into Oracle Cloud Infrastructure (OCI) has turned it into a serious contender in AI driven cloud computing. With major deals secured from leading AI firms and strong momentum in its cloud business, Oracle is proving it can compete in a market long dominated by AWS, Azure, and Google.

To support this growth, Oracle is investing heavily in expanding its global data center footprint. These investments are building the backbone required for AI training and deployment at scale, while its established database ecosystem gives it an advantage in retaining enterprise customers and making cloud adoption easier.

Still, risks remain. Oracle’s cloud scale lags behind the biggest hyperscalers, its heavy spending has weighed on cash flow, and much of its AI growth story depends on one major customer. Its valuation is also elevated, meaning strong execution will be critical.

For long-term investors who believe in the growth of AI and cloud infrastructure, Oracle offers a high-upside opportunity but with higher risks than its larger, more established peers. Whether it fits in your portfolio depends on your strategy: a bold growth play with execution challenges, or a steadier compounder like Microsoft or Amazon.

IDDA Point 3: Fundamental

Oracle delivered strong Q1 FY26 results, showing solid revenue growth, though just under analyst expectations. Cloud services were the main driver, with Oracle Cloud Infrastructure (OCI) seeing especially strong momentum. Despite still being viewed by some as a second-tier provider, Oracle’s rapid progress in cloud is helping it win market share and catch investor attention.

The standout was Oracle’s record backlog of future cloud commitments, fueled by major AI infrastructure deals, most notably with OpenAI, and partnerships with firms like xAI, Meta, NVIDIA, and AMD. This provides clear visibility into long-term growth. Management is confident Oracle can scale its cloud infrastructure business to a level comparable with Google Cloud by the end of the decade.

Oracle’s multi-cloud strategy is another strength. Partnerships with Microsoft Azure and Amazon AWS have significantly boosted multi-cloud revenue, while Oracle continues expanding its global data center network. Its integration with existing databases makes it easier for enterprises to adopt AI, and its private cloud solutions are drawing interest from industries such as manufacturing, aerospace, semiconductors, and energy. This positions Oracle to benefit not only from AI training but also from the broader shift toward real-world AI applications.

This growth story comes with heavy investment. Oracle is spending aggressively to expand its data center capacity, which has pushed cash flow into negative territory and is expected to keep it there for the next few years. However, underlying cash generation remains strong, and these investments are designed to secure Oracle’s place as a long-term AI cloud provider, making it harder for customers to switch away once locked in.

On the financial side, Oracle’s debt levels have risen sharply in recent years, and the company now trades at a premium valuation compared with peers like Microsoft and Amazon. Even so, analysts remain optimistic, raising fair value estimates and long-term price targets. If Oracle can successfully convert its massive backlog into actual revenue, it could evolve from a legacy software vendor into one of the fastest-growing cloud platforms of the AI era.

Fundamental Risk: Medium – High

IDDA Point 4: Sentimental

Strengths

Scaling OCI retains customers, shifts workloads to cloud, and drives new service revenue.

Oracle’s relational database likely to maintain leadership with strong features like load-balancing efficiency.

OCI’s flexibility and ease-of-use can attract first-time users; AI demand adds further growth tailwinds.

Risks

Risk of slower growth if customers choose specialized databases over Oracle’s.

Smaller scale vs top hyperscalers makes Oracle less cost competitive.

Highly leveraged balance sheet limits flexibility and acquisition capacity.

Investor sentiment toward Oracle is broadly bullish, fueled by record RPO growth, rapid AI-driven cloud adoption, and the company’s underdog status compared to larger rivals like AWS and Microsoft. The stock has surged on optimism that Oracle could grow its cloud revenue eightfold by 2030 and potentially rival Google Cloud, with analysts lifting price targets as a result. However, caution remains due to premium valuations, persistent negative free cash flow, and rising debt tied to aggressive AI-related CapEx.

Concerns also center on Oracle’s heavy dependence on OpenAI, an unprofitable customer that may not generate profits until 2029, raising risks around execution and financial stability. Overall, while the long-term growth story is compelling, investors remain mindful of short-term volatility and the need for flawless delivery to justify Oracle’s elevated valuation.

Sentimental Risk: High

IDDA Point 5: Technical

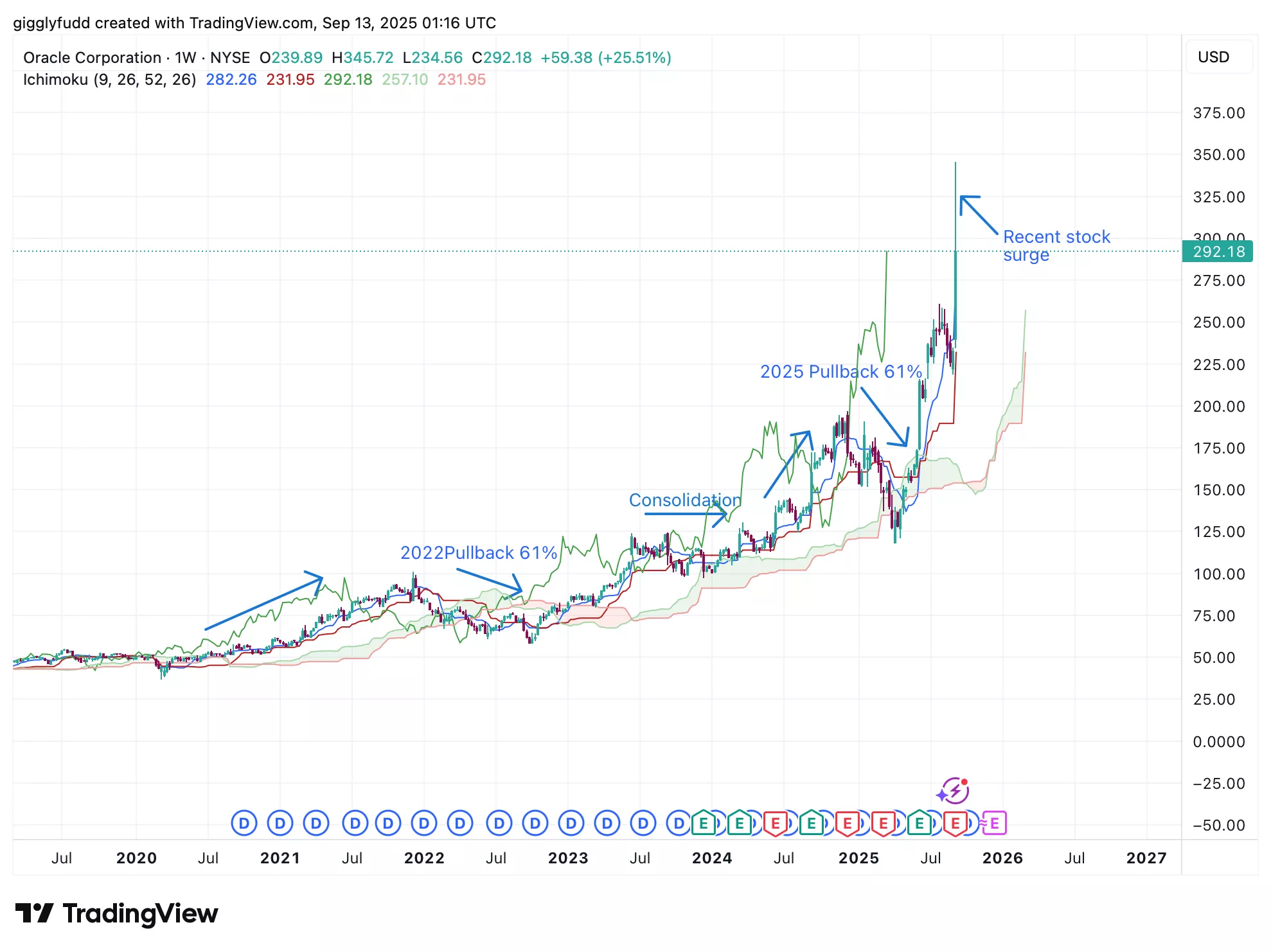

On the weekly chart:

The current candlestick is long and bullish, reflecting strong buying sentiment.

Oracle’s stock has been steadily climbing, with only two major pullbacks of around 61%.

Historically, bullish Ichimoku clouds have outweighed bearish ones- signaling sustained long-term momentum.

On the weekly chart, Oracle shows a clear uptrend. The stock pulled back around 61% in 2022, consolidated through the latter half of 2023, then resumed climbing before another 61% retracement in 2025. Now, the latest candlestick is a strong bullish bar, highlighting renewed demand and sentiment fueled by Oracle’s record AI cloud deals.

(Click on image to enlarge)

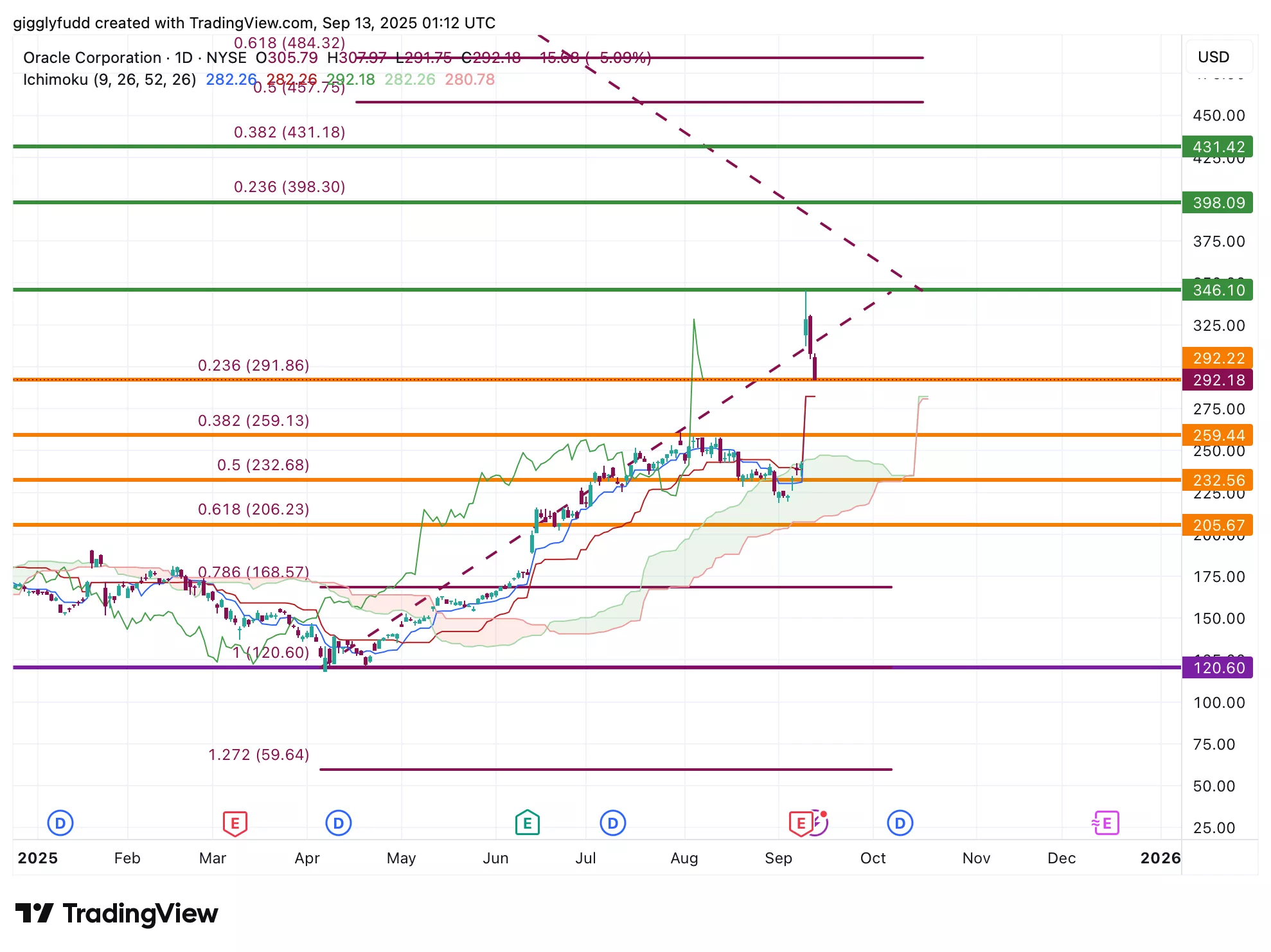

On the daily chart:

Oracle’s stock jumped from 238 to a new high of 345 on Sept 10, establishing fresh resistance.

The future cloud remains bullish, with candlesticks positioned above the cloud—showing strong upward momentum.

A bearish engulfing candle pattern, along with the Kijun line has crossed above the Tenkan line (a “death cross”), signaling a potential pullback or correction.

On the daily chart, Oracle’s stock surged from 238 to a new high of 345 on September 10, establishing a fresh resistance level. The Ichimoku future cloud remains bullish, with candlesticks positioned above the cloud—indicating strong underlying momentum. That said, a bearish engulfing candle pattern and the Kijun line has crossed above the Tenkan line, forming a “death cross.” This suggests that, despite the broader bullish trend, the stock may be entering a short term pullback or correction before resuming its upward trajectory. Historically, pullbacks have retraced about 61%, which would imply a potential drop toward the 206 level, aligning with the lower band of the Ichimoku cloud.

If the price holds above this support, a rebound and continuation of upward momentum remain likely. Currently, the stock is also testing the 23% Fibonacci retracement level, making this a key area to watch.

(Click on image to enlarge)

Investors looking to get in ORCL can consider these Buy Limit Entries:

292.18 (High Risk – FOMO entry)

259.44 (High Risk)

232.56 (Medium Risk)

205.87 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

346.10 (Short term)

398.09 (Medium term)

431.42 (Long term)

Hold (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Oracle (ORCL)

Oracle is no longer just a legacy database company – it’s transforming into a bold player in cloud and AI infrastructure. While it still trails the hyperscaler giants, its record-breaking bookings, aggressive data center buildout, and deep ties with leading AI firms are shifting the narrative.

The company’s core advantage lies in its sticky enterprise relationships and the integration of its database ecosystem with cloud services, giving customers fewer reasons to switch. At the same time, Oracle is making heavy investments to expand its cloud footprint, positioning itself to capture long-term demand for AI training and inference.

Yet challenges remain. Oracle’s scale is smaller than its peers, its spending spree has pushed cash flows into the red, and much of its near term upside is concentrated in a few high profile AI deals.

Valuation is also elevated, meaning flawless execution is key. Still, if Oracle can successfully convert its backlog into revenue and maintain momentum, it could evolve from a “second-tier” cloud provider into a true rival to Google Cloud by the end of the decade.

Key Takeaways:

The biggest reason Oracle could be setting up for long-term growth isn’t its legacy software – it’s the massive shift toward AI-driven cloud infrastructure. For long term investors, Oracle offers exposure to surging AI demand, sticky enterprise customers, and a bold strategy to scale its cloud revenue.

For short-term traders, recent momentum has been strong, but risks around pullbacks, high spending, and execution remain. Entry points may emerge during corrections, while confirmed breakouts could signal Oracle’s next leg higher.

Overall Stock Risk: Medium – High

More By This Author:

3 Reasons Wall Street Could Be Wrong About Salesforce Stock

Meta Just Committed $600 Billion – And Wall Street Isn’t Paying Attention (Yet)

One Big Reason SentinelOne Stock Could Be A Hidden Winner In Cybersecurity