Meta Just Committed $600 Billion – And Wall Street Isn’t Paying Attention (Yet)

Image Source: Pixabay

Meta (Nasdaq: META) just unveiled one of the most ambitious investment plans in tech history – yet Wall Street seems more focused on TikTok trends than trillion dollar infrastructure. At a recent White House round table, Mark Zuckerberg revealed Meta is planning to spend at least $600 billion through 2028 on U.S. data centers, AI infrastructure, and next-gen platforms. That’s not a typo – six hundred billion.

While this might sound like a moonshot, the strategy is crystal clear: Meta isn’t trying to ride the AI wave, it’s building the rails. With over 4 billion users and dominant platforms like Facebook, Instagram, WhatsApp, and Threads, Meta is now embedding AI into everything from content delivery and advertising to chips and infrastructure. The company’s AI vision goes beyond flashy demos. It’s creating the backend of the attention economy and doing it at an unmatched scale.

The financial engine powering this vision is Meta’s highly profitable ad business. With better targeting, rising engagement, and smarter recommendation algorithms, Meta continues to print cash which it’s aggressively reinvesting into AI talent, infrastructure, and long-term growth. And while its rivals chase hype, Meta is methodically executing designing custom chips, scaling data centers, and quietly monetizing under-the-radar platforms like WhatsApp and Threads.

Video Length: 00:03:49

Yet, despite record earnings, soaring margins, and a rebound from its 2022 slump, many investors still treat Meta like a high-risk growth stock. Concerns about regulation, Reality Labs losses, and AI competition have held back valuations leaving the stock trading at a discount to peers like Microsoft and Nvidia. But if Meta’s infrastructure bet plays out, that discount could flip into a premium.

Which brings us back to the title: with $600 billion on the table, a massive AI ecosystem in progress, and Wall Street still distracted… is Meta the most underestimated AI stock in Big Tech?

Let’s break it down using the IDDA framework: Capital, Intentional, Fundamental, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Thinking of investing in Meta? Here are some key questions to consider:

- Do you want to invest in a company that controls every stage of the digital ad journey—from user behavior and targeting to placement and conversion?

- Are you looking for exposure to a business that’s weaving AI into all areas of its operations, not just experimenting with it?

- Do you believe digital attention is today’s most valuable resource—and Meta is building the infrastructure to monetize it?

Meta is going all in on AI, not just with flashy features, but by rebuilding the foundation of how it operates. It’s designing custom AI chips, reengineering its ad systems, and rolling out smarter, more personalized ad experiences across Facebook, Instagram, WhatsApp, and Threads. Every second of user attention is being optimized for relevance and monetization.

Behind the scenes, Meta is investing tens of billions into future tech – AI data centers, AR hardware, and next gen platforms. This isn’t about chasing trends. It’s about owning the rails of tomorrow’s attention economy. Even lesser-known products like WhatsApp and Threads are now being monetized, showing Meta’s focus on deepening value where it already leads.

That said, Meta’s growth path isn’t without bumps. Investors saw this in 2022, when heavy investment and market shifts led to a sharp drop in the stock. While it bounced back stronger, such volatility might not be right for everyone – especially those with a shorter investment horizon or lower risk tolerance.

For long-term investors who believe in the power of AI and digital platforms, Meta stands out as a strategically positioned tech leader. But like any high-growth company, it comes with swings. Whether it fits your portfolio depends on your belief in its long-term vision and your comfort holding through the ups and downs.

IDDA Point 3: Fundamentals

- Meta’s core strength continues to be its advertising business, which remains highly profitable and fuels its broader ambitions. With over 4 billion monthly active users across Facebook, Instagram, and WhatsApp, Meta has built one of the largest ecosystems on the internet. This user base gives it a massive data advantage, helping improve ad targeting and engagement, while also offering a reliable monetization engine. Recent results show expanding margins and rising ad pricing, proving Meta’s ability to generate consistent cash flow from its core business.

- What sets Meta apart today is how it’s reinvesting that cash into future-focused growth – particularly artificial intelligence. The company is building a powerful AI infrastructure, including proprietary chips, state-of-the-art data centers, and advanced models like Llama. Its focus is on developing “personal superintelligence”, AI tools that assist users with everyday tasks and can be deployed across its existing apps. Unlike the metaverse, this initiative is practical and fits easily into current user behavior, making wide-scale adoption more likely.

- Meta’s scale offers a major competitive edge. Its enormous user base creates feedback loops that strengthen its AI capabilities, and new AI tools can be integrated directly into Facebook, Instagram, and WhatsApp, enabling instant distribution and monetization. At the same time, Meta is assembling a top tier AI research team and has made news for offering billion-dollar compensation packages to recruit elite talent, signaling just how serious it is about leading the next wave of AI innovation.

- From a financial standpoint, Meta continues to outperform peers with sector leading profit margins, strong EPS growth, and improving capital efficiency. Its valuation, while slightly elevated, is compressing over time as earnings grow, making the stock more attractive for long term investors. Analysts expect steady double digit EPS growth through 2028, supported by both ad strength and AI-driven revenue opportunities.

- Now, with CEO Mark Zuckerberg revealing plans to spend at least $600 billion by 2028 on U.S. data centers and infrastructure, Meta is making one of the most aggressive AI investments in the world. This includes $66B to $72B in capex for 2025 alone, which is up 68% from 2024 and “similarly significant” spending for 2026. If trends continue, that suggests another $300B+ could be deployed in 2027 – 2028. These massive investments reflect not just vision, but confidence that Meta is building the digital backbone of the AI era, turning its infrastructure into a long-term economic moat.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

- Core ad business is thriving due to better targeting algorithms and overall digital ad growth.

- A massive user base gives Meta access to valuable data for advertisers.

- Growth potential from expanding ad inventory via Threads, Stories, and Reels.

Risks

- Heavy spending on Reality Labs and AI could lead to significant annual losses.

- Ongoing U.S. monopoly case could force a breakup, reducing Meta’s scale advantage.

- Growth is partly reliant on Chinese advertisers like Temu and Shein – any pullback may hurt results.

Investor sentiment around Meta is strongly bullish, fueled by both performance and vision. The company’s narrative around “personal superintelligence” is not only timely but compelling, capturing market imagination and drawing comparisons to past tech inflection points.

Meta’s massive AI investments, aggressive talent recruitment, and clear messaging from leadership have created a powerful story that’s driving momentum in the stock. Even if execution isn’t perfect, belief in the vision could sustain investor enthusiasm for years. Unlike the metaverse pivot, this narrative feels more practical, immediately monetizable, and aligned with how users already engage with technology, making it easier for the market to rally behind.

Sentimental Risk: High

IDDA Point 5: Technical

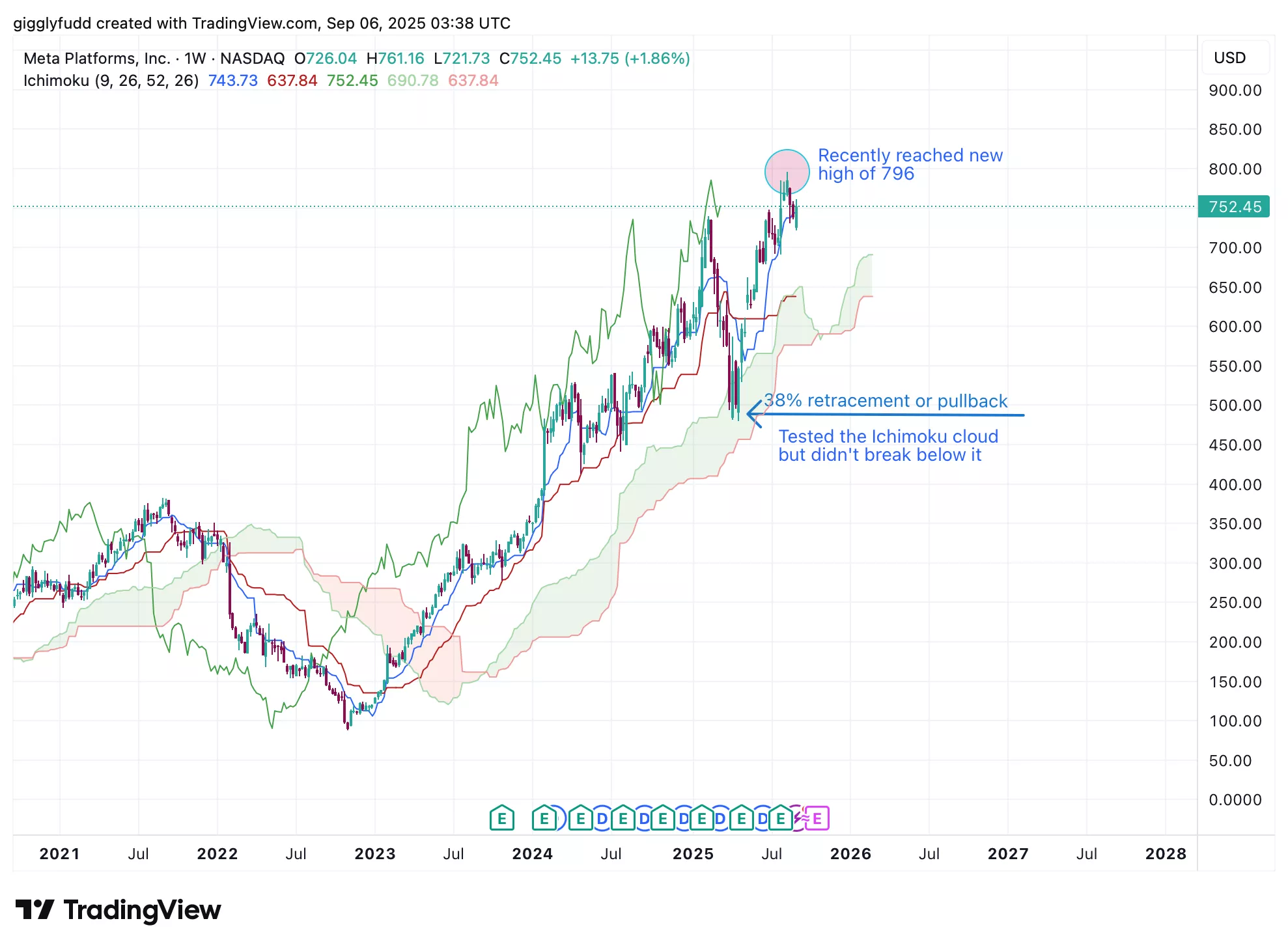

On the weekly chart:

Meta continues to trend higher on the weekly chart, backed by strong technicals.

The Ichimoku Cloud remains wide and green, confirming a clear bullish structure.

Price is comfortably trading above the cloud, which is now acting as dynamic support — a key signal that long-term momentum remains intact.

Looking at the broader picture, Meta’s sharp decline in 2022 stemmed from heavy metaverse spending, and headwinds from Apple’s iOS changes, and broader tech market weakness. The stock dropped over 60% from its peak, driven by investor concerns around Reality Labs losses and rising competition from TikTok. Despite that, Meta stayed profitable and began to recover steadily.

From the October 2022 bottom to its 2024 high, Meta staged a massive rally. In early 2025, the stock retraced approximately 38% of that move, driven by rising concerns over elevated capital expenditures and a potential slowdown in ad momentum. This healthy correction helped reset expectations, with price pulling back to test the weekly Ichimoku Cloud, which acted as a key support zone and successfully held.

Since then, the bulls have regained control. Meta surged past its previous high of $739 after impressive Q2 earnings. Most recently, the stock hit a new all-time high of $796, signaling continued confidence in the company’s AI strategy and future monetization potential. With long-term structure still intact and strong fundamentals backing it, Meta’s uptrend looks far from over.

(Click on image to enlarge)

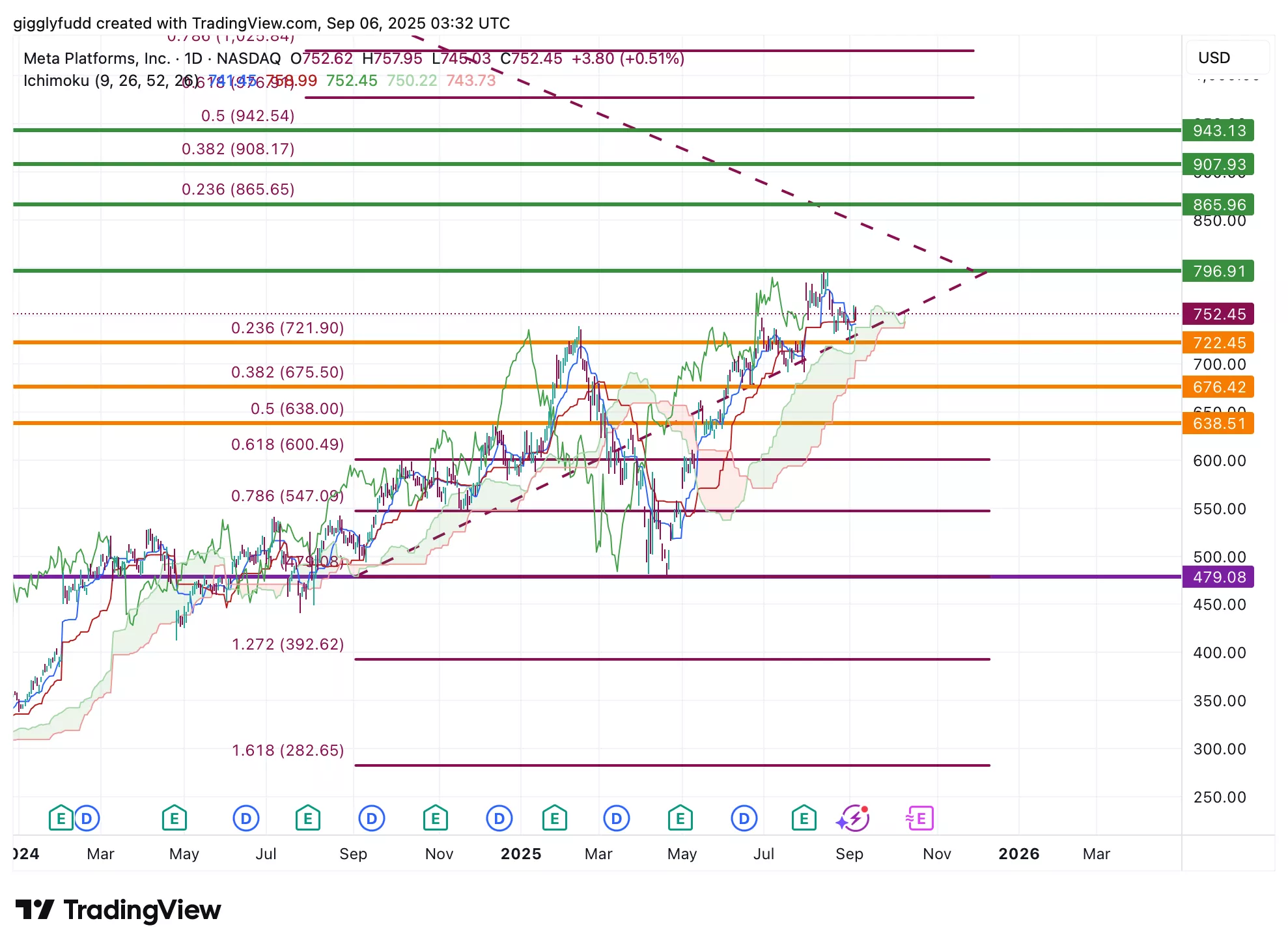

On the daily chart:

- The Ichimoku Cloud shows bullish continuation however this is thinning suggesting a slowdown in the momentum

- Recent candles remain above the cloud, suggesting strength, though price is appearing to consolidate.

- The Kijun line has crossed over the Tenkan line forming a death cross which is an early bearish signal

Earlier in 2025, Meta experienced a healthy correction after peaking at $739. The pullback was largely due to investor concerns about the company’s aggressive ramp-up in capital expenditures for AI infrastructure. Although revenue remained strong, guidance turned more cautious as Meta began lapping its record growth from the previous year. Combined with tech market volatility and elevated valuations, this triggered a wave of profit-taking.

Adding to the short-term caution, the recent death cross is worth watching. While it doesn’t always signal a deep downtrend, especially in strong uptrends like Meta’s it often marks a pause or shift in market sentiment. In this case, the cross came during a period of consolidation, and could suggest a slower grind higher or a deeper pullback if support levels break.

While near-term volatility is possible, especially with overbought RSI technicals and lingering caution around capex, the broader uptrend remains strong. For long-term investors, any dips could offer renewed entry points as Meta continues building its AI infrastructure and monetizing its ecosystem.

(Click on image to enlarge)

Investors looking to get in META can consider these Buy Limit Entries:

- Current market price 752.45 (High Risk – FOMO entry)

- 722.45 (High Risk)

- 676.42 (Medium Risk)

- 638.52 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

- 865.96 (Short term)

- 907.93 (Medium term)

- 943.13 (Long term)

- Hold (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Technical Risk: Medium

Final Thoughts on Meta:

Meta has evolved from a social media platform into a digital powerhouse, combining its dominance in advertising with a bold push into artificial intelligence. With over 4 billion users across Facebook, Instagram, WhatsApp, Threads, and Messenger, it has one of the most valuable data ecosystems in the world. Now, with plans to invest at least $600 billion through 2028 into U.S. data centers and AI infrastructure, Meta is laying the groundwork for the next phase of the attention economy.

While risks like Reality Labs losses, regulatory pressure, and market concerns over spending remain, Meta’s strong margins, rising ad revenue, and early AI monetization set it apart. The recent all time high of $796 shows that Wall Street is starting to catch on but many still underestimate the scale of what Meta is building.

Key Takeaways: The one big reason Meta could be setting up for a multi-year run is the sheer scale of its AI infrastructure build, paired with the cash generating power of its core ad business. For long term investors, Meta offers exposure to the compounding of digital infrastructure, AI monetization, and platform scale network effects. For short term investors, the breakout to $796 is promising, but caution is warranted with technical indicators like a recent death cross and overbought RSI, suggesting that confirmation of support on pullbacks will be key before chasing further upside.

Overall Stock Risk: Medium

More By This Author:

One Big Reason SentinelOne Stock Could Be A Hidden Winner In Cybersecurity

Snowflake Stock: Is Wall Street Ignoring This AI Growth Secret?

Build A Bear Stock: 5 Reasons This Could Be The Most Surprising Retail Play Of 2025