3 Reasons Wall Street Could Be Wrong About Salesforce Stock

Image Source: Pixabay

Salesforce is the global leader in customer relationship management (CRM) software. It helps companies manage sales, marketing, customer service, and now AI-powered workflows.

The company trades under the ticker CRM. With recent big moves like buying Informatica, expanding partnerships with Google Cloud, and pushing hard into AI with Agentforce, Salesforce is making bold bets to stay on top of the enterprise software world.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Salesforce’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Revenue and profits keep growing

Salesforce pulled in 10.2 billion dollars last quarter, up 10 percent from last year. Profit margins hit 34 percent. Translation: the core business is still making solid money.

Wall Street didn’t love the forecast

Even with good numbers, the stock slipped. Why? Management said the next quarter might not be as strong. Investors wanted proof that the new AI tools will make real money now, not later.

AI and Data Cloud are catching fire

Salesforce’s AI and Data Cloud business doubled in size in one year, hitting over 1.2 billion dollars. Their new Agentforce product already has thousands of paying customers. That’s a strong early signal that companies want what Salesforce is selling.

Big deal with Google Cloud

Salesforce signed a 2.5 billion dollar, seven-year partnership with Google. Customers can now use Salesforce with Google’s AI models and connect data straight into BigQuery and Tableau. This reduces their reliance on Amazon and gives customers more choice.

New AI tools keep rolling out

Agentforce 3 launched with a dashboard that lets companies watch and control what their AI agents do. They also shipped over 100 ready-to-use actions to make the software easier to adopt. This matters because big companies need safety and speed before they trust new tech.

Buying Informatica for 8 billion dollars

Salesforce plans to acquire Informatica, a leader in cleaning and organizing company data. Why does this matter? AI is only as smart as the data it eats. If the data is messy, the results are bad. This deal could make Salesforce’s AI tools more powerful and harder to replace.

Job cuts may hurt culture

Salesforce is laying off hundreds of employees to keep costs down. That’s good for the bottom line, but too many cuts can lower morale and slow down innovation.

Investors still need convincing

Analysts are cautious. The story sounds good on paper, but Wall Street wants to see actual dollars from AI, not just flashy demos.

Fundamental risk: medium.

Salesforce has strong growth and profits, bold bets in AI and data, and powerful partners like Google. But until the AI strategy proves itself in hard revenue, the stock will stay under extra scrutiny.

IDDA Point 4: Sentimental

Overall sentiment is bullish for Salesforce. Investors on Seeking Alpha and other platforms are leaning positive, driven by the strong AI and Data Cloud growth story. The belief is that Salesforce is setting itself up for bigger wins even if short-term guidance looks soft.

Strengths

Investor sentiment on Seeking Alpha is bullish, with analysts highlighting AI and Data Cloud as major growth drivers.

The 2.5 billion dollar partnership with Google Cloud makes Salesforce look like a long-term AI leader with strong partners.

Agentforce 3 launch and rapid adoption of AI tools show the company is executing, not just talking.

Consistent profits and buybacks keep investors confident Salesforce can balance growth and shareholder returns.

Risks

Guidance for next quarter came in light, which raises questions about near-term momentum.

Layoffs may signal cost-cutting pressure and can create worry about company culture.

Some investors fear Salesforce could fall into the same “AI hype” trap as other software companies if revenue growth slows.

Regulatory pressure from the EU AI Act and other global rules could slow adoption.

Sentimental risk: medium-low.

Overall mood is optimistic, with most investors giving Salesforce the benefit of the doubt. But the company still needs to keep proving that AI adoption translates into real, recurring revenue.

IDDA Point 5 – Technical

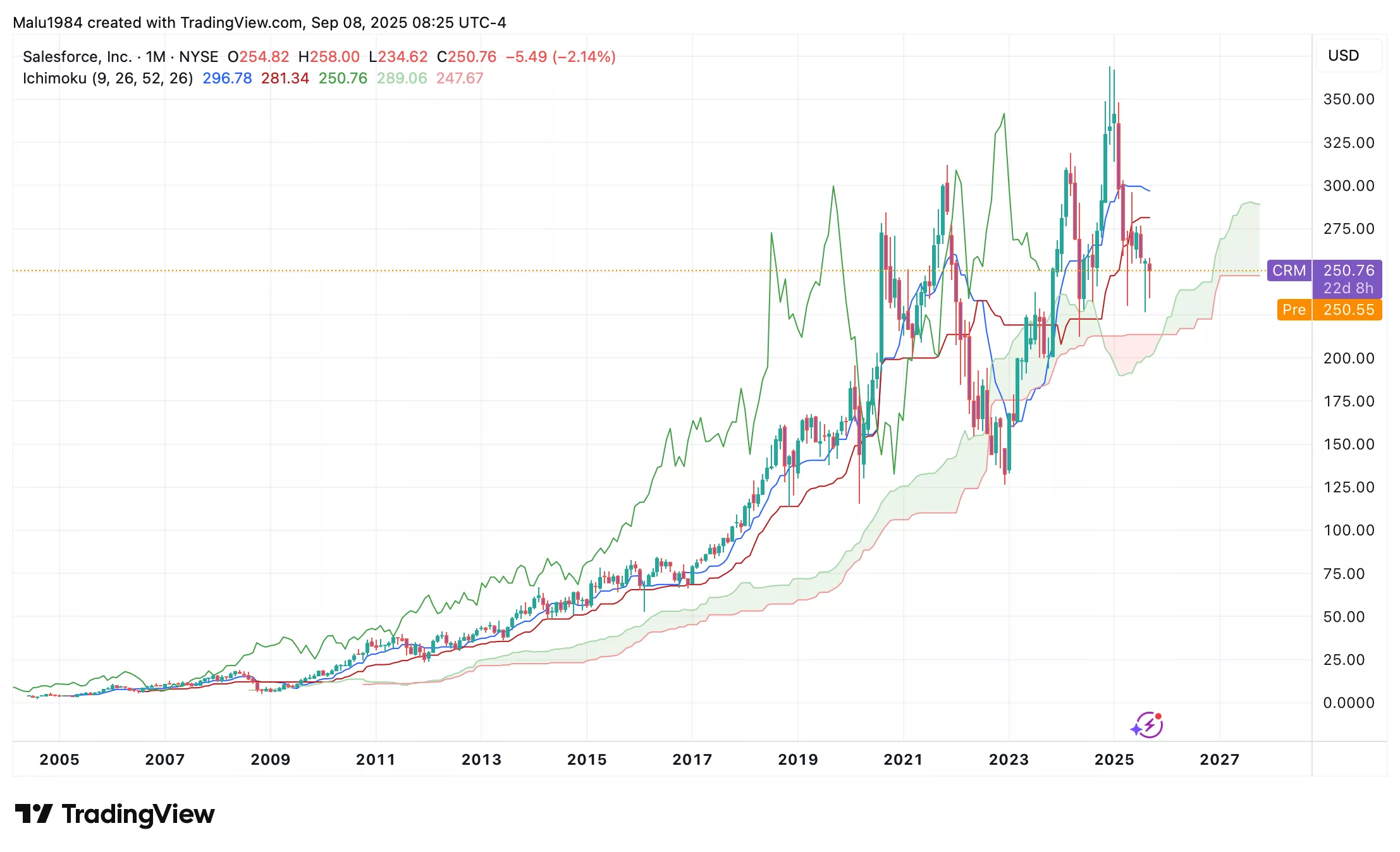

Monthly Chart

Candles sit above the Ichimoku cloud, showing long-term strength.

The conversion line is above the baseline, another bullish sign.

The cloud is acting as strong support, keeping the uptrend intact on the big picture.

(Click on image to enlarge)

Weekly Chart

Price peaked at 368.96 dollars in December 2024 and has been sliding since.

The stock bounced near 238 dollars, which is now a strong support level. This price also acted as resistance in the past, so it is a key area to watch.

Candles are below the Ichimoku cloud, and the cloud itself is red, signaling weakness in the shorter term.

The conversion line is below the baseline, confirming bearish pressure.

RSI is around 43, close to neutral but leaning weak.

(Click on image to enlarge)

Overall technical outlook:

Salesforce looks bullish on the monthly view, with the long-term trend still supported by the Ichimoku cloud. On the weekly chart, the stock is under pressure and struggling to hold an uptrend. The 238 dollar level is the key battleground. If that support holds, Salesforce could try to climb back, but if it breaks, more downside could follow before the bigger bullish trend returns.

Buy Limit (BL) levels:

$250.35 – High Risk

$219.02 – Moderate Risk

$196.98 – Low Risk

Hold long term.

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: medium-high.

The long-term monthly trend stays bullish with the Ichimoku cloud holding support, but the weekly chart shows clear weakness. The price is below the cloud, momentum is soft, and RSI sits near neutral. If the 238 dollar support breaks, the stock could see more downside before bulls regain control.

Summary: Final Thoughts

Salesforce sits at an interesting crossroads. The numbers show steady growth, the products keep evolving, and Wall Street sentiment is leaning bullish. But the stock still faces questions about how quickly AI will turn into real dollars.

Here are the 3 reasons Wall Street could be wrong about Salesforce stock (CRM):

- The 8 billion dollar Informatica deal could give Salesforce a data edge that makes its AI agents far more powerful than investors expect.

- The 2.5 billion dollar Google Cloud partnership quietly shifts Salesforce into a stronger multi-cloud position and brings in new AI firepower.

- AI and Data Cloud sales are already doubling year over year, hinting at real momentum while the market keeps focusing on short-term guidance.

Still, risks remain. Guidance for the next quarter is soft, and layoffs raise questions about execution. Some investors also worry Salesforce may fall into the “AI hype” bucket until results prove otherwise. On the regulatory side, the EU AI Act and similar rules could slow adoption or add costs.

Sentiment is overall bullish, but not without nerves. The market is optimistic about the long-term AI story but wants proof in the short term.

Overall risk: medium.

Salesforce has the tools, partners, and early traction to deliver. But until the AI bets show clear financial payoff, the stock will carry both promise and doubt.

More By This Author:

Meta Just Committed $600 Billion – And Wall Street Isn’t Paying Attention (Yet)One Big Reason SentinelOne Stock Could Be A Hidden Winner In Cybersecurity

Snowflake Stock: Is Wall Street Ignoring This AI Growth Secret?