Nvidia: What The Tech Giant Said After Blowing Away Estimates

Image Source: Unsplash

Concerns about the path of rates put pressure on stocks going into Nvidia Corp.’s (NVDA) earnings, but prices bounced back for a while after the tech giant’s results once again beat expectations. Notably, it was one of the first days I can recall where Stocktwits sentiment for the four major indexes was in bearish or extremely bearish territory, highlights Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Or that’s certainly what the sentiment felt like even as Nvidia's stock price eclipsed $1,000. Let’s see the key takeaways from this week’s big earnings report.

The chipmaker’s adjusted earnings per share of $6.12 topped the $5.59 expected, while revenues of $26.04 billion were also ahead of the $24.65 billion consensus estimate. Nvidia said it’s expecting $28 billion in current-quarter revenues, once again beating the $26.61 billion anticipated by Wall Street.

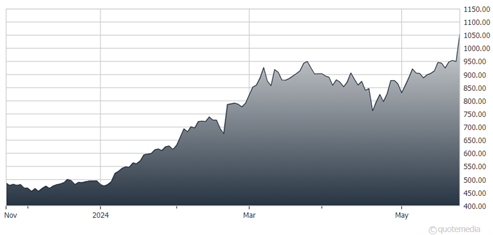

Nvidia Corp. (NVDA)

Data center revenues were up a whopping 427% year-over-year, with overall revenue rising 262% year-over-year and EPS jumping 560% year-over-year. Remember, this is a multi-trillion-dollar company we’re talking about. These types of growth rates are not supposed to be possible -- yet the company continues to deliver.

Additionally, the company announced a 10-for-1 stock split and will begin trading on a split-adjusted basis on June 10. That, combined with a 150% increase to its (albeit very small) dividend, should be more than enough to continue broadening its investor base.

At this point, the question many are asking is: Who doesn’t own Nvidia? And where will the incremental demand for the stock come from to support current prices?

Despite those being valid questions, the stock soared to new heights as celebrity CEO Jensen Huang began to speak on the conference call. Some soundbites that made headlines were:

- The industry is going through a major change; the next industrial revolution has begun.

- We will see a lot of Blackwell revenue this year.

- After Blackwell, there’s another chip. We’re working on a one-year rhythm.

- We’re not just making good-looking PowerPoints, we’re actually building stuff at scale

Clearly, the company cannot continue this growth rate forever at its massive scale, but betting on when growth will slow remains a tough game to play. For now, the momentum remains in favor of the bulls. And until there’s a meaningful shift in stock (or business) momentum, many expect the path of least resistance to remain higher.

About the Author

Tom Bruni is the head of market research at Stocktwits, where he publishes the brand’s flagship market recap newsletter, The Daily Rip, for one million subscribers and oversees the platform’s growing publishing efforts.

Mr. Bruni has been at the intersection of finance and media for the last decade, regularly featured in the Wall Street Journal, Bloomberg, Reuters, Barron’s, and more. He holds both CPA and CMT licenses and graduated with an accounting degree from Molloy University in 2016.

More By This Author:

XLK: A Great Way To Profit From Rising Earnings And Stock Buybacks

WMT, TGT, COST: What Retail Sector News And Moves Say About Consumer Spending

EPD: How Dividend-Paying Energy Stocks Can Offset Pain At The Gas Pump

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more