Monthly Dividend Stock In Focus: Fortitude Gold Corporation

Monthly dividend stocks are great candidates for the portfolios of income-oriented investors. They distribute their dividends on a monthly basis and offer a smoother income stream to investors.

In addition, many of these stocks are laser focused on maximizing their distributions to their shareholders.

In this article, we will analyze the prospects of a high-quality monthly dividend stock: Fortitude Gold Corporation (FTCO).

Business Overview

Fortitude Gold is a gold producer, which is based in the U.S., generates 99% of its revenue from gold, and targets projects with low operating costs, high returns on capital, and wide margins.

Its Nevada Mining Unit consists of five high-grade gold properties located in the Walker Lane Mineral Belt. Nevada is one of the friendliest jurisdictions to miners in the world.

As Fortitude Gold generates essentially its whole revenue from gold, it is obviously highly sensitive to the cycles of the price of gold. Fortunately for the company, the unprecedented fiscal stimulus packages offered by most governments in response to the pandemic have led inflation to soar to a 40-year high this year.

As a result, the price of gold has rallied to an all-time high in the last two years. This is an ideal development for a pure gold producer, such as Fortitude Gold.

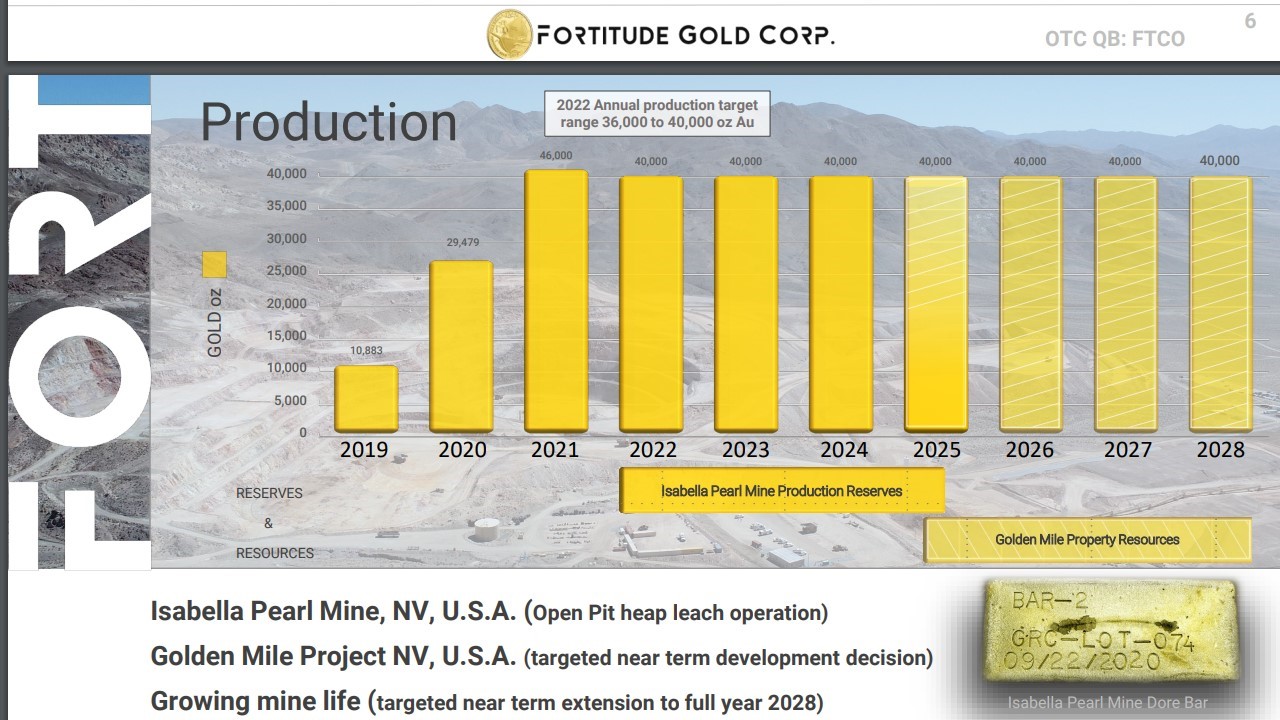

In 2021, Fortitude Gold grew its production 58%, from 29,479 ounces in 2020 to 46,459 ounces, and exceeded its initial guidance by 16%. The strong production growth resulted from the major growth project of the company in Isabella Pearl Mine.

The average realized price of gold slipped 1%, from $1813 to $1795, but Fortitude Gold drastically reduced its production cost, from $952 per ounce to $705 per ounce, primarily thanks to the high quality of its new mine. As a result, the company grew its earnings per share 54%, from $0.48 to $0.74. Overall, Fortitude Gold enjoyed a blowout year in 2021, as it grew its output and its earnings at an impressive pace.

Fortitude Gold expects to produce approximately 40,000 ounces of gold in 2022, assuming no disruptions from the coronavirus crisis. The company is also aggressively moving its Golden Mile property forward towards a development decision, which may extend the production at this mine by an additional ~3.3 years, for a combined 7-year mine life through 2028.

Growth Prospects

Fortitude Gold has grown its production at a fast pace in each of the last two years, primarily thanks to the major growth project of Isabella Pearl Mine.

Source: Investor Presentation

As shown in the above chart, the reserves of Isabella Pearl Mine will last until approximately 2025 and then they will probably be replenished by the additional reserves of the Golden Mile Project.

The chart depicts essentially flat production in the upcoming years. As a result, the earnings of Fortitude Gold will be essentially determined by the prevailing price of gold.

On the bright side, inflation has proved more than transitory and it is likely to remain high as long as governments keep offering fiscal stimulus packages in downturns such as the coronavirus pandemic, and the invasion of Russia in Ukraine. This bodes well for the price of gold for the foreseeable future.

Competitive Advantages & Recession Performance

Gold producers are infamous for their cyclicality, which is caused by the wild swings of the price of gold. Fortitude Gold is inevitably vulnerable to the cycles of the price of gold but it is an above-average gold producer thanks to some key characteristics.

First of all, the company has a debt-free balance sheet, with a net cash position of $30 million, and negligible interest expense. The net cash position is 17% of the market capitalization of the stock and hence it is a testament to the rock-solid balance sheet of the company. A pristine balance sheet is paramount in this commodity business, as it enables Fortitude Gold to endure the downcycles of its business much more readily than most of its peers.

Moreover, Fortitude Gold enjoys another key competitive advantage, namely the exceptional grade of Isabella Pearl Mine.

Source: Investor Presentation

Thanks to the exceptional quality of its mines, Fortitude Gold has an all-in sustaining cost of $705 per ounce, which is much lower than the global average cost of $1,067 per ounce. As a result, Fortitude Gold is much more profitable than most of its peers at a given price of gold and is one of the most resilient gold producers to the downturns of the price of gold.

It is also worth noting that the price of gold usually rises during recessions, as the precious metal is considered a safe haven during sell-offs of the stock market. This means that Fortitude Gold is likely to perform well during recessions.

Dividend Analysis

Income-oriented investors should avoid gold stocks in principle due to the high cyclicality that results from the swings of the price of gold. It is not accidental that there is no gold producer in the list of Dividend Aristocrats.

On the other hand, Fortitude Gold has some attractive features for dividend investors. It is offering a monthly dividend of $0.04, which corresponds to an annualized dividend yield of 5.7%. This is the highest dividend yield in the group of precious metals producers.

Source: Investor Presentation

In addition, Fortitude Gold has a payout ratio of 64%, which is not ideal but it is reasonable. Given also the debt-free balance sheet of the gold producer, the dividend is likely to remain safe for the foreseeable future.

On the other hand, investors should always be aware of the vulnerability of commodity producers to the commodity cycles. If the price of gold enters a prolonged downturn at some point in the future, the dividend of Fortitude Gold is likely to come under pressure. Gold producers need to spend significant amounts on capital expenses in order to replenish their reserves.

As a result, the dividend is not their top priority, even though the management of Fortitude Gold has repeatedly emphasized its commitment to the dividend and its shareholder-friendly character.

Final Thoughts

Gold producers are highly cyclical and hence they should be avoided in principle by income-oriented investors, who cannot stomach a volatile stock price and a potential dividend cut.

While Fortitude Gold is highly sensitive to the cycles of the price of gold, it has some unique advantages. It has a debt-free balance sheet, which makes it much easier to endure the downturns of this business.

The stock also offers the highest dividend yield in its peer group and pays its dividend on a monthly basis. Therefore, it is a great candidate for the portfolios of those who want to gain exposure to the price of gold.

I think that graphic may be inaccurate as to the current plan. Golden mile should be in production in 2023.