Microsoft Q2 Preview: What's In Store?

Image Source: Unsplash

Earnings season has arrived, and investors are more than prepared for companies to unveil what’s transpired behind closed doors.

Investors will receive a surplus of quarterly results each day for some time, definitely enough to stay busy.

A big-time company that’s quickly become an investor favorite, Microsoft Corp. (MSFT - Free Report), is slated to unveil its Q2 results on Tuesday, January 24th, after the market close.

Microsoft, a mega-cap technology giant, is one of the largest broad-based technology providers in the world. Currently, the company is a Zacks Rank #4 (Sell).

How does the company currently shape up? Let’s take a closer look.

Key Metric To Watch

Microsoft’s intelligent cloud services have been a significant growth driver for the company over the last couple of years, and investors will undoubtedly be watching the metric like a hawk.

In its latest quarter, the company’s intelligent cloud posted strong results; revenue totaled $20.3 billion, up a solid 22% Y/Y.

Satya Nadella, CEO, on the results, “In a world facing increasing headwinds, digital technology is the ultimate tailwind. In this environment, we’re focused on helping our customers do more with less while investing in secular growth areas and managing our cost structure in a disciplined way.”

For the upcoming release, the Zacks Consensus Estimate for intelligent cloud revenue stands at $21.4 billion, indicating an improvement of 17% year-over-year.

While the growth is impressive, it’s also starting to slow.

Quarterly Estimates

Analysts have had mixed reactions to the quarter to be reported, with a singular downward and upward earnings estimate revision hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $2.29 suggests a decrease of roughly 7.6% year-over-year.

Image Source: Zacks Investment Research

Still, the company’s top line is in better shape; the Zacks Consensus Sales Estimate of $52.9 billion indicates an increase of 2.3% year-over-year.

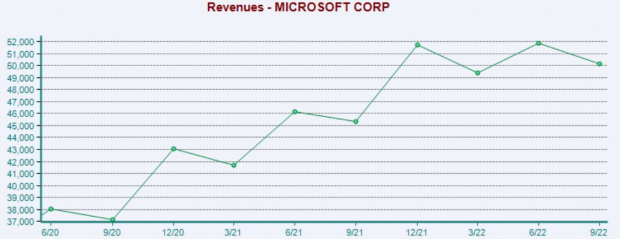

Quarterly Performance

MSFT has primarily posted better-than-expected earnings results despite a bleak business environment, exceeding earnings and revenue estimates in three of its last four quarters.

Just in its latest release, Microsoft registered a 2.6% EPS beat and reported revenue modestly above expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

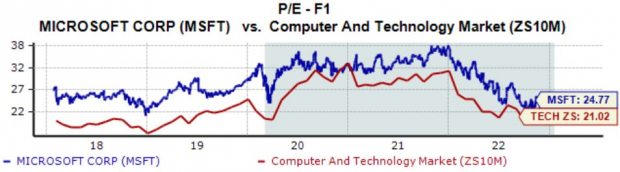

Valuation

Following the rough stretch of price action, Microsoft’s valuation multiples have pulled back by visible margins; MSFT shares currently trade at a 24.8X forward earnings multiple, beneath its 28.5X five-year median and highs of 36.7X in 2022.

Image Source: Zacks Investment Research

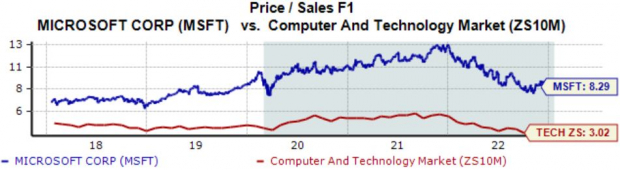

In addition, the company’s forward price-to-sales ratio has come down to 8.3X, again beneath the 8.9X five-year median and highs of 12.9X in 2022.

Image Source: Zacks Investment Research

Putting Everything Together

Being an investor favorite, all eyes will be on Microsoft’s quarterly release. Heading into the print, one metric that investors should keep tabs on is the company’s cloud results.

Analysts have had mixed reactions to the quarter to be reported, with estimates indicating a pullback in earnings but an uptick in revenue – likely a reflection of rising costs eating into margins.

Further, the company’s valuation multiples have fallen by fair margins, with MSFT carrying a Style Score of “C” for Value.

Heading into the release, Microsoft is currently a Zacks Rank #4 (Sell) with an Earnings ESP Score of 0.3%.

More By This Author:

Inflation Hits Holiday Sales: 4 Retailers Still Worth a Look

Netflix (NFLX) Q4 Earnings Miss Estimates

Bear Of The Day: Advance Auto Parts Inc.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more