Bear Of The Day: Advance Auto Parts Inc.

The Zacks Retail and Wholesale sector has modestly underperformed relative to the S&P 500 over the last year, down roughly 15%.

One company residing in the sector, Advance Auto Parts (AAP), has seen its earnings outlook shift negative over the last several months, pushing the stock into a Zacks Rank #5 (Strong Sell).

(Click on image to enlarge)

Image Source: Zacks Investment Research

Advance Auto Parts primarily sells replacement parts (excluding tires), accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy-duty trucks.

Let’s take a deeper dive into how the company shapes up.

Share Performance

Over the last year, AAP shares have widely lagged behind the S&P 500, down more than 30%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

And over the last three months, sellers have remained in control, with shares down 13% and again lagging behind the general market.

(Click on image to enlarge)

Image Source: Zacks Investment Research

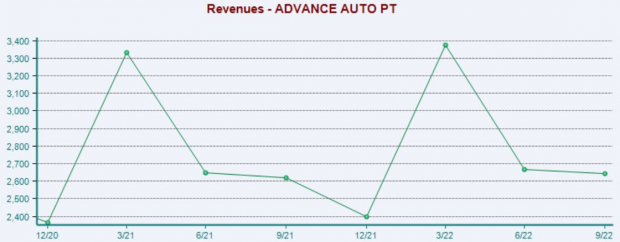

Quarterly Results

Advance Auto has struggled to find consistency within its quarterly results, falling short of the Zacks Consensus EPS Estimate in back-to-back quarters. Top-line results have also left some to be desired, with AAP missing revenue expectations in three consecutive quarters.

Just in its latest release, the company fell short of earnings expectations by roughly 15% and reported sales marginally below estimates.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Growth Outlook

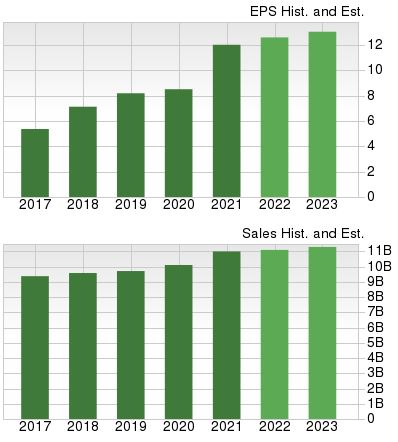

Despite its earnings outlook coming under pressure, AAP still carries a respectable growth profile, with earnings forecasted to climb 5% in its current fiscal year (FY22) and a further 5.4% in FY23.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 1% in FY22 and 2.6% in FY23.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Inconsistent quarterly results and negative earnings estimate revisions from analysts paint a challenging picture for the company in the near term.

Advance Auto Parts is a Zacks Rank #5 (Strong Sell), indicating that analysts have lowered their bottom-line outlook across the last several months.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

D.R. Horton To Report Q1 Earnings: Here's What To Expect3 New Chip Leaders To Focus On

2 Former Pandemic Darlings Poised To Lead Again

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more