Inflation Hits Holiday Sales: 4 Retailers Still Worth A Look

Holiday season sales fell short of industry estimates, as consumers navigated soaring prices and high borrowing costs. Data compiled by the National Retail Federation (NRF) showed that holiday retail sales increased 5.3% year over year to $936.3 billion during 2022’s November-December period. However, the numbers came below NRF’s projection of 6% to 8% increase over the 2021 period to between $942.6 billion and $960.4 billion.

Nonetheless, stimulus savings from last year, steady wage gains and a lower unemployment rate still kept demand alive. While inflation-wary shoppers looked for eye-popping deals to fit their budgets, retailers left no stone unturned to make the most of the season.

Retailers — be it Casey's General Stores, Inc.’s (CASY) , The Kroger Co. (KR) , Ulta Beauty, Inc. (ULTA) and Five Below, Inc. (FIVE) — have been enhancing customer engagement and making logistics improvements to make the most of the festive season.

The NRF’s report highlighted a year-over-year increase in sales of myriad categories. Sales at grocery and beverage stores rose 7.8%, while the same at general merchandise stores increased 3.8%. Sporting goods stores registered sales growth of 3.5%, while health and personal care stores witnessed an increase of 2.8%.

Sales increased 2.2% at clothing and clothing accessory stores, while the metric jumped 1.5% at building materials and garden supply stores. However, demand at furniture and home furnishings stores as well as electronics and appliance stores was soft with sales down 1.1% and 5.7%, respectively.

That said, we have highlighted four stocks from the Retail - Wholesale sector that look well-positioned based on their sound fundamentals and earnings growth prospects. These stocks have either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

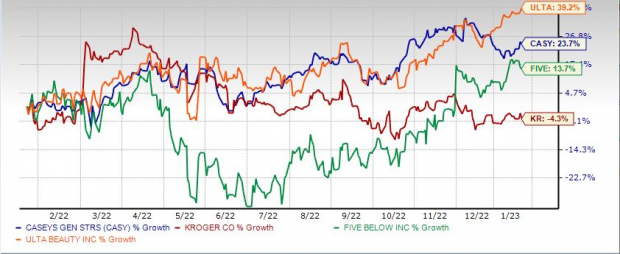

Past One Year Price Performance

(Click on image to enlarge)

Image Source: Zacks Investment Research

4 Prominent Picks

Casey's, a leading convenience store chain, is a potential pick. The company’s price and product optimization strategies, increased penetration of private brands and digital engagements, comprising mobile app and online ordering capabilities, are commendable. Casey's strength in the Inside category and acquisition activities bode well.

This Zacks Rank #1 company has a trailing four-quarter earnings surprise of 7.2%, on average. The Zacks Consensus Estimate for Casey's current financial year sales and EPS suggests growth of 23.1% and 18.4%, respectively, from the year-ago period.

Kroger, is another lucrative option. The company, which operates in the thin-margin grocery industry, has been undergoing a complete makeover with respect to products and how consumers prefer shopping. The company has been adding new products as well as eyeing technological expansion to enhance its omnichannel reach. Kroger has been making significant investments to enhance product freshness and quality and expand digital capabilities.

Kroger has a trailing four-quarter earnings surprise of 13.4%, on average. The company has an estimated long-term earnings growth rate of 6.1%. The Zacks Consensus Estimate for Kroger’s current financial year sales and EPS suggests growth of 7.5% and 12.2%, respectively, from the year-ago period. The stock carries a Zacks Rank #2.

You may invest in Ulta Beauty. The company has been strengthening its omni-channel business and exploring the potential of both physical and digital facets. It has been implementing various tools to enhance guests' experience, like offering a virtual try-on tool and in-store education, and reimagining fixtures, among others. Ulta Beauty focuses on offering customers a curated and exclusive range of beauty products through innovation.

This beauty retailer and a premier beauty destination for cosmetics, fragrance, skincare products, hair care products and salon services has a trailing four-quarter earnings surprise of 26.2%, on average. This Zacks Rank #2 company has an estimated long-term earnings growth rate of 13.8%. The Zacks Consensus Estimate for Ulta Beauty’s current financial year sales suggests growth of 15.7% from the year-ago period.

You may bet on Five Below. The company’s focus on providing trend-right products, improving the supply chain, strengthening digital capabilities and growing brick-and-mortar footprint bodes well. The company is known for its impressive range of merchandise, per the evolving consumer trends. These factors, combined with its pricing strategy, enable it to cater to demographic shoppers and resonate with value-seeking customers.

This extreme-value retailer for tweens, teens and beyond has a trailing four-quarter earnings surprise of 26.3%, on average. This Zacks Rank #2 company has an estimated long-term earnings growth rate of 19%. The Zacks Consensus Estimate for Five Below’s current financial year sales suggests growth of 7.4% from the year-ago period.

More By This Author:

Netflix (NFLX) Q4 Earnings Miss EstimatesBear Of The Day: Advance Auto Parts Inc.

D.R. Horton To Report Q1 Earnings: Here's What To Expect

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more