Micron Stock Surges After Blowout Earnings: Is MU Still A Buy In 2026?

Image Source: Unsplash

Micron Technology (Nasdaq: MU) has quietly become one of the most important companies supporting the AI boom – even if it doesn’t receive the same attention as Nvidia or other high-profile AI names.

While much of the focus is on GPUs and AI software, Micron operates behind the scenes, supplying the memory that allows AI systems, data centres, and cloud platforms to function at scale.

Following a strong earnings update, Micron’s stock surged and quickly returned to the centre of market attention. The rally reflects growing confidence that the company’s strategic shift away from lower margin consumer products toward higher-value enterprise and data-centre memory is gaining traction.

With MU now trading sharply higher, investors are naturally asking whether this move has further upside or if much of the good news is already priced in.

For much of the past year, Micron was still viewed as a cyclical memory stock tied closely to consumer electronics. That perception is now changing.

The company is deliberately reshaping its business to focus more on enterprise customers, where demand tends to be more stable and pricing power stronger. Micron’s planned exit from its consumer memory business by early 2026 highlights this long-term commitment to a higher-quality growth profile.

This shift aligns Micron more closely with the ongoing expansion of AI and data centre infrastructure. As computing workloads continue to grow, memory remains a critical component across servers and cloud systems, placing Micron in a supportive position regardless of which AI platforms ultimately lead the market.

This behind-the-scenes role allows the company to benefit from broader AI adoption without relying on a single winner.

At the same time, Micron is working to reduce the historical boom-and-bust nature of the memory industry. By prioritising higher-value products and long-term customer relationships, the company is aiming for stronger margins and clearer demand visibility.

While short-term volatility is always possible after a sharp rally, Micron’s evolving business model suggests it is becoming more resilient than in past cycles.

Of course, opinions remain divided. Some investors see Micron entering a more sustainable phase of growth as AI investment continues into 2026 and beyond. Others remain cautious, pointing to higher expectations and the potential for near-term pullbacks.

Micron’s recent momentum highlights a broader shift in how the market views the company. Rather than a purely cyclical memory supplier, Micron is increasingly seen as a core infrastructure player in the AI ecosystem.

Whether MU is still a buy in 2026 will depend on how well it executes from here, but its role in the AI buildout is now firmly on investors’ radars.

Let’s look into Micron more using the Invest Diva Diamond Analysis (IDDA).

IDDA Point 1 & 2: Capital & Intentional

Before investing in Micron, ask yourself:

Do you want exposure to a company that sits at the core of AI infrastructure – supplying the memory that powers data centers and AI systems?

Are you comfortable investing in a stock whose growth is closely tied to cloud providers and AI spending cycles?

Do you believe Micron’s shift toward enterprise and AI-focused memory can reduce cyclicality and support more stable long-term growth?

For long term investors, Micron offers exposure to one of the most essential but less glamorous parts of the AI ecosystem. The company is sharpening its focus, improving profitability, and embedding itself deeper into the AI supply chain – all of which could support growth well beyond the recent earnings surge.

For short term investors, it’s important to expect volatility. After a big rally, the stock may react sharply to earnings updates, changes in memory pricing, or shifts in AI sentiment. Timing and risk management matter.

Before investing, consider your goals and risk tolerance. Micron’s future is closely tied to the pace of AI and data-center investment. If AI demand remains strong and Micron continues executing on its higher margin strategy, MU could remain a compelling long-term winner – even after its recent surge.

IDDA Point 3: Fundamentals

Micron Technology is going through a major shift in how it makes money. Instead of focusing on lower-margin products used in everyday consumer devices, Micron is now prioritising memory used in data centres and AI systems. These higher value products are in strong demand as cloud providers and AI companies continue to spend heavily on computing power. Compared to consumer memory, enterprise memory tends to sell at higher prices, comes with longer term contracts, and delivers more consistent profits. Micron’s decision to fully exit its consumer memory business by early 2026 highlights how serious it is about this shift and strengthens its position in the AI supply chain.

The company’s most recent earnings results show that this strategy is already paying off. Micron reported record revenue of around $13.6 billion for the first quarter of fiscal 2026, comfortably beating analyst expectations and marking one of the strongest quarters in its history. This strength was driven by solid demand from data-center and AI customers, alongside improved pricing across its memory products. Profits also came in well above forecasts, highlighting that Micron is not just selling more chips, but doing so at higher margins.

One of the biggest reasons Micron’s outlook looks stronger today is tight supply across the global memory market. Demand for memory chips used in servers and AI systems is rising faster than supply, which has pushed prices higher. Both DRAM and NAND memory prices have increased sharply, improving profitability for memory makers like Micron. Industry data suggests these pricing conditions could stay favourable for some time, especially as large cloud providers continue expanding their data centres. This pricing strength gives Micron more leverage to grow profits, not just revenue.

AI remains a powerful growth driver for Micron, especially through its high bandwidth memory products. These chips are essential for advanced AI systems and are used by major players such as Nvidia, AMD, Google, and Microsoft. As newer versions of these memory products are rolled out, Micron is becoming even more embedded in the infrastructure that supports AI and cloud computing. In many ways, Micron acts as a behind-the-scenes supplier, a “pick-and-shovel” company, benefiting regardless of which AI platform wins, as long as AI investment continues.

Overall, Micron’s fundamentals point to a higher-quality, AI-linked business with stronger pricing power, improving profitability, and clearer long-term demand drivers. While the stock may still experience short-term volatility, Micron’s earnings momentum and deep exposure to AI and data-centre growth provide a solid foundation for continued long-term growth beyond the recent surge.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

AI and data-center demand keeps growing –

Micron is deeply tied to AI infrastructure through its memory chips, which are essential for servers and AI systems. As cloud providers and AI companies continue investing heavily, demand for Micron’s products could stay strong well into 2026.

Higher prices mean better profits –

Memory chip supply is tight, and prices for DRAM and NAND have been rising. If these higher prices hold, Micron can earn more on every chip it sells, supporting stronger margins and earnings growth.

Business is becoming less cyclical –

By moving away from consumer products and focusing on enterprise and AI memory, Micron is reducing its reliance on boom-and-bust cycles. This shift could lead to more stable earnings and justify higher long term valuations.

Risks

Expectations are already very high – After a big rally and strong earnings, the market expects Micron to keep delivering near-perfect results. Any slowdown, cautious guidance, or disappointment could trigger short-term volatility.

AI spending could cool – If cloud providers slow down AI and data-center spending, demand for memory chips could weaken. Because Micron is now more closely tied to AI investment trends, sentiment could turn quickly.

Memory prices can change fast – eWhile pricing is strong now, the memory market is still competitive. If supply increases faster than demand, prices could fall, putting pressure on margins and profits.

The market’s positive reaction reflects growing confidence in Micron’s position as a core AI infrastructure beneficiary rather than a purely cyclical memory stock. While investors are becoming more selective across AI names, Micron’s results have helped distinguish it as a company delivering real earnings growth, not just future promise.

As the market continues to assess execution and demand visibility, sentiment suggests that any near term consolidation could be healthy, with the broader trend supported by improving fundamentals, rising confidence in management’s strategy, and increasing recognition of Micron’s role in the AI buildout.

Want our top stock picks and analysis every month? Get Our Monthly Newsletter and get Kiana’s Hot Picks and our top strategies

Sentimental Risk: High

IDDA Point 5: Technical

On the weekly chart:

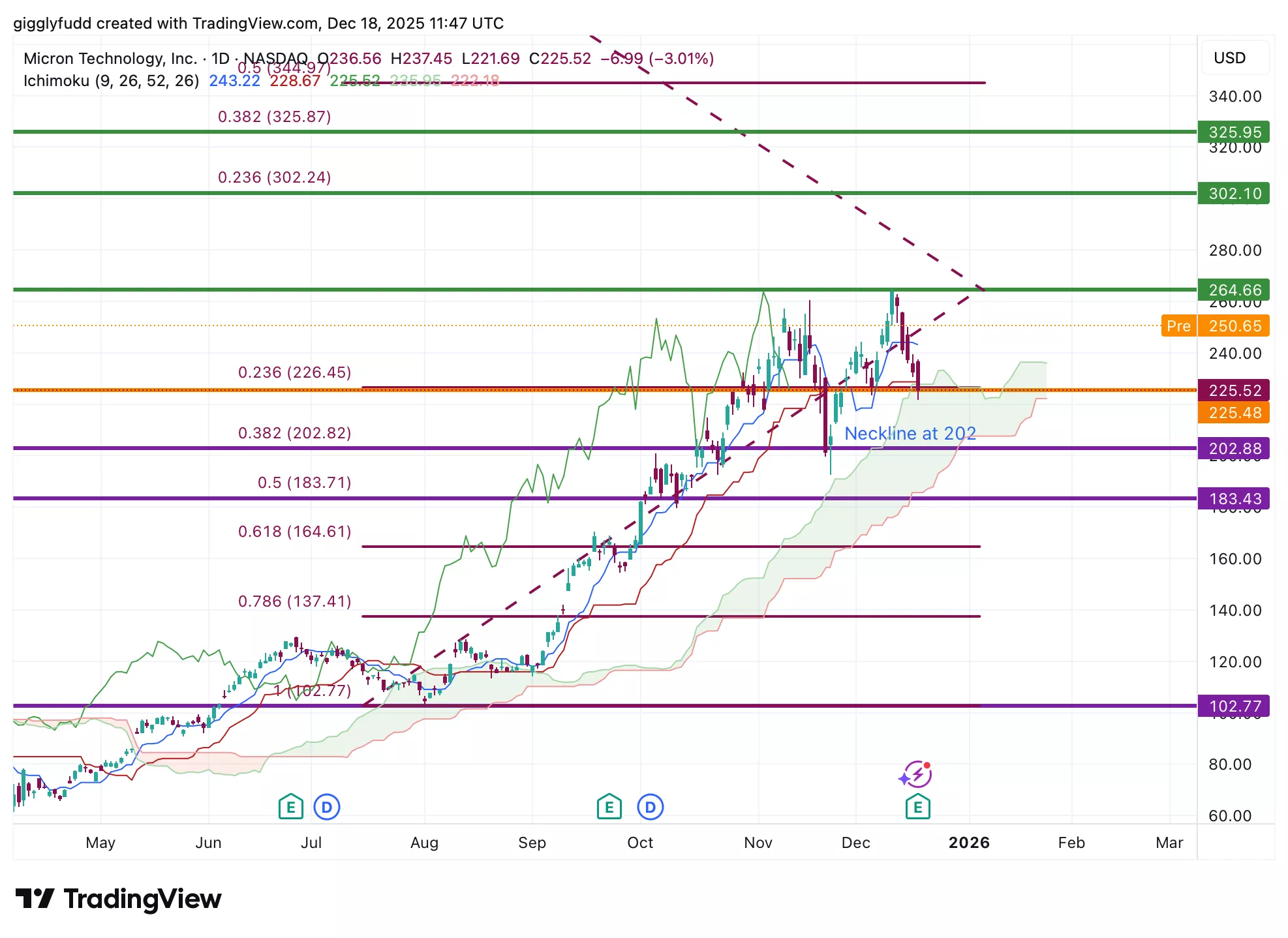

The pattern has been in an uptrend since April 2025, reaching a new high of 264.75 in early December

The Ichimoku cloud is bullish and thick, signifying strong and ongoing upward momentum

Candles are positioned above the cloud, with the cloud acting as a key support zone

On the weekly chart, we can see that the stock entered a clear uptrend from April 2025 after a prolonged period of slow decline and consolidation throughout 2024 and early 2025. This shift marked a change in momentum, with buyers gradually taking control and pushing prices higher over the following months.

The stock went on to reach a new high of 264.75 in early December, confirming the strength of the longer term trend. The Ichimoku cloud remains bullish and thick, which signals sustained upward momentum and a healthy trend structure. The candles continue to stay above the cloud, with the cloud acting as a strong and reliable support zone, suggesting that the broader uptrend remains intact unless this support is decisively broken.

(Click on image to enlarge)

On the daily chart:

The pattern remains in an uptrend, although momentum appears to be slowing

The Ichimoku cloud is still bullish but thinning, signalling weakening bullish momentum

The latest candles are bearish, indicating a potential pullback or correction

On the daily chart, the bullish Ichimoku cloud is thinning, which suggests that bullish momentum is weakening. The most recent candlesticks have been bearish, pointing to the early stages of a pullback or correction. A potential double-top pattern may be forming, which would be a bearish reversal signal if confirmed. This would require a break below the neckline at 202, which aligns with the 38% Fibonacci retracement level, as well as a break below the Ichimoku cloud.

At present, the latest candle is sitting on the cloud, which is acting as a support zone. If this support continues to hold, the stock could move into a period of consolidation or potentially resume its uptrend. The current market price has reached and slightly moved past the 23% Fibonacci retracement level.

(Click on image to enlarge)

Investors looking to get in MU can consider these Buy Limit Entries:

Current market price 225.52 (High Fill Probability)

202.88 (Moderate Fill Probability)

183.43 (Low Fill Probability)

Investors looking to take profit can consider these Sell Limit Levels:

264.66 (High Fill Probability)

302.10 (Moderate Fill Probability)

395.15 (Low Fill Probability)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final thoughts on Micron Technology (MU)

Micron Technology has re-emerged as one of the most important, yet still underappreciated, players in the AI infrastructure boom. While Nvidia and other AI leaders dominate headlines, Micron sits behind the scenes supplying the memory that powers AI servers, cloud platforms, and data centres at scale.

Its recent earnings surge has brought the stock back into focus, highlighting how Micron’s shift toward higher value enterprise and AI-focused memory is transforming the business.

With stronger pricing power, improving margins, and deep exposure to AI and data-centre investment cycles, Micron is increasingly being recognised as a core “pick-and-shovel” provider in the AI ecosystem rather than a purely cyclical memory stock.

However, Micron is not without challenges. The company’s fortunes are now more closely tied to AI and cloud spending trends, which means any slowdown in data centre investment or shifts in capital spending could introduce volatility.

Expectations have also risen sharply following the stock’s strong rally, raising the bar for continued execution. From a technical perspective, Micron remains in a broader uptrend, but recent price action suggests the stock may need time to consolidate after its rapid move higher.

While the longer term trend remains constructive, short term pullbacks or sideways movement would not be unusual as the market digests recent gains.

Key Takeaways:

Micron’s strategic shift toward enterprise and AI-driven memory places it firmly at the centre of the global AI infrastructure buildout.

Bulls point to strong earnings momentum, improving profitability, and sustained demand from hyperscalers as reasons MU could continue to perform well into 2026. Bears highlight elevated expectations, potential volatility tied to AI spending cycles, and the need for consistent execution at higher valuations.

For long term investors, Micron represents a compelling way to gain exposure to AI infrastructure through a company with strengthening fundamentals and growing pricing power.

For shorter term investors, pullbacks and consolidation phases may offer more attractive entry points as Micron continues to evolve into a higher quality, AI-linked business.

Overall Stock Risk: Medium

More By This Author:

Marvell Stock: The Hidden AI Powerhouse Wall Street Keeps Underestimating

2 Months Ago Oracle Stock Was Flying And Now… The Mood Has Flipped. Is A Comeback Still On The Table?

Is Alphabet About To Take The Lead In AI?