Marvell Stock: The Hidden AI Powerhouse Wall Street Keeps Underestimating

Image Source: Unsplash

Marvell Technology (Nasdaq: MRVL) is quickly becoming one of the most important companies in the AI infrastructure space – even though many investors still aren’t sure what the business actually does.

While most headlines focus on Nvidia and its GPUs, Marvell builds the networking, optical, and custom silicon chips that help AI models move data faster and run more efficiently. In its latest earnings report, Marvell posted strong double-digit growth in its data center business and shared bold guidance for the next few years, sending MRVL stock higher.

With its new Celestial AI acquisition and fast growing custom ASIC chip business, Marvell is shaping up to be one of the most overlooked semiconductor stocks in the AI boom.

For most of last year, Marvell stayed in the shadows while bigger AI names dominated the news. But that has changed quickly. The company delivered strong financial results, improved profitability, and announced a major acquisition that caught Wall Street’s attention.

Many investors who previously thought Marvell was falling behind in the AI race are now seeing it as a potential under-the-radar winner in the fast-growing AI infrastructure market.

Marvell’s latest quarterly report showed solid revenue growth and much stronger margins. Management also shared a confident outlook, especially for the company’s data center and AI-related segments. Marvell expects demand for custom chips built for cloud providers, like Amazon and Microsoft, to be one of the biggest drivers of its future growth.

The company also announced a major new purchase: Celestial AI. This startup builds optical interconnect technology that uses light instead of copper to move data – a huge advantage for AI systems that need to transfer massive amounts of information at high speed. Marvell believes Celestial AI will become a meaningful contributor in the next few years and help strengthen its position in next-generation AI networking.

This acquisition fits perfectly with Marvell’s long term strategy. Over the past few years, the company has focused on high growth areas such as custom AI silicon, optical networking, and advanced data center connectivity. By adding Celestial AI to its portfolio, Marvell is better positioned to serve the next generation of AI-heavy cloud data centers used by major tech companies around the world.

Of course, opinions are divided. Some analysts believe Marvell is entering a new phase of growth and are raising their price targets. Others argue that competition from Nvidia, Broadcom, and new AI chip startups is still strong – and that it may take time for the benefits of the Celestial AI acquisition to fully show up in the numbers. There are also bigger market questions about whether AI spending can stay this high for years.

Even so, Marvell clearly has momentum right now. With improving fundamentals, a sharper business focus, and a big move into breakthrough optical technology, MRVL is positioning itself as a key player in AI infrastructure. Whether it becomes a long term leader will depend on how well it executes from here.

Let’s dive further using the Invest Diva Diamond Analysis (IDDA):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Marvell, ask yourself:

Do you want exposure to a company sitting at the core of AI infrastructure — the “picks and shovels” behind data centers, custom AI chips, and high-speed connectivity?

Are you comfortable investing in a business whose growth relies heavily on major cloud providers like Amazon, Microsoft, and Google?

Do you believe Marvell’s push into custom silicon and its new optical technology from Celestial AI will help it grow alongside the next generation of AI data centers?

For long term investors, Marvell offers exposure to one of the most essential parts of the AI ecosystem – the hardware, networking, and custom chips that make large-scale AI possible. The company is narrowing its focus, strengthening its role in cloud and data center technology, and making strategic moves (like acquiring Celestial AI) that could support long term growth.

For short term investors, it’s important to note that the stock may experience volatility as the market reacts to earnings results, big acquisitions, and shifts in AI spending from major cloud companies.

Before investing, think about your own goals and risk tolerance. Marvell’s potential is closely linked to the broader AI infrastructure cycle, which can be very rewarding but also competitive and cyclical.

If Marvell executes well on its custom chip strategy and successfully integrates Celestial AI, it could become one of the more surprising long-term winners in the global AI buildout.

IDDA Point 3: Fundamental

Marvell Technology is gaining strong momentum across its data center and networking businesses. Revenue grew almost 40% year over year, and earnings jumped more than 70%. The data center segment remains the heart of the company, bringing in over $1.5 billion and making up nearly three-quarters of total sales. Networking products – including optical chips, switching, and storage – also performed well as demand for AI infrastructure continues to grow.

Profitability is improving. Marvell delivered stronger gross and operating margins thanks to high-value products like optical interconnects and custom data-center chips. Management expects margins to keep rising as costs come down and new platforms ramp up. Guidance for the upcoming quarter was also positive, showing stable and healthy near-term trends.

Looking forward, the outlook remains very strong. Marvell expects data center revenue to grow more than 25% next year, with even faster acceleration planned for fiscal 2028. Custom chips (ASICs) are one of the company’s biggest growth drivers. Marvell is believed to be designed into Amazon’s Trainium accelerators and is expected to ship significantly more units as Microsoft scales its next-generation Maia AI chip in fiscal 2028.

The company’s long term strategy continues to strengthen its position. Marvell now offers one of the broadest networking-chip portfolios worldwide – covering switching, processing, optical components, and custom accelerators. This gives it multiple ways to grow as AI systems require faster speeds and more advanced connections. The newly announced Celestial AI acquisition (valued up to $5.5B) fits perfectly into this strategy. Celestial builds optical technology that helps move data much faster inside AI systems. While the startup has minimal revenue today, Marvell expects it to contribute meaningfully starting in fiscal 2028.

Financially, Marvell is on solid ground. The company holds almost $1B in cash and around $4.1B in debt, which it plans to reduce over time. Free cash flow is projected to grow from $1.4B today to over $3B annually by 2030, giving Marvell the flexibility to invest, pay dividends, and buy back stock. As the company expands its data center business, strengthens relationships with major cloud providers, and integrates Celestial’s technology, it is positioned for multi-year growth driven by both custom silicon and optical networking.

Fundamental Risk: Medium – High

IDDA Point 4: Sentimental

Strengths

Marvell is strong in optical chips and custom chips, which are key building blocks for AI — giving it a big growth opportunity.

The company makes healthy profits, showing it can charge well for its products.

It sells a wide range of networking chips, giving it more chances to win customers and sell multiple products to the same companies.

Risks

Marvell is still behind Broadcom, the biggest player in networking chips, which makes competition tough.

Its markets can be up and down, meaning sales may slow when the economy cools.

Part of its business still relies on storage-related chips, which are more basic and don’t stand out as much.

Market sentiment toward Marvell has been improving rapidly, with investors reacting positively to strong multi-year guidance, accelerating data center demand, and continued strength in custom AI chips. The stock initially dipped after earlier earnings but surged again once management revealed a ‘stronger than expected’ fiscal 2027 and especially fiscal 2028 forecasts, which point to major growth in custom chip shipments for AWS and Microsoft.

The announcement of the Celestial AI acquisition added excitement, with investors viewing it as a strategic move that complements Marvell’s leadership in optical connectivity. Although concerns remain about competition from Broadcom and the cyclical nature of its markets, sentiment now reflects growing confidence that Marvell is firing on all cylinders, well positioned for the AI boom, and benefiting from multiple long-run growth drivers.

Want our top stock picks and analysis every month? Get Our Monthly Newsletter and get Kiana’s Hot Picks and our top strategies

Sentimental Risk: High

IDDA Point 5: Technical

On the weekly chart

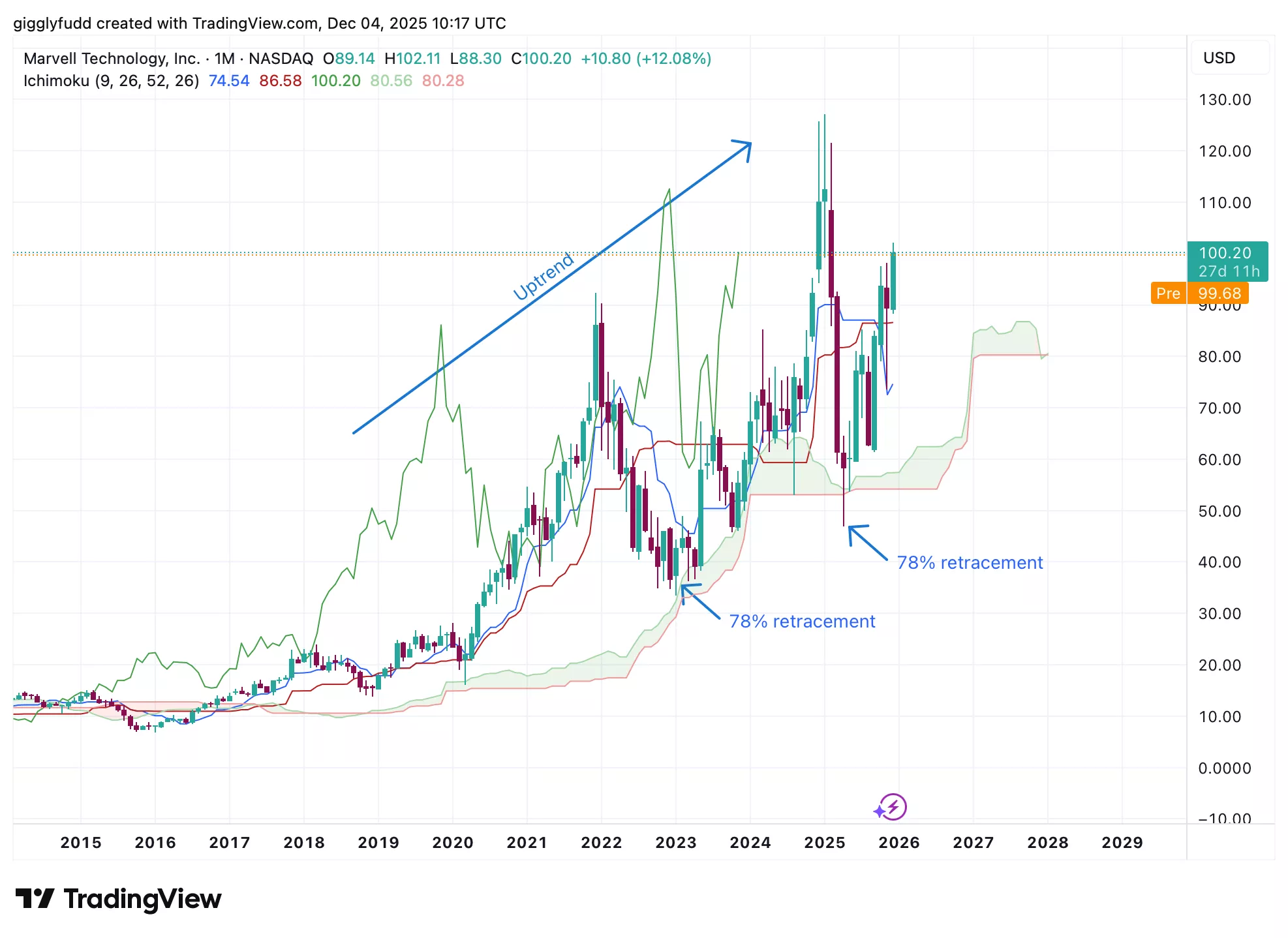

The chart has been trending upward long term, with periods of choppy pullbacks.

The candles are currently above the cloud, which continues to act as a support zone.

The Kijun line has crossed below the Tenkan line, forming a death cross – an early bearish signal.

The overall pattern has been trending upward despite several deep and choppy pullbacks over the years, with some retracing as far as 78% before recovering. Even with this volatility, the stock ultimately pushed to a new high of 127.15 in January 2025, reinforcing the strength of its long-term bullish trend. Throughout most of this period, the Ichimoku cloud has stayed bullish, which generally confirms that buyers remain in control over the long run and that the broader direction continues to point upward.

However, the future cloud has not yet fully formed, which is worth noting. When the cloud is incomplete or begins to flatten out, it often reflects indecision in the market – a sign that momentum could be pausing as buyers and sellers reassess. This doesn’t necessarily indicate a reversal, but it does show that the strong bullish acceleration seen previously may be slowing down.

The candles themselves are still positioned above the cloud, which remains one of the most important support zones in Ichimoku analysis. Historically, each time the stock has pulled back into this zone, the cloud has successfully held as support before price rebounded upward again. This makes the cloud a key area to watch for any future retests.

However, a new development is emerging: the Kijun line has crossed below the Tenkan line, creating a death cross on the weekly chart. While this signal is weaker when it occurs above the cloud, it still serves as an early warning that short term momentum is cooling. Combining this with the forming future cloud, the chart is hinting at a potential pause within the long term uptrend.

(Click on image to enlarge)

On the daily chart:

The pattern is currently on a shallow uptrend.

The candles are above the cloud, acting as a support zone.

The Tenkan and Kijun lines have converged, signalling a potential trend change.

On the daily chart, the stock has been in a gradual recovery phase following a steep decline in early 2025. That decline came right after the price formed a triple top pattern around the 127.15 level – a well known bearish reversal signal that often appears when buyers fail to push through the same resistance multiple times. After the reversal, the stock entered a period of selling pressure before stabilising and beginning its current slow, choppy recovery.

As the recovery has developed, the candles have moved back above the Ichimoku cloud, which is a positive sign. When the candles are above the cloud, it generally suggests that short term momentum is shifting back toward the upside and that buyers are regaining control. The cloud itself is acting as a support zone, helping price hold its recent gains.

A key detail to watch is the behaviour of the Tenkan (conversion) line and Kijun (base) line. These two lines have now converged, meaning short term and medium term price averages are aligning. This often appears when the market is preparing for a potential trend change. If the Tenkan line crosses above the Kijun line, forming a golden cross, it would provide another bullish confirmation that momentum is strengthening. A golden cross above the cloud is considered one of the stronger bullish signals in the Ichimoku system.

If this cross occurs, it may support a further continuation of the current recovery, potentially leading to higher highs or at least a more decisive push upward. However, if the lines fail to cross or instead cross downward, it could indicate hesitation and a possible pullback.

For now, the daily chart suggests early signs of improvement, but the upcoming Tenkan-Kijun interaction will be important in confirming whether the stock has enough strength to continue its upward path.

(Click on image to enlarge)

Investors looking to get in MRVL can consider these Buy Limit Entries:

Current market price 100.20 (High Fill Probability – FOMO entry)

96.79 (High Fill Probability)

87.15 (Moderate Fill Probability)

77.75 (Low Fill Probability)

Investors looking to take profit can consider these Sell Limit Levels:

127.22 (High Fill Probability)

144.67 (Moderate Fill Probability)

158.03 (Low Fill Probability)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium – High

Final thoughts on Marvell Technology (MRVL)

Marvell Technology has rapidly evolved into one of the most important, yet still overlooked, players in the AI infrastructure boom. While Nvidia captures most of the spotlight, Marvell is quietly powering the backbone of AI: the high-speed networking, optical interconnects, and custom AI chips that enable data centers to scale. With strong momentum in its data-center business, double-digit revenue growth, and expanding partnerships with hyperscalers like Amazon and Microsoft, Marvell is positioning itself at the core of next-generation AI networks.

The company’s bold move to acquire Celestial AI further strengthens its leadership in silicon photonics, a technology that will be essential as AI workloads grow larger and require dramatically faster data movement. As AI infrastructure spending accelerates globally, Marvell stands out as a critical enabler with a widening portfolio and improving fundamentals.

However, MRVL still faces meaningful challenges. Its growth remains closely tied to a small number of large customers, making its revenue trend more sensitive to cloud spending cycles from companies like AWS and Microsoft. Competition is fierce, with Broadcom, Nvidia, and emerging chipmakers racing to dominate custom accelerators and advanced connectivity. In the short term, the stock may also experience volatility as investors digest large acquisitions, fluctuating margins, and the timing of major design wins.

Technically, Marvell’s chart shows a long term uptrend supported by the Ichimoku cloud, but recent signals – such as a weekly Kijun–Tenkan death cross – suggest the potential for a pause or consolidation before the next leg higher. The broader uptrend remains intact, yet short-term fluctuations should be expected.

Key Takeaways:

Marvell’s deepening focus on custom AI silicon, optical networking, and high speed data center connectivity places it at the heart of the AI infrastructure wave. Bulls highlight the company’s strengthening relationships with hyperscalers, its leadership in optical interconnects, and its multi-year growth outlook with expectations of over 25% data center growth next year. Bears point to customer concentration risks, rising competition, and the time needed for acquisitions like Celestial AI to meaningfully impact revenue.

For both long term and short-term investors, MRVL represents a compelling AI infrastructure play backed by improving margins, growing demand, and a strategic product portfolio aligned with the future of AI computing. Pullbacks may offer attractive entry points as the company continues to execute on its vision and the global buildout of AI infrastructure accelerates.

Overall Stock Risk: Medium – High

More By This Author:

2 Months Ago Oracle Stock Was Flying And Now… The Mood Has Flipped. Is A Comeback Still On The Table?

Is Alphabet About To Take The Lead In AI?

CrowdStrike Stock: The Move No One Is Talking About But Everyone Should Watch