CrowdStrike Stock: The Move No One Is Talking About But Everyone Should Watch

Image Source: Pixabay

CrowdStrike (CRWD) is one of the biggest names in cybersecurity. They protect computers, cloud systems, and now even AI models. The company keeps growing fast, keeps making moves with giants like Nvidia and Google, and keeps expanding its platform into places most investors are not watching yet.

That is why this blog exists. There is a lot happening behind the scenes with CrowdStrike. Some of it is obvious. Some of it is quiet. Some of it could shape the future of the stock in bigger ways than the headlines show.

If you want to know whether this stock belongs on your buy list or your watchlist, you need to look deeper than price charts or hot news clips. You need to see the story behind the story.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess CrowdStrike’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong revenue growth

CrowdStrike keeps growing fast. Revenue rises each year because more companies move to the cloud and need stronger security. The company adds new products often, so customers buy more from the same platform.

Rising annual recurring revenue

ARR sits in the billions and climbs year after year. This matters because it shows predictable cash coming in. It also means customers stick with the platform and keep adding new modules.

Expansion into AI security

CrowdStrike is moving from simple endpoint protection to full AI security. They build tools that protect AI models, data, and cloud systems. This shift opens a new market and gives the company more ways to grow.

Major partnerships with tech giants

CrowdStrike now plugs into Nvidia AI factories and Google Cloud security systems. These links help the company enter huge enterprise deals because customers trust these big ecosystems.

Active product innovation

New features like the agentic security platform, natural language dashboards, and AI ready data layers help reduce manual work for security teams. These upgrades make the platform more important for customers.

Acquisitions that fill key gaps

The company bought Flow Security, Adaptive Shield, and Pangea Cyber. These deals add cloud data security, SaaS security posture management, and full AI security. The platform becomes stronger and more complete.

Legal overhang from the 2024 outage

CrowdStrike still deals with lawsuits from the global Windows outage that hit airlines, hospitals, and banks. The Delta case alone claims hundreds of millions in damages. This can create pressure and uncertainty for investors.

High valuation risk

The stock trades at a high price compared to peers. It needs strong growth to justify the premium. If growth slows or the market shifts, the stock can pull back fast.

Competitive pressure

Companies like Palo Alto, Zscaler, and cloud native names push hard in the same markets. The fight for AI and cloud security dominance is intense. This can squeeze margins over time.

Outage related revenue drag

Some customers got discounts after the 2024 outage. This lowers revenue in the short term until those adjustments reset.

Fundamental risk level: Medium

IDDA Point 4: Sentimental

Overall sentiment is bullish for CrowdStrike.

Strengths

Investor confidence stays strong

Many investors see CrowdStrike as a leader in cyber and AI security. The company keeps landing big customers and big partnerships, so the market views it as a long term winner even when the stock dips.

Strong CEO presence

The CEO speaks often about how the platform is built for the future of AI, cloud, and data security. Clear direction from leadership helps investors feel safe holding the stock through volatility.

Tailwinds from global cyber threats

Hacks keep rising around the world. More attacks push more companies to buy cybersecurity tools. This steady need gives CrowdStrike a strong demand story that investors like.

Big partnerships signal trust

Deals with Nvidia, Google Cloud, F5, and other large players boost confidence. Investors see these as signs that the company is deeply tied into the future of AI and cloud systems.

Strong brand reputation

Even after the 2024 outage, many companies still view CrowdStrike as a top tier security provider. The platform continues to win awards and high ratings, which supports the bullish mood.

Risks

High valuation fear

Some investors worry the stock price is too high. When a stock trades at a premium, even small disappointments can cause sharp drops. This creates caution in the market.

Legal uncertainty from the 2024 outage

Ongoing lawsuits, including the large case from Delta, still hang over the company. These cases create fear of big costs or harder regulations in the future.

Competition pressure

Rivals like Palo Alto and Zscaler push into AI and cloud security too. New cloud native players also enter fast. Some investors fear CrowdStrike might need to spend more to defend its position.

Short term revenue drag

Discounts tied to the outage still affect earnings. Investors worry this could slow momentum for a few quarters.

Sentimental risk level: Medium

IDDA Point 5: Technical

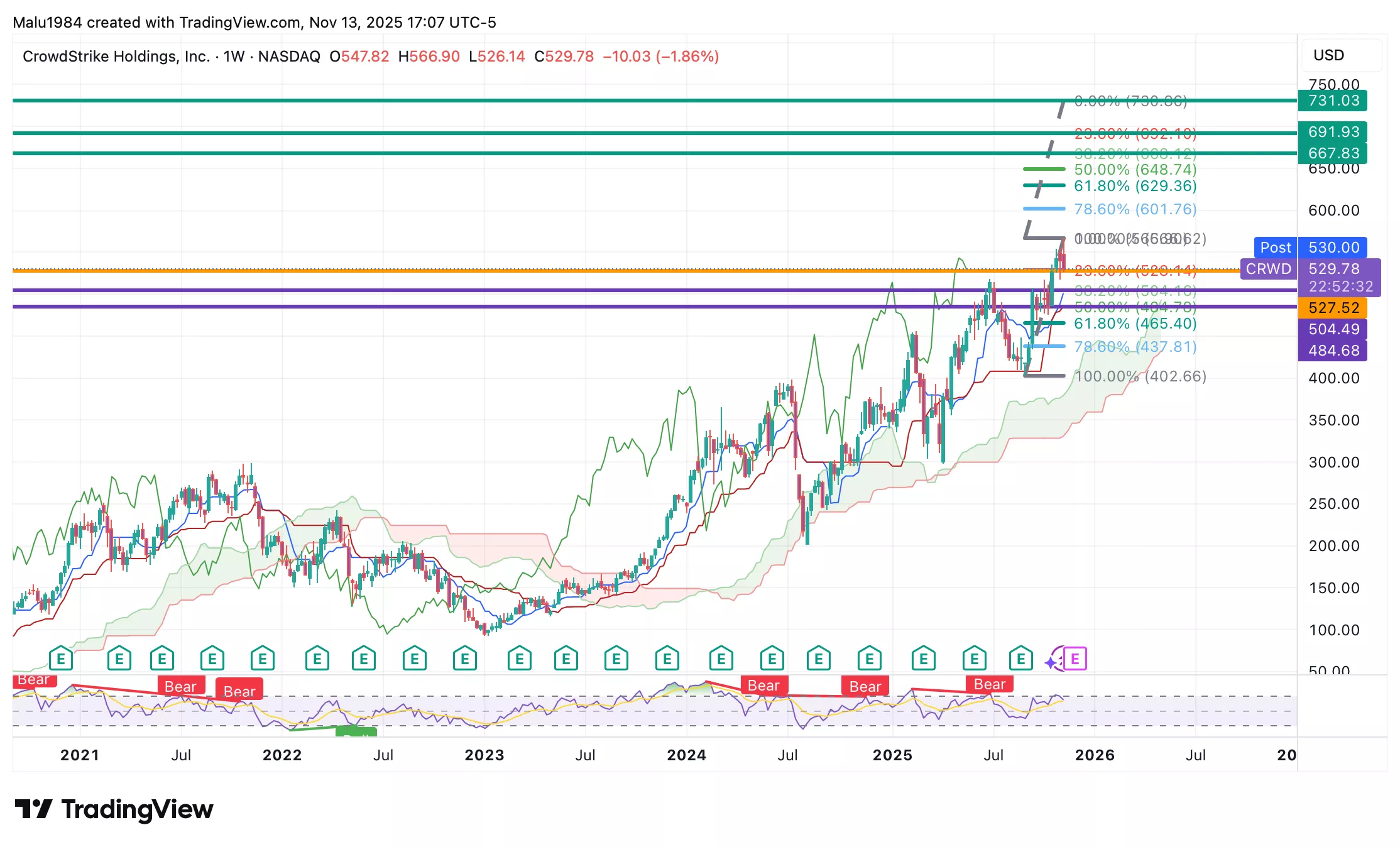

Price sits well above the Ichimoku Cloud which shows buyers stay in control.

The conversion line follows above the baseline line (Tenkan above Kijun) which signals steady upward momentum.

The future cloud is green which hints the trend can keep pushing higher.

The RSI sits at 65 which shows strong demand while still leaving room for more upside.

The chart keeps forming higher highs and higher lows which confirms a strong long term uptrend.

Overall this is a bullish weekly setup with solid long term growth potential.

(Click on image to enlarge)

Buy Limit Levels:

$527.52 – High Fill Probability

$504.49 – Moderate Fill Probability

$484.68 – Low Fill Probability

Sell Limit Levels:

667.83 (High Fill Probability)

691.93 (Moderate Fill Probability)

731.03 (Low Fill Probability)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk level: Low

Summary: Final Thoughts

CrowdStrike shows strong growth, steady demand, and clear leadership in cybersecurity and AI security. The company keeps adding new products, new partners, and new markets which supports long term growth potential. The chart also stays bullish with clean momentum signals.

The main fundamental risks come from the legal fallout of the 2024 outage, short term revenue drag from customer discounts, and a high valuation that needs strong performance to stay supported. Sentimental risks include ongoing lawsuits, competitive pressure, and fears that the stock price may be ahead of itself.

Overall the story leans bullish for long term investors who understand the risks and can handle some volatility along the way.

Overall risk level: Medium

More By This Author:

Nvidia $5 Trillion Milestone Is Still Shaking Up Wall Street – Is This The Peak Of The AI Boom Or Just The Beginning?

Netflix Stock: Exciting 10:1 Split. Not-So-Exciting Earnings. What’s Under The Surface?

Beyond Meat Stock $900 Million Debt Deal News: Lifeline Or Last Gasp Before Collapse?