McDonald’s Corp Valuation: Is The Stock Undervalued?

Image Source: Pexels

As part of an ongoing series, we typically conduct an analysis on one of the companies in our screens each week. This week, we thought we’d take a look at one of the stocks that is not currently in our screens: McDonald’s Corp (MCD).

Profile

McDonald’s is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets. McDonald’s pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe.

The company earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

Recent Performance

Over the past twelve months, the share price has moved down by 7.67%.

Source: Google Finance

Inputs

- Discount rate: 6%

- Terminal growth rate: 3%

- WACC: 6%

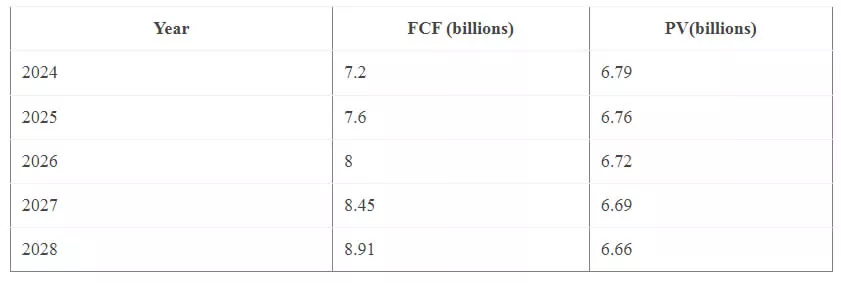

Forecasted Free Cash Flows (FCFs)

Terminal Value

- Terminal Value = FCF * (1 + g) / (r – g) = 305.91 billion

Present Value of Terminal Value

- PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 228.59 billion

Present Value of Free Cash Flows

- Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 33.62 billion

Enterprise Value

- Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 262.22 billion

Net Debt

- Net Debt = Total Debt – Total Cash = 50.04 billion

Equity Value

- Equity Value = Enterprise Value – Net Debt = 212.18 billion

Per-Share DCF Value

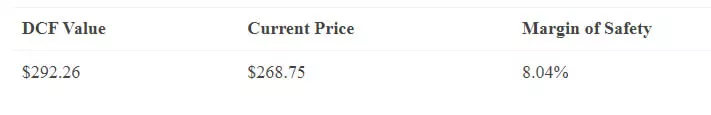

- Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $292.26

Conclusion

Based on the DCF valuation, the stock is undervalued. The DCF value of $292.26 per share is higher than the recent market price of $276.69. The margin of safety is 8.04%.

More By This Author:

Why Unilever PLC Stock Is A Buy

PepsiCo Inc DCF Valuation: Is The Stock Undervalued?

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months - Saturday, July 20

Disclosure: None.