Why Unilever PLC Stock Is A Buy

Image Source: Pexels

As part of our ongoing series, we will focus on one of the stocks from our stock screeners, and take a short look at why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our stock screeners is: Unilever PLC.

Unilever PLC (UL)

Unilever is a diversified personal-care (52% of 2022 sales by value), homecare (14%), and packaged food (34%) company. Its brands include Knorr soups and sauces, Hellmann’s mayonnaise, Axe and Dove skin products, and the TRESemmé haircare brand. The firm has been acquisitive in recent years; notable purchases include Paula’s Choice, Liquid I.V., Horlicks, Garancia, and The Vegetarian Butcher.

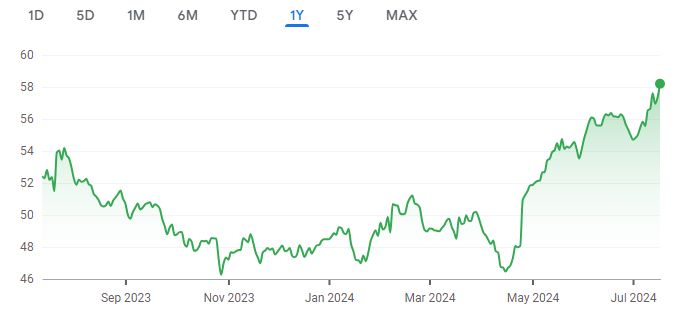

A quick look at the share price history over the past twelve months shows that the price is up 11.01%. Here’s a brief look into why the company is undervalued.

Image Source: Google Finance

Key Stats

- Market cap: $145.44 billion

- Enterprise value: $173.46 billion

Operating Earnings

- Operating earnings: $10.74 billion

Acquirer’s Multiple

- Acquirer’s Multiple: 16.20

Free Cash Flow (TTM)

- Free cash flow: $7.68 billion

FCF/MC Yield Percentage

- FCF/MC yield: 5.60

Shareholder Yield Percentage

- Shareholder yield: 4.40

Other Indicators

- Piotroski F score: 7.00

- Dividend yield: 3.20

- ROA (five-year average percentage): 13

More By This Author:

PepsiCo Inc DCF Valuation: Is The Stock Undervalued?Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months - Saturday, July 20

Why Is Stellantis NV Stock A Buy?

Disclosure: None.