PepsiCo Inc DCF Valuation: Is The Stock Undervalued?

Profile

PepsiCo is a global leader in snacks and beverages, owning well-known household brands including Pepsi, Mountain Dew, Gatorade, Lay’s, Cheetos, and Doritos, among others. The company dominates the global savory snacks market and also ranks as the second-largest beverage provider in the world (behind Coca-Cola) with diversified exposure to carbonated soft drinks, or CSD, as well as water, sports, and energy drink offerings. Convenience foods account for approximately 55% of its total revenue, with beverages making up the rest. Pepsi owns the bulk of its manufacturing and distribution capacity in the US and overseas. International markets make up 40% of total sales and one third of operating profits.

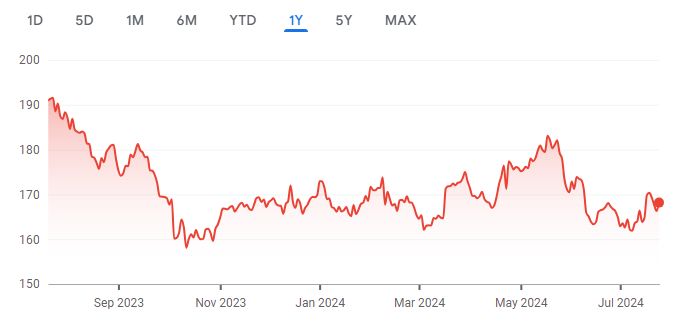

Recent Performance

Over the past twelve months the share price is down 11.92%.

Source: Google Finance

Inputs

- Discount Rate: 6%

- Terminal Growth Rate: 3%

- WACC: 6%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 8.12 | 7.66 |

| 2025 | 8.77 | 7.81 |

| 2026 | 9.48 | 7.96 |

| 2027 | 10.25 | 8.12 |

| 2028 | 11.08 | 8.28 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 380.41 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 284.27 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 39.82 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 324.09 billion

Net Debt

Net Debt = Total Debt – Total Cash = 37.90 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 286.19 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $208.44

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $208.44 | $168.17 | 19.32% |

Based on the DCF valuation, the stock is undervalued. The DCF value of $208.44 share is higher than the current market price of $168.17. The Margin of Safety is 19.32%.

More By This Author:

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months - Saturday, July 20Why Is Stellantis NV Stock A Buy?

Merck & Co Inc. DCF Valuation: Is The Stock Undervalued?

Disclosure: None.