Market Correction Turned Into A Waterfall Invoking 2022 & 2020 – Zone For A Bottom Opens This Week

In last week’s video, I discussed how Thursday’s plunge didn’t look like the decline was complete. Rather, the market needed some more downside and time to attempt to forge a low again. In that thesis, I certainly wasn’t talking about nor expecting the complete rout that happened on Friday where 90% of the volume came in stocks that declined. After very constructive behavior leading up to April 2nd, the two-day, about to be three-day, drop has turned into an emotional, waterfall selloff, the likes of which we haven’t seen since the shock of the inflation wave in June 2022. You can see that below on the right side of the chart with the consecutive red days. The behavior in May 2022 was constructive before the market was blindsided in June.

(Click on image to enlarge)

Last week, investors threw out the baby with the bathwater as evidenced by mass selling the most defensive sector like utilities and consumer staples which are considered the recession trade. First, let’s look at the S&P 500 below.

(Click on image to enlarge)

Next, you can see the utilities and consumer staples which saw indiscriminate selling. In other words, investors sold what they could not what they wanted.

(Click on image to enlarge)

(Click on image to enlarge)

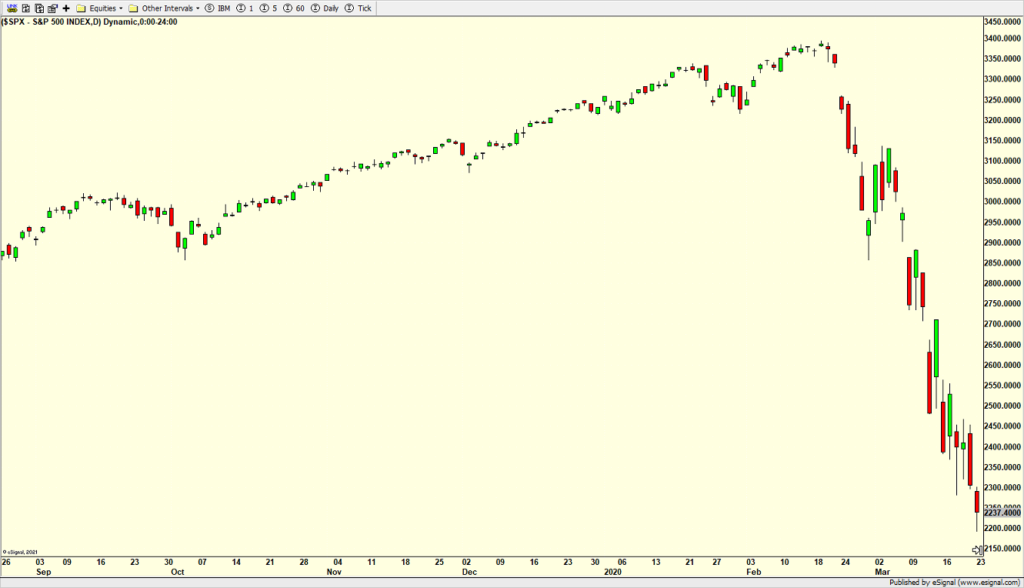

Friday’s plunge also harkens back to the COVID Crash which you can see below. There are some similarities although once the bottom came on March 23rd, 2020, stocks soared and never looked back. I do not think that’s the case here.

(Click on image to enlarge)

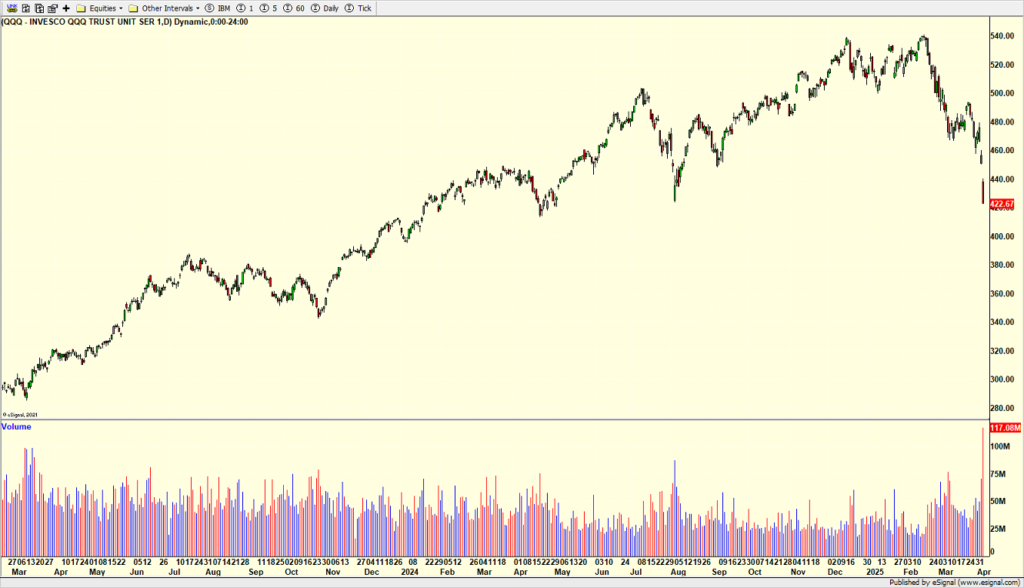

Below is a chart of the QQQ which tracks the NASDAQ 100. Underneath price you can see the volume on a daily basis. Notice that Friday saw 117 million shares traded which is the most since 2022. Oftentimes, markets will bottom or attempt to bottom when volume spikes in the QQQ. I think that index is in the zone for a low this week.

(Click on image to enlarge)

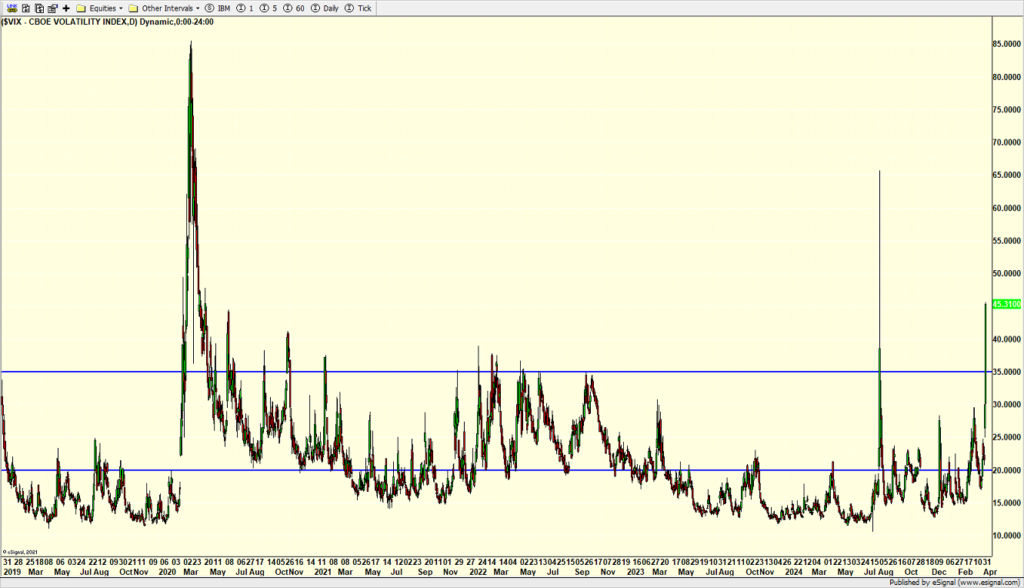

Volatility has also spiked. Below is the Volatility Index or VIX. You can see that moves above 35 usually mean the stock market is in the zone for a low. You can also see that moves above 35 are also short-lived. The VIX will likely see 50 on Monday.

(Click on image to enlarge)

Thursday and Friday saw vicious declines and that’s likely to spill over to Monday. The zone for the most intense low is this week which should be followed by a short and sharp bounce for more than just a few days. However, unlike the COVID Crash and the August 2024 mini-crash, I don’t see stocks going back up in straight line fashion. Rather, time and a series of rallies and constructive declines to build a foundation is likely needed during Q2.

I have argued that the three-week, 10% correction from February 19th to March 13th was mostly about Wal-Mart (then Nike and Fedex) and an old fashioned growth scare, not about tariffs. Look no further than Thursday’s and Friday’s mini-crash to see that confirmation. Markets knew tariffs were coming. The President and his administration indicated that many times. Markets just didn’t believe they would actually come to fruition and did not price in what began as a 1/2%-3/4% hit to the economy. As Q1 wore on, the tariff plan expanded. By the time March ended, the full plan had more potential downside to the economy and April 2nd came and went without the administration backing down.

As I have said for the past few months, the Fed is woefully late again. I pounded the table that they should have cut interest rates by 1/4% last month and then again in early May. They are worried about inflation which is all but dead with the economy slowing. And yes, while I do understand that tariffs may lead to some prices going up, I also know that a slowing economy is a more powerful force in bringing prices down.

Finally, as with the 20%+ declines we saw in 2022, 2020 and 2018, there are always things investors can do to take advantage of the situation, both market-wise and financial planning-wise. Tax loss harvesting, ROTH conversions, adding risk and new money are some. I also strongly advise folks to have us rerun their retirement projections which have been stress tested for situations just like this.

On Wednesday we bought SDS, PCY and HYG. We sold BMAY, some QLD and some UNH. On Thursday we bought more TLT. We sold SDS, PCY, IYR, PDBC, ARRY, TSM, EEM, EFA, HYG and some QQQ. On Friday we bought RYILX and more QLD. We sold RSYYX and JHYFX.

More By This Author:

Stock Market Bottom Could Be In As Tariffs BeginHere’s The Good News – Stocks Getting Close

Bears Coming Out? Inflation Data Now Partisan

Please see HC's full disclosure here.