Market Briefing For Thursday, May 25 '23

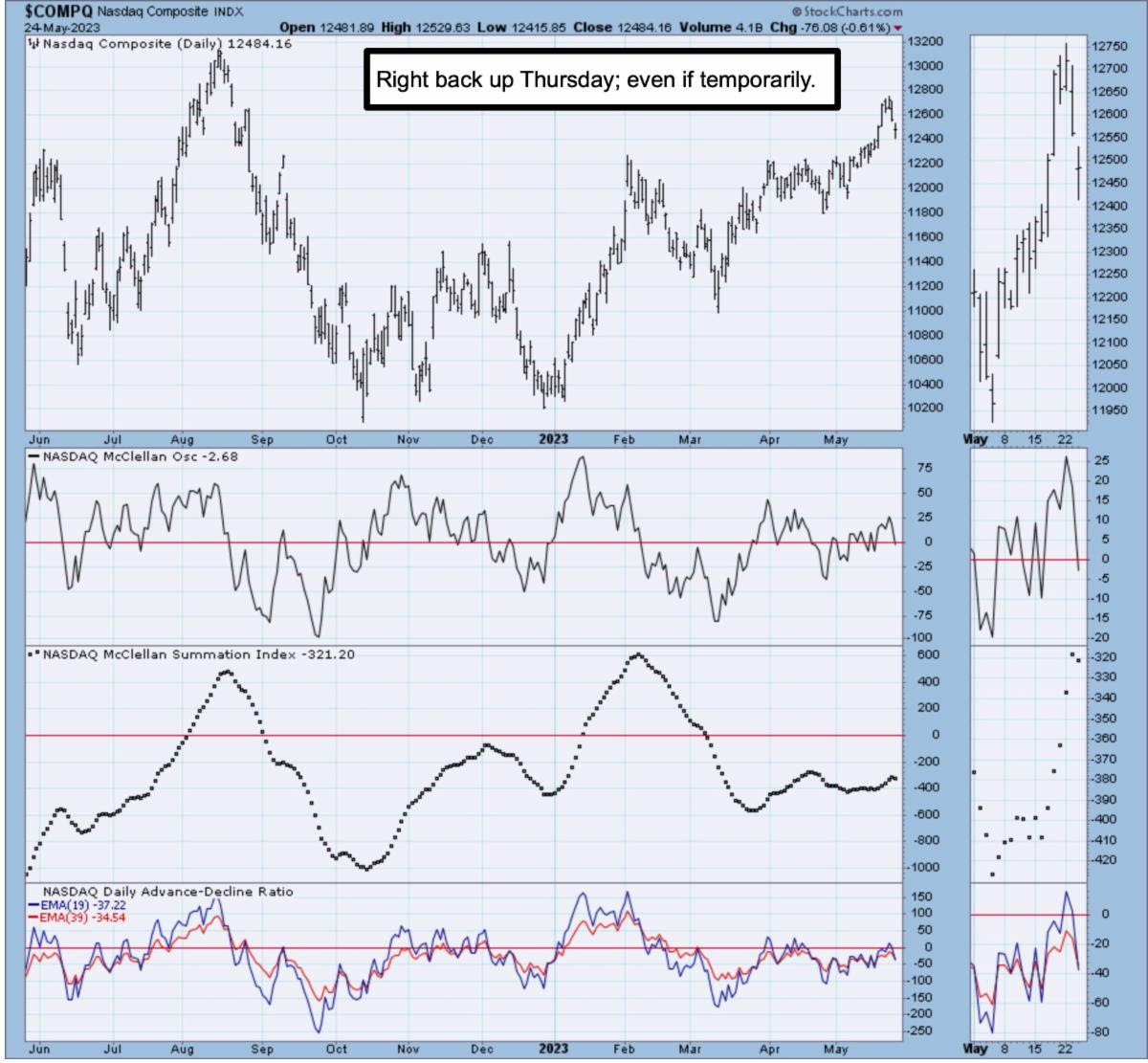

The Magnitude of the AI revolution - became a bit more resounding, after a very impressive Nvidia 'beat' (huge gain) after Wednesday's close. Sure there will be profit-taking or so on, but the importance to us is: that very heady price stock is a roll-model in this case for the sector, that's really just getting started.

Our AMD (held remainder since 17... portions previously sold between higher 100-150 prices last year) continues a forecast run over 100 now; as ongoing. It's also a transformative time for Microsoft among bigger stocks; as it affirms this as a 'new era' that is more concerned about AI than about interest rates.

Certainly that can bite; which is why the 'new home builders' being thrilled is a sort of warning, lest Americans become severely overextended with 'biting-off more than they should really chew', in terms of housing costs, even if they can for the moment. So while my view has been that market resilience primarily is a result of a 'prominent new era'; it doesn't mean throw all caution to the wind.

For the moment lots of shorts are going to be scrambled; core data-center biz is also good (not just for Nvidia or AMD); and a lot of AI stocks will kick-again, as the next phase of speculation and investment in the sector advances anew I suspect. So yes, Microsoft gets a boost and maybe Google; but from a risky leverage perspective, the smaller plays like SoundHound and BigBear.ai will run a bit too. As I said before; this is nothing (yet) like a classic bubble; just at best a mini bubble which has many puffs (air or not) remaining to be played.

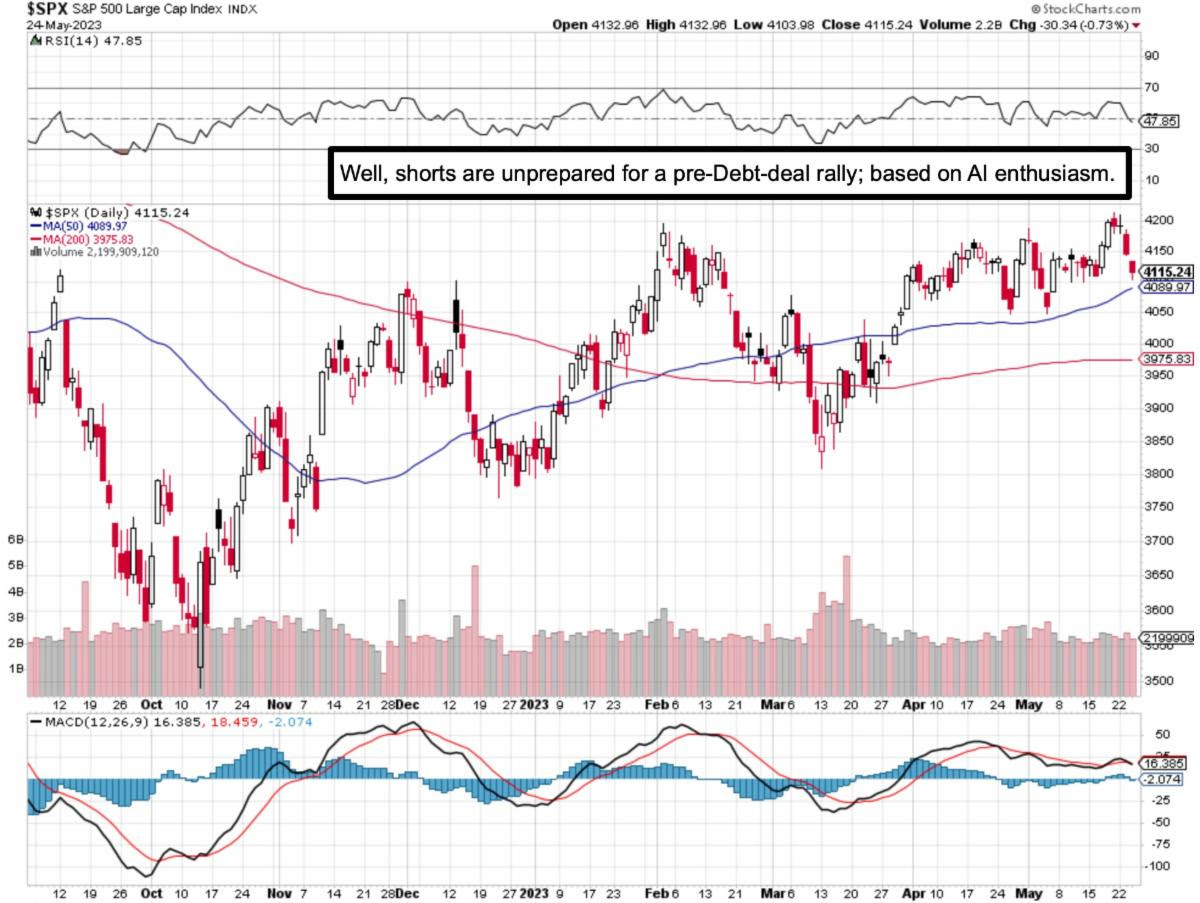

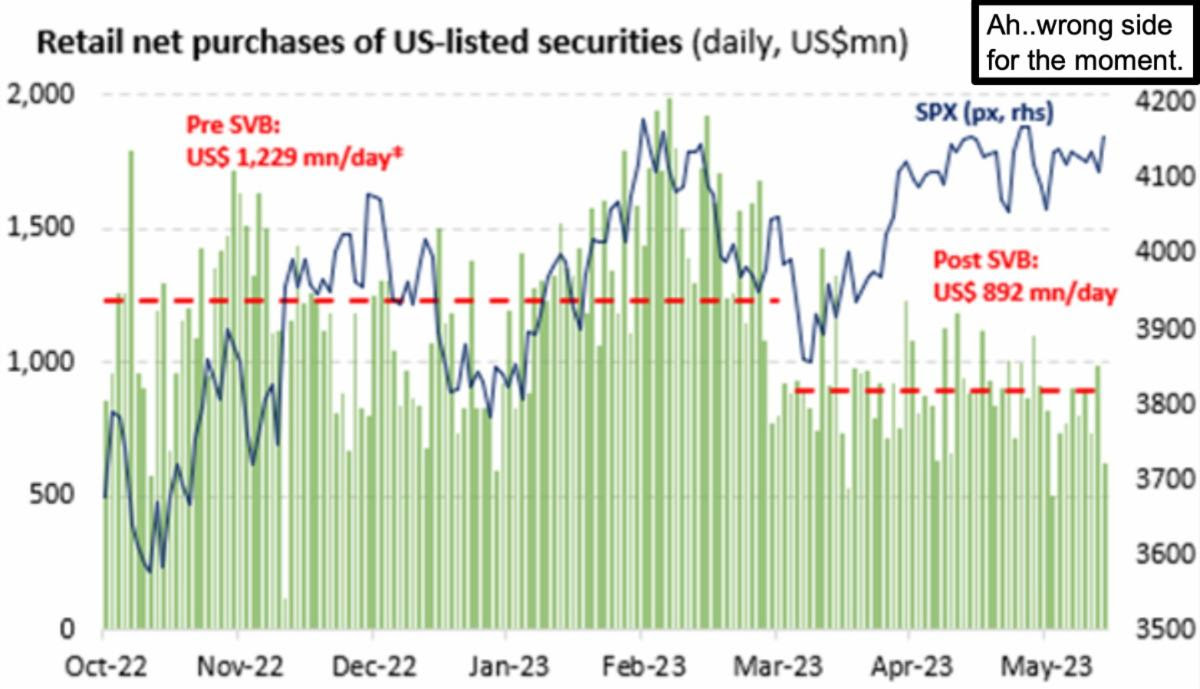

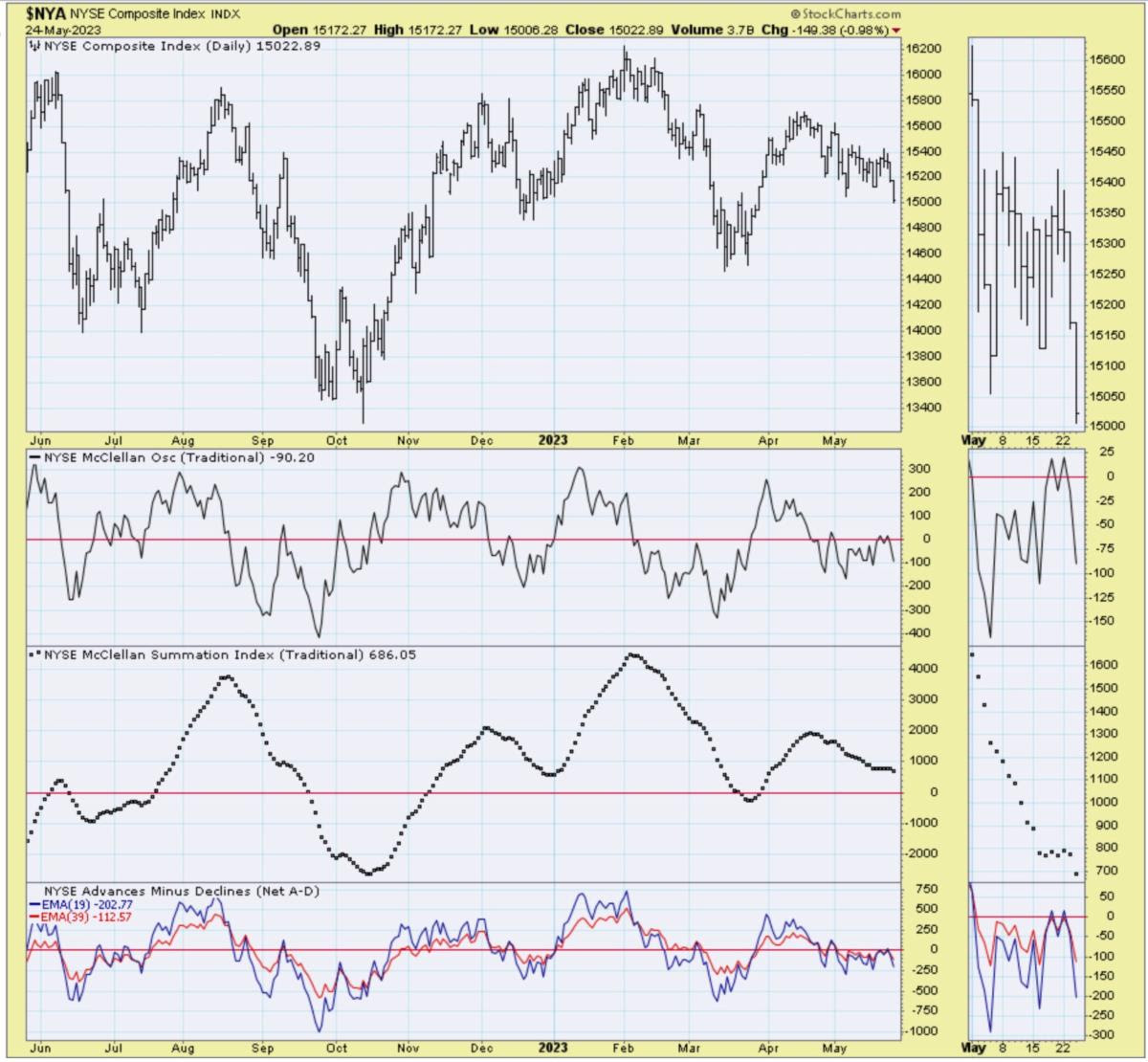

In sum: market positioning by money managers and technical analysts still is excessively and significantly bearish. Obviously we presuppose we won't get a horrid event from Washington, like a Debt Ceiling deal 'failure'; even though whatever is agreed (presuming it is) will be a bit of financial charade.

Perhaps 'charade' is why the S&P has been fairly resilient in our trading range for seemingly months now; given the actual Debt Ceiling was hit in January, with emergency measures stretching it out (and shame on Washington for the whole way it's been handled; not just the negotiations; but waiting so long).

Sure, we will have ebbs & flows; and the big indexes have relatively limited at the same time, impact.. on the AI space, which sort of has its own tailwind.

It's late and no time to type re: Fitch AAA rating downgrade threat.

So we hear that Nvidia mentioned 'AI' and then 'AI', at least 28 times in just the first 12 minutes of their Conference Call. I'm more an AMD fan obviously, but the near-endless loop of the use of the term 'AI' emphasizes how key it is.

Also AMD is up a bit over 10 on the Pacific. In the short-term analysts will be again crowing for big-cap semiconductors; as some analyst will encouraging chasing the most expensive (like Nvidia) and as optimistic as I am about AI; it's not about buying big-caps into highs; while yes focused on others that are less exploited; and perhaps even 'innovative'.

More By This Author:

Market Briefing For Wednesday, May 24 '23Market Briefing For Monday, May 22, 2023

Market Briefing For Thursday, May 18

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more