Market Briefing For Thursday, April 14

Correlating market action with actual developments borders a fool's errand at this point. There of course are reactions to rates, to oil prices, and the war. At the same time there are occasional bounces because too many are really frenetically bearish, so presumably that sets-up periodic short-squeezes.

Yesterday, amid more gloom and doom, we suggested another rebound, and we had that, even though there's no evidence that it's more than a rebound as outlined. And then there's China: where authorities have dampened stories of reduced COVID restrictions, by suggesting restrictions continued rigorous with strict enforcement. Of course in Shanghai (the largest and advanced city most disrupted by this) there is no Amazon as such to alleviate the need for 'stuff'. I suspect most Chinese, like Americans a year and two ago, don't care if Bezos stuffs his pockets with more profits, if they could just obtain what they need.

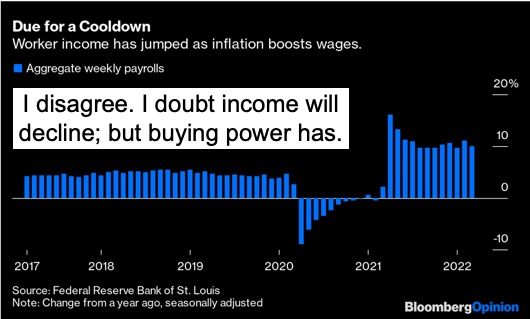

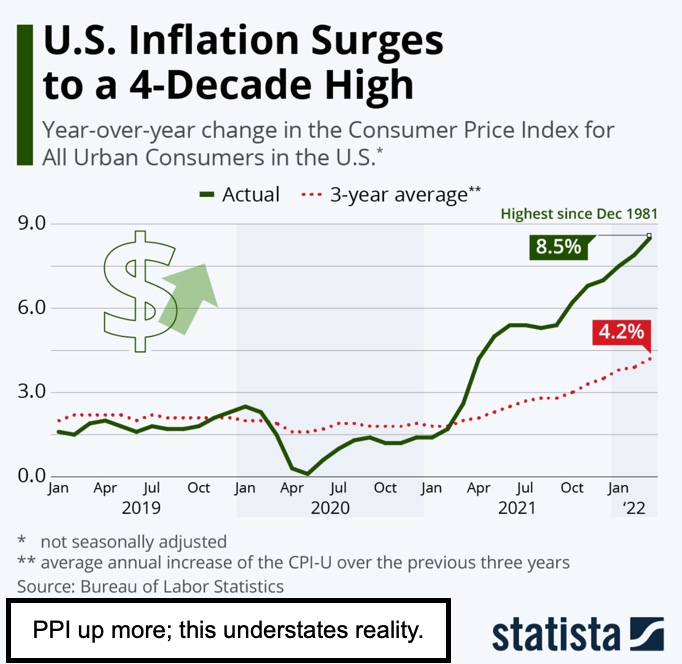

Obtaining what is needed is getting tougher for Americans too. From inflation. There is no meaningful relief now, though 'demand destruction' is starting now to be a bit more evident. Today a friend who specializes in 'exotic cars' noted this week's Florida Auction (of all kinds of cars to dealers mostly) was terribly disappointing, and did 'about half' the expected (or currently typical) volume.

It's an anecdotal report, but contradicts media stories suggesting 'over-sticker' and other reports of excess prices. That may be so for absurdly-priced exotic cars that appeal to a portion of society with more outlandish tastes, or far less humility than most folks, although we don't judge. You only live once (a rumor) so who can deny any 'crypto or sports' wealthy the right to flaunt it if they have it. Although last time I heard, most overpriced cars in the U.S. are leased, not purchased, vehicles, a detail that isn't mentioned in media-glorification stories.

The only point is prices, for cars and travel and Oil-related ventures, is getting so high it may inhibit or limit some spending this summer, as things appear at this point. Despite Delta reporting good cash flow and doing better, I hear lots of flights where schedules have just increased ahead of summer, are flying to distant locations with barely more than 50% load factors, again the opposite it seems of domestic stories of too many flights, too congested, and so on. We do note that Delta (our favorite airline) gave solid Q2 guidance, valid or not. I did hear CEO Ed Bastian say March was the highest booking 'ever', and that is great (DAL). However, I think the phenomenal demand is not just post-pandemic, but domestic, since everyone wants to travel, but not necessarily far abroad.

In regard to 'premium cabin' demand, that's not surprising given a preference of not being sandwiched closer to other folks than necessary. Also Delta has (finally) improved their version of 'premium economy' on some aircraft, which allowed creating essentially 5-classes: Business, Premium Select, Comfort+, Main Cabin, and actual economy. (The latter I would think avoided by flyers with any interest in obtaining mileage or perks, who are just price-shopping, a totally understandable way to travel for students or maybe large families.)

So yes, I know JetBlue (JBLU) is cutting overall schedules by at least 10% trying to limit the 'chaos' as they say, but I think it's also crew issues. Southwest (LUV) and other pilots are complaining of stress, which probably means crew shortages, since the cockpit crew doesn't directly deal with congested airport boarding. If a contraction actually occurs, then the rallies in Marriott (MAR), Booking Holdings (BKNG) or so on will be limited, but again people 'do' want to go somewhere (me too but not yet, one more step and then full recovery should blossom). Oh a brief note that 'mask-wearing' was just extended for at least another two-weeks. At the same time there is real chaos, there is tremendous domestic demand for travel, and so far inflation seemingly hasn't suppressed family travel budgets. If that's the case and demand doesn't moderate, well, the Fed won't like it.. a lot of pricing might suggest the peak travel was now. Good problem to have in the airline industry, but this is sort of insane to expect continuation of with all the cost pressures on maybe 95% of overall population for whom it matters.

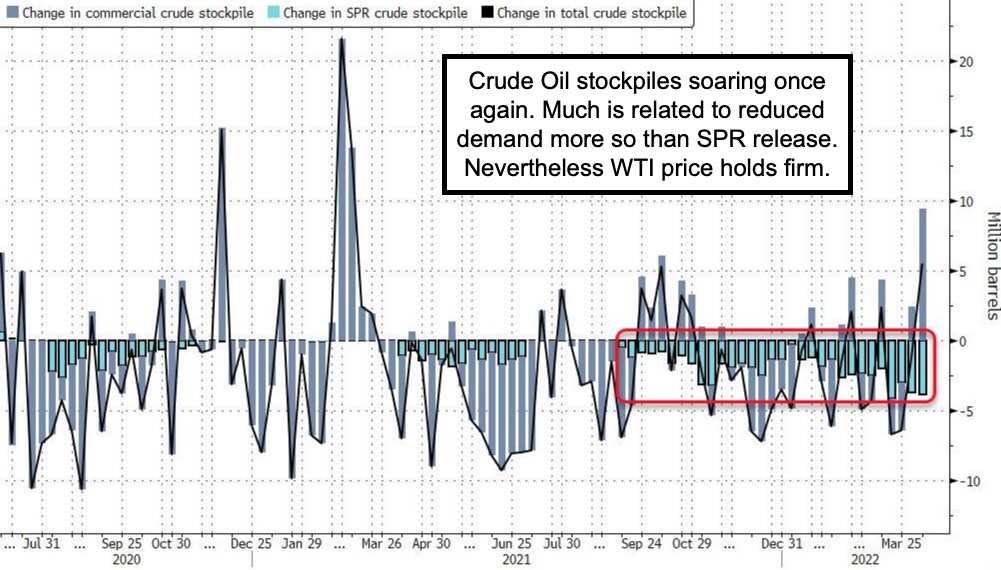

Finally media is reporting that OPEC output is 1.5 million bbls/day below their own targets, something I've noted in the last couple days. It's not just Russia, but Saudi Arabia upset that the U.S. has been working with Iran on reinstating the nuclear deal apparently. Whether that happens or not, because Iran balks at not having an assurance that the U.S. won't drop a new deal 'in the future', Riyadh is aware the U.S. is behaving in its own interests (which is should for sure, not that I favor the nuclear deal but simply say Saudi's are not really our friends), and that has the sheiks a bit jittery.

Anyway that's what weighs on Oil prices beyond the superficial obviousness of inflation and war-related aspects, which alone contributed to stronger Oil & Gas prices, starting months before...really about a year before...Putin's war. Of course the war and sanctions aggravated Oil prices, but Europe is still in a mode of buying from Russia, and most pipelines (as noted) traverse Ukraine.

Speaking of fuel: Amazon (AMZN) today is adding a 'fuel surcharge' for deliveries by any 'sellers on Amazon' that are not actually Amazon doing the selling. That's sort of sneaky, as most such sellers use Amazon for warehousing facilitation, so cost to deliver a package for a reseller usually matches directly from them.

Perhaps even more significantly, Ukraine is starting to plant Spring crops that the world needs. Make one ponder if both Ukraine and Russia have a motive of strictly economic and human (?) self-interest to sort things out before time for harvest arrives, though that's months off. Again a huge variable for not just markets, but the world and the preservation of humanity.

Overnight, Taiwan Semi (TSM) will report, and likely warn about current conditions. In Thursday's action we'll see mixed Bank comments too. The importance of trying to put together a couple upside days would infer emerging from what's been a series of days of 'indecision' with respect to volatility and prospects. In a sense it's entirely understandable with mixed bags of ongoing uncertainties.

One worry is whether or not the super-high inflation gets the Fed even more hawkish. That's also part of the idea that the higher stocks are (they're looking at S&P, not smaller stocks) the more the Fed will be aggressive. Not sure I will embrace that idea, of the Fed wanting people to 'feel' poorer, that some see it that way, hopefully the guys and gals (um: pronoun 'they' hah.. for politically correct silliness) at the Fed don't see it thusly. 'Sticky' inflation (which fails to ease regardless of near-term Fed action) is a problem, probably a real one.

The Fed's 'Waller' talked of enough cushion for jobs and growth to muddle its way through the 'scary' monetary tightening process. I'm not sure that's valid, but for now that a good-enough excuse for the current rebound traction.

On a real economic basis we already see signs of retracement, but declaring it a 'soft landing' is something the Fed would like to be able to accomplish. It's a tough-job to extrapolate given the factors that are 'external' to domestic U.S. economic factors, including what OPEC is doing 'to' thwart a nuclear deal with Iran, and of course the influences not only of Putin's war in Ukraine, but really the choking-off of economic activity by Beijing due to COVID spreading widely.

Bottom-line:

Bumpy roads remain ahead, and we cannot yet say traction is sufficient to call the market's rebound more than 'transitory'. However much of the market, outside of big-caps, has become increasingly realistically priced.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more