Market Briefing For Monday, Sept. 12

After solemn reflection Sunday (not overshadowed by memorials to QE2); we will also pray for the brave St. Petersburg council members who indeed did send a Letter demanding arrest or prosecution of Vladimir Putin for 'treason' to the Russian Federation, by much he did without the will of Russian people. Putin is the threat and thinks he's a monarch or worse. What it tells us: there indeed is some movement to 'out' Putin and stop the insanity, from within Russia.

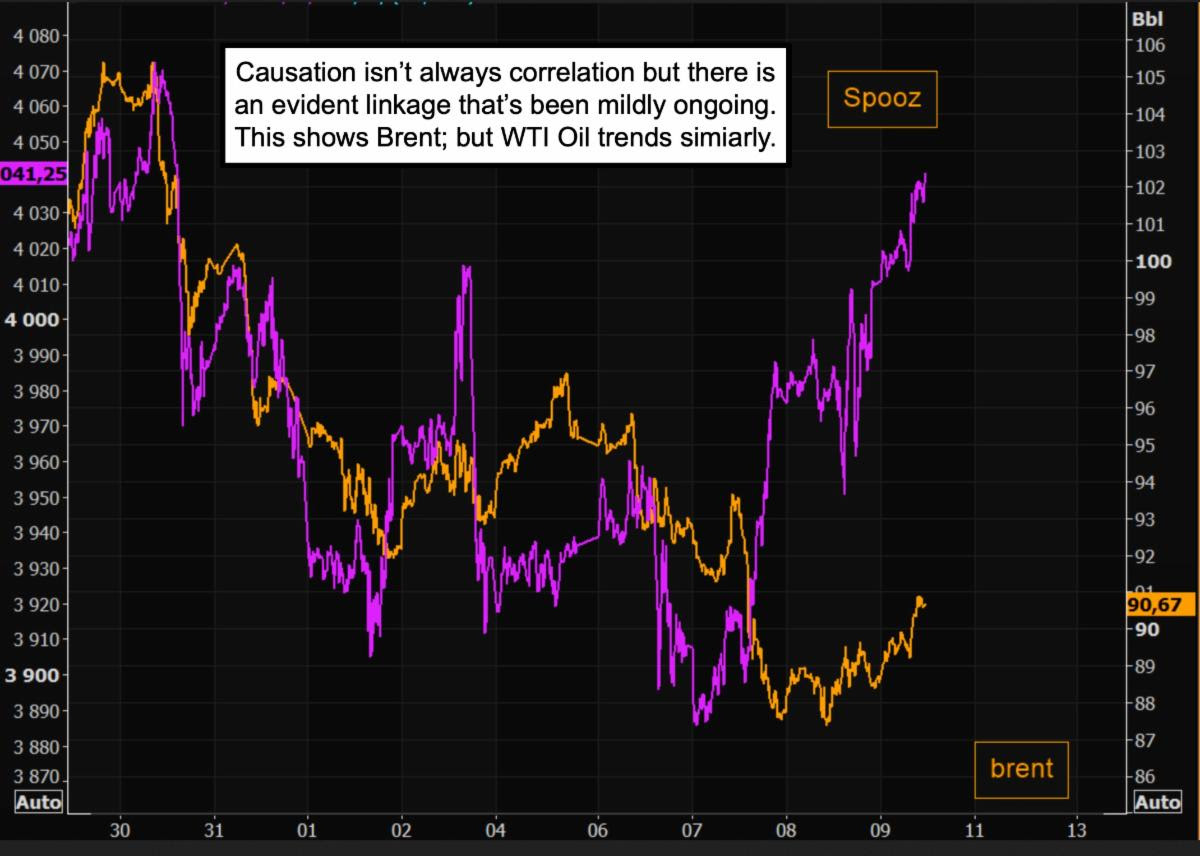

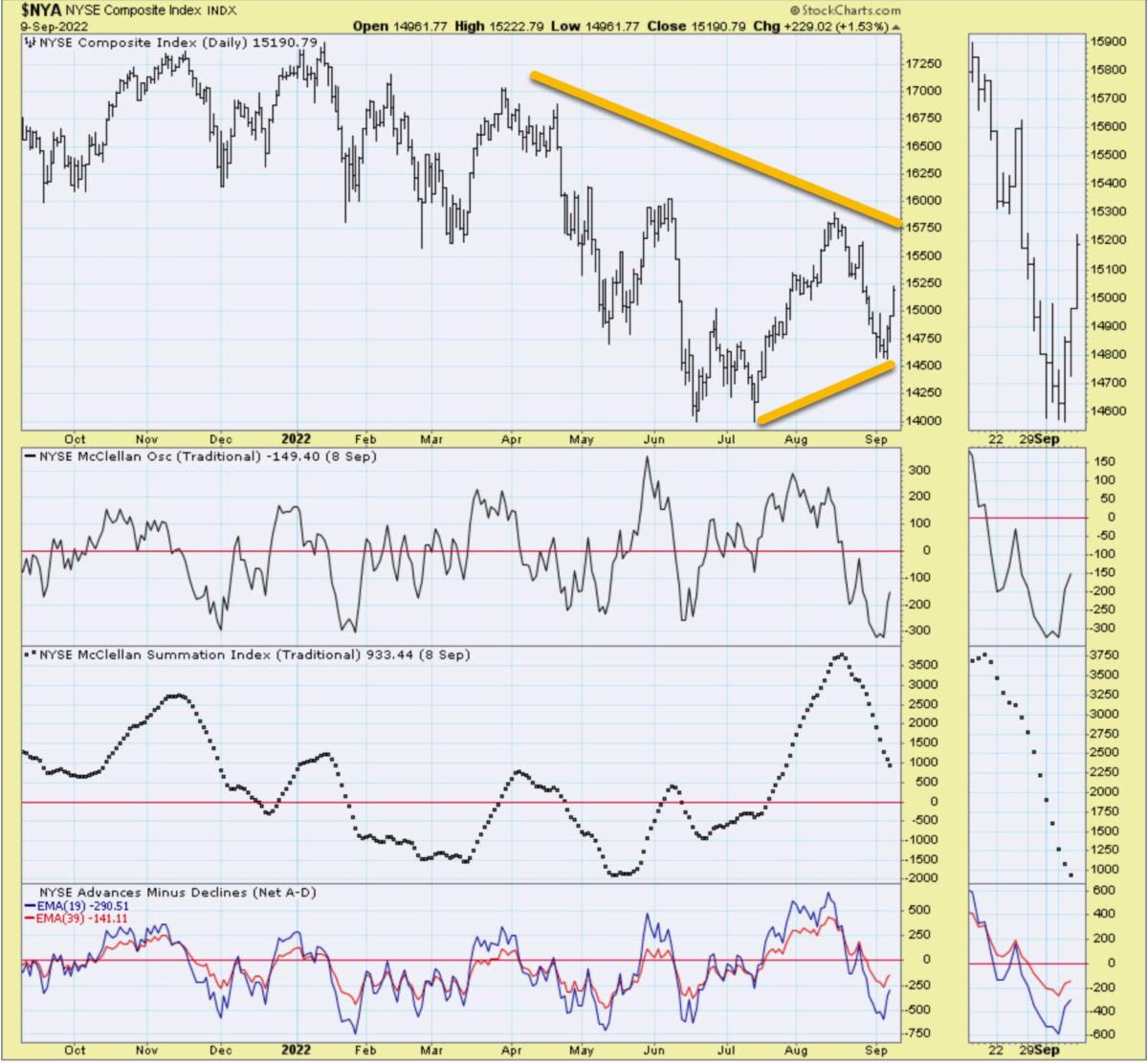

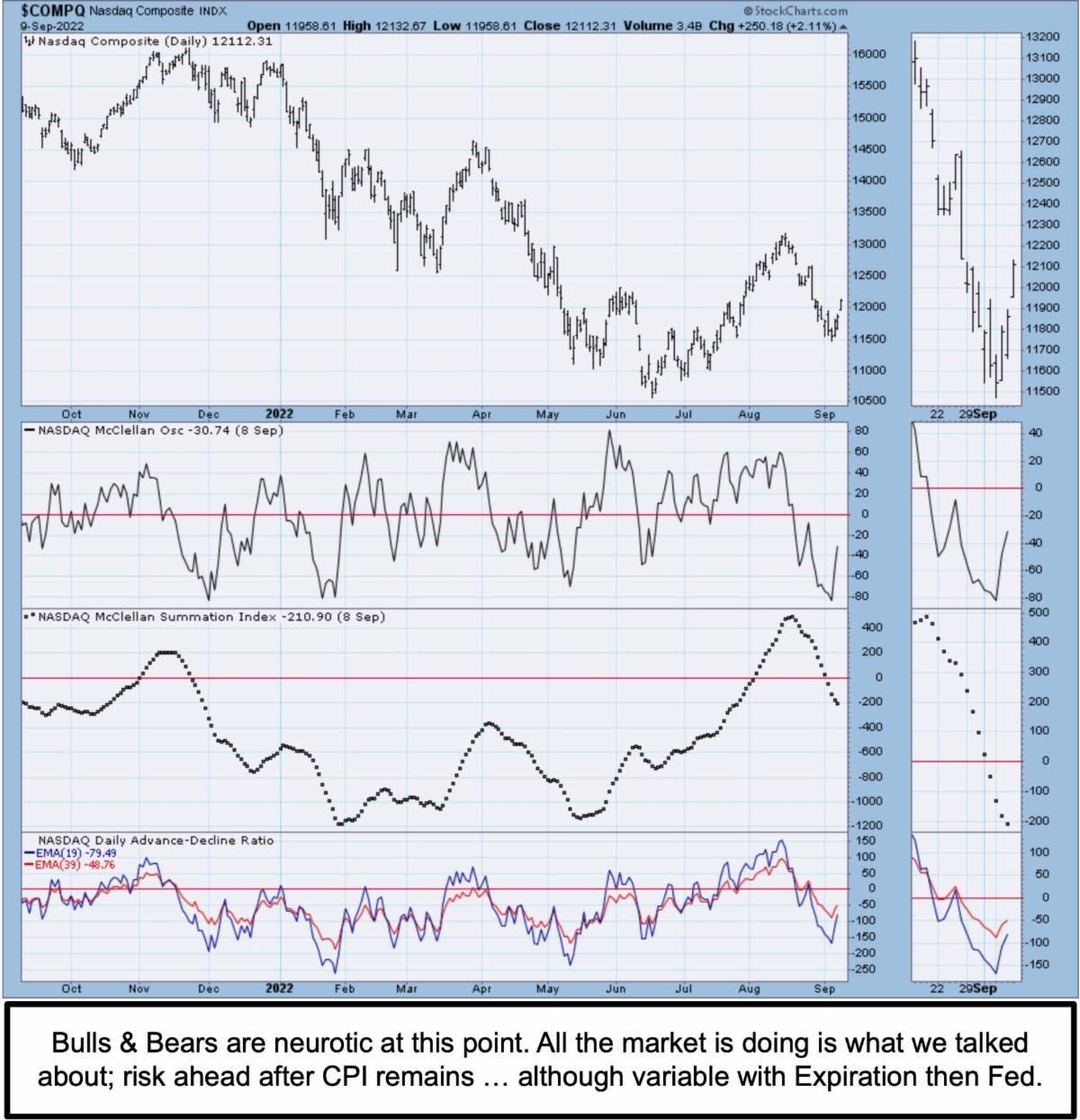

Aggressive bearishness recently was understandable or easy to rationalize, merely from the perspective of slower growth next year warranting a lower multiple of earnings limiting forward progress for the S&P.

We don't want to get too excited about upside prospects given we called the preceding drop and rebound; and now suspect we get another phase likely after the CPI has a slower pace of gain (not the same as drop) and drags in stragglers.

So the higher we go in the very short run, after CPI, the less optimistic we'll become; providing of course some other variable didn't intercede.

In sum: the dynamics of this world are fluid and can change rapidly.

Anyway we got our market move; it's likely not over; and here comes the CPI.

My optimism is that the CPI is coming; not the intergalactic bodies. I might get a 'scotch on the rocks' tomorrow; but I am thinking ice cubes not space rocks.

My optimism will likely fade if the war continues 'as is' while welcoming limited advance by Ukraine in the East; but as Kazakhstan shuts-down their pipelines heading toward Caspian Sea and Ukraine (it gravitates toward Europe). I do expect favorable CPI forthcoming; but again that won't deter the Fed, yet.

I also ponder what will stabilize California, where 'man' has created the critical energy and power shortage situation, in what was the leading energy State. It was 'wishful thinking' anti-civilization supposedly-green policies that reflected not the responsible 'climate change green' crowd; but radical anti-people stuff.

Really it seems; because I just heard that now-scuttled decommissioning of the Diablo Canyon nuclear reactor was originally started not because a fear of nuclear energy dominated; but rather because they wanted high energy costs and high taxes to combine discouraging people from living in California.

Is that really possible? Are they that unrealistic? I don't know these days; but I sure remember the high taxes even before I left after over 20 years in LA. But if so they ought to be very careful about what they wished for, since the way it is all developing will generally not allow starving people of power and water at the same time Sacramento tries to extract ever-higher taxes and levies.

One more thought, as I don't need to engage in the impossible chatter clearly dominating analyst and pundit opinions about how strong or weak the future is (among the chats really the multiple valuations levels for S&P; not individual issues with unique specifics matters). For now I'll stick with pattern evolution as we've outlined it, and a prospective situation facing new risks; especially if we get through a favorable CPI report and (incidentally) an Expiration.

Perhaps more notably, they aren't focusing adequately on how funds gravitated to the USA financial assets as the world risks more deterioration in many ways. So, more investors who retreat to the safe haven of the Dollar, whenever the world looks like it’s in a fiscally precarious state, have migrated to our shores.

Bottom line: we began the week 'heavy' and looked for and got a turn, with a very nice rally that has managed to maintain traction ahead of this weekend of remembrance (the losses especially repugnant for those of us who personally memorialize a few lost in radical Islam's attack on the United States, including the Captain of AA Flight 77 that the terrorists thrust into the Pentagon).

Here in the U.S. we believe an accelerated armaments preparation continues, but some of it relates to advanced weaponry for the Navy; which essentially is something I relate to the tensions around Taiwan; not the primarily land-based fighting in Ukraine. I have mentioned the (at last) equipping of more than one USN warship with the latest laser-weapon (presumably to defend against the combined risks of aircraft, missiles and even drones) ... there is limited info at this time; though we shared a picture of one ship's installation. Just because I may also believe certain military contractors have engineers working overtime doesn't automatically mean there's preparation for hostilities; but we already it should be noted, heard a National Security Advisor reference heightened risk of China invading Taiwan... he said that this week and hardly anyone notes it.

I'm not suggesting imminent conflict; but prepare mentally to recognize how any such development would confound markets in short order; irrespective of the Fed, earnings or any other consideration. That is part of what I mean when I say this is like a preamble to WW2; aka 1930's.

Stay tuned for CPI and incidentally... Quarterly Expiration. Remember those comments about nearly historic Put buying before this week? Well how about the open interest and potential upward action related to this Expiration plus of course my suspicion that a lot of overly bullish Oil traders who bought a pitch (lunacy I called it) for 200/bbl Oil got their clocks cleaned. We'll address a lot more next week, presumably we don't get hit by an asteroid before then :).

More By This Author:

Market Briefing For Friday, Sept. 9

Market Briefing For Tuesday, Sept. 6

Market Briefing For Thursday, Sept. 1

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.