Market Briefing For Monday, Feb. 28

Boom Times are not envisioned by politicians, the Fed, or given the war. So wouldn't it be interesting if the ultimate 'contrary opinion' would be post-Covid, post-Fed; post-war ('Roaring '20's') recovery; and for Europe a sobriety that includes the appropriate percentage spending levels by NATO members.

I'm reminded of this today as I recall the remark of Finland's Foreign Minister a few weeks ago as the Russian threats on Ukraine were ramping up; saying it is (essentially stuff) like this that 'makes us consider if we should join NATO' as contrasted to remaining non-aligned. This leads up to today's most-telling (or truly concerning) remarks by a Kremlin spokeswoman; essentially warning Finland and also Sweden of 'military consequences' if they ever think of NATO membership. Again my response would be to immediately start thinking more.

We won't dwell on the war except for areas the media distorts or misleads, as well as we can ascertain. There's too much ahead to make any definitive clear forecast; other than 'stocks will fluctuate'. (That's sort of humor; since the late Louis Rukeyser once asked in front of a crowd if I thought 'the market will go up, down or sideways'. My response drew laughs: 'Lou, stocks will fluctuate'.)

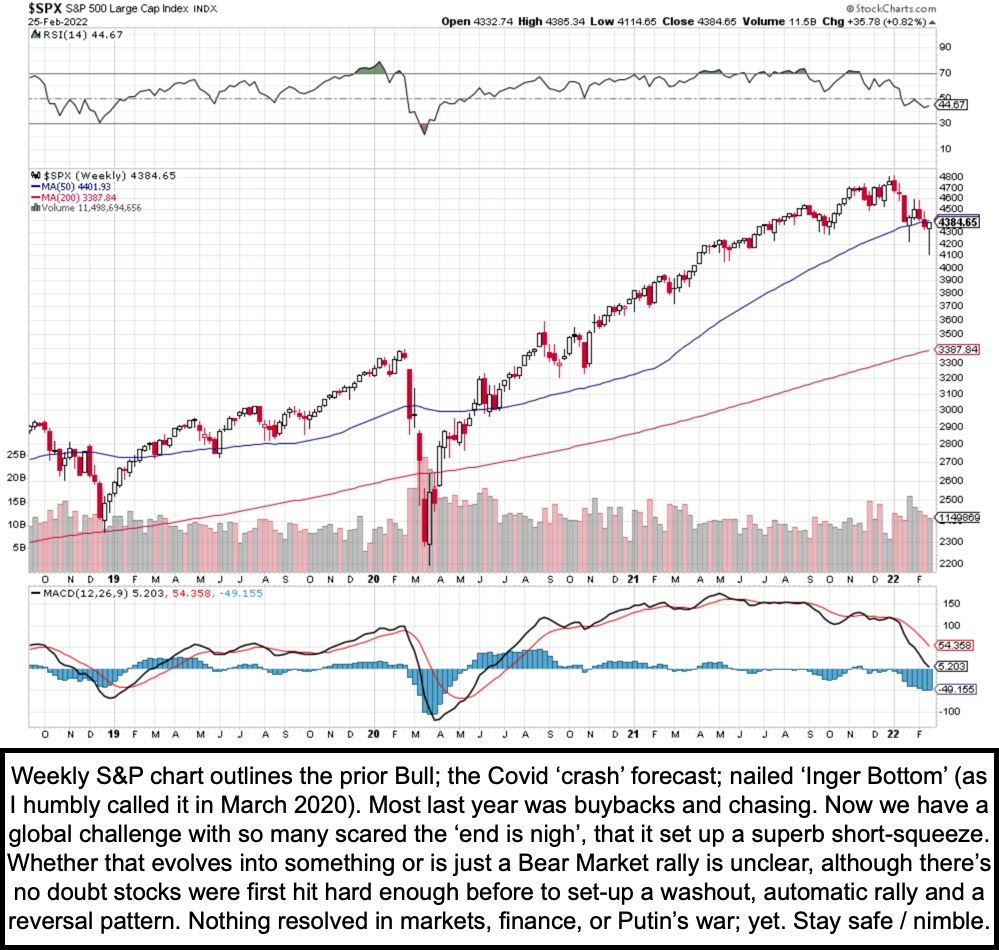

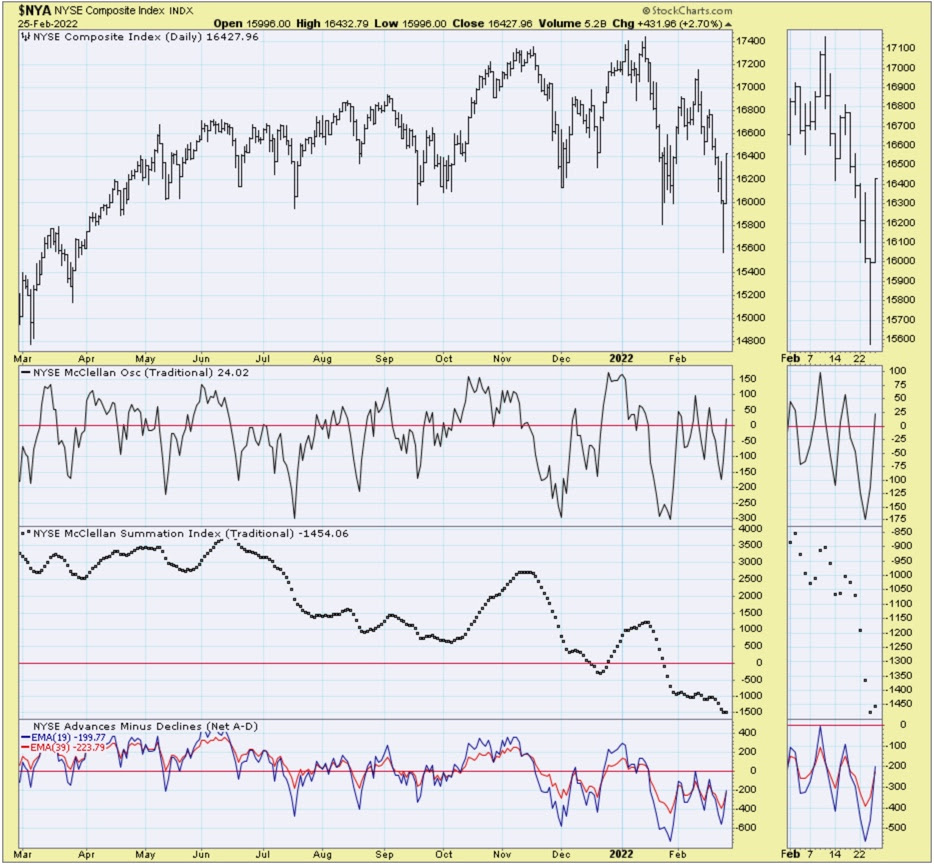

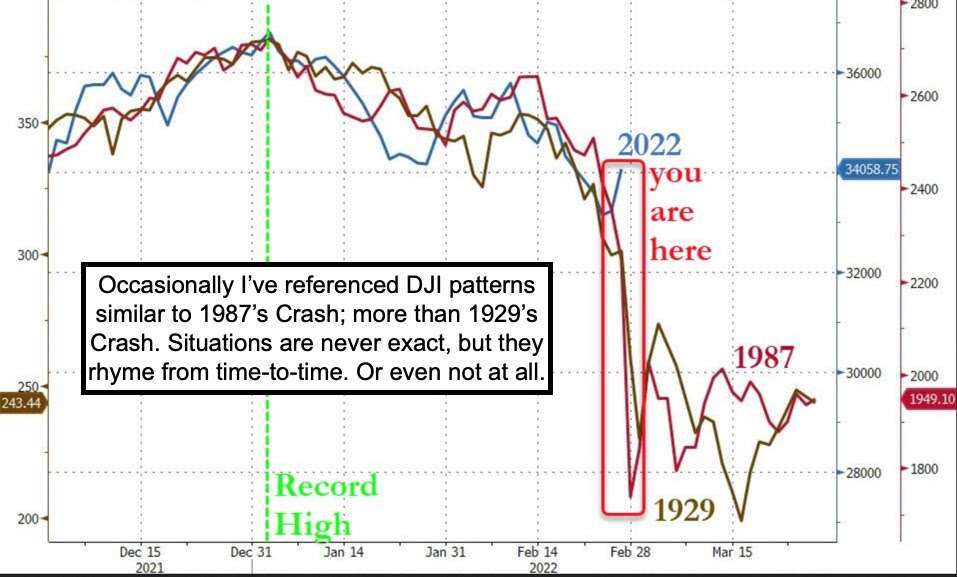

Just looking at technicals, and 'how hard down' the market (big and small) got hit in the days and weeks leading-up-to war; and then the 'washout' on actual wider conflict ... it's not impossible that we've had an important correction low. I cannot say that because not everyone is on-board the idea of war being short-lived (I'm not particularly optimistic about that, feeling Putin has bigger ideas); but I do know that markets have often bottomed as the cannon boomed; then were already up by the time trumpets sounded (which they don't in insurgency style conflicts, which this could become). So it's 'fluid' as they say; pressure in a few forms is going to be seen by Putin, expanding as the days go forth.

Now that the U.S. and 'most' allies have sanctioned Putin personally; that will impact his mostly-secretive family holdings in a number of countries too. Lots of his close colleagues own condos in the United States and more in the U.K. by the way; so hard to say what gets attached (or if that can be); but you stop their ability to spend much of their winter in Florida (such as at Trump-named properties in Sunny Isles next to Aventura in Miami). By the way Trump got a small percentage for use of his name; and those properties did not prevent as I noted, his criticism of the NATO spending insufficiencies a few years ago.

The Fed knows only breaking the back of the economy would tame inflation to the degree they want; and they dare not do that. So modest 25 BP increases; and the Fed may adjust the goalposts depending how things moderate. They won't in some areas, including semiconductors or related supply-chain issues because Covid's rampant in China (especially Hong Kong) even if better here.

So companies move closer to home; we're focused on new semiconductor fab endeavors in the U.S. (AEHR is a play on wafer-testing with hope they win at least some of the testing business in this newly-built facilities and existing too; while AMD is of course our now-long-term core holding in the sector.)

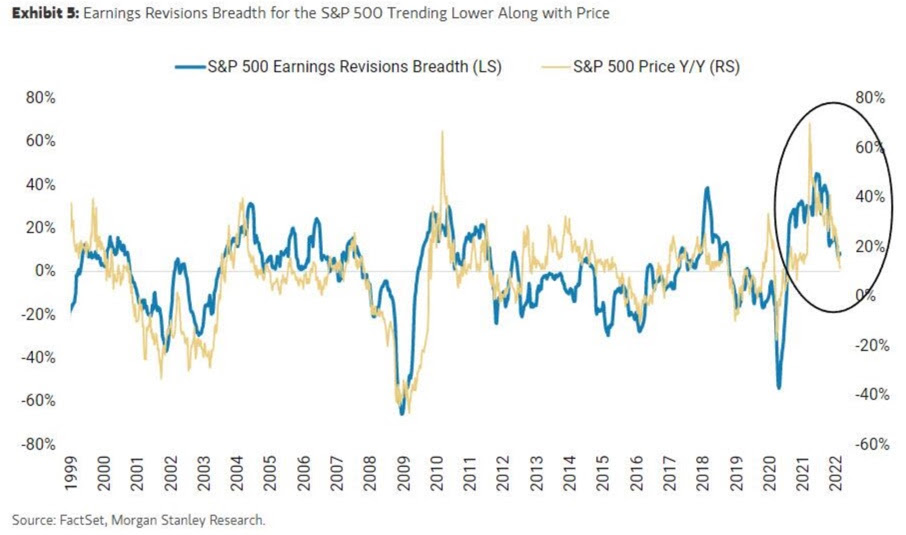

We realize there's a bearish rant out there (not just Bank of America's analyst or Societe General or one at Morgan Stanley); but while I recognize a liquidity situation in some countries; excess debt at most; and conflicted politics at well all of them; I am not going to engage in fire and brimstone negativity. In fact, I'll take the high road for the outcome, as Friday's short-squeeze affirms what can happen if too many get swept-up into a deluge of bearishness.

Capital flight from Russia is actually helping buoy prices lately; perhaps in last ditch moves before the door is closed (money coming 'into' the West not 'out'). Perhaps that's why the Dollar was especially strong during the attack's start. I have pondered now and then that Russia should have been embraced sooner but of course that's slightly cynical, as I mentioned 'if' it were without Mr. Putin.

When Russia was invited to join the Group of seven in 1997 (as I think mostly is forgotten by the press) it was intended as a major step toward membership of Russia in NATO. History has shown that it was a wrong decision for both parties to detach from that course. Western powers considered the invitation sort of an 'advance' to Russia, to motivate a post-Soviet trend toward a more open, accountable, rule-based way of government. And actual democracy.

The Russian side considered it closing the chapter on defeat in the Cold War, and looked at the Western attempts to share 'rules' based systems in Russia, as somehow subjugating Russia. Putin famously called that 'arrogance' with the West wanting to relegate Russia to a 'folding seat' at the global G7 table. Seemed cute; in reality it was the start of a brief time of freedom's demise.

Oligarchical rule took root under Yeltsin’s presidency; continued with Putin for sure, and fit poorly with the Western principles of liberal democracy. Oligarchs don’t need rotation of power, or a free press, or the accountability of rulers, or offer protection of minorities. The rise of authoritarianism under Putin was a logical step in Putin's Russia evolution. Freedom gradually eroded under him.

Some old communists and state bureaucrats retained Soviet hostility to NATO and the US, and saw the rise of the liberal world order as a threat to Russian national interests. They converted the chaos and popular dissatisfaction of the 1990s into resentment toward the West. It crystallized after the NATO strikes on Serbia in 1999 (and no Hillary was not really shot-down in the Balkans).

After Russia's fiscal default of 1998 (essentially), popular opinion took a basic nationalistic anti-Western turn they never recovered from; so any doubting the backdrop need only look at the road to this point. As Putin consolidated power in the autocracy; freedom gradually fled or was suppressed. Many Russians barely realize what's happened to them as they had a taste of freedom (and a free press) and even imagine they still do as nobody rescinded their rights in a formal way; though they did officially anoint Putin. I'll also note Ukrainian 'war' provides cover for Putin to lock-up his opponents or even the 900 then today 500 demonstrators who came-out (bravely / naively) to oppose his war.

Solution: get rid of Putin; as one of his retired Generals suggested; or did so before he found the current era's version of a gulag; a slave labor camp.

A quick survey of technicians finds near 4 out of 5 believing S&P will be lower in 4-6 weeks. That near-unanimity of bearishness means there's lots of shorts and while the market will absolutely continue to be volatile, might also suggest the next dip may find it to be a secondary test of the washout low of this week. If so that could find the S&P back up to these levels in the later Spring.

All this is speculation as things are uncertain in many so ways. Clearly much depends on how the world situation goes; especially Ukraine and Oil prices. I would be very pleased if Finland and Sweden stick it to Putin and join NATO right now. Just kidding. Sort of. Anyway the market remains 'rough' for now so sure, I distrust this rally, but would have no problem if it's a harbinger of better times. It was entirely concentrated in big-caps to make an S&P technical point of course, and so 'if' it acts well on the defensive, the ensuing upward swing is better positioned to bring along smaller cap stocks which stayed out of this so far and that's understandable, as money had to focus on proving the Index.

This market 'sold' on war drums, and rallied 'after' cannons sounded. So we'd got the turnaround but without enthusiasm for speculative small-caps. Now it's got to process everything from inflation, to the Fed, to Covid ending pretense, to eventually State of the Union, and of course.. the course of the Putin-war.

More pertinent next week: Chairman Powell testifies Tuesday (House panel) and speaks on Wednesday. If Russia doesn't attack Finland (just kidding I'd like to think) we might see the focus more on the Fed than the freak Putin. I'd normally not take time to try to capsulize my perspective on Russia and Putin; but I thought I'd offer one view of how he came to a confrontation view and for sure there's more involved, including ego and narcissism; but also materialism since Putin grew up in a very impoverished village; hence a military and KGB direction, which led him to East Germany at the height of the Cold War. If he's not suffering personal post-Covid psychosis, he simply wants to resurrect the past, which he often prides himself saying was the biggest last Century loss. I think his delusional comments about Ukraine capture the essence of the man.

Sunday Night Update

Brief Sunday evening update: everyone knows the Russian-Ukraine news. It now includes Putin's Nuclear threat, with little question as to whether he still is his once-fairly-rational self. The best simple response came from France's Macron, who responded: 'Putin should shut-up; you know we have nukes too.'

My concern has been Russia using tactical nukes against a Ukrainian city if a mad Putin doesn't realize he made a colossal mistake; and instead sides with his single General that strategized this insanity, and that's why you see lines of military vehicles heading toward Kiev (I know Kviv) right now; continuing an advance on the Capitol of Ukraine.

I speculated Putin has a 'post-Covid psychosis' and sure, a degree of isolation and delusional imagination about non-existing support. A glance at the global protests and increasing funding to help Ukraine tells a story that really should be broadcast in Moscow; but people figure it out. Russians are protesting this.

Now we're going to see this possibly kick-into a regional war 'if' there's not an immediate ceasefire resulting from the upcoming low-confidence negotiations kicks into what 'was' a regional war, but now expands as Russia mostly likely is going to occupy Ukraine. That will make the resistance interesting 'if' Putin doesn't use his bariatric bombs that sucks the oxygen out of people, or nukes.

Most key is something I mentioned would indicated an expansion: Turkey said they may close the Dardanelles to Russia; which would a) prove that Russian fiction of a sympathetic Turkey were wrong, and b) lock the Black Sea to entry or exit of Russian ships (they have a couple warships 'in' the Black Sea now; more out in the Med and Aegean trying to tag the U.S., French and Italian Carrier battle groups as well as a couple dozen other NATO warships.

One of the more interesting stories I've heard involves the UK Foreign Sec'y. endorsing volunteers (sounds like the Spanish Civil War era) to go to Ukraine; and there is EU funding released (including from non-NATO members) that's not just for supplies and ammo; but .. get this .. 'jet fighters' that are of a type the Ukrainian pilots are familiar with (I'm unaware which allies fly MIGs).

And of course we have the probable catastrophe in the Russian Ruble (180 to a Dollar as of this evening before markets open in Russia); and a 'Lehman Moment' in a sense for Russia. How that cascades into Western Europe or otherwise isn't clear, but the markets will be very negative initially; and give for sure back everything gained late last week, at least briefly.. unless.

The 'unless' is that it's not entirely simple ahead of Monday for the market as although the S&P futures are off 90 handles and DJIA futures off equivalent of nearly 700, you might or might not have a sign of 'rapprochement' or ceasefire before the U.S. markets open on Monday. More likely you won't; but if you do of course the 'down becomes up'; if it continues as seems more likely; it's very hard down. Is it a buying opportunity for traders if hit like last week? Maybe. It all depends.

Oil is up more than $4/bbl to $96/bbl in the front-month April contract. Cutting Russia off from Swift 'deftly' is being attempted (with energy carve-outs); but that's going to be tough, with politicians making decisions they know very little about; and that's a market concern. Major global upheaval is at-hand; but this can change almost on a dime if there is a ceasefire deal; and not a Putin trap, which would by the way not end the fighting. Like I send from the start: this is going to be the 'undoing of Putin', and it's just a matter of time. The tragedy is the lost lives (of every participant); resumed global polarization 'unless' there's removal of Putin either politically or by a Julius Caesar approach to 'change'.

So stay tuned; if Putin takes the chance for peace markets will soar; if he will 'nuke' a city in Ukraine, the tragedy will be magnified (but we would enter the war formally I suspect); but the Russian people would probably revolt too. The chance to stabilize things generally past; so it requires a leadership purge in Russia; not in Ukraine. (Zelensky has become a modern folk hero already and Putin is the Evil Empire Nazi he accuses others of.. no new Russian empire.)

Enjoy the night; we'll follow this tomorrow and if very hard down might buy for a trade; but again it's all very fluid and changes hourly. 'Probably' we get sort of a deal, or this goes downhill further. The day ahead is very crucial militarily, politically, and financially. Mostly for Russia/Ukraine; but there is spillover risk.

God Bless America and we pray for Ukraine.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more