Market Briefing For Monday, December 19

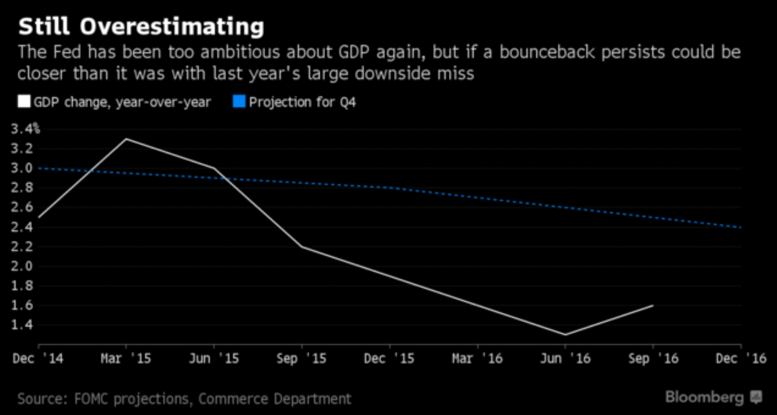

Chilling challenges are ahead and not just because the approaching two months of general euphoria from the election of Donald Trump will correct, or increasingly exhaust itself. Even the prospect of short-term realization of a continued (or reentered) 'recession' isn't off the map; though debatable.

Much will depend on how the so-called 'Day One' blueprint lays-out forward thinking; and what issues receive priorities, while others are back-burnered or deferred. The broad market, helped primarily by rotation and re-weighting of sectors, including many dormant for years or decades, primarily accounts for the stamina of our forecast bullishness in the wake of the election. That's mostly 'in' the market for now; as we move to a 'proof is in the pudding' sort of mode; especially as we enter 2017.

That doesn't mean that it won't go higher. For instance we can still have the classic year-end rebound, perhaps after some brief post-Quadruple Friday Expiration. And you didn't get any specificity on 'retaliation' against Russia, by Obama at his news conference (didn't expect much since he was going to Hawaii immediately after the Press Room disbanded). Little in the story is beyond what was already known: that Putin is a thug and manipulator, and of course that Russian propaganda has achieved 'some' purported results.

To that extent Trump has surrounded himself with a mixed group that holds both promise and risk; something we'll address more in coming days. At this point we are going to highlight several areas to keep an eye on near-term, as how these go (starting with taxes) could determine an investment posture approach, beyond of course selling associated with 2017 tax-date arrivals.

Consider (and perhaps in-order of priority for now):

1) Speculation that Trump will outline a 'slow as you go to start' tax reform package. That might be a huge mistake, as contrasted to 'go big at the start for tax cuts'. The history of tax reform is that going slow then takes a longer time or even negates the prospect of the full package of tax cuts being very eagerly passed by Congress.

If that were to happen (the slow smaller version) I think the market would be tanking in response; especially if it delayed aspects that would encourage, if not compel, major companies to repatriate money to the United States. If it's a deferral of returning manufacturing; that doesn't happen instantly anyway.

Personally I believe Trump will go for the 'full package' right away if he's well aware of the greater difficulty that would occur doing it incrementally; plus a realization that only the 'first tranche' of reforms is likely retroactive to Jan. 1 of 2017. So we'd encourage going forward with maximum effort initially.

2) Speculation abounds that President Trump will not 'tear-up' the Iran deal on day one; and instead propose a more serious dialogue with that rogue sort of state. I suspect there's something else afoot, and the market might reel a bit, unless it embraces the significance.

That could relate to a rumor that Trump WILL at least threaten to reverse the deal; but ONLY if we get total support from other major powers that had signed-onto the Iran deal. To wit: it would be necessary for everyone to tell Iran that any violations will result in unanimous re-imposition of sanctions.

There is another more ominous proposal said to be 'floated' by one of DJT's National Security team. That would be an ultimatum to Iran to abandon all of its nuclear programs amidst a revelation of secret aspects of the Kerry/Iran deal that aren't publicly known. And if not, again; all the sanctions come to play. My take on that is it's too Draconian, will be stonewalled by Iran, and it wouldn't play with Moscow, at least in initial draft versions possibly around.

3) Speaking of Russia; there is far more involved with President-Elect Trump and Putin than the superficial discussions appearing in the media or critique of embracing a thug and so on. My suspicion is that Trump, once again, is and will be negotiating with Russia; not rewarding aggression in the direct way. There can, however, be no doubt that Russian intervention did bring the turnabout in Syria; and though lamenting the civilian losses, we don't hear too much grumbling about the loss of the 'rebels' or Islamists; and that may be because the West (in the past year) really didn't know who they were, or who they were ultimately showing affiliation to.

I dismiss (for now) the idea of cozying up to Moscow without Putin's serious cooperation on the Middle East; and clear understanding of limits as far as incursion and disruption in Eastern Europe. Putin's cyber-gangs are also said to be trying to stir-up German politics (and he now dislikes his old friend Merkel who is running for re-election again; remember they were both friends when he was KGB in East Germany); along with propaganda in Poland, Estonia and Lithuania; and they moved ballistic missiles into their enclave wedged-in between them. A de-escalation must occur.

Do all that in a solid package; and the U.S. and Russia can cooperate, with the complainers not realizing that these guys are focused on the big picture (the humanitarian aspects are sad, but can't really be undone other than a big rebuilding plan for Aleppo perhaps with return of refugees planned too). If Russia itself could be persuaded to improve their traditionally rigid human rights record, that would be welcomed.

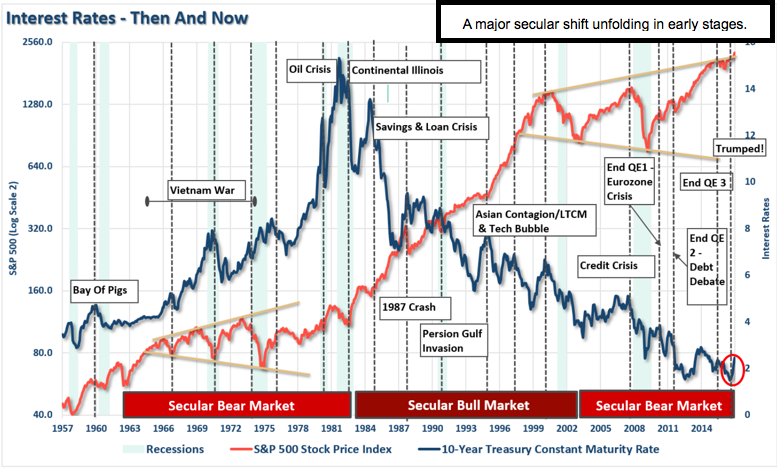

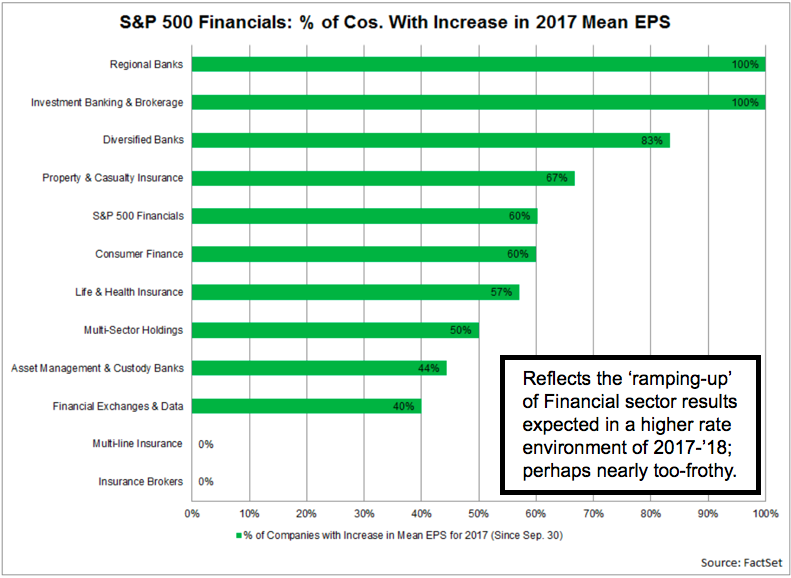

4) We of course have the Fed's rate hike; and series of forthcoming hikes. All taken together still leave rates low relative to 'normalization' but have big impacts on 'debt service' and other aspects of the economy and pensions. It remains to be seen; but prospects are that the markets are pricing in too big changes for the moment, beyond relief that 'fresh breezes' are blowing. Now the concern will become if those breezes are truly fresh or bringing odors of a stale era back. Hopefully the focus we're seeing on innovative technology is not just window dressing; but an idea of how they envision the future. As Trump has always focused on 'modernity' or apparently quality construction in his own projects, there's no reason to really see his approach as totally a retrograde experiment. Again the proof will be in the pudding.

In sum

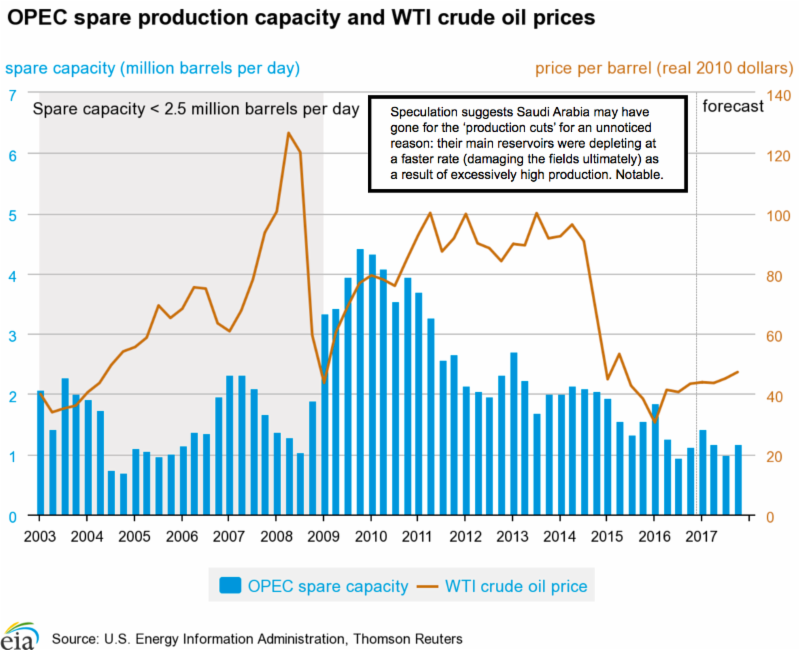

Russia may be the big story there, and how all of that could restore financial sanity for them; and stabilize Oil prices realistically for all, while in a sense 'breaking the back' of the OPEC Cartel, without explicitly saying so.

Markets have pretty well discounted whatever can go right; and not so much the things that can go wrong. Early 2017 should be a reminder of both; and I did want to share these thoughts this weekend; given that many will disengage over the holidays, so I'm actually jumping a week or two ahead with respect to when I suspect some of these issues will be more concerning to markets.

Daily action basically believes I have been pretty clear about a persisting overall period of S&P strength (NASDAQ too) running into somewhat of a tax-based potential brick wall within the next couple weeks as we get to 2017 settlement dates.

Politics, not finances, dominate the headlines today. There is no special systemic market risk; not even much of a decline; as we had an upward and then sideways consolidation; adhering to our expectations for this day.

The anxious Fed door to higher rates was opened wide by Trump's victory, and the promise to revive, not just recover, America's economy as we go forward. The Federal Reserve may envision enhanced prospects in ways they're not going to discuss (probably politically); but nevertheless as anticipated (by them as well); they had the 'window' to hike rates as well as indicate a faster-pace to coming rate hikes, by virtue of the 'new optimism'.

.

At another time the market would have sold off; more than knee-jerk types of responses that were not surprising at all. The faster pace is not really so much; because it's all still at low rates; and the Fed knows 'debt service' is at-risk if they were to assume a velocity of rates beyond what can readily be absorbed along the 'pace' of the economy.

|

The Election has been a catalyst to shuffle money; as markets seriously reflect dynamic new American economic prospects; or at least perception of revivals with punch, not just a bland stagflation sort of recovery. Sure, too much too fast is part of this, as swings get increasingly extended. I've called ideally for exhaustion forthcoming; however, at the moment this is basically reactivity to news and upward consolidation in the wake of the Fed hike. |

|

|

Disclosure: None.

Well said and 'close' to what I've said to our www.ingerletter.com 'actual' subscribers for several weeks. I wouldn't worry about 'Trade'; just avoid 'linear thinking' and recognize that China and Mexico realize things have to be renegotiated. As to the market; before the Vote I projected an extreme rally if Trump won; opposite of most forecasts. And now I have another view as we move into the new tax year. I appreciate your interest in my work; and reflections. (The comments here are usually required to be a day or two after shared with our subscribers and do not include my technical chart video analysis... I do appreciate the interest... happy holidays!)

The market hopes for growth. It is too soon to expect it besides the growth from Obamas policies. In reality global trade wars have so frightened people there is like a last hurrah mass buying these last months for those trying to get what they can before something disrupts it. Buying before a storm is good for a economy only so much as no storm arises. Those buying seem to differ that all will be peaceful.

A China trade wart would in itself be a mass shock to the market and prices. However, it will cause faster growth of even more price competitive players unless the US decides to block it all which will crash the economy. If you want negative growth that would be a great way to do it. If you want America to stop being a super power that would be a great start. If you want a horrid economy imagine an America with no trading partners besides Canada.

Thanksfor sharing