Macy's: Q3 Results Strengthening Conviction

We have been largely positive on Macy's (M) among the departmental store operators contrary to the popular opinion of the investors shunning away from the sector and crowding out the tech as well as other essential retailers which had rocketed sharply already. In our previous report, we had highlighted why the earnings beat and the subsequent market share gains due to the bankruptcies and store closures of weaker players could possibly act as a tailwind and advised investors to keep investing using the 'Buy on Dips' strategy ascribing a target price of $10 per share. Post the article, the stock has gained almost a third from its lows and continues to fire. Fast forward Q3, the company has yet again surprised the street through effective cost management, rising gross margins, and recovery in sales. We continue to remain positive on the company and reiterate a buy on dips strategy.

Photo by Nick Sarvari on Unsplash

Earnings Corner

For the quarter, revenues were down almost 23% over the previous year beating analyst estimates by about 250 basis points. The top-line drop has also narrowed significantly from Q1's fall of 45.2% and Q2's 35.8% fall. Also, same-store comps (ex-licensed departments) showed a decline of 21% versus the street consensus of a decline of over 23%. Also, the company reported a massive gain of 12 percentage points sequentially in gross margins to 35.6% as a result of disciplined inventory management, higher sell-through, and lower markdowns. It continues to contain costs and lowered SG&A expenses by $476mn YoY. Driven by significant gross margin expansion and revenue beat, the company was able to beat the earnings estimate by $0.6 per share with non-GAAP EPS of ($0.19) per share. In summary, Macy's results hit a home run with a relatively better quarter in an extremely challenging environment.

Summary

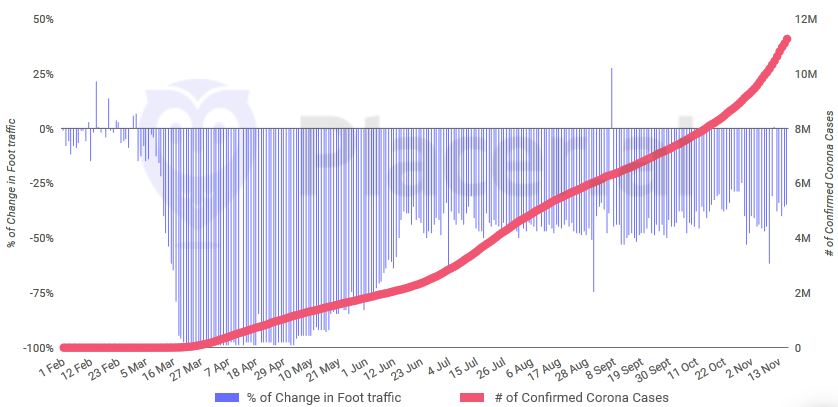

The street expects a marginal profit for Q4 which includes a crucial holiday season. Also, despite the rising COVID-19 cases across the US, the footfall has not drastically reduced but has remained in the ~30% lower footfall range meaning the people have accepted to learn to live with the virus.

(Click on image to enlarge)

That being said, the holiday season remains crucial for the company and we expect e-commerce sales to continue to bridge the footfall shortfall. The new customers that the company has been able to retain throughout the pandemic is also worth noting of the brand image and quality that the company has built. The stock trades roughly at 12x PE and though it remains significantly off its all-time highs, we continue to believe the stock would be a beneficiary of the vaccine and subsequent retail recovery, particularly within the departmental store's space.

Educational article indeed. This reminds us that aside from making the correct moves to reduce damage, size helps towards survival. The collapse of the much smaller competitors is mostly a size and resources reality. And the ability to quickly move towards an on-line business mode is certainly a valuable asset.

Thanks for the educational article.