Macy's: Earnings Beat Warrant A Relook

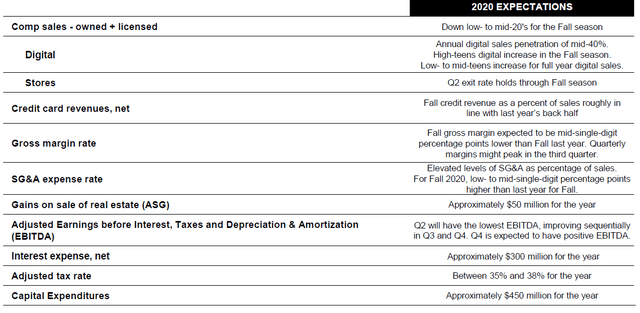

Macy's (M) has been one of the worst affected companies due to the COVID-19 pandemic as the company shuttered down its stores, in lieu of the regulations, to control the spread of COVID-19. Despite reopening in April, the store footfalls remains an elusive dream for most of the non-essential retailers with traffic down as much as 45%, as the number of COVID cases continue to crop up.

(Click on image to enlarge)

Source: Placer.ai

The silver lining, however, is the continued strong performance of the online channel as a large number of consumers look to shop online at the comfort of their homes. It is no surprise, the stock has largely underperformed the benchmark, down 55% YTD compared to a 6% rise in S&P 500 while Dow Jones US Apparel Retailers Index is down 13%. However, (M) posted an earnings beat in Q2 sending the stock price higher by up to 17% while the broader market witnessed a massive sell-off. Despite the uncertainty largely remains within the sector, we believe M to come out as a leaner and more focused organization within the departmental store ghost town.

Earnings Corner

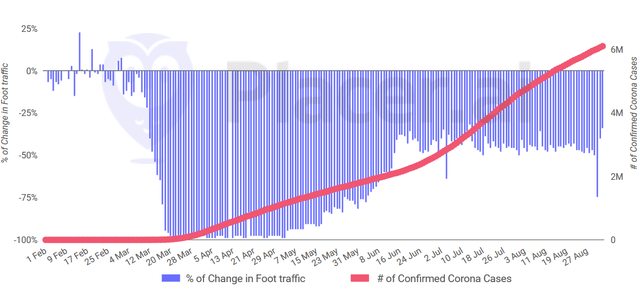

The company had posted a 45% decline in sales in Q1 while Q2 also remained under pressure, albeit improving sequentially with sales down 35% for the quarter. As the store traffic continues to remain soft, online sales again come to the rescue of the store operator, surging 53% for the quarter. Management noted that luxury categories at Bloomingdale’s surpassed their internal expectations. Its inventory was down 29% for the quarter which is expected to reduce the pressure on gross margins and the merchandise discounting to stabilize. It had also undergone a headcount reduction in June cutting about 4,000 corporate jobs which resulted in SG&A down 36% compared to the previous year. Adjusted EPS came in at ($0.81) compared to $0.28 per share in the corresponding quarter previous year which was far ahead of the analyst estimates pegged at ~($1.5) per share. Given the uncertain environment ahead of the crucial holiday season, the management expects the Comp sales to be down as much as mid-'20s for the fall season with digital sales growing about mid-teens and expect the digital penetration to grow from 26% last year to about mid-40% in the current year.

(Click on image to enlarge)

The company also expects the falling horses within the space would act as a tailwind for market share growth as a whole host of companies from the likes of JC Penney, Neiman, and Lord & Taylor have declared bankruptcies. CEO Jeff Gennette expects a $10bn market share up for grabs due to the shakeout in retail.

Look at luxury right now, look at Neiman’s, look at parts of Lord & Taylor. There is an opportunity for us. Bloomingdale’s is having a moment. We have brands in our arsenal that we didn’t have before that are looking for additional distribution

- CEO Jeff Gennette

It also mentioned that the company will be testing smaller format stores, away from malls, as the company believes that while the mall culture is expected to survive, only the best malls will thrive. It still expects to continue growing its off-price business through Macy’s Backstage and the 125 store closure plans remain on track, albeit with a potentially amended timeline.

Summary

Overall, the dust has not yet been settled in the dramatically changing retail landscape as the store footfall remains scant while the all-important holiday season booster shot that the mall retailers appear elusive. However, we believe the worst is behind for the company and they have adequate liquidity to grow on from here. We expect Q3 EPS to narrow further down to ($0.5) and Q4 EPS to be breakeven. While a lot of argument goes into Amazon and Off-price retail eating into the market share, we strongly believe the mall culture will survive and thrive as it does provide consumers a buffet of brands to shop at with apparel shoppers looking to try on the clothes before purchase. As we expect a vaccine early next year or even by the end of this year, we believe the company will be able to return back to profitability in 2021E and post an EPS of $1 (conservative view given the uncertain environment).

(Click on image to enlarge)

Data by YCharts

M trades at 12x 1-year Fwd P/E, in line with its peers, and at a discount to its 3-year average at ~15x P/E. We believe (M) provides a deep value opportunity for the risk-tolerant investors and at a 2021E P/E of 10x, we ascribe a target price of $10 per share. We believe as the dust settles and the fear of COVID-19 subsides the company is expected to route through store traffic and given its digital investments, it would warrant a multiple expansion. The risks are a prolonged COVID-19 pandemic continuing to hurt store footfalls, failure of vaccine, and market share cannibalization by off-price retailers/ e-commerce players. Upgrade to a Buy on Dips strategy.

Thanks for the informative article. It shows that survival is possible if one makes the right moves in a timely manner. Definitely encouraging.

Indeed. While there is a sizable part dependent on vaccine and Covid management, there are few departmental stores which are poised to survive and the argument that mall culture in itself will die as people can just buy online, it just goes again the very nature of human societal being where they look for experience while shopping. And as someone said at the height of the 1918 Spanish Flu pandemic

"NY will never come back"

We know how far along everyone has move forward.

Certainly you are correct. And it looks like the Macy's group has made some wise changes. Eventually there should be some recovery, and some things will return. We can, and should, learn from the past.

And the past is always more predictable than the future.