M&A Activity: Down But Still Alive In 2023

Mergers and acquisitions (M&A) activity has witnessed a slowdown, with market volatility and lingering economic uncertainty weighing heavily on potential deals.

However, M&A activity hasn’t stopped entirely, with whispers of energy titan Exxon Mobil expressing interest in potentially acquiring Pioneer Natural Resources surprising the market.

And just recently, we received news that Emerson Electric entered into a definitive agreement to purchase National Instruments.

So, while deal-making has slowed significantly, it’s still alive. With both companies making headlines, let’s closely examine each.

Exxon Mobil & Pioneer Natural Resources

The market was caught off guard following news that energy titan Exxon Mobil expressed interest in potentially acquiring Pioneer Natural Resources. However, it’s critical to note that no deal has officially been made or announced.

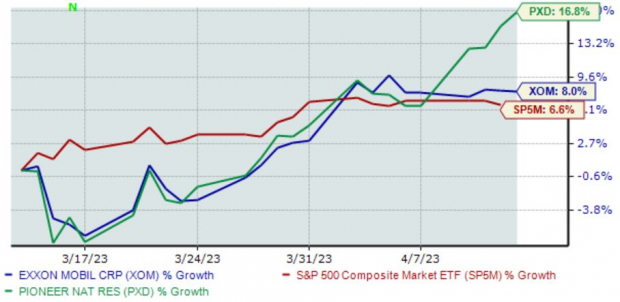

Nonetheless, the market took the news in stride, with PXD shares gaining 5% in Monday’s session. Below is a chart illustrating the performance of both stocks over the last month, with the S&P 500 blended in as a benchmark.

(Click on image to enlarge)

Pioneer Natural Resources is an explorer and producer of oil, natural gas, and natural gas liquids. PXD primarily operates in the Permian, which is known for its vast reserves of shale oil and gas.

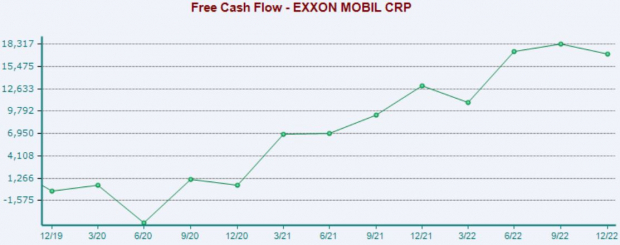

The potential deal reflects consolidation within energy following a year in which Exxon Mobil generated serious cash, as shown in the chart below.

(Click on image to enlarge)

Impressively, Exxon Mobil exited FY22 with $29.7 billion in cash and equivalents, up a mind-boggling 330% year-over-year. Presently, PXD has a market capitalization of roughly $52 billion.

Emerson & National Instruments (also known as NI)

Emerson revealed in a news release that it had entered into a definitive agreement to acquire National Instruments at a price tag of roughly $60 per share at an equity value of $8.2 billion.

Like PXD, NATI shares saw a nice boost following the announcement, gaining nearly 10% in yesterday’s session. As we can see in the chart below, NATI shares are up nearly 20% over the last month, widely outperforming the general market.

(Click on image to enlarge)

National Instruments offers software-connected test and measurement systems that accelerate time-to-market and reduce costs for enterprises.

It’s a clear attempt from Emerson to tap into the fast-growing test and measurement market, estimated with a total addressable market (TAM) of $35 billion.

Interestingly enough, EMR already spoke about the test and measurement market in its latest Investor Conference in 2022, with the recent deal confirming their optimistic view.

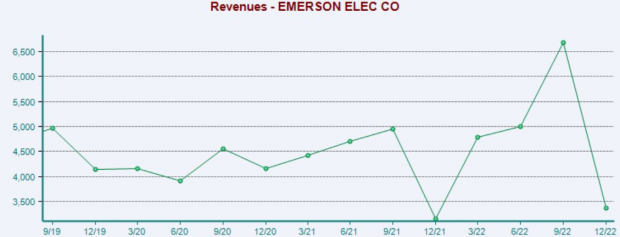

Emerson posted quarterly results that came in under expectations in its latest release, falling short of bottom line projections by 11%. Quarterly revenue totaled $3.4 billion, nearly 3% below the consensus estimate and declining 24% year-over-year.

(Click on image to enlarge)

Bottom Line

Mergers and acquisitions can offer several notable benefits for companies and shareholders, including cost savings from economies of scale, increased market share, and other synergies that the combined business can create.

And while M&A activity has slowed, it’s still alive, with news of Exxon Mobil (XOM) potentially interested in Pioneer Natural Resources (PXD) and Emerson Electric (EMR) acquiring National Instruments (NATI).

More By This Author:

Buy These 2 Highly Ranked Oil Stocks To Join The Rally

Bear Of The Day: Walker & Dunlop, Inc.

3 Global Equity Funds To Buy Notwithstanding The Banking Crisis

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more