Buy These 2 Highly Ranked Oil Stocks To Join The Rally

Several weeks ago, OPEC+ announced a large cut in oil production, and prices haven’t stopped rallying since. The price of WTI Oil is breaking out of a bull flag after retaking the $80/barrel level.

Energy has been the leading sector over the last two years, and it looks like it may continue. Even after the tremendous run up in the sector, many energy companies still boast reasonable valuations, and bullish catalysts.

In addition to the technical catalysts, there are also fundamental tailwinds for the energy market as well. Trends in travel, particularly air travel are up considerably over the last year, and the reopening of China’s market boosts demand dramatically. Additionally, fears of an economic slowdown have yet to show up in any significant way, and inflation continues to slow at only a meager pace. However, a contraction in the economy would certainly have a strong effect on the price of oil and does remain a risk.

(Click on image to enlarge)

Par Pacific

Par Pacific (PARR) manages and maintains energy and infrastructure businesses. The company's operates refining, retail, and logistics for energy assets. PARR also markets and distributes crude oil from the Western U.S. and Canada to refining hubs in the Midwest, Gulf Coast, East Coast and to Hawaii. Par Pacific was formerly known as Par Petroleum Corporation, and is headquartered in Houston, Texas.

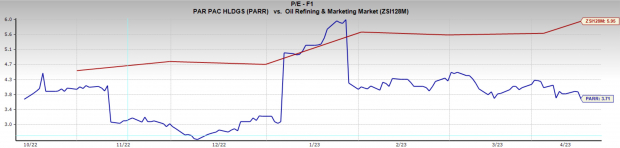

So far this year Par Pacific has performed quite well, up 15% YTD. PARR has climbed 230% over the last three years to considerably outperform the industry and broad market.

(Click on image to enlarge)

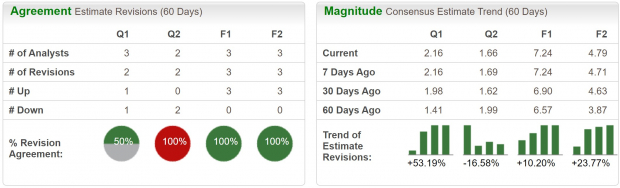

PARR is a Zacks Rank #1 (Strong Buy) stock, indicating upward trending earnings revisions. While current quarter and next quarter estimates have seen some mixed revisions, current year and next year have been upgraded significantly. Next year’s earnings have been revised higher by 24%.

(Click on image to enlarge)

Par Pacific is currently trading at one-year forward earnings multiple of 4x, which is in line with its two-year median and below the industry average of 5x.

(Click on image to enlarge)

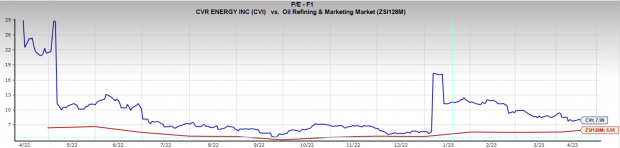

CVR Energy

Headquartered in Sugar Land, Texas, CVR Energy (CVI) is an independent refiner and marketer of high value transportation fuels such as gasoline and diesel. CVI owns and operates a coking medium-sour crude oil refinery in Kansas and a crude oil refinery in Oklahoma. The business serves retailers, railroads, farms and other refineries and marketers.

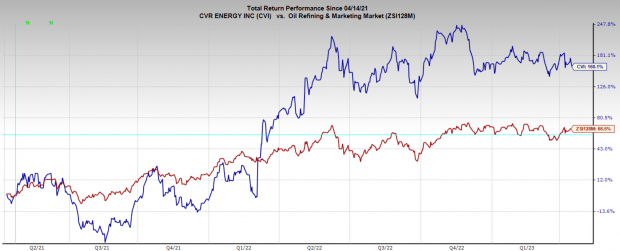

CVR Energy is currently a Zacks Rank #1 (Strong Buy) stock, indicating upward trending earnings revisions. CVI stock was a strong performer over 2021 and 2022, but the appreciation has since slowed in 2023. Fortunately, to make owning the stock easier, CVI offers a hefty dividend yield of 6.4%.

(Click on image to enlarge)

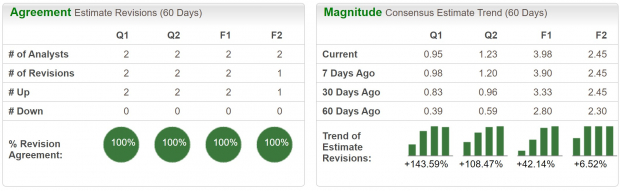

Over the next few earnings periods, sales are expected to fall, but current quarter earnings are still expected to skyrocket 143% YoY to $0.95 per share. Over the last 60 days, analysts have unanimously revised earnings higher across all reporting periods. Current year earnings expectations have nearly doubled over the last three months.

(Click on image to enlarge)

CVI is trading at a one-year forward earnings multiple of 8x, which is below its 10-year median of 12x, and above the industry average 5x.

(Click on image to enlarge)

Bottom Line

The dynamics of the energy market have quickly shifted to tighter supply, and higher energy prices. Investors who want to take part in the next leg higher in the energy market can use the Zacks Rank to identify energy stocks with bullish catalysts.

More By This Author:

Bear Of The Day: Walker & Dunlop, Inc.3 Global Equity Funds To Buy Notwithstanding The Banking Crisis

Are Computer and Technology Stocks Lagging Airbnb This Year?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more