Looming Threat Of A Rising Wedge

Image Source: Unsplash

Watch the video extracted from the WLGC session before the market open on 5 Mar 2024 below to find out the following:

- What does a rising wedge mean (in price action)?

- The ultimate defense for the S&P 500 to watch out for when there is a breakdown from the rising wedge pattern

- The sudden market reversal scenario traders to pay attention to in these overbought conditions.

- The trading strategies to adopt should traders want to get exposure.

- and a lot more...

Video Length: 00:06:19

Market Environment

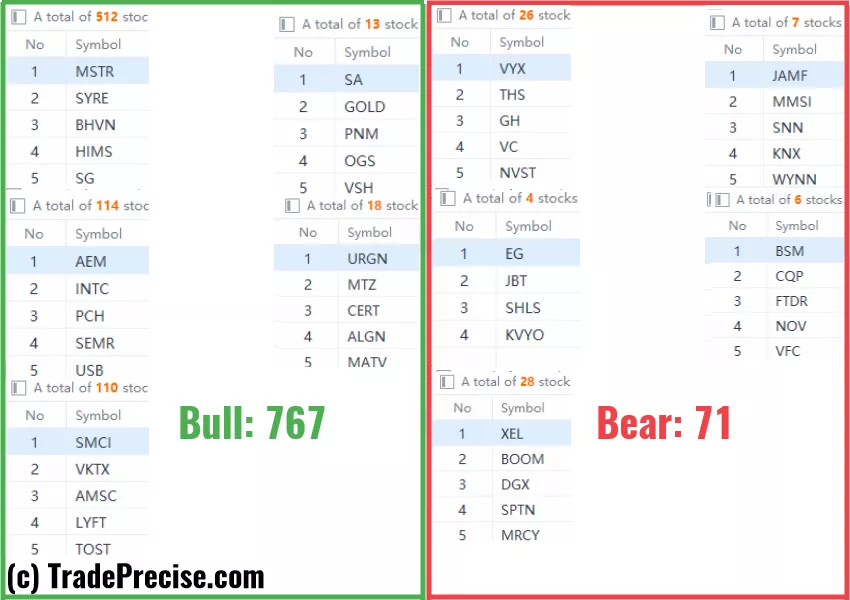

The bullish vs. bearish setup is 767 to 71 from the screenshot of my stock screener below.

Market Comment

The exhaustion of the up momentum is reflected in the rising wedge pattern.

Traders need to watch out for the ultimate key level illustrated in the video that could trigger a meaningful correction closely.

Volatility should pick up and a market rotation into the small and mid-cap stocks as discussed in the live session is a favorable bullish scenario we anticipate, which is healthy for a sustainable rally.

There are a lot of post-earning setups as discussed in the premium video below that will give you immediate feedback regarding the current market condition.

A failure or no trigger should put you in the defensive seat.

9 “low-hanging fruits” (DPZ, FAS, etc…) trade entries setup + 14 actionable setups (CG etc…) plus 4 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

The NVDA Earnings Effect And What It Means For The Current Market Momentum

Is The Stock Market Ready To Plunge? The Warning Signs Are Here

Overbought, Overextended - What's The Buzz In S&P 500 Now?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.