Is This The Beginning? Insights On Bearish Distribution Patterns

Image Source: Pexels

Watch the video from the WLGC session on 11 Mar 2025 to find out the following:

- How can growth stocks be used to gauge the development of a bear market on top of price action?

- How the Death Cross could unfold in the S&P 500 using the 2022 analogue comparison.

- The capitulation moment traders need to pay attention to even if a relief rally happens.

- and a lot more...

Video Length: 00:10:37

Market Environment

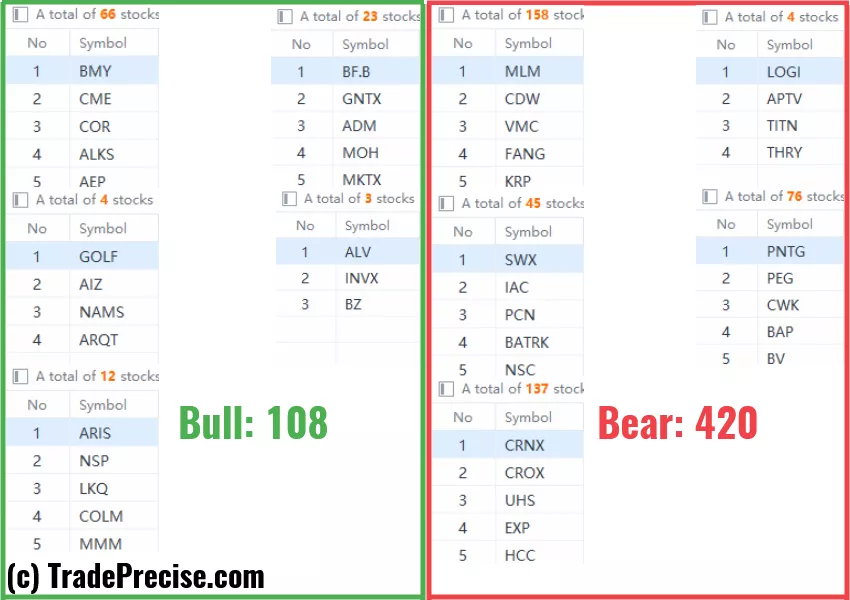

The bullish vs. bearish setup is 108 to 420 from the screenshot of my stock screener below.

3 Stocks Ready To Soar

12 actionable setups such as AEM, ROOT, EXEL were discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Bearish Distribution Pattern Emerged In The S&P 500

Volatility Is Back: Buy The Dip?

This Key Signal Just Flashed In The S&P 500

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!