Bearish Distribution Pattern Emerged In The S&P 500

Image Source: Unsplash

Watch the video from the WLGC session on 4 Mar 2025 to find out the following:

- The 2 bearish characteristics traders need to watch out for.

- The key differences between the first, second, and third segments in the S&P 500 structure.

- The key supports & resistance level in the S&P 500, Nasdaq 100, Dow Jones, and Russell 2000.

- and a lot more...

Video Length: 00:11:50

Market Environment

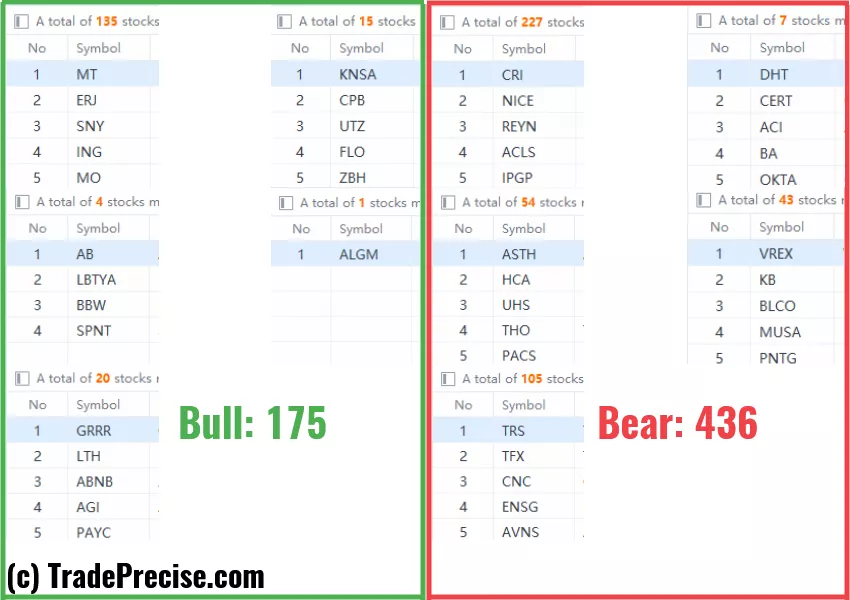

The bullish vs. bearish setup is 175 to 436 from the screenshot of my stock screener below.

3 Stocks Ready To Soar

11 actionable setups such as AHR, WELL were discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Volatility Is Back: Buy The Dip?

This Key Signal Just Flashed In The S&P 500

Market Rally Or Collapse? This Chart Pattern Says It All

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!