Is The Pullback Behind Us Or Still Looming? Let's Investigate

Image Source: Pixabay

Watch the video extracted from the live session on 8 Aug 2023 below to find out the following:

- The significance of bearish and change of character bars in determining market pullbacks.

- The importance of volume and supply levels in confirming pullbacks and potential bounce points.

- The current market trends and potential support and resistance levels for Nasdaq, Russell 2000, and Dow Jones

- Comparison of the supply level among S&P 500, Nasdaq, and Russell 2000

- And a lot more

Video Length: 00:09:50

The confirmation bar showed up as discussed in the video to kick-start the pullback. It is essential to judge the characteristics of the test as illustrated in the video in various scenarios to anticipate the next move.

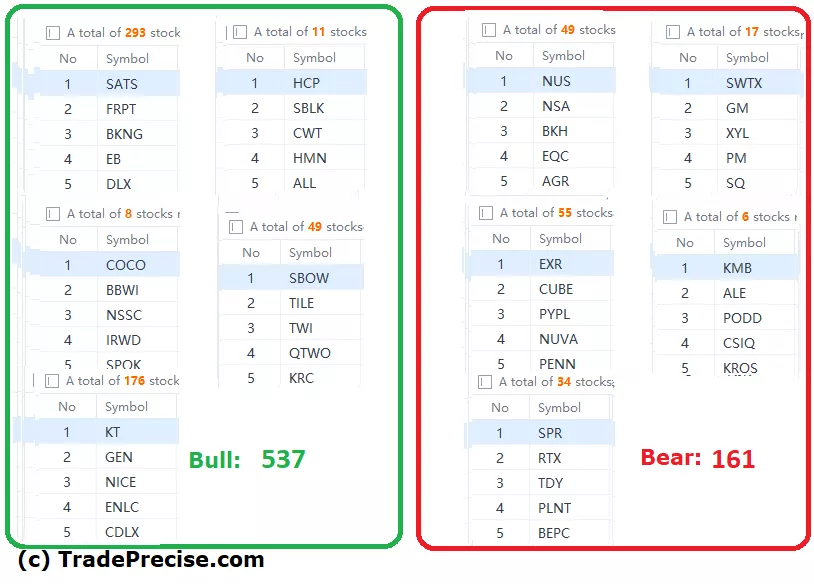

The bullish vs. bearish setup is 537 to 161 from the screenshot of my stock screener below pointing to a positive market environment. However, the 4 market breadth confirms the pullback is still unfolding.

9 “low hanging fruits” (MHO, ETN, etc…) trade entries setup + 29 others (MNSO, PSTG, etc…) plus 19 “wait and hold” candidates are discussed in the video (53:05) accessed by subscribing members below.

(Click on image to enlarge)

Easy Way To Identify Outperforming Stocks

Here is 1 easy way for you to identify outperforming stocks without spending any money on sophisticated software or AI.

- Identify when the market (e.g. S&P 500 or Nasdaq) starts to pullback

- Compare the stock with the market during the same period to judge if the stock performs better or worse.

Check out the example below comparing MHO and S&P 500.

(Click on image to enlarge)

The pullback started on 2 Aug 2023. MHO managed to climb higher while S&P 500 still dive lower, as illustrated in the blue arrow. This shows that MHO outperforms the S&P 500.

When the market stops going down, consolidates, or even bounces up, the outperforming stock will likely charge up more than the market.

So do take the chance to spot the outperforming stocks now and form your trading plan so that you can reap big during the next swing up.

More By This Author:

Beware! Red Flags In The Market

Bull Or Bear? Anticipate The Next Big Move With Price Volume Analysis

Unmasking The Bear's Footprint - Is There Still Room For Growth?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.