Is Tesla Counting On A Billion Dollar Regulatory Credit Bonanza?

- Tesla’s primary business of manufacturing and selling electric vehicles, or EVs, generates two classes of tradable regulatory credits that it sells to other automakers.

- Under rules promulgated by the EPA, automakers must meet Federal greenhouse gas emissions standards, buy GHG Credits from other automakers, or pay substantial fines.

- Under rules promulgated by California and nine other states, automakers must sell a specified percentage of Zero-Emission Vehicles, buy ZEV Credits from other automakers, or pay substantial fines.

- During the five years ended December 2017, Tesla reported $890 million of cumulative ZEV Credit revenue and another $352 million of cumulative GHG Credit revenue.

- For 2018, if the market absorbs anticipated ZEV and GHG Credits at 2017 prices, Tesla could earn $996 million of ZEV Credit revenue and $287 million of GHG Credit revenue.

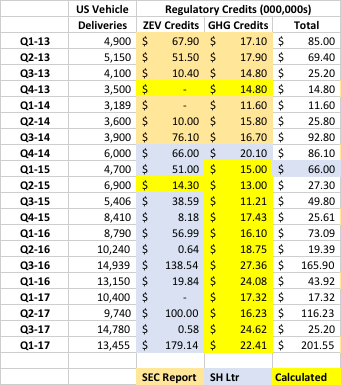

Since inception, Tesla (TSLA) has generated over $1.4 billion in incremental revenue from sales of ZEV and GHG Credits. While Tesla’s reporting of revenue from ZEV and GHG sales has been patchy and inconsistent, my first table summarizes my estimates of Tesla’s revenues from ZEV and GHG Credit sales during the five years ended December 2017. Quarterly Vehicle delivery estimates are derived from monthly estimates published by Inside EVs. ZEV and GHG Credit estimates are derived and/or estimated from granular information in Tesla’s SEC reports and shareholder letters.

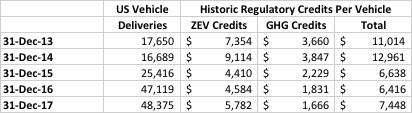

My second table shows how the prices Tesla received for ZEV and GHG Credits have softened over the last five years as the supply of credits increased. This second table is not as precise as the first because it ignores the possibility of unrealized credit inventories and divides annual ZEV Credit sales by total US Vehicle deliveries to arrive at a per vehicle number. While the methodology works for GHG Credits because those credits are earned on every car delivered in the US, it understates the per vehicle value of ZEV Credits because it divides total ZEV Credits by total US Vehicle deliveries. A more accurate analysis would divide total ZEV Credits by total vehicle deliveries in ZEV states but I haven’t been able to find that statistic. If you assume that the proportion of Tesla’s sales in ZEV and non-ZEV states is relatively stable from year to year, the inaccuracy becomes unimportant.

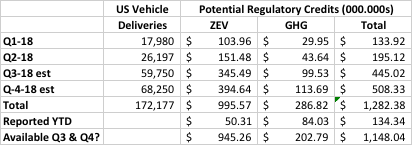

My third and final table estimates the total ZEV and GHG Credits that Tesla could generate in 2018 if it sells 80,000 cars in Q3 (25,000 Models S&X and 55,000 Model 3) and 90,000 cars in Q4 (25,000 Models S&X and 65,000 Model 3). For purposes of this table, US Vehicle deliveries are assumed to include:

- 52% of total Model S&X deliveries; and

- 85% of total Model 3 deliveries.

ZEV and GHG Credits are priced at 2017 values of $5,782 and $1,666 per vehicle, respectively.

While many commenters, including Elektrek, have allowed that Mr. Musk might pull a couple hundred million in ZEV Credits out of his hat for Q3, nobody has flashed on the possibility that Tesla is counting on a billion dollar regulatory credit bonanza in the last half of 2018

Preliminary Observations

Inconsistent Accounting Methods for GHG and ZEV Credits. If you study the quarterly vehicle delivery, ZEV Credit and GHG Credit numbers in my first table, it will quickly become obvious that GHG Credit revenue is relatively stable from quarter to quarter and tends to fluctuate up and down with random variability in the number of vehicles delivered and the declining market value of GHG Credits. This strongly suggests that Tesla uses the accrual method of accounting for its GHG Credits. It is equally obvious that ZEV revenue bears no relationship to anything other than sales of credits during the quarter. This strongly suggests that Tesla uses the cash method of accounting for its ZEV Credits.

My undergraduate degree was in accounting and was licensed to practice as a CPA for 10 years before I let that license lapse and focused exclusively on practicing law. Frankly, I can’t imagine a sound theoretical justification for using different and wildly inconsistent accounting methods for two classes of tradable regulatory credits that are generated by the same business activities and sold to the same customers. In my view, the first table is solid evidence that Tesla has been relentlessly cooking the ZEV Credit books for years. While manipulative accounting practices pale in comparison to other manipulative practices that are currently drawing regulatory scrutiny, they’re far from insignificant.

Demand for ZEV Credits. Last May, in an article titled “Tesla's ZEV Credit Lifeboat May Hit The Iceberg,” SAContributor Jaberwock analyzed California ZEV Credit statistics from August 2017 and concluded that future demand would probably be limited due to oversupply. While I found Jaberwock’s reasoning compelling, Tesla’s sold $179 million of ZEV Credits in Q4-17 and another $50 million of ZEV Credits in Q1-18, several months after the August statistics were published. These significant ZEV Credit sales by Tesla during a period when a theoretical glut of credits existed suggests that something that I don’t understand is driving demand. Under the circumstances, it would seem imprudent for me to assume that the ZEV Credits Tesla is accumulating at a breakneck pace will have little or no value.

Demand for GHG Credits. In 2017, Tesla sold GHG Credits at average price of $1,666 per vehicle and in Q1-18 it sold GHG Credits at an average price of $1,670 per vehicle. But in Q2-18 it sold GHG Credits at an average value of $2,062 per vehicle. While one-quarter of 20% higher GHG Credit values does not establish a trend, recent EPA reports suggest that automakers are having a tough time satisfying increasingly stringent CO2 emissions standards. If that trend continues, the value of the GHG Credits Tesla is currently generating could be significantly higher than they have been in prior years when most automakers were ahead of the CO2 compliance curve.

Unexpected ZEV and GHG Credits Could Be Game Changers in Q3 and Q4. In October 2016, Tesla created a $22 million GAAP profit by booking $139 million in unexpected ZEV Credit revenue. If the estimates in my third table are correct Tesla’s current book of ZEV and GHG Credits could be as much as $650.2 million, including:

· $53.7 of unreported Q1 ZEV Credits;

· $151.5 million of unreported Q2 ZEV Credits;

· $345.5 million of anticipated Q3 ZEV Credits; and

· $99.5 million of anticipated Q3 GHG Credits

Similarly, Tesla’s Q4 ZEV and GHG Credits could be as much as $508.3 million, including:

· $394.6 million of anticipated Q4 ZEV Credits; and

· $113.7 million of anticipated Q4 GHG Credits

If the value of GHG Credits is increasing, the potential upside surprise could be even greater.

My Investment Strategy

When I completed my analysis for this article, I closed out my short position because I believe Tesla’s Q3 delivery numbers will be better than many expect and I fear that up to $650 million of unexpected regulatory credits will give rise to paroxysms of ecstasy among Tesla longs who will undoubtedly bid the stock price to unsustainable nosebleed highs.

I also believe Q3 is as good as it’s ever going to get for the following reasons:

· Tesla’s supply chain for the cathode powders required to make lithium-ion batteries for its EVs is limited to 100,000 Models S&X and 340,000 Model 3s per year.

· Tesla’s Freemont factory is already running at or near capacity and there’s very little room for short-term expansion of that capacity.

· While annualized production of 100,000 Models S&X and 250,000 Model 3s in Q3 won’t be the peak of the S-Curve, we’ll be able to see the peak from there and the sustainable growth story will deteriorate rapidly.

· Tesla’s US centric delivery program will rapidly run out of steam, even if it begins selling a lower priced version of the Model 3. Since Tesla won’t earn $7,500 per car in ZEV and GHG credits for vehicles sold in other countries, any profit margins it reports in Q3 and Q4 will be unsustainably high.

· I think ongoing SEC and Department of Justice investigations will significantly complicate Tesla’s efforts to raise additional capital until those investigations are concluded and the problems are resolved.

This afternoon I bought my first long position in Tesla – $350 March 2019 calls. I intend to flip out of those calls and into long-dated puts after Tesla’s Q3 conference call because I continue to believe the intrinsic value of Tesla’s stock is zero.

At one time #GM had over 100,000 in tax credits for large SUVs like Hummers. Why don't you put tax credits into perspective so it does not sound like #Tesla is taking taxpayers' money! $GM $TSLA

Apparently tax credits are bad law. Maybe even a scam.

I think the ZEV Credits are a scam because the number of credits is determined by a formula that multiplies the range by.01 and adds half a credit. So an EV with a 50 mile range gets 1 credit and an EV with a 300 mile range gets 3.5 credits.

Since the average Tesla owner drives his car 32 miles per day or 11,700 miles per year, just like every other driver, a 300 mile EV offers no more environmental benefit than a 50 mile EV.

I guess nobody taught the regulators in California to think about whether their rules actually support their goals.

ZEV and GHG Credits are not "Tax Credits" and nothing in my work suggests otherwise. They're created by regulatory edict and represent an unjustified fiscal plunder of competitors who must buy credits from sellers like Tesla or pay heavy fines to regulators.

I guess one could characterize the credits as an indirect rape of the taxpayer since the regulators would collect fines if the credits were not tradable, but that's a bit of a stretch.

This is an aspect of #Tesla that I had no idea about! Very enlightening.

Explosive article.