Is Coinbase Setting The Stage For A Strong And Strategic 2026?

Image: Shutterstock

Key Takeaways

- Coinbase is advancing its centralized DeFi integration and expanding institutional partnerships.

- The company completed nine acquisitions in 2025, and it is re-entering India via investment in CoinDCX.

- Coinbase aims to lead with RWA perpetuals, DeFi infrastructure, and AI-driven trading innovations in 2026.

Coinbase Global (COIN - Free Report) is poised for a strong 2026 as it builds on the momentum of an active 2025 while executing on its long-term strategic roadmap. This year, Coinbase advanced its efforts to integrate centralized and decentralized ecosystems by launching DEX trading for Solana access—an important step toward linking its core platform with on-chain liquidity and supporting its vision of a unified centralized–DeFi experience.

Coinbase also continued strengthening ties between traditional finance and digital assets. The company has collaborated with major banks, including JPMorgan, Citi, and PNC, and is in discussions with leading U.S. financial institutions on pilot programs involving stablecoins, custody, and trading.

A favorable regulatory climate and growing acceptance of digital assets as banking services seems to work as a tailwind. Notably, PNC Bank recently enabled direct Bitcoin trading for its high-net-worth private clients, underscoring this shift in sentiment.

M&A has been another area of focus, with Coinbase completing nine acquisitions in 2025 as it expands capabilities and accelerates product development. International growth remains a priority as well. Coinbase is re-entering India’s market after nearly three years, supported by an investment in CoinDCX, a leading exchange across India and the Middle East.

Looking ahead to 2026, Coinbase’s strategic focus areas include real-world asset (RWA) perpetuals, specialized exchanges and trading terminals, next-generation DeFi infrastructure, and the integration of AI and robotics. With these initiatives, Coinbase aims to build a comprehensive product and service ecosystem and solidify its position as the industry’s premier “everything exchange.”

What About its Peers?

Robinhood Markets (HOOD - Free Report) has stayed focused on accelerating growth through rapid product innovation and global expansion. Robinhood has been engaging in opportunistic acquisitions to deepen its footprint and expand its product reach within the United States and globally.

Robinhood also noted that AI features and fast rollouts are increasing engagement, premium monetization, and retention, while stronger tools attract both retail and advanced traders.

Interactive Brokers (IBKR - Free Report) has continued to explore growth opportunities in the emerging markets of Taiwan, Mexico, and India. Given the rapid growth of its European business, Interactive Brokers has substantially expanded its operations there. Additionally, Interactive Brokers has been undertaking several measures to enhance its global presence.

Coinbase’s Price Performance

Shares of Coinbase stock have gained 10.7% year-to-date, outperforming the industry.

Image Source: Zacks Investment Research

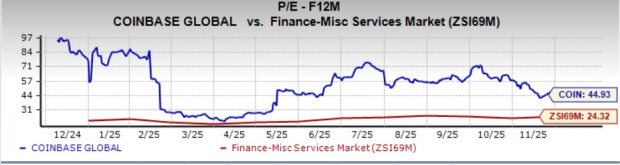

Coinbase’s Expensive Valuation

Coinbase stock has recently been trading at a price-to-earnings value ratio of 44.93, which is significantly above the industry average of 24.32. It carries a Value Score of D.

Image Source: Zacks Investment Research

Estimates for Coinbase

The Zacks Consensus Estimate for Coinbase’s fourth-quarter 2025 EPS has moved 2 cents south in the past seven days, while the same for first-quarter 2026 has witnessed no revision in the past seven days. The consensus estimates for 2025 and 2026 EPS have moved south by 0.6% and 1%, respectively, in the past seven days.

Image Source: Zacks Investment Research

The consensus estimates for Coinbase’s 2025 and 2026 revenues appear to indicate year-over-year increases. Though the consensus estimate for the company’s 2025 EPS indicates a year-over-year increase, the same for 2026 indicates a decline.

Coinbase stock currently carries a Zacks Rank #3 (Hold) rating.

More By This Author:

Accenture Q1 Earnings Preview: Buy Now Or Wait For The Results?

AT&T Versus Comcast: Which Telecom Stock Should You Bet On?

Will Lululemon Stock Keep Rebounding After Strong Q3 Results?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more