Accenture Q1 Earnings Preview: Buy Now Or Wait For The Results?

Image: Bigstock

Key Takeaways

- Accenture is set to report Q1 results on Dec. 18, with expected earnings of $3.74 and $18.6 billion in revenues.

- Analysts' upward EPS revisions and broad regional demand underpin its projected Q1 growth.

- Managed services, strong liquidity, and active acquisitions shape Accenture's near-term outlook.

Accenture plc (ACN - Free Report) is set to report first-quarter fiscal 2026 results on Dec. 18, before the market open.

The Zacks Consensus Estimate for earnings is pegged at $3.74 per share, suggesting 4.2% growth from the year-ago quarter’s reported level. The consensus estimate for revenues is $18.6 billion, hinting at 4.9% year-over-year growth.

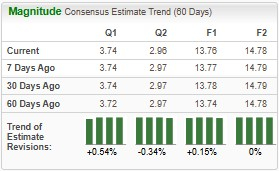

Over the past 60 days, two EPS for the first quarter of fiscal 2026 have been revised upward, without any downward revisions. During this period, the Zacks Consensus Estimate moved up marginally. These upward revisions demonstrate analysts' increased confidence.

Image Source: Zacks Investment Research

Accenture’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average surprise of 3.2%.

Lower Chance of Q4 Earnings Beat for Accenture

Our proven model does not conclusively predict an earnings beat for Accenture this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy), or #3 (Hold) rating increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Accenture currently has an Earnings ESP of -1.53% and a Zacks Rank of #3 (Hold).

High Demand Across Regions to be Accenture’s Q1 Growth Driver

We anticipate revenues from the Americas to grow 4.2% to $9.1 billion. Revenues in this region are expected to have been driven by growth in banking and capital markets, industrials, and software and platforms.

We estimate revenues from the EMEA region to be $6.7 billion, suggesting a 4.6% rise from the year-ago quarter’s actual. Growth in insurance, utilities and consumer goods, life sciences, and retail and travel services is expected to have fueled this region’s revenue growth.

We anticipate revenues from the Asia Pacific to rise 3.7% to $2.6 billion from the year-ago quarter’s actual. Improvements in banking and capital markets, public services, and utilities are anticipated to have led this region’s revenue growth.

Accenture’s Stock Comparison With Peers

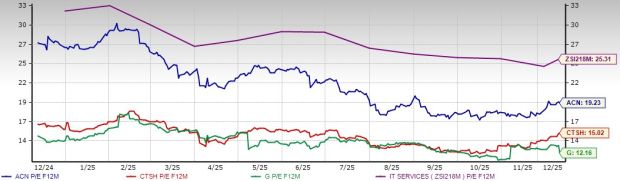

Accenture shares have declined 23% over the past year compared with the 16.7% dip of its industry and against the 17.6% rise of the Zacks S&P 500 composite. The company has underperformed its industry peers, Cognizant Technology Solutions (CTSH - Free Report) and Genpact (G - Free Report), which have reported 6.4% and 7.6% growth, respectively.

One-Year Share Price Performance

Image Source: Zacks Investment Research

Over the past six months, Accenture has dipped 12.2% compared with the 5.2% decline of the industry and against 18.7% growth of the Zacks S&P 500 composite. The stock has failed to beat its industry peers, as Cognizant Technology Solutions and Genpact have gained 7.1% and 11.6%, respectively.

Accenture has been trading at a trailing 12-month price-to-earnings ratio of 19.23X, which is lower than the industry’s 25.31X. However, the stock has been trading at a premium when compared with Cognizant Technology Solutions and Genpact’s respective 15.02X and 12.16X.

P/E - Forward 12-Months

Image Source: Zacks Investment Research

Accenture’s Investment Considerations

Accenture’s managed services business is significantly enhanced by the growing demand for modernization and application maintenance, cloud enablement, and cybersecurity-as-a-service. In fiscal 2025, revenues in this segment gained 9% year-over-year. For the first quarter of fiscal 2026, the same is expected to move up 2.3% year-over-year.

The company maintains a strong balance sheet position, with cash and equivalents of $11.5 billion as of Aug. 31, 2025, and current debt of $114 million. This highlights the company’s strong liquidity position, which is further bolstered by the fact that its current ratio for fiscal 2025 was 1.42, improving from the preceding year’s 1.1. Having a current ratio of more than 1 makes Accenture’s prospects of covering short-term obligations very high.

Accenture’s buyout strategy is also impressive, as it acquires multiple companies in a given year. In fiscal 2025, the company made 23 acquisitions for $1.5 billion. In November, the company acquired RANGR Data, which expands Accenture's engineering talent and capabilities, strengthening its position to drive enterprise reinvention for customers.

This buyout strategy comes with a drawback of high integration risks. Investors may consider this a red flag since heightened integration risks may hamper long-term organic growth. Accenture operates in a labor-intensive and foreign talent-dependent industry. A key risk that the company struggles to manage is higher talent costs due to a competitive talent market. The fast-paced growth of AI enables clients to improve their performance independently, which reduces their reliance on Accenture.

Hold On to Accenture For Now

Accenture is expected to witness growth in services across its geographic segments. Rising demand for its managed services business is a key driver of the top line. A strong cash position with substantially lower current debt results in a robust liquidity position, providing a leeway to cover short-term obligations.

Despite the company’s rapid acquisition strategy improving its operational and financial position, integration risks are high, which can deteriorate growth, waving a red flag for investors. Higher talent costs resulting from a competitive talent market and a lack of reliance on the company by potential clients due to AI may add to investor concerns.

We recommend investors refrain from buying the Accenture stock at this juncture since it is facing challenges ahead of its earnings release on Dec. 18. Investors are asked to monitor Accenture’s share price movement post earnings to ascertain a preferable entry point, as a hasty decision may affect portfolio gains.

More By This Author:

AT&T Versus Comcast: Which Telecom Stock Should You Bet On?Will Lululemon Stock Keep Rebounding After Strong Q3 Results?

Is Broadcom The Best Chip Stock To Buy As Q4 Earnings Approach?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more