Will Lululemon Stock Keep Rebounding After Strong Q3 Results?

Image Source: Pixabay

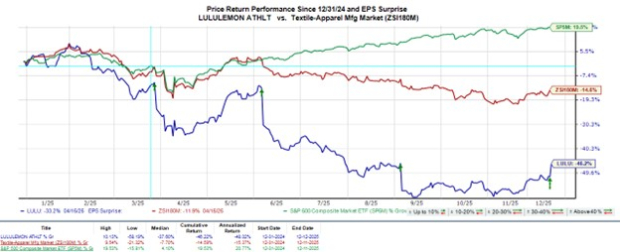

Rebounding further off its multi-year lows, Lululemon (LULU - Free Report) stock spiked as much as +14% in Friday’s trading session after delivering stronger-than-expected Q3 results yesterday evening and providing favorable guidance.

Still trading more than 50% from a 52-week high of $423 a share, Lululemon’s Q3 report helped to calm fears of slower demand in its core U.S. market, along with tariff and inflation-related pressures that have squeezed margins.

Further boosting investor confidence regarding its long-term value, the retail apparel leader authorized a $1 billion stock repurchase plan. Lululemon also announced its current CEO, Calvin McDonald, will step down by January, with the succession plan being welcomed after a challenging year.

Image Source: Zacks Investment Research

International Expansion Drives Strong Q3 Results

Driven by strong international growth, Lululemon’s Q3 sales increased 7% year over year to $2.56 billion, exceeding estimates of $2.48 billion by 3%. Asia and Europe fueled the growth in particular, showing Lululemon’s brand strength outside North America, with international markets revenue increasing 33% while seeing 18% comparable store sales growth.

Americas segment sales dipped 2%, with comparable store sales down 5%. However, another positive highlight included global digital sales of $1.1 billion, a 13% increase from Q3 2024, and contributing to 42% of total revenue for the quarter.

On the bottom line, Q3 EPS of $2.59 came in 16% above expectations of $2.22 despite declining from $2.87 per share a year ago.

Lululemon's Raised Guidance

Raising its full-year guidance, Lululemon now expects annual sales at $10.96-$11.05 billion, up from prior forecasts of $10.85-$11 billion and above the current Zacks Consensus of $10.95 billion or 3% growth. EPS targets were increased to a range of $12.92-$13.02, from earlier guidance of $12.77-$12.97 and above consensus estimates of $12.91, or a 12% decrease.

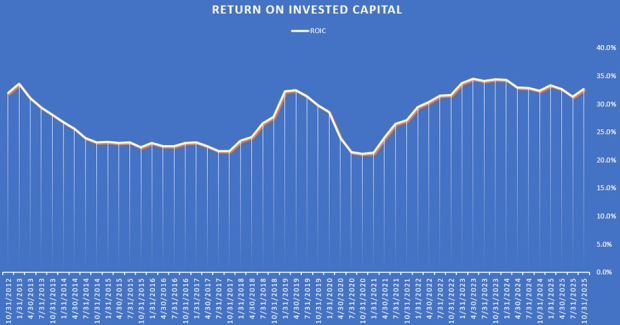

Tracking Lululemon’s Operational Efficiency

Lululemon’s operating margins slipped to 17%, down from 20.5% in the comparative quarter. That said, Lululemon’s store expansion correlates with its high return on invested capital (ROIC) of 32%. Lululemon opened 14 new stores during Q3, bringing its total store count to 730 globally.

Lululemon’s ROIC has wavered in recent years, but the overall uptick from a 20% ROIC in 2021 also indicates the company has continued to use its capital very efficiently to generate profits.

Image Source: Zacks Investment Research

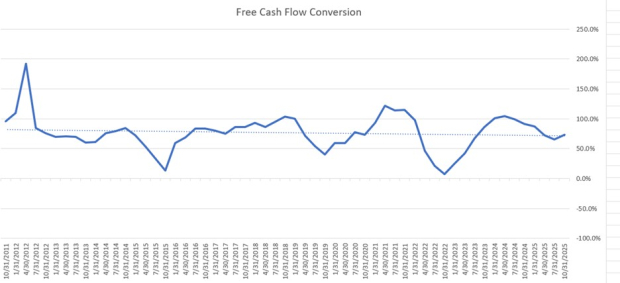

It is important to note, though, that Lululemon’s free cash flow conversion rate has fallen below the preferred range of 80% or higher (72.9%), making its cash generation look weak relative to its net income. The lower FCF conversion signals that reported profits aren’t fully translating into cash and is often seen in companies that are expanding rapidly and have cash tied up in receivables, inventory, or capital expenditures.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Following its stronger-than-expected Q3 report, Lululemon's stock lands a Zacks Rank #3 (Hold). While Lululemon hasn’t set the alarm off regarding liquidity concerns and has a relatively strong balance sheet, the apparel leader is no longer in the top tier of quality companies in terms of operatinal efficiency.

Still, the increasing ROIC is promising, and hopefully, Lululemon’s international and digital sales expansion will help the company get back on track to the stellar growth that captivated investors in the past. At current levels, Lululemon’s reasonable valuation of 14X forward earnings is attractive to long-term investors as well, even if better buying opportunities are ahead after the post-earnings rally.

More By This Author:

Is Broadcom The Best Chip Stock To Buy As Q4 Earnings Approach?Are Buyouts And Partnerships Powering Mastercard's Long-Term Growth?

Dell Stock Soars 24% In The Past Six Months: Should You Buy Now Or Wait?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more