Is A Reversal Coming To S&P 500?

Watch the free-preview video belowextracted from the WLGC session before the market open on 7 May 2024 to find out the following:

- How to identify potential market reversals and judge the “bearishness”

- The pivot level day trader could adopt to trigger an entry

- The short-term, medium-term and long-term direction for S&P 500

- Analyze the market momentum using the previous analogue

- And a lot more…

Video Length: 00:04:56

Market Environment

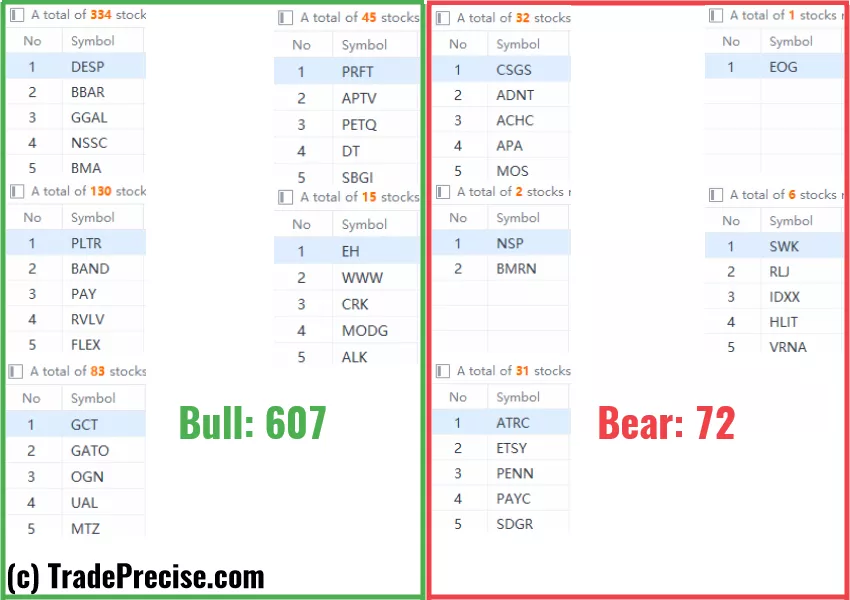

The bullish vs. bearish setup is 607 to 72 from the screenshot of my stock screener below.

(Click on image to enlarge)

Market Comment

8 “low-hanging fruits” (FIX, GDDY) trade entries setups + 15 actionable setups (GNK) were discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Market Reversal Alert: Unveiling A Strategic Trading Plan From The Resistance Zone

How The S&P 500 Reacts To The Mysterious Dance Of The 10-Year Yield

Is The Bull Run Nearing Its End? This Is What You Could Do

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.