Investors Are Finding It Difficult To Run With The Risk-On Baton This Week

Image Source: Pexels

The S&P 500 remained virtually unchanged as U.S. bond yields surged to their highest levels since late November, suggesting investor optimism about the prospects for Federal Reserve interest rate cuts is dwindling.

Fortunately, oil prices eased on Monday, providing some relief to investors amid renewed efforts to negotiate a ceasefire in the Middle East. This development offered a brief respite amidst a challenging landscape marked by uncertainties such as geopolitical tensions, the impending US presidential election, first-quarter earnings releases, and central bank policy decisions.

Traders are endeavouring to recalibrate after last week's lacklustre performance. Despite the market bounce on Friday, the significant damage incurred in the rates market makes it difficult to run with the risk-on baton this week, especially ahead of a US inflation cliffhanger.

The upcoming significant US Treasury auctions, slated for this week, will see $199 billion worth of three-, ten-, and thirty-year Treasuries up for grabs. These auctions, taking place from Tuesday through Thursday, are important in providing insights into the evolving rates market dynamics.

Furthermore, investors are also keeping a close eye on earnings season, set to commence on Friday with reports from major U.S. banks. The proximity of U.S. stock indexes to record highs adds to the palpable sense of anxiety, as the EPS pre-season bar is the highest in nearly two years.

Nonetheless, this week's inflation data is anticipated to be crucial for shaping the Fed's reaction and, hence, investment trends throughout the summer. US Consumer Price Index (CPI) reports have consistently acted as significant turning points in the bond markets in recent months. Given the surprise upside in US inflation during January and February, another upside surprise in March could pose challenges to overlook. At some point, higher US yields will provide the ultimate downdraft for stocks, especially amid so many global risk sentiment unknowns.

The ongoing resilience of the US macroeconomy is compelling the Fed to postpone rate cuts, resulting in a re-pricing of the Fed funds trajectory and even raising the spectre of a no-cut scenario in 2024. This, coupled with tighter financial conditions on the margins, presents a challenging backdrop for markets, especially as stocks remain near their highs.

Moreover, the market will need to absorb this week’s reopening auctions amid a backup in yields, which typically dampens demand. Adding to the complexity is tax season, which implies a liquidity drain as investors pay Uncle Sam just before the traditional "sell in May and go away" period begins.

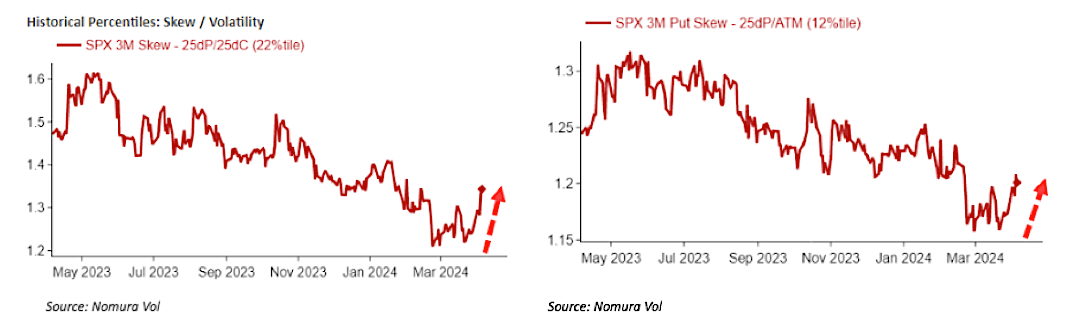

All of this is adding to the pick-up in the Vol regime. Skew's awakening is noteworthy. The contrast between minimal interest in downside hedges and the demand for upside optionality to guard against a potential continuation of the market's upward trend had pancaked skew for months. Now, however, it's showing signs of re-steepening.

(Click on image to enlarge)

If you're new to this, the figure on the left represents puts versus calls, while on the right, it's put versus other puts. Essentially, it's a barometer for the increasing demand for crash protection. However, I would ward against using this as a lasting guide as due to the “ Fed Put,” Vol spikes have been difficult to sustain

More By This Author:

War Drums Beat: Growing Sense Of Widespread Geopolitical Unease

A Challenging Rebound Effort (S&P 500)

Good News Is Bad News Ushers In Q2