Investors Always Miss This Key Element

Image Source: Unsplash

Last week, I caught up with my former boss, mentor, and friend, Chris Mayer.

Chris is the author of a handful of books. His most popular is 100 Baggers: Stocks that Return 100-to-1 and How to Find Them. It’s a wonderful book full of great case studies on companies that soared 100X or more.

After a long career in the newsletter industry, Chris now runs Woodlock House Family Capital. You can find more about him here, including links to his books, blog, and Twitter account.

Now, Chris and I have spent hundreds of hours on the phone together, talking primarily about stocks.

This recent chat was no different, although midway through, Chris brought up a point that I often need to be reminded of.

It’s critical to achieving long-term success in the stock market.

I’ll explain in a second and give you some stocks that pass this test. But first, it’s important to understand what I call the “foundations of value.” And there are a handful of great books to check out if you haven’t already...

The Foundations of Value

Warren Buffett’s most popular book recommendation is Benjamin Graham’s The Intelligent Investor, specifically chapters 8 and 20. Ben Graham was Buffett’s teacher and the father of value investing.

Chapters 8 and 20 explain that buying stocks is not buying pieces of paper, or 1s and 0s on a computer screen, but instead represents a fractional ownership interest in a business. These chapters also introduce the concept of Mr. Market.

Mr. Market offers prices for stocks every day. You, as the investor, can choose to buy, sell, or wait. These are critical lessons for public market investors.

There’s another book, though, that is essential reading for an up-and-coming investor. And that’s McKinsey & Company’s Valuation: Measuring and Managing the Value of Companies.

It’s a thick book… practically a textbook. Fortunately, the whole book can be distilled down into a few chapters—and really, a key concept.

What Matters

There’s quite a bit of backstory and history in how exactly a stock, or any asset, should be valued. For that, you can read John Burr Williams’s The Theory of Investment Value.

In it, Williams introduces the concept of a discounted cash flow method for valuing an asset. It’s a bit academic, sure. But it also makes sense: An asset’s value can be derived from the free cash flow it generates from now into perpetuity.

With public securities, the trick is to wait for Mr. Market to give you a price that’s below your discounted cash flow-derived value. After all, you want to buy stocks that are cheap in relation to your estimate of fair value.

This isn’t the point Chris reminded me of—his focus was on what drives those future cash flows.

Return on Invested Capital

Return on invested capital, or ROIC, is one of the most critical inputs needed to figure out the value of a company.

Imagine a company with $100M invested into the business through, say, inventory and equipment. That $100M is the invested capital.

That company then earns $30M in after-tax income. Therefore, the return on invested capital is 30%.

A business earning 30% on capital is strong. It’s a sign of a good business. The magic happens with that $30M. Can the company continue to reinvest these profits at similar rates?

If that’s the case, then in year two, the company now has $130M in invested capital—$100M plus the $30M it earned. At an equivalent 30% return on invested capital, earnings would be $39M.

It’s simple math, but earnings, in this scenario, just grew 30%.

If the same business keeps reinvesting at these rates, by year 10, the company now generates over $300M in net earnings, a 10-fold increase.

Obviously, the value of the company is significantly greater than it was in year one. But very few businesses can pull off 30% year after year. Those that do… well, they become 100 baggers!

Putting ROIC into Practice

Calculating ROIC takes some handiwork. A company with excess cash on its balance sheet, for example, needs that excess cash stripped out when calculating ROIC.

Public accounting rules now require capitalizing leases on the balance sheet. That may also distort your return on invested capital calculation.

And then the unfortunate part is the numerator: after-tax earnings. Many highly valued companies simply don’t have any.

These were companies valued at many billions of dollars during the COVID mania. And many still have lofty valuations.

In Smart Money Monday, I’ve highlighted a handful of high-ROIC companies.

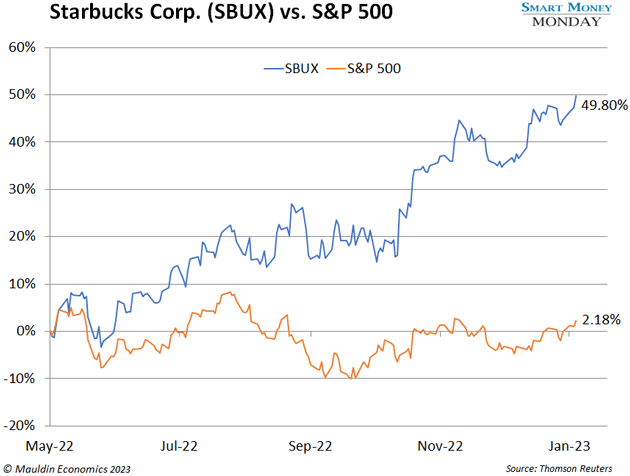

Starbucks is one that I like. Shares are up 50% since I highlighted Howard Schultz’s mega insider buy and return to the company.

Bayer AG (BAYRY) is going through some temporary issues, which I highlighted last week. But it’s a strong company that generates superior returns on capital.

CSX Corp. (CSX) has seen its margin improvement over the past decade. That’s led to the company now earning a low double-digit return on invested capital.

There will likely be more ideas like these.

So, when analyzing a company, consider the historical return on invested capital data… and make sure you have confidence that the future ROIC will look strong as well.

More By This Author:

Ring The Register; Plus, Where To Park Your Profits

A High-Torque Way To Play A Rebound In Air Travel

How The Top 3 Storylines In 2023 Will Impact Small Caps

Now I see that to invest in value is important, but consider the ROIC is the key. I have to confess that I always saw the ROIC like something "accesory" before to buy a company. Not big deal for a accounter. But when you start to see the ROIC meaning for the interest´s shareholders the things looks different. Great article Thompson, thanks for share.

By the way, the Chris Mayer´s book "100 Baggers" is updated?. I have a 2015 edition and some companies mentioned there are mergered or sold to another company.