Investing In Luxury: Adamas One Unlocks The Potential For Lab-Grown Diamonds

Photo by Edgar Soto on Unsplash

Adamas One (JEWL) produces lab-grown diamonds with a proprietary scalable process that is protected by 36 issued patents (28 of which are in the US). It is in the first stages of commercial production as it is scaling up production facilities in South Carolina. Management expects this year’s production capacity to reach a $12M sales run rate.

Expansion is planned well beyond that capacity in two ways, through increasing the number of machines (growers), and by increasing the batch size each grower can handle per growth cycle.

The market for lab-grown diamonds is rapidly growing. Currently, lab-grown diamonds represent over 42% of diamond sales in the US market. Demand doesn’t seem to be a problem.

The main bottleneck at the moment seems to be the turnaround time for cutting and polishing, management is working on solutions to speed things up here.

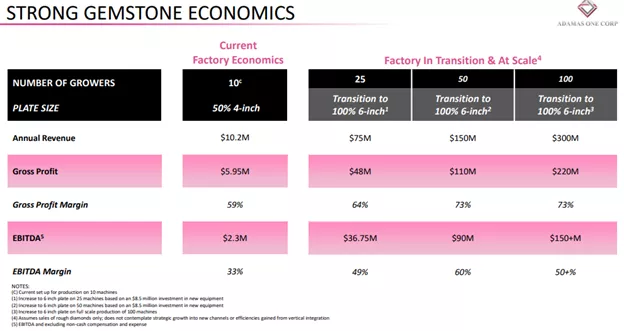

The unit economics of this expansion promises to be very good, with gross margins expected to be at 70%+ and EBITDA margins at 50%+ when the expansion is complete.

If these figures are anywhere near accurate, the stock looks like a promising investment as its current market cap is tiny to the expected sales and profits.

However, before we get there the company needs to overcome a few hurdles:

- The aforementioned hurdles in cutting and polishing.

- While initial expansion is already underway, the company has to arrange finance for additional capacity expansion (beyond the $12M it gained from its IPO late last year, which is already down to $3.45M at the end of Q1). The CapEx needs aren’t huge, and the company already has the leases to expand its production facility.

- Expand marketing and customer awareness in the jewelry market.

- At present, the company has a small group of (wholesale) customers, they also sell directly through their website.

- There is considerable competition in the grown-diamond market, especially in industrial applications where sales are concentrated.

The CVD technology

There are two ways to produce diamonds:

- HPHT (high pressure, high temperature) is the predominant way basically consisting of very large physical presses exerting huge amounts of pressure on a small cell containing graphite material and a catalyst.

- CVD (Chemical Vapor Deposition) is the method the company uses and is described in the slide from the IR presentation below:

From the 10-K:

Our Diamond Technology is based on a proprietary CVD diamond growth system. Large single crystal diamonds produced through this specific CVD process have been shown to be exceptionally pure and possess very low levels of structural defects. Diamonds produced by this process include highly desirable Type-IIa diamonds, which contain negligible levels of impurities and are the most precious for white diamond gemstones. Similarly, the low impurities of these diamonds make them ideally suited for industrial applications, including electronics… Our lab-grown diamonds are identical optically, physically, and chemically to the best mined diamonds. Our Diamond Technology allows us to manufacture diamond materials of the specific size and composition for each specific application.

As a result of the enhanced purity, management hopes not just to sell into industrial markets but to make inroads into the jewelry market as well.

Indeed, the company is embarking on its own line of jewelry and finished its first design which it will be selling through its ElleJolie.com website after launching in September.

The company owns 36 patents on its CVD production method, more specifically their diamond growing machines are proprietary (10-K):

Inside the diamond growing machines, carbon rich gases are ionized into a plasma (a very high energy state). These high energy gases will then deposit carbon atoms on top of the diamond seeds. The carbon atoms from the gas plasma bond to the seed, extending the solid diamond crystal. This process is repeated over and over, depositing several atomic layers per second. Over a period of a few weeks, the diamond crystals grow inside the machines vertically into sizes that can be subsequently cut and polished into gemstones or fashioned into industrial pieces.

Producing diamonds this way can take up to 45 days, depending on the size of the diamonds. There are two main avenues of improvement:

- Adding grower machines.

- Increase the batch size per machine, management believes that it can almost double the production per machine with modifications to the machines.

The company does the cutting (by lasers) of industrial diamonds itself while those produced for jewelry are cut and polished by third-party contract resources, something of a bottleneck at present.

The company also took an (all share) 9.99% stake in NexGenAI Solutions Group, which gives access to its AI-driven solution (from the PR):

Which will help the Company streamline a number of its manufacturing, marketing, branding and communications processes. Adamas expects this partnership to help improve manufacturing output volume, create and manufacture new jewelry designs in its high-end Elle Jolie line and help streamline marketing activities that range from simple AI-driven communications on the Company’s website to spearheading targeted marketing campaigns.

The market

Lab-grown diamonds constitute a large market already, with $26B in sales in 2020. The market is expected to grow at a CAGR of about 10%.

China is by far the largest producer of lab-grown diamonds, with a 56% market share with India coming second with 15% followed by the US at 13%.

Lab-grown diamonds predominantly sell to industrial (as opposed to jewelry) markets, but jewelry sales are expanding rapidly (10-K):

Sales of lab-grown diamonds into the diamond jewelry market are currently small but aggressively growing because of awareness, acceptability, social factors, and pricing.

Recent market trends

While demand for mined diamonds is declining, lab-grown diamonds are experiencing a bit of a boom. Lab-grown diamonds for jewelry were up 57.6% in unit sales although up a lower 37.2% in value sales as the average retail price declined from $2,740 in March 2022 to $2,405 in March 2023, from Tenoris April 2023 Market Comments.

Larger lab-grown diamonds are meeting increasing demand, with sales up 50% y/y in March 2023 in unit terms and 16% in value. It could be that this year lab-grown diamonds are overtaking natural diamonds in sales by US specialty retailers, from Tenoris:

From a value perspective, lab-grown diamonds have a long way to go yet before they catch up with natural diamonds:

Lab-grown diamonds are on average considerably smaller so this isn’t surprising, but there is another element in this:

There is quite a plunge in the retail price of lab-grown diamonds, although it’s nearly matched by a fall in average production cost.

Lab-grown versus natural diamonds

Lab-grown diamonds generally sell at a discount to mined diamonds and management argues that their produced diamonds can have a competitive advantage versus mined diamonds (10-K):

The consistency and other characteristics of lab-grown diamond gemstones using our Diamond Technology may provide advantages over their mined counterparts in areas that matter to jewelers, jewelry manufacturers, and consumers, with characteristics such as the following:

- quality and brilliance of our lab-grown diamonds equal to that of mined diamonds;

- matched sizes, colors, and clarities (particularly in lab-grown diamonds ranging in sizes from 0.5 to 2 carats);

- opportunity for color palette of diamond gemstones; and

- environmentally friendly and socially conscious alternative to mined diamonds

We will seek to establish and maintain market acceptance through consumer education and industry cooperation. We intend to educate retailers and consumers on the physical properties and quality of our lab-grown diamonds as compared to mined diamonds.

But as the latter part of the quote shows, it has taken considerable effort to convince the public about this. The company has hired influencers to create consumer awareness.

But there is also the industrial market, which is plagued by mined diamond scarcity, low uniformity, and high cost. The company’s production process will solve all three of these disadvantages.

Competition

Management believes that it can compete against HPHT produced diamonds based on batch size cost, color quality, and clarity. The company produces large single-crystal diamonds, where competition is less pronounced than most lab-grown diamonds from competitors (10-K):

offer material in different sizes and classes of diamond, including diamond films, diamond grit, diamond bort, and polycrystalline diamond.

Management expects competition to increase with the rise in industrial demand for lab-grown diamonds and increasing customer acceptance of diamonds in jewelry.

Scalability and economics

Their proprietary production technology is very scalable and this is the most important slide of their IR deck:

In order to expand beyond the current 10 (actually 12, with one or two at times used for the production of diamond seeds) growers, the company has to build a new facility for which all engineering and structural planning is already completed.

To get to 25 growers will cost an additional $8.5M but CapEx needs for subsequent additions are much lower and management expects that it can finance a lot from cash flow to be generated by its present facility (which is already working at full capacity).

It already extended the factory lease for 400 growers, which would be good for $1.2B in revenue per year but the first phase will be to expand the capacity to 100 reactors.

What investors also need to understand is that the new facility will operate 6-inch growth plates, rather than the 4-inch plates used in the present facility, which doubles the production capacity per grower. Due to power restrictions, the present facility can’t operate 6-inch plates.

Finances

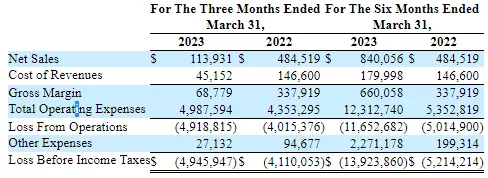

The company is already generating some revenue, from the 10-Q:

In its fiscal year 2022 (ending in September 2022), it sold $1.78M of lab-grown diamonds.

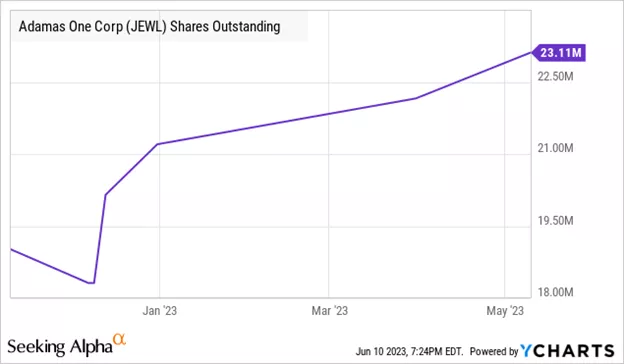

The company collected $12.67M in gross proceeds from the IPO in December last year (assuming the 367.5M additional share option for the underwriters was lifted), from the 10-Q:

2,450,000 shares were sold to investors for $11,025,000, before expenses of the offering in the Company’s IPO;

1,332,825 shares were issued to note holder electing to convert upon IPO valued at $4,198,399;

920,000 shares valued at $3,680,000 were granted to employees as compensation;

481,020 shares were issued for $2,070,000 for incentive to lenders: and

In addition, we purchased 350,000 shares of treasury stock for $1,200,000.

As the company incurred $7.3M in OpEx in Q1 (the December quarter), that cash is rapidly dwindling, at the end of March 2023 just $905K was left.

The cash burn is considerably less. Operational cash outflow was $4.1M in the six months to April 2023, mostly due to the $6M in stock-based compensation.

There was also $2.2M in interest expense in Q1, but the IPO converted most of the debt into equity so interest expenses will be much less going forward (there are $727K in notes payable left at the end of Q1).

Late February 2023, the board approved a $7.5M share buyback program as management deemed the stock price (at roughly $1.60 at the time) didn’t reflect the economic opportunity the company is facing.

However, the company is already running at full production capacity since the end of March this year, which means that they are set to reach $12M in revenue run rate fairly soon.

Demand isn’t the problem, the only bottleneck is the turnaround time for cut and polish but management is working on that.

The company was operating with a gross margin of 81.4% in Q1 and $7.3M in OpEx which indicates the company is breakeven at a revenue level of $9M.

OpEx will rise further but we don’t think the speed of that should worry us, given the gross margins.

However, the slide above indicates a gross margin of 59% at the present full capacity (12 growers), which would indicate a $12.4M breakeven level of revenue.

What should potentially worry investors is the speed at which they will be able to sell the output of their 12 growers, which is the present production capacity of the facility at which the company is already operating. Given the cash position ($905K at the end of Q1), that can’t come soon enough.

Valuation

There are a further 666K warrants and 920K options related to performance pay so the fully diluted share count is 24.7M shares, giving the company a market cap (at $1 per share) of $24.7M

Given the relatively modest CapEx needs for the company to scale up production and the excellent economics, it should be clear that the company could easily be worth multiples of that should they manage to get the capital to build that new facility.

Management even argues that much of it can be paid out of cash flow from the present facility, which would even be better, needless to say.

Conclusion

The company has a patented proprietary production process for growing diamonds that sell into an expanding market.

In principle, this is a highly profitable company. There is no lack of demand for lab-grown diamonds and the company has already been producing at full production capacity since March this year.

The share price doesn’t even begin the opportunities here as there is an important bottleneck (the turnaround time for cut and polish) and cash levels are low.

These can be overcome and the company might need a modest capital raise to finance further expansion which it would likely take into profitability.

There are risks involved (cash needs are pretty immediate, scaling up might be slower than expected which would increase the need for cash), but the risk/reward ratio seems attractive to us here.

More By This Author:

Evogene Offers An Excellent Risk/Reward Ratio

RenovoRX's Latest Innovative Technology Creates New Hope for Chemotherapy Patients

7 Reasons Why SurgePays Is Going To Surge

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Some good research here. Didn't realize this was such an attractive market.

Thanks for the comments people, appreciated, I also see a favorable risk/reward ratio.

I never heard of this company, but lab generated diamonds are definitely the future. De Beers has artificially increased the cost of diamonds far higher than they should be. And obviously, mining and transporting diamonds is far more expensive than creating them locally in lab. Seems the $JEWL should go up as the industry grows, no matter what.

Excellent analysis. Very thorough.

I agree with the author. The risk/reward ratio on $JEWL is very attractive. And lab grown diamonds are far more attractive (in both price and appearance) over traditional diamonds. Plus ESG investors should appreciate the positive affect the changing industry will have on conflict diamonds and forced mining labor.

This is a great investment idea. Personally, I love lab-grown diamonds. They are so much cheaper, and look better than natural diamonds, and my wife (nor her friends can tell the difference).