Evogene Offers An Excellent Risk/Reward Ratio

In short

We think the company’s main CPB computational engine has the potential to be an extraordinary value creation engine as it can create:

- A near endless stream of potentially valuable new compounds.

- Developing these in subsidiaries with the ability to tap their own sources of funding (milestone payments, participations, license and royalty sales, etc.). They already have five subsidiaries and one division.

- Commercial success, three of their subsidiaries already have products on the market, albeit in the very early innings.

- IPOs, putting a market value on the subsidiary and a large pile of additional cash.

- Rinse-repeat.

The company has no debt and has enough cash to last into next year with multiple additional sources of funding likely materializing at the subsidiary level well before that. The market cap ($27M) is a fraction of the potential with many of its subsidiaries likely exceeding that on an individual basis.

There is risk, but it’s well spread among five subsidiaries and one division, investors only need one of these to succeed to de-risk their investment at these levels.

Introduction

Evogene (EVGN) has a proprietary CPB (Computational Predictive Biology) platform in order to greatly improve the chances of successful product discovery and speed up product development in life science industries through the use of big data and AI.

Unlike competitors like Schödinger (SDGR), Evogene mainly develops new compounds for its own development (through five subsidiaries and one division), rather than third parties even if it does have quite a number of partnerships and some income from IP. Some of the products have already reached the commercial stage. Other competitors include Ginkgo Networks (DNA), Exscientia (EXAI), and Relay Therapeutics (RLAY)

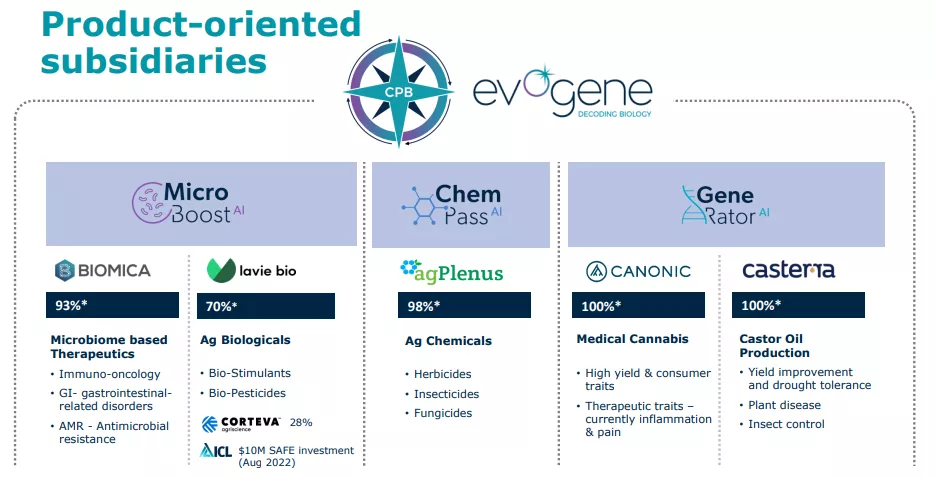

Successful product candidates are given their own subsidiary for further development and commercialization and they can also attract partners which help with capital needs and put a valuation on the subsidiary. At present, the company has five subsidiaries:

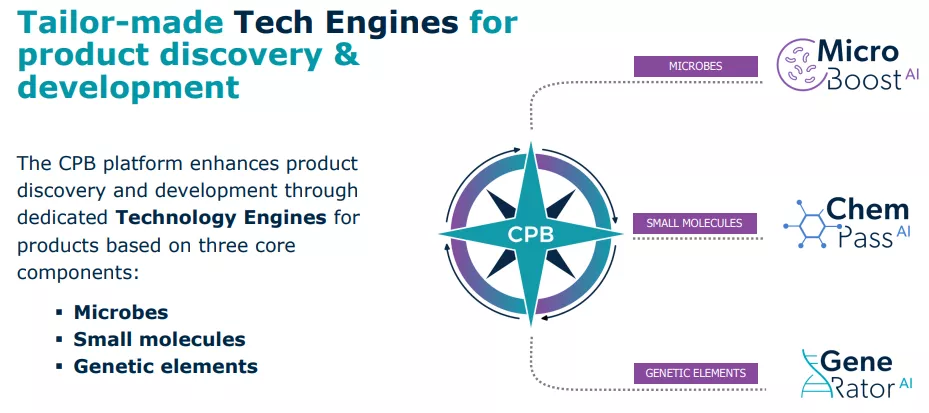

The CPB platform

The mission of the CPB platform is (20-F):

to revolutionize the product discovery and development approach in life science industries by decoding the biological world using computational biology

The CPB platform uses big data and machine learning and is greatly helped by the twin data and computational processing revolutions (20-F):

This platform is the outcome of over a decade long multidisciplinary effort to integrate scientific concepts with big data and advanced computational analytics in order to develop predictions of potential product candidates that later undergo experimental validation and optimization toward commercialization. We believe that the uniqueness of our computational prediction approach stems from our ability to successfully address multiple product attributes at the beginning of the discovery process, and during the optimization phase.

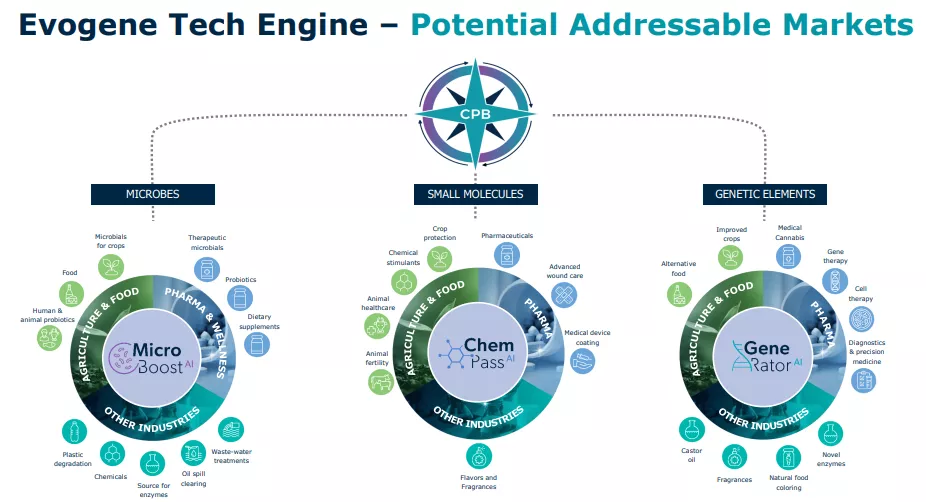

The CPB platform has three engines, each tailored for a specific domain:

- MicroBoost AI for the identification and development of new microbial candidates.

- ChemPass AI for the identification and development of new small molecules.

- GeneRator AI for the identification and development of genetic elements.

The TAM is very large:

But management indicated that in order to preserve cash, they will focus on the development of existing products in their existing subsidiaries, rather than discovering new compounds, which is reasonable as the subsidiaries already have plenty of useful compounds to bring to market (in fact, some of them have already been introduced to the market).

Before we describe the company’s different subsidiaries, we have to draw attention to the fact that Evogene’s Ag-Seed division is still part of Evogene’s business.

The division has cooperation deals with the likes of Monsanto, now Bayer (BAYRY) and several others like Corteva (CTVA), Tropical Melhoramento & Genética S/A, and TMG for the development of bio seeds. These agreements are confidential, so we don’t really know the progress here.

There were more recent deals with Plastomics in 2021 for the joint development of novel insect control traits for soybeans, and Bayer revived its interest in December 2022 with a $3.5M payment for the license to genes discovered to address specific seed traits, for use in corn, soy, cotton, and canola.

The biotech seeds market is huge and is expected to reach $78 billion by 2030.

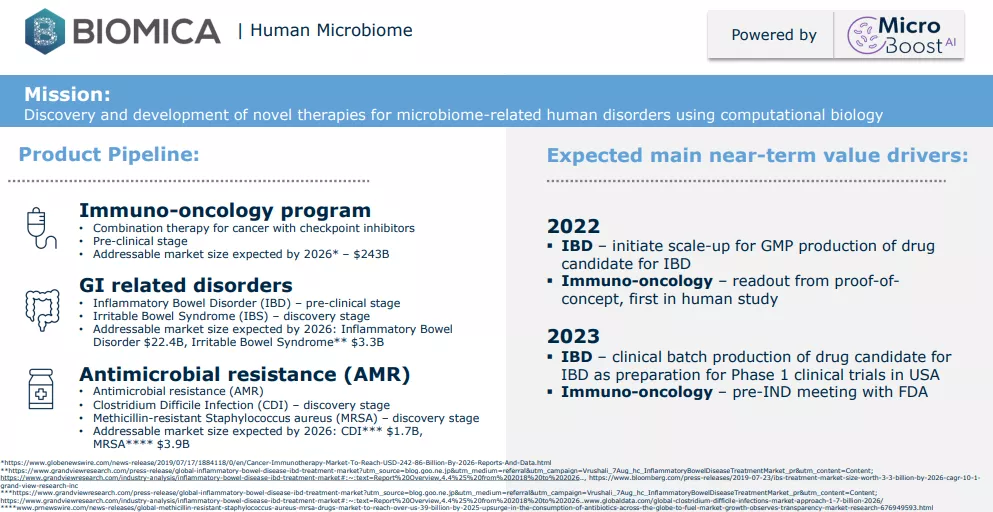

Biomica

Biomica, 67% owned by Evogene (after it raised $20M from partners at a $50M valuation), develops solutions for the human microbiome, focusing on innovative microbiome-based therapeutics for the treatment of immune-mediated and infectious diseases, in particular, Immuno-Oncology, GI-related disorders, and Antimicrobial resistance.

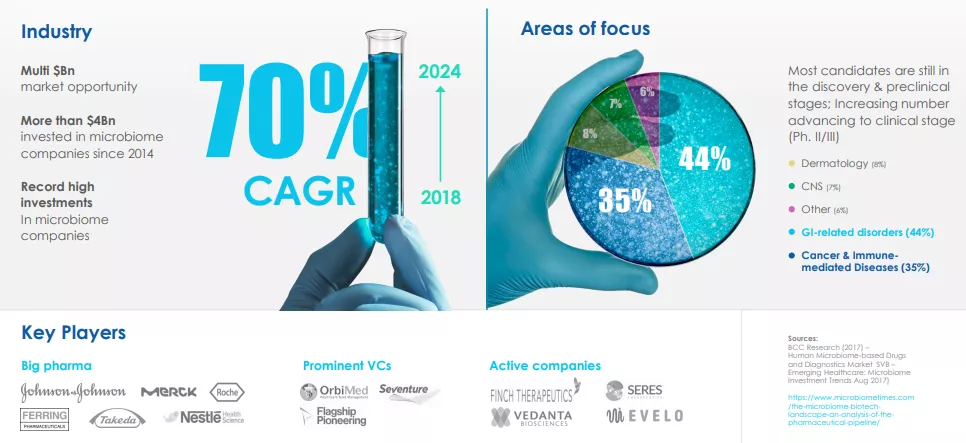

The realization that the microbiome (the bacteria in the gut) plays a crucial part in human health and the immune system has grown very fast in the last years. It won’t be a surprise that this field offers a large and very fast-growing market, from Bionica’s IR presentation:

There are all sorts of potentially very interesting opportunities, as is illustrated from Science Magazine:

Early results from two groups described at the annual meeting of the American Association for Cancer Research (AACR) here this week suggest some patients who initially did not benefit from immunotherapy drugs saw their tumors stop growing or even shrink after receiving a stool sample from patients for whom the drugs worked. However, researchers caution, the results are preliminary.

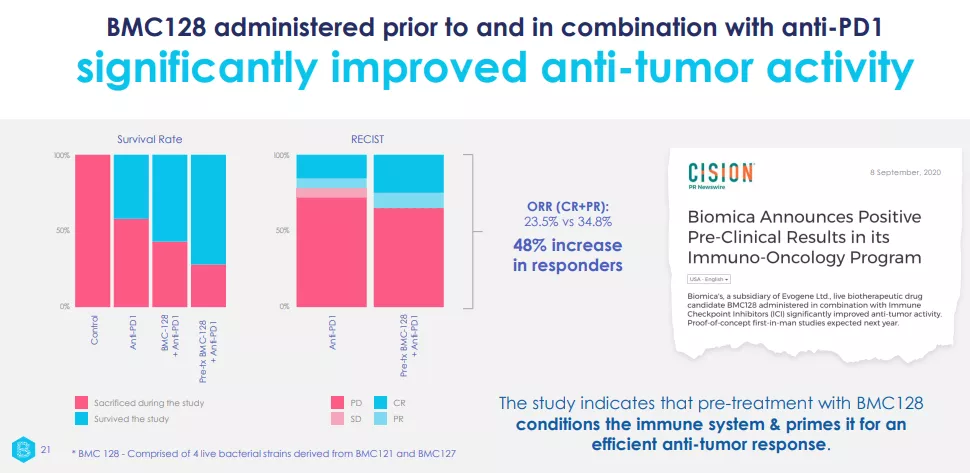

But it isn’t clear which microbes are responsible for this remarkable effect, providing ample space for discovery and the company already developed BMC128 which is pretty promising.

As in other fields, the computational method of finding key microbes using big data and machine learning can deliver much faster results than the traditional biological method.

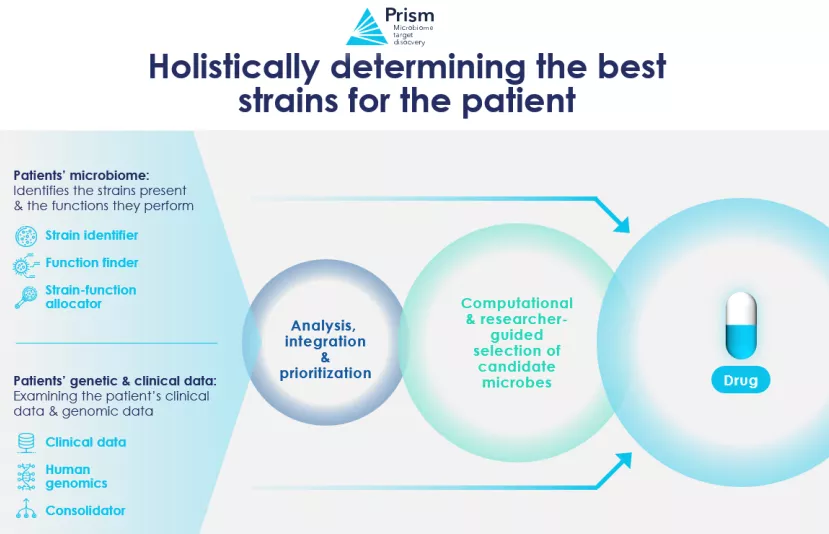

Central in the company’s discovery and development process is its proprietary PRISM (Predictive, High Resolution, Integrative Selection of Microbes) platform. There is a considerable degree of the personalization involved:

The company also has the ability to identify which genetic microbe functions are producing which aspect of product development (stability, efficacy, shelf life, etc.).

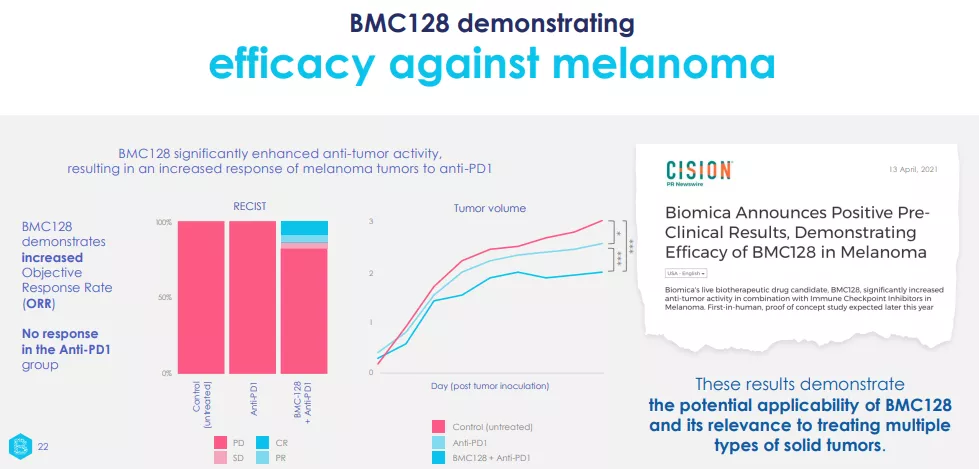

BCM128 showed similar promise when used with a checkpoint inhibitor against melanoma.

Within the confines of this article, we can’t cover all the details, but these can be found in the IR presentation and a detailed article By Steven Goldman.

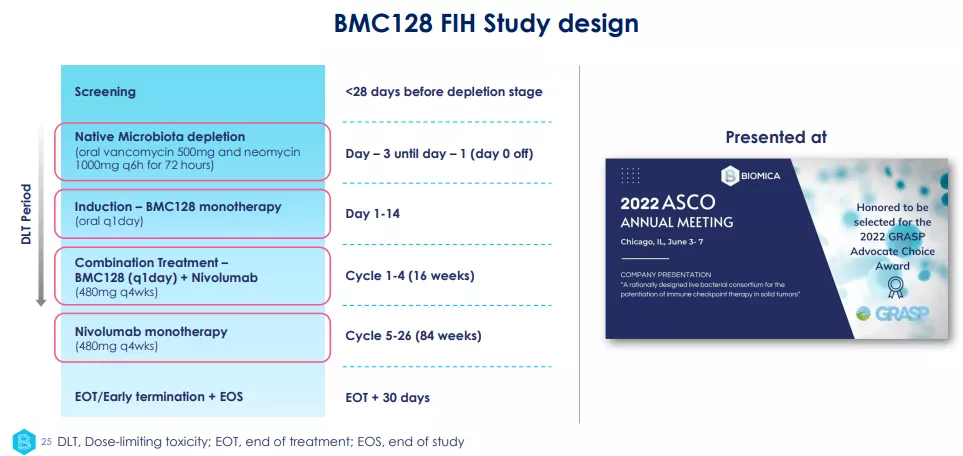

Building on these very impressive successes, BMC128 already started a phase 1 trial (in combination with Bristol Myers' PD-1 checkpoint inhibitor) with the first patient given a dose in July last year:

The trial has already progressed to the third patient (from a total of 12) and the first results (when the first few patients have concluded their treatment programs) are expected in the spring of this year with the trial finishing before the end of the year.

It’s early days but these preclinical results were highly impressive, potentially opening up BMC128 for a host of solid tumor treatments producing significant improvement (in combination with checkpoint inhibitors).

They have also been given the green light from Israeli regulators for another clinical trial for BMC128 in combination with Opdivo for treating patients with Non-Small Cell Lung Cancer "NSCLC", Melanoma or Renal Cell Carcinoma and they have a supply agreement with Bristol Meyer in place.

But it’s early days, we don’t even have the results of stage I clinical trial yet, but on the other hand, we should also not forget that their pipeline has several other candidates:

- BMC333 for IBD (inflammatory bowel disease), with early indications of success and for solid tumors (in combination with immune checkpoint inhibitors). Once again, Steven Goldman provides more details.

- BMC426 for IBS (Irritable Bowel Syndrome).

- BMC202 to address C. difficile infections.

- A small molecule in the advanced discovery stage that is a candidate to address MSRA infections.

Nor should we overlook their data and computational engines that can continue to provide the company with a stream of new promising candidates.

The company did raise $20M in financing last December, $10M of which from Chinese private equity firm Shanghai Healthcare Capital, giving it a 20% stake in the company so the deal puts a $50M valuation on the company, almost double the entire market cap of Evogene.

Lavie Bio

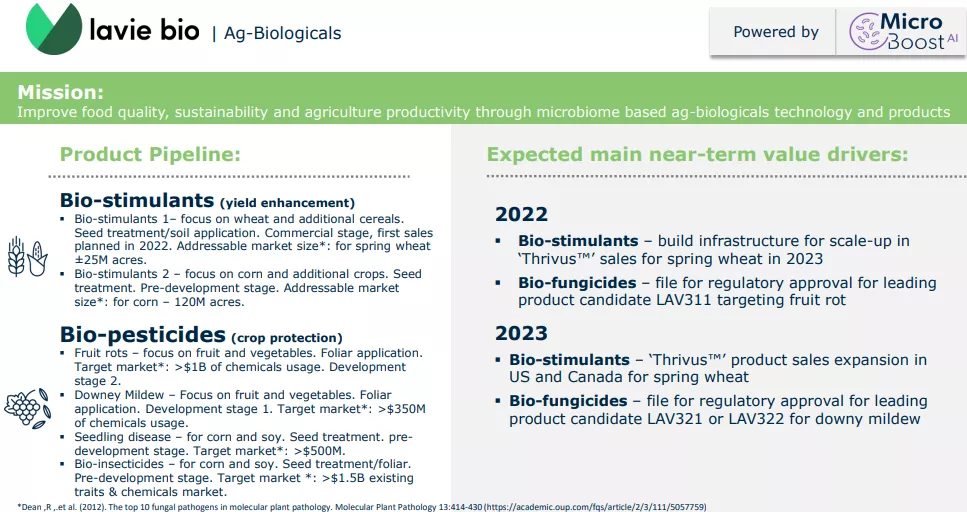

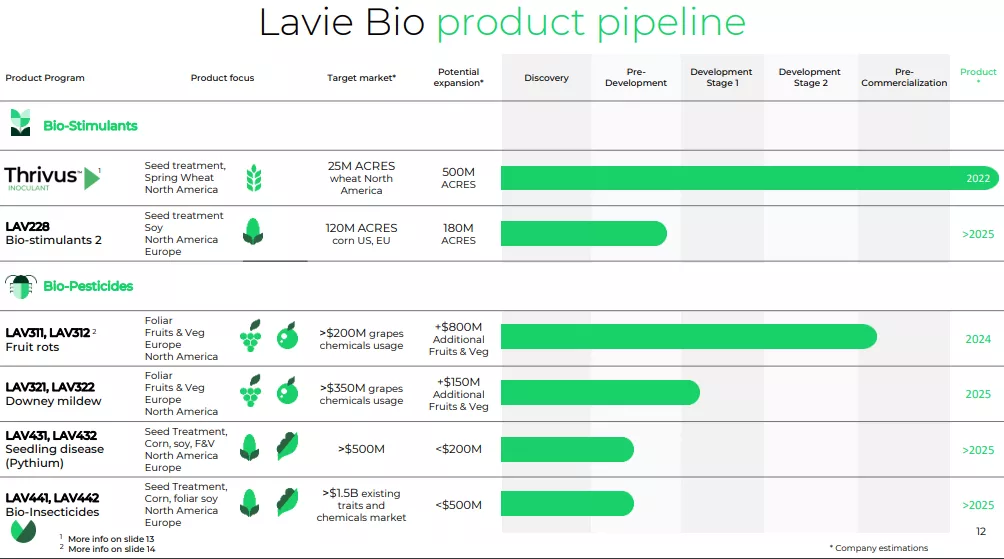

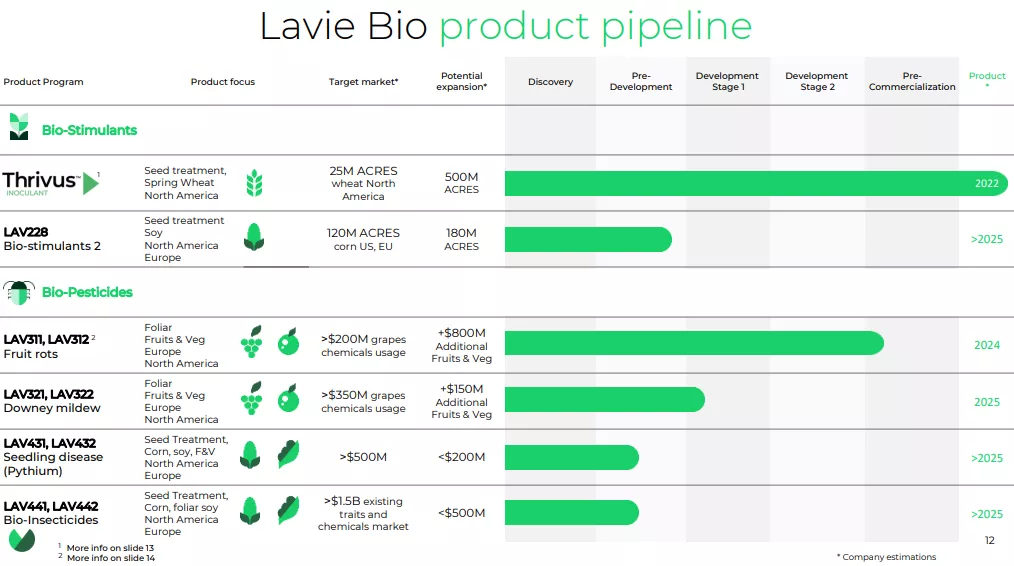

Lavie Bio, 72% owned by Evogene, develops two types of products, bio stimulants and bio pesticides. The company has a substantial pipeline with one product, Thrivus (formally called result), already in the commercial stage and two others close to it. From Lavie IR presentation:

Thrivus (LAV211) has already been selling in the crop season in parts of South Dakota last year, with the help of a distribution deal with United Agronomy, and is expected to expand sales to other areas in the US and Canada in the 2023 crop season.

Thrivus has been field tested for four years and can bring significant advantages to farmers (company PR):

the development of result™ included positive four-year field trials in multiple locations and commercial validation through broad-acre fields under standard farmer practices in target locations. The results achieved in the field trials have demonstrated that result™ has the potential to contribute an additional 3-4 bushels per acre and showed increased yield improvement compared with industry benchmarks. Based on current wheat prices for farmers, this could provide growers an average of $30-40 in additional revenue per farmed acre.

Lavie also has two strategic partners, Corteva and ICL:

Including the shares of Taxon Bioscience, the investment of Corteva in Lavie was $27.5M for a roughly 28% stake in Lavie. The $10M investment from ICL was a SAFE (simple agreement for future equity) investment with a fixed value for the next round and not likely below the Corteva value in 2019 when there wasn’t a commercial product yet.

The fact that Evogene still owns 72% of Lavie should have investors rejoicing as it indicates that Lavie’s value alone is considerably above Evogene’s market cap (which is under $30M).

Investors should be aware of the potential. The Spring Wheat market covers 10M acres throughout the US and constitutes a $12M market opportunity for the company. Adding Canada would make this 25M acre.

There are other expansion opportunities:

- Further territories will be addressed during the 2024 spring wheat season in a few other states and a part of Canada, this could ultimately spread to all of the US and Canada

- Further international use

- Label expansion, for instance addressing the winter wheat market which is 5-10x the size of the spring wheat market.

- Further label expansion like addressing additional small grains, such as durum, barley, and oats, adding over 20M acres in North America; international expansion and/or using Thrivus on oil seed crops, such as canola and soybean.

And it’s not just Thrivius, there are plenty more candidates in the pipeline:

LAV311/LAV312, a biofungicide targeting fruit rots and powdery mildews based on novel bacteria naturally present in nature, could very well be their second product as it is close to commercialization.

The company has supplied the registration package to the EPA in October 2022. This process normally takes some 18 months. Management hopes to soft launch for the 2024 growing season, this is a $2B market and the indications so far are very promising (company PR):

Over the past three years, LAV.311 has consistently demonstrated control of fruit rots and powdery mildew in grapes, strawberries, cucurbits, and fruiting vegetables, in over 30 trials conducted in the U.S., Europe and Israel.

Indeed, here is management on the Q4CC:

The initial product market type for LAV311 is over $200 million in the treatment of risk and there is a potential room to expand the target market to over $800 million, once it includes targeting additional fruits and vegetables. In the coming year, we plan to expand the potential addressable market for LAV311 by broadening its applications to additional crop while optimizing the product and manufacturing costs.

LAV321/LAV322 is another candidate targeting the Downey Mildew market, a $350M market (grapes chemical usage) with further potential $150M upside although a commercial launch won't be before 2025.

Apart from one commercial launch and several promising products in its pipeline, investors should further appreciate that Lavie has not only achieved two well-capitalized partners, it also reached the commercial stage with Thrivus, lessening the financing need of Evogene.

So this could quickly add up a few years down the road. Therefore, we think Lavie alone could be worth hundreds of millions of dollars in a few years, making a mockery of Evogene’s present market cap.

Ag Plenus

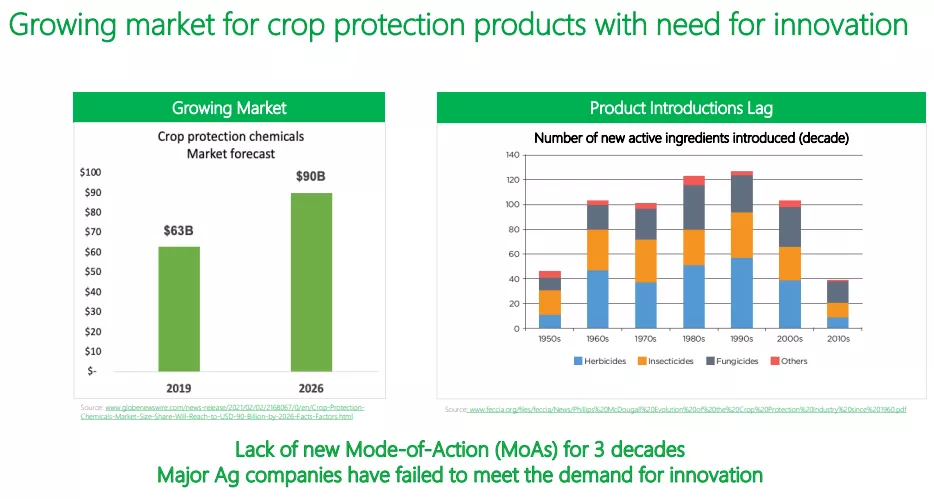

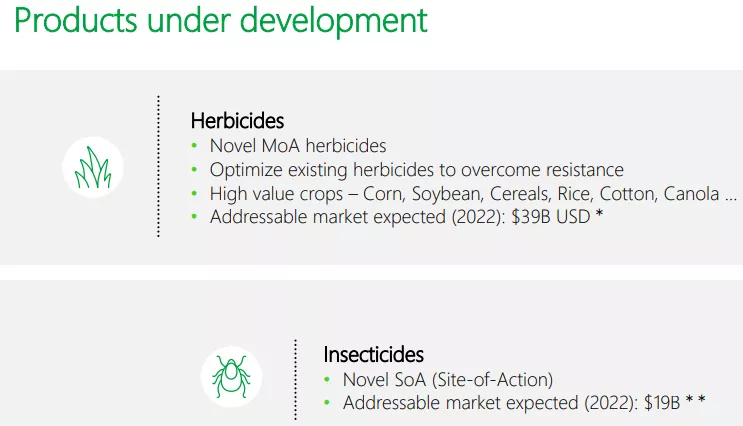

This subsidiary plans to introduce something that hasn’t happened for three decades, new MoA (Mode-of-Action) non-toxic weed killers. This is a very large market with an urgent need for innovation:

Simply mentioning RoundUp and the trouble it has gotten into, there is an urgent need for non-toxic weed killers and protective insecticides. Apart from toxicity, the market also suffers from increasing weed resistance to many herbicides, there is a real problem here, and a large market opportunity for products that can solve these.

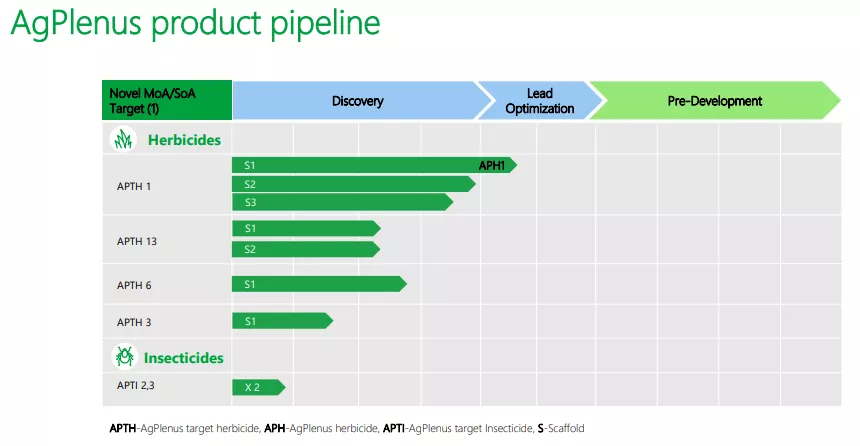

The company has a considerable pipeline of substances but they’re got significant work to do before they can reach commercialization, from the AgPlenus IR presentation:

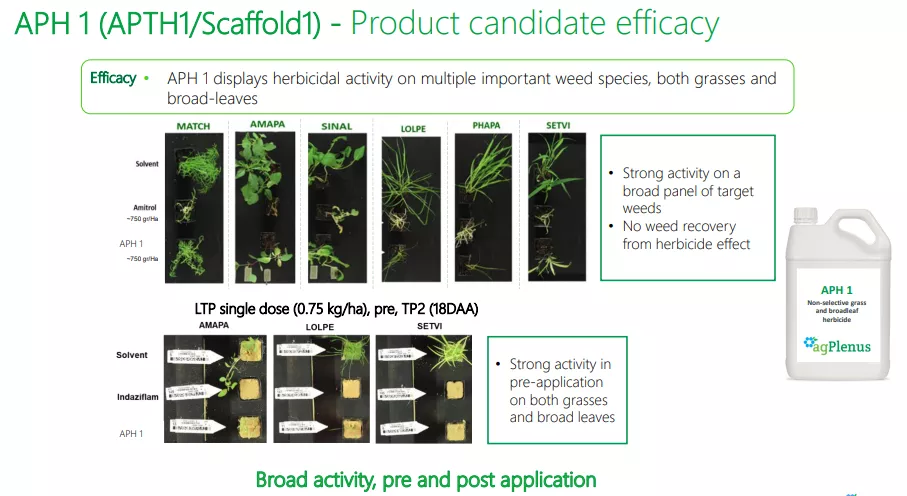

The table excludes product development programs undertaken with collaborators (which are subject to confidentiality restrictions). Their main candidate APTH1 has broad applicability:

Broad applicability for a non-toxic weed killer, that would open up a huge market opportunity, in fact, they’re developing both herbicides and insecticides:

And here too, the company is collaborating with Corteva:

From the Q4CC:

Corteva received license to this product subject to AgPlenus being paid, research fees, milestone and royalty upon commercialization. The AgPlenus-Corteva collaboration has been ongoing since March 2020.

With a $90B market (by 2026) to go after, big commercial crops like corn and other cereals already show tolerance to the company’s APTH1, and other crops could follow by developing a resistance trait for them (something that the company has already shown for tobacco).

Management argues that a novel mode of action herbicide such as APTH1 could generate peak sales of $750M to $1.5B, again making a mockery of the company’s market cap. But once again, we’re a long way off from there, and it’s likely they will partner well before that happens, or do an IPO.

Canonic

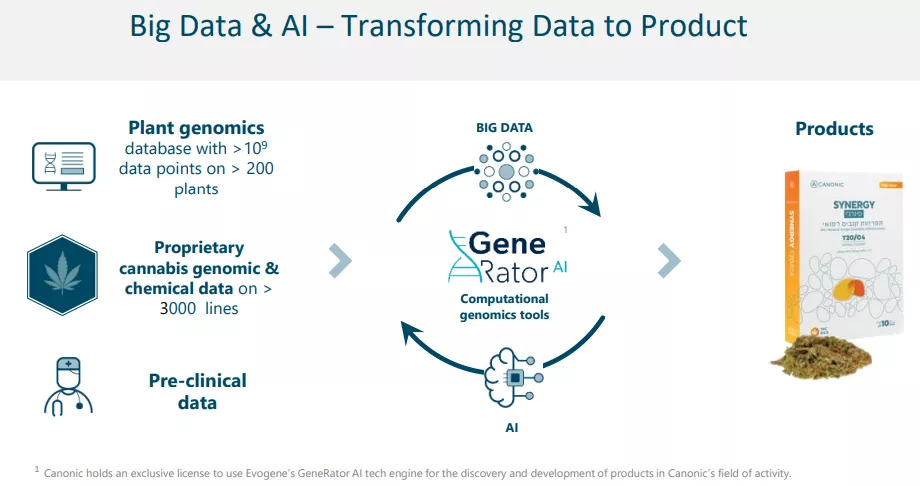

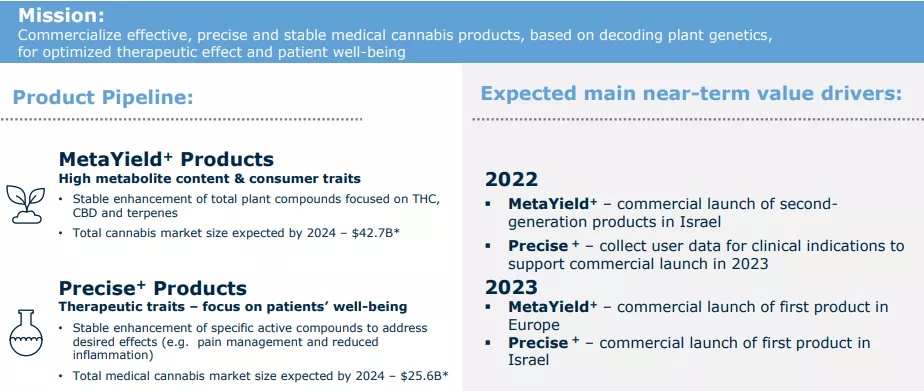

Canonic uses plant genomics data and computational genomics, which is Evogene’s GeneRator AI tech engine to enhance properties in medical cannabis, from the company IR presentation:

The company already has one commercial product and another one under development, from the Evogene IR presentation:

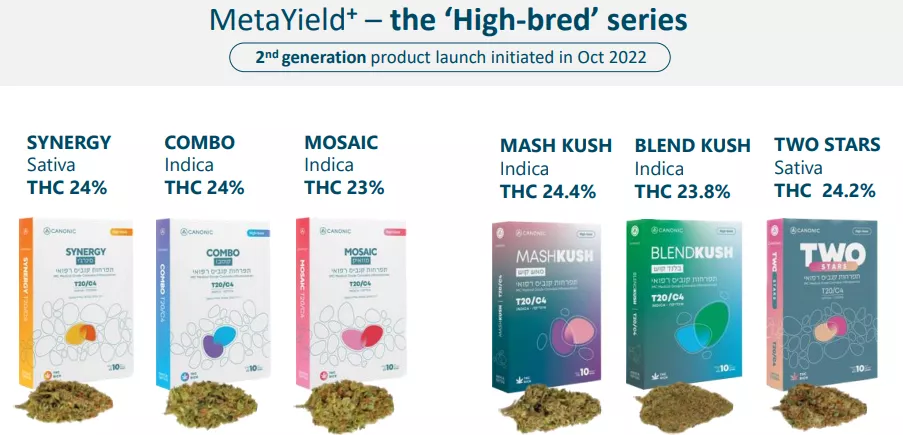

The company launched a second generation products with even higher THC levels and unique terpene profiles with a market introduction in Israel that was very well received.

The company also struck a licensing deal with GroVida, a Portuguese cannabis cultivation company, for the commercialization of two of their new cannabis lines in Europe.

The company announced in February that all of the six products in the slide above are now launched in Israel:

Looking ahead, we will continue the development of our third-generation products, particularly with selecting new and unique terpenes. Furthermore, we intend to sell our products to broader markets starting with Europe

Not everybody might be familiar with Terpenes (Q3CC):

plant compounds known to provide relief for many mental symptoms, including pain relief, anti-inflammation, anti-anxiety, anti-depression and more. They also influence the aroma and the scent of the cannabis inflorescence.

The market for medical Cannabis products has become quite competitive so management is reducing cost and is considering various longer-term options for the company.

Casterra

Recently interest has been greatly revived in this subsidiary due to renewed interest in castor oil as a biofuel and the phasing out of some alternatives like palm oil, resulting in a major deal for the company with a large European energy company (see below).

Using Evogene’s GeneRator engine, Casterra is developing compounds to assist the cultivation of castor grains and the castor oil value chain with end-to-end solutions, from Casterra website:

Casterra is an offshoot of Evogene’s Ag-Seed’s division which has a wider remit, targeting key commercial crops such as corn, soy, wheat, rice and cotton in order to improve plant traits.

Casterra is concentrating on castor grains, utilizing biotechnology approaches in order to improve traits. The company has a number of solutions, including three castor varieties and even some proprietary machinery, like a fast-moving harvesting header with reduced field losses and a high-capacity dehulling machine.

Castor beans have significant advantages for the biofuel market (Q4CC):

Castor beans represent the highest energy return to growth as they have high oil content, approximately 50% can go on marginal lands, meaning that they pose no competition on land which can support other edible crops and support environmentally-friendly cultivation practices.

This is a $1.2B global market, and given the high oil and energy content and environmentally friendly cultivation practice, biofuel is a significant opportunity, with tailwinds from regulation in Europe (requiring transportation fuels to contain 14% biofuels by 2030 and banning products linked to deforestation, like Palm oil to fulfill this role).

The company’s varieties have considerable advantages over existing ones (95% come from India), from Steven Goldman quoting Evogene’s CEO Ronen:

Ronen explained that traditional castor oil plants (grown from Indian sourced seeds) are typically tall, grown plantation style and have low grain yields: 500 kg/Hectare or Ha (approximately 2.2 acres) in non-irrigated soils and 700 kg/Ha in irrigated soils with less than 50% oil content, generating 250 kg to 350 kg of castor oil per Hectare.

In contrast, Casterra's proprietary castor oil seeds result in castor oil plants which are smaller, with a denser architecture, shorter growth cycle and much higher yield of 2,000 kg to 3,000 (or higher) per hectare per cycle, generating 1,000 to 1,500 kg of castor oil, with the potential to increase the number of castor bean crop plant/harvest cycles each year from two to three.

In fact, Ronen indicated that in remarkably optimized conditions, he has seen reports of Casterra's castor bean seeds producing 5,000 kg of castor beans per hectare yields generating approximately 2,500 kg of oil per hectare (per growing cycle). The current market price for unrefined castor oil is approximately $1,800 US FOB per metric ton.

Indeed, in January 2023, the company announced an agreement with a major European energy company (one of the seven sisters) for the biofuel market.

The PR sounds a little dry but management is very encouraged by this as it can potentially open up tens of millions of dollars in orders in a couple of years. This deal alone has put the company on the map and investors should take notice.

In November 2022 the company signed a long-term exclusive production and distribution agreement with Titan Castor Farms in Zambia where Titan will pay royalties on the sale of its castor oil products starting in 2023.

The market opportunity is substantial with roughly $500 per hectare per year in yield and likely to be at least a few million hectares by 2030, we’re looking at several hundred million dollars assuming Casterra can capture a significant part of that market.

To compare, CoverCress is a company with a similar concept to Casterra, doesn’t produce revenues yet, and was sold to Bayer for what management believes to be roughly $200M. There is lots of interest in the sector.

Finances

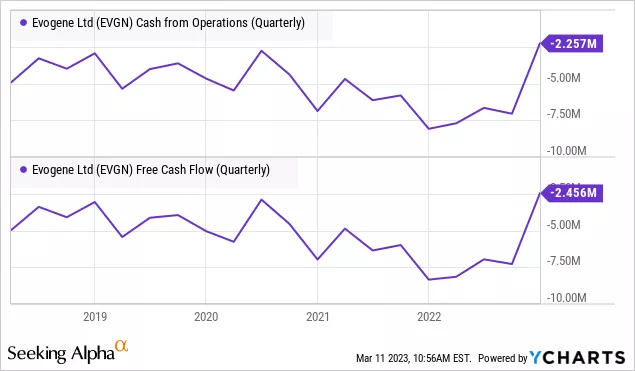

The company still doesn’t generate much in terms of revenue:

But with several (Canonic, Lavie) subsidiaries now having commercial products on the market that is likely to change. The cash bleed is down to under $30M per year:

The company has $35M in cash, which is certainly enough to take them into 2024 as they expect a cash burn of $27M-$29M this year.

And this assumes no additional financing on the subsidiary level, given what happened last year this strikes us as unlikely. For starters, there is the $10M from SHC, the Chinese private equity fund investment in Biomica, which could very well arrive in the coming weeks after clearing with Chinese regulators.

Speaking of financial injections, the Biomica and Lavie financings have been done at levels that value each subsidiary well above the whole present market cap of Evogene (less than $30M), that should tell investors something of the possibilities here.

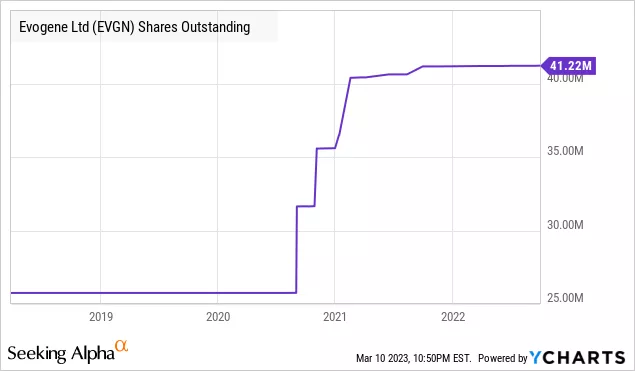

The share count did go up significantly in H2/20, but since then has been quite steady as the company still has cash until the end of 2024 and several subsidiaries tapped their own financial sources (Lavie with $10M from ICI, an earlier $10M from Corteva, Biomica raised $20M, the Ag-Seeds division raised $3.5M from Bayer in a license payment etc.) or are even already selling commercial products (like Canonic and Lavie, and Casterra could be close).

The company has no debt and one might be surprised to know that the market capitalization (at $0.67 per share) is just $27.6M, the shares trade below cash.

An IPO of one of its subsidiaries (as things stand now that would most likely be Lavie Bio) could put a market value on the subsidiary and provide tens of millions of additional cash for parent Evogene.

Conclusion

We see a lot to like here:

- The company has an impressive core capability with their three-engine computational CPB platform, which already has generated numerous potentially very valuable compounds and can keep doing this.

- A number of these compounds have been given their own subsidiary (and one division) for further development, partnerships and tapping their own financial sources, greatly stretching the financial reach of the company.

- Three of these divisions (Lavie Bio, Canonic and Casterra) already have commercial products, although these are in the very early innings.

- We think each of these subsidiaries (and the Ag-Seed division) could be worth a multiple of the company’s market cap (just $31M at the point of writing) in a couple of years, if not sooner.

- The company has no debt and $38M in cash which would last them until the end of 2024.

- But the capacity for raising additional sources of funds are numerous, through participations, licenses and royalties, commercial success, or, as is the goal of management, one or more IPOs.

- Financing rounds at Biomica and Lavie have valued each subsidiary well above the entire market cap of parent Evogene, we think this is likely to hold for all their subsidiaries.

- A single IPO of one of its subsidiaries (at this stage the most likely candidates are Lavie Bio or Casterra, as they have launched commercial products already and the interest in Casterra has recently spiked) would put a market value on it and likely provide substantial additional funds, extending the cash another couple of years.

- This IPO process could extend when developments in other subsidiaries (or the Ag-Seed division) is sufficiently interesting to consider this route.

- So the company’s main CPB engine could create a stream of potentially valuable new compounds, subsidiaries, IPOs and even commercial success, it has the potential to be an extraordinary value creation engine.

We think at these levels the shares offer a potentially huge upside at quite acceptable risk levels, given that they have so many shots on goal that the chance of missing all seems quite acceptable to us.

More By This Author:

RenovoRX's Latest Innovative Technology Creates New Hope for Chemotherapy Patients

7 Reasons Why SurgePays Is Going To Surge

Protalix BioTherapeutics Well Placed to Advance in 2023

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

What do you currently think about $EVGN? Do you agree with this analysis?

Looking To Invest In Artificial Intelligence? Consider Evogene And Its Five Subsidiaries

I'm convinced. I'm picking up some $EVGN.

This sounds like a very good buy!

Great article, very thorough! I think $EVGN is extremely undervalued. It's at its lowest price ever right now and truly a bargain.

Thanks, appreciated Kurt. I agree, the platform has already proven itself by generating many useful compounds which are now being commercialized by five different subsidiaries, some of which already selling commercial products and some of them worth more than Evogene itself.