Invest In U.S. Exceptionalism

Image Source: Pexels

American exceptionalism

World happenings form the basis for my investments and my articles plus being of great personal interest. Today I find the US at an inflection point where external catalysts and internal readiness meet. In a recent article titled Follow the money - Invest in the US I talked about the mess in Europe making it a difficult place to invest in and that investing in the US is best. Today I add to that by showing the trillions being invested in the US make the US as exceptional now as when it was first muted by French writer Alexis de Tocqueville, who noted its unique commitment to democracy and self-governance following his visit there in 1831 and that the United States is unique and distinct from other nations, based on its history of democratic ideals, liberty, and a special role on the world stage

The French connection had a further importance when that symbol of the US ...

The Statue of Liberty was gifted to the US by France.

Between 1787 and 1789 the French people led a revolution that finally freed them from tyrannical leadership and gave them independence. In 1865 Frenchman Édouard de Laboulaye had the idea of presenting a monumental gift from the people of France - the Statue of Liberty - to the people of the United States. An ardent supporter of America, Laboulaye wished to commemorate the centennial of the Declaration of Independence as well as celebrate the close relationship between France and America. He was also motivated by the recent abolition of slavery in the U.S., which furthered America’s ideals of liberty and freedom.

In recent times many "experts" have stated those times of Exceptionalism are over for the US but I can find no other country that has taken over.

To put things into perspective I shall start first with state of the three European countries - the 3rd, 6th and 7th largest world economies - (IMF October 2025 rankings) - that I mentioned in the above linked "Follow the money" article.

Britain

The lack of sound political leadership in Britain goes back years and it shows.Since the 2007/2008 financial crisis UK GDP growth per head has been the lowest of all members of the G7 at a mere 0.7%. The US figure is more than double at 1.5%. (those figures from the Financial Times - FT). The latest official forecast up to 2029 shows no growth.

There are some good opportunities for investors in that mess and I shall write about those another day.

Germany

Europe's largest economy, the world's third largest and a biggest financier of the defective EU is stuck in its fourth year of stagnation following several years of decline. Industrial production - the backbone of its economy - is no higher than the 2005 level and now declining; manufacturing PMI decreased to 48.40 points in November from 49.60 points in October, according to the latest ‘flash’ HCOB PMI survey. That is likely to get worse since President Trump's tariffs have reduced exports to the USby 7.4% in the first nine months of this year according to figures in a recent Financial Times article headed The free fall of German industry. On the other side of those tariffs is the increasing squeeze from China becoming a high quality, high tech global powerhouse with an ever improving education system. German school curriculums have not been updated since the 1980s in a world that has digitised since then!

Internally, Germany's political "leaders" are making matters ever worse. Their dogma for years stated that all debt is bad debt. Earlier this year new fiscal rules relaxed that "debt brake" and released up to one trillion euros for investments in decaying infrastructure and defence over the next decade.Today it appears that the part intended for crucial infrastructure is being siphoned off to cover day-to-day spending.

My only investment there is in Siemens Energy (SMEGF) or ENR on the Frankfurt exchange where I own it. I especially like its gas turbines that are a huge growth area and it is one of three world leaders in those along with US GE Vernova (GEV) - that I also own - and Japan's Mitsubishi Heavy Industries.

Obviously there are some more gems there and if readers know of any please lets us know in the comments below.

My main European bets are in ...

France

Like Britain and Germany the politics are in a mess but it has some real positives for investors and I shall expand on those soon in an article probably headed France - More than just a champagne maker.

All larger French companies have much of their business outside France including in ...

American exceptionalism

That exceptionalism truly exists but with investing risks as well as ...

Positives

Love him or loathe him (I claim Swiss neutrality!) President Trump has both vision and energy. I cannot find those important characteristics in another major western economy leader except for Italian leader Giorgio Meloni who is transforming once weak Italy. Moody's recently upgraded Italy's debt because of what she is doing. Worth watching for investment opportunities!

For years the US drifted sideways while China surged upwards until recent times proving correct the saying "There are decades when nothing happens; and there are weeks when decades happen”. That might have started during Trump's first term in office. It certainly continued and accelerated under Biden's Chips Act and the weirdly named Inflation Reduction Act.

This week Nouriel Roubini - Professor Emeritus at the Stern School of Business - wrote an article in the Financial Times headed Tech trumps tariffs: why US exceptionalism will last .Maybe he read my earlier articles and hacked into this one that I started drafting a month ago!Anyway he makes some good points that support my positive outlook.

In October 2023 I showed part of the new start in an article titled The US Dollar in the main safe haven currency. In there I wrote that America is enjoying an economic transformation - a new Industrial Revolution and linked in an excellent article from the Financial Times; US economy is on the brink of a new growth cycle. That mentions the nearly $3 trillion in federal funding - good debt! - devoted to productive investment some of which has yet to be spent.In addition, private sector investment is soaring with Intel being quoted as one example - it will invest up to $100 billion in building its new semiconductor manufacturing hub in Ohio, in part due to federal tax credits aimed at incentivising such projects.

Many more have been announced over the two years since then encouraged in part by those things plus the political push to bring back production to the US. I list some of those in that linked article and the ones of $1bn and more add up to over $350bn!There were many also many "small" ones such as John Deere (DE) investing $29.8m to shift production from China to Louisiana. Those were all unrelated to the recent AI boom.

Private investments in US tech companies in the first nine months of this year rose 95% to $177bn compared with a 7% increase to $33bn in the EU.

Since then Trump's attempts to bring more investment to the US plus state backed incentives have caused a tidal wave of almost weekly investment announcements that include ...

- GE Appliances. $3bn to move manufacturing to the US from China and Mexico.

- Japan to invest $550bn by the end of 2028.

- Stellantis (Chysler, Dodge and Jeep car maker) pledged $13bn of investment in the US over the next four years creating 5,000 jobs.

- Apple an extra $100bn over the next few years.

- Switzerland will invest $200bn by the end of Trump's term

-Toyota Motors will invest an additional $10bn in the next five years on top of a recently completed $14bn investment

- Alphabet will be investing $40bn into developing new data centres in Texas.

- Merck has broken ground on a $3bn pharmaceutical manufacturing facility in Elkton, Va.

- Meta will build a $1bn AI data centre in Wisconsin.

- Nokia will invest $4B to expand R&D and manufacturing in the U.S.

- Anthropic will spend $50bn building AI infrastructure in the coming years.

- Amazon will invest at least $3B into a data centre in Mississippi and $15B in Northern Indiana to build new data centre campuses plus up to $50B to boost AI and supercomputing infrastructure for US agencies.

- Crown Prince Mohammed bin Salman, Saudi Arabia's leader said the his nation would increase a previously committed investment of $600B into the U.S. to $1T.

- JP Morgan estimates there will be $1.8tn of corporate bond issuance in 2026.

There is much more plus the multiplier effect from those dollars will have an enormous positive influence on the US economy generally for the next 2-3 years at least.

Jobs growth is healthy. The U.S. labor market added 119K jobs in September, easily outstripping the consensus of 50K. It could be better but some companies are reporting a lack of migrants to fill available places due to Trump turning them away. Layoffs across the tech sector are down dramatically this year, according to the tracker Layoffs.fyi. There are a total of 114,000 tech employees laid off year-to-date as 2025 draws to a close. In comparison, 153,000 were laid off in 2024 and 264,000 were laid off in 2023.

The important housing market has been in the doldrums for a long time. I have seen estimates that one person directly involved in house building can create work for six others in the whole supply chain. When/If the Fed ever wakes up in the real world and lowers interest rates that could cause a surge in buying and thus building some of the 2.5 million homes said to be needed on that liked FreddieMac article.I own LHI Homes (LGIH) in preparation for that - they build much needed affordable homes. Finances are very ok with a high inventory available to satisfy demand rapidly plus there is no debt problem. PE is only 10. The share price peaked at $180 in May, 2021, today it is $51! The long term stagnant housing market also limits worker mobility thus increasing joblessness in some parts of the country and causing worker shortages in others.

More money for US company equity investments could come from cryptocurrency investment product outflows of over $1tn in the past six weeks. Hopefully a continuation of that does not cause a market panic and that some of that money will go into normal equities. There is also around $1tn available for investment by PE firms and, as of mid-November 2025, the total assets in U.S. money market funds were approximately $7.54 trillion. If the Fed lowers interest rates a lot of that money market money will seek a new home.

- Large banks could unlock some $2.6T as a result of U.S. bank deregulation that could drive lending, M&A, and tech investment, Jefferies said in a recent note to clients.

- US companies earnings are growing at the fastest rate in four years with median growth YOY of the Russell 3000 index reaching 11% in Q3. That will fuel more investments. This chart shows the positive change of direction ...

The above also fits with my belief in seven year cycles - it shows a peak in 2021 and the rise from the bottom shows things are on track for another peak in 2028. Earlier peaks in my investing times were in 2000, 2007 and 2014.

Negatives/ Risks

- AI job losses. A new study released by the Massachusetts Institute of Technology reported that artificial intelligence can already replace 11.7% of the U.S. labor market, potentially impacting $1.2 trillion in wages across finance, healthcare, and professional services. That can have a nasty effect on the economy generally if those workers cannot be retrained to work in other sectors such as construction where there are worker shortages.

- An AI bubble burst danger. There are comparisons with the dotcom bust but today's capex numbers are only around 40% of operating cash flow compared to over 70% during dotcom mania times and most AI investment is by giant, very profitable companies not start-ups. Their problem will be getting a return on those huge investments. The biggest danger for investors is ...

- Herd market madness. Individual stocks have gained or lost more than $100bn in market value in a single day 119 times so far this year, the highest annual total on record. Oneexample was on November 20 when the Nasdaq swung from around 2% up to 2% down on a single day with no news except good news from Nvidia (NVDA) and the jobs report! PEs are near all time highs with a narrow focus on a few. Perhaps the most extreme is car maker Tesla (TSLA) with a PE 0f 285 compared with 8.9 for the world's laergest car maker, Toyota (TM). Since all car makers are getting into self drive cars and humanoid robots from multiple sources are arriving Tesla no longer has a differentiator to justify that extreme difference

- A crypto crash could be pending - bitcoin has sunk hugely since early October. I have warned in other articles that it has no intrinsic value and another big drop down to zero dollars would get bitcoin to fair value! The drop since early October might have been the cause for the overall markets drop so, one hopes. The next drop does not cause more. Banks are also getting entangled adding to the danger.

- The gold rush. Gold prices have surged as panic sought safety. More gold has been sold than exists un-mined via promissory notes and other means - paper gold!China's has been a big buyer and - according to an article in the FT - its unreported gold purchases could be more than 10 times its official figures "highlighting the increasingly opaque sources of demand behind bullion's record breaking rally."What happens when buyers discover their paper gold is just that - paper - is anyones guess but mine suggests that that opaqueness is a danger sign. Likewise when they find that the "weak" US dollar they fled from will again become one of the world's strongest currencies.

- Mixed signals make investment decisions harder.Americans have not been so concerned about unemployment since 2008 at the height of the great financial crises yet jobs growth is actually ok as I mentioned in Positives above.Consumer sentiment is low yet Kohl's and Abercrombie&Fitch just reported that consumers have been spending nicely sending their share prices up over 40% and 27% respectively.

- The Fed is a risk. Those huge investments could cause short term inflation because they are not paired with productivity gains that only come after completion. The Fed only looks backwards and could repeat past mistakes and raise interest rates making the poor poorer , housing affordability worse and investment financing more costly. Its adherence to an unscientific, plucked-from-the-air 2% target makes matters worse and has no base in history.

According to a report by Currency Research Associates (that I read in the FT) inflation bottomed out last April and is now in a cyclical upturn. The report, which analyses over 100 years of data, finds inflation has moved in four-and-a-half-year cycles on average since 1933. Cyclical inflation has “seldom dipped below 3 per cent but has frequently bottomed out near 3 per cent”, it says, and predicts inflation to rise and peak in 2027.Why does the Fed not learn from that?!

- American exceptionalism has ended for today's migrants. Engraved on the Statue of Liberty pictured above are the words "Give me your tired, your poor, Your huddled masses yearning to breathe free". They came and Made America Great. Today - like many other western countries - Trump is not being exceptional by driving such migrants away - many being Spanish speakers from South and Central America - believing it will Make America Great Again. It will not! Such people are needed as much today as then if America is to maximise the benefits from those massive investments. Even academics that teach today's and tomorrow's American leaders are being driven away to other countries by his attack on America's world leading universities. Spain has been chosen to be exceptional by doing the opposite and welcoming those Spanish speakers, helping Spain's GDP growth over the past two years to be strong and robust. Despite riven politics Spain's GDP growth rate was about 3.2% in 2024, one of the fastest-growing in the euro area. For 2025, growth is expected around 2.9%. That beats US 2024 growth rate of 2.8% and this year's around 2%. France, Germany and Italy are respectively forecast to expand 0.6%, 0% and 0.7% this year.

- America exceptionalism has also ended for today's middle classes. The hollowing out of the middle classes is another negative. Real income growth for workers aged between 25 and 54 has dropped to the lowest level since the 2008 financial crisis while today there is no such crisis. The top 10% of earners now account for nearly half of all spending up from around one third in the 1990s. That is not healthy for a normally consumption led economy. The US led the world with the expansion of the middle classes and they also helped make America great A better balance is needed now that much needed investment is well on the way back in the US.

- Exceptionalism does not apply to government debt either. Like most other western countries it has soared. In 1970 US federal government debt was around35% of GDP. Today it is 125%!And there is nothing to show for it ...

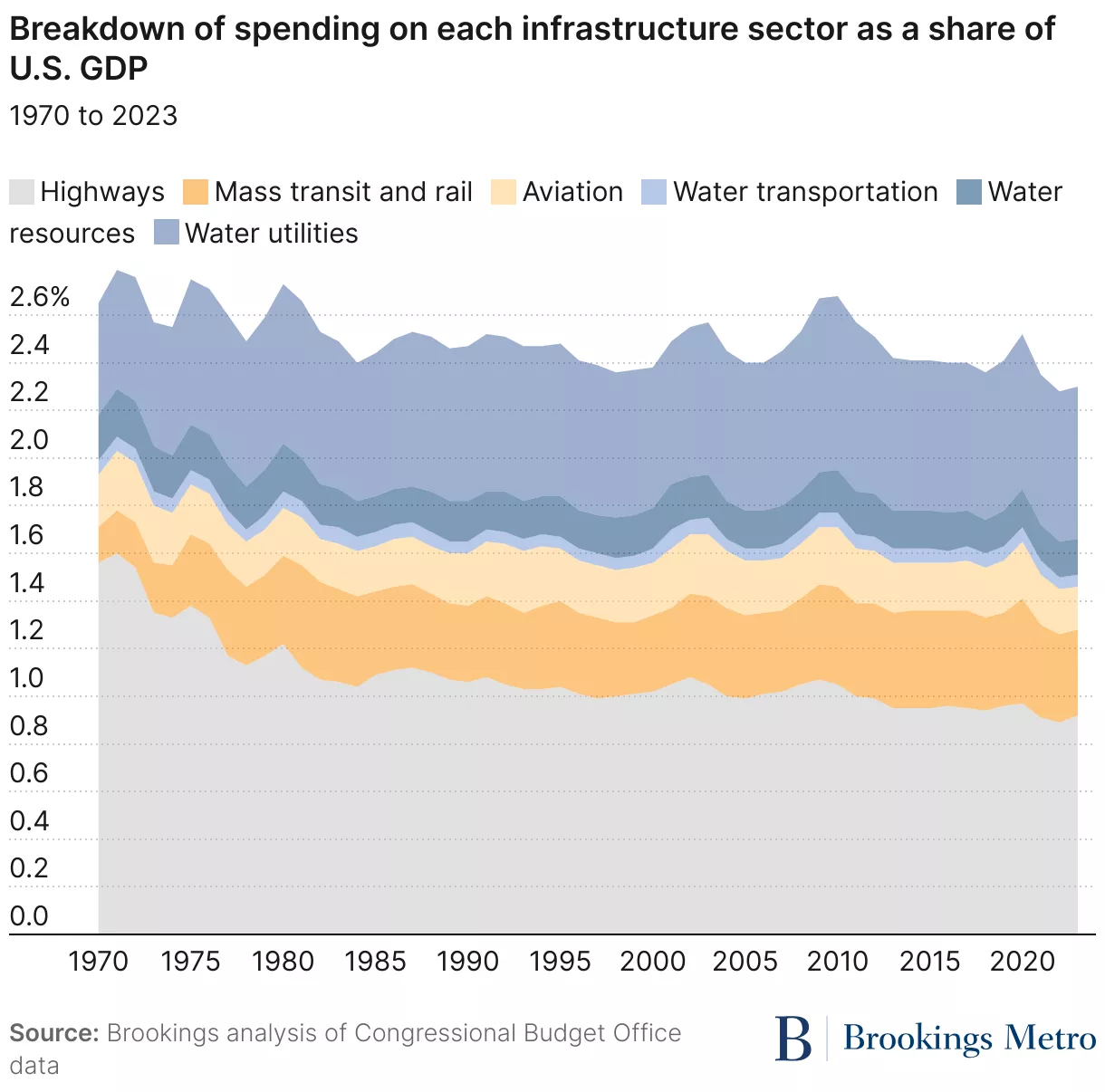

- Infrastructure spending has been in almost constant decline since 1970.

The population has since grown by 203 million or around 65% so need has constantly increased and especially that for electrical power otherwise economic growth will be stifled. Fixing the approval system would be a good start - I recently met with a senior person at one of America's largest transmission line installers who told me it has taken them up to 14 years to get approvals in some states to install well known, urgently needed new lines!

Few things work without electricity and my main investments are not in AI but in ...

Power supply

The U.S. power market is entering a structural super cycle of growing demand.

It does not matter if there is an AI bubble burst as the power supplies being built for it are desperately needed anyway to fix old, overloaded grids worldwide.The US is not exceptional in that and Forbes published on September 2, 2025: Is The U.S. Headed For A Power Grid Crisis?

The world is thus in the early innings of a massive energy infrastructure build out. I will write a comprehensive article on the subject another day but for today will name some of my 28 US picks that keep me away from any AI risks...

- Antero Resources (AR), EQT Corp (EQT) and Range Resources (RR) are very efficient gas producers and will supply that to the many gas turbines that are on order to generate more electricity. They are both underpriced at present so now could be a good time to buy especially as early winter prices are high and more LNG will be exported as new plants open in coming months

- Williams Companies (WMB) pipes the gas to users including to the massively growing fleet of gas turbines.

- GE Vernova (GEV) makes those turbines and, among other important things, has a jv with Hitachi on nuclear. I am up over 63% with GEV in the past year but still think it has room to go higher given the huge demand.

Quanta Services (PWR) connects the power to the people. The need for what they do is vast too.

Powell Industries (POWL) manufactures and services the equipment and systems that distributes, controls and monitors the flow of electrical energy to those people.

All are very sound financially and are among leaders in their fields.

In conclusion for today I am pleased to say the performance of my portfolio that contains mostly US companies backs my beliefs. The S&P 500 is up 13% YTD. My portfolio is up 25%

I also strongly believe that US exceptionalism will continue for a long time to come and add backing my article's title Invest In US Exceptionalism. The US has regained its traditional world economic driver position at a time China's real growth (as opposed to reported growth) has topped out.US strength also shows in the 68% share of world GDP that it has together with its bloc of allies compared to 26% for the China bloc that has Russia as the only important ally.

I hope you - the reader - find this article of use and if you have company names or other ideas you would like covered in my future articles - especially in the power supply chain - please mention those in comments below.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. More ...

more

Spain’s Ibex index, up by a little over 40% this year — the biggest jump in more than three decades — to a record high.

In Italy, stocks have climbed by more than 26%.

“We maintain the stance that Europe will surprise to the upside” next year,

“The conviction on our side is that the fiscal stimulus will be more effective than people assume.”

~ Luigi Speranza, chief economist at BNP Paribas.

https://giftarticle.ft.com/giftarticle/actions/redeem/0eaa1bb6-be98-4dd9-848b-8e3167ea9b99

Wall Street's S&P 500 index (SP500) on Black Friday turned positive for November, marking an impressive rebound for the benchmark gauge from lows of as much as nearly 5% a week ago. The reversal is the largest swing from red to green in the month of November ever.