Intrinsic Value Definition, Formula & Calculator: A Rational Investor’s Guide To True Worth

Key Takeaway

Understanding how to find the intrinsic value of a stock is the cornerstone of sound, long-term investing. By focusing on fundamentals and using proven valuation models, investors can cut through market noise and make rational, data-driven decisions. Using an intrinsic value calculator free online or a stock intrinsic value calculator can simplify this process and help you invest confidently.

Introduction: What Is Intrinsic Value and Why Should You Care?

“Price is what you pay; value is what you get.” This timeless wisdom, echoed by Warren Buffett and championed by value investors like Chuck Carnevale (Mr. Valuation), lies at the heart of successful investing. The market’s daily price swings are often driven by emotion, speculation, and short-term news. But the intrinsic value of a business, its true worth based on fundamentals, remains anchored in reality.

In this article, we’ll demystify the concept of intrinsic value, walk through the most reliable models for calculating it, and show you how to use an intrinsic value calculator. Whether you’re a beginner or a seasoned investor, mastering these tools will help you find intrinsic value of a stock and invest with confidence.

Models for Calculating Intrinsic Value

There’s no single “right” answer when determining what a business is truly worth. Investors rely on a toolkit of models, each with its own strengths. Let’s break down the most widely used approaches, just as Mr. Valuation would, with clarity, discipline, and a focus on fundamentals.

Discounted Cash Flow (DCF) Models

The Gold Standard for Intrinsic Value

The Discounted Cash Flow (DCF) model is the bedrock of modern valuation. It asks a simple but profound question: How much are all the future cash flows of this business worth in today’s dollars? By projecting a company’s free cash flows and discounting them back to the present using a rate that reflects risk, you arrive at an estimate of intrinsic value.

DCF Formula (Intrinsic Value Formula):

Intrinsic Value = CF₁/(1+r)¹ + CF₂/(1+r)² + … + CFₙ/(1+r)ⁿ

Where:

CFₜ = Cash flow in year t

r = Discount rate (often the company’s weighted average cost of capital)

n = Number of forecast years

Forecast Johnson & Johnson’s free cash flow for the next 5-10 years.

- Free Cash Flow Projections (2026–2030)

Year Projected FCF per share:

2026 9.57

2027 10.36

2028 11.21

2029 12.14

2030 13.14

Estimate a terminal value for cash flows beyond the forecast period.

Discount all cash flows and the terminal value back to present value.

Sum the present values to find the intrinsic value per share.

Step-by-Step Example: Johnson & Johnson

Summary Table

Component Value ($B) % of Total Value

PV of 2026–2030 FCFs 45.77 14.2%

PV of Terminal Value 277.04 85.8%

Total Enterprise Value 322.82 100%

Shares Outstanding 2.407

Intrinsic Value/Share $134.13

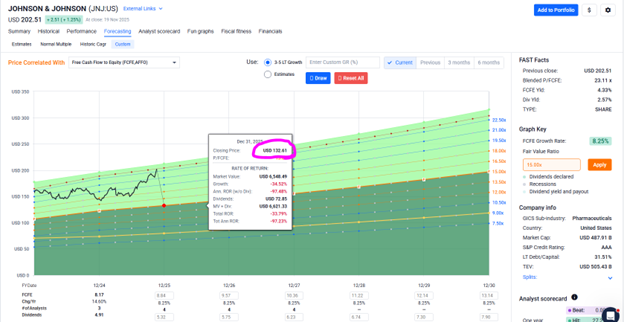

FAST Graphs utilizing a modified version of DCF calculations

Note that using the academic version versus the FAST Graphs simply point-and-click option provides very similar results. FAST Graphs’ intrinsic value number is $132.61 versus $134.13, virtually the same. Remember, the intrinsic value calculation is precise but not perfect.

(Click on image to enlarge)

Why Use DCF?

- Best for companies with predictable cash flows (e.g., Johnson & Johnson, Coca-Cola).

- Allows for scenario analysis and sensitivity testing.

- Many investors use a stock intrinsic value calculator or intrinsic value of stock websites to automate these calculations and reduce errors.

Pro Tip:

Always use conservative assumptions for growth and discount rates to build in a margin of safety.

FAST Graphs modified dividend cash flow calculations

The fundamentals analyzer software tool FAST Graphs incorporates and utilizes a modified version of the academic discounted cash flow calculation. The primary adjustment is that FAST Graphs discounts adjusted operating earnings in lieu of cash flow. Additionally, FAST Graphs utilizes a discount rate based on Ben Graham’s recommendation to never pay a P/E ratio over 15 for most companies.

Dividend Discount Models (DDM)

Tailor-made for companies with stable, predictable dividends. It values a stock as the present value of all expected future dividends.

- General DDM Formula:

- Intrinsic Value = D₁/(1+r)¹ + D₂/(1+r)² + … + Dₙ/(1+r)ⁿ

- Where:

- Dₜ = Dividend in year t

- r = Required rate of return

Types of DDM:

- Zero-Growth DDM: Dividends stay constant.

- Gordon Growth Model: Dividends grow at a constant rate.

- Multi-Stage DDM: Varying growth rates over time.

Why Use DDM?

- Ideal for mature, dividend-paying companies (e.g., Coca-Cola, Procter & Gamble).

- Works well with a stock intrinsic value calculator or intrinsic value of stock website.

Gordon Growth Model (GGM)

A Special Case of DDM for Consistent Dividend Growers

The Gordon Growth Model (GGM) is a streamlined version of the DDM, assuming dividends grow at a constant rate forever.

GGM Formula:

Intrinsic Value = D₁ / (r – g)

Where:

D₁ = Next year’s expected dividend

r = Required rate of return

g = Dividend growth rate

Why Use GGM?

- Best for companies with a long record of steady dividend growth.

- Quick and effective for blue-chip stocks.

Residual Income Models

For companies with irregular dividends or asset-heavy businesses.

Intrinsic Value = Book Value + Σ [Residual Incomeₜ / (1 + r)ᵗ]

Where:

Residual Incomeₜ = Net Incomeₜ – (r × Book Valueₜ₋₁)

r = Cost of equity

Step-by-Step Example:

Calculate current book value per share.

Forecast net income and book value for each period.

Compute residual income for each year.

Discount residual incomes to present value and add to book value.

Why Use Residual Income Models?

Useful for banks, insurance companies, and firms with unpredictable dividends.

Focuses on value creation above the cost of capital.

Key Finding:

No single model is perfect. The best investors use multiple approaches, compare results, and always anchor their analysis in the business’s fundamentals.

Why Use Residual Income Models?

- Useful for banks, insurance companies, and firms with unpredictable dividends.

- Focuses on value creation above the cost of capital.

Why Intrinsic Value Matters (Including Margin of Safety)

Intrinsic value is the North Star for rational investors. By focusing on what a business is truly worth, rather than what the market is willing to pay, you gain a powerful edge. This is where margin of safety comes into play—a principle championed by Ben Graham, Warren Buffett, and Chuck Carnevale.

Margin of Safety Defined:

It’s the buffer between a stock’s intrinsic value and its market price. For example, if a stock’s intrinsic value is $60, but it’s trading at $40, you have a $20 margin of safety.

Why It Matters:

- Reduces risk of permanent capital loss.

- Allows for mistakes in estimation.

- Encourages disciplined, unemotional investing.

Common Measures of Intrinsic Value

While DCF and DDM are the gold standards, investors often use a variety of relative valuation metrics to cross-check their analysis. Here are the most common:

|

Measure |

What It Tells You |

Best Use Case |

|---|---|---|

|

Discounted Cash Flow (DCF) |

Present value of all future free cash flows |

Predictable cash flow businesses |

|

Price-to-Earnings (P/E) |

Price relative to earnings per share |

Quick comparison within same industry |

|

Price-to-Book (P/B) |

Price relative to book value per share |

Asset-heavy or financial companies |

|

Dividend Discount Model (DDM) |

Present value of all future dividends |

Mature, dividend-paying companies |

|

Enterprise Value/EBITDA |

Total value relative to operating cash flow |

M&A, companies with different capital structures |

|

Residual Income Model |

Value created above cost of equity |

Banks, insurance, irregular dividend payers |

|

Comparable Company Analysis |

Value based on similar companies’ multiples |

Market-based cross-check |

How to Use These Measures:

- Start with a DCF or DDM to estimate intrinsic value.

- Use P/E, P/B, and EV/EBITDA to compare with peers.

- Check your results with a stock intrinsic value calculator or intrinsic value of stock website for additional perspective.

Conclusion

Sound investing is about understanding value, not chasing price. By mastering the intrinsic value formula and using an intrinsic value calculator free online, you empower yourself to make rational, disciplined decisions. Remember: the market is a voting machine in the short run, but a weighing machine in the long run. Focus on the business behind the stock, and let intrinsic value be your guide. FAST Graphs simplifies this by providing a clear comparison between intrinsic value and market price.

More By This Author:

A High-Yield Dividend Growth Portfolio Objective FIRE (Financial Independence Retire Early) - Part II

Screening For Dividend Growth: Objective FIRE (Financial Independence Retire Early) - Part I

Common Size Analysis Of Financial Statements

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more