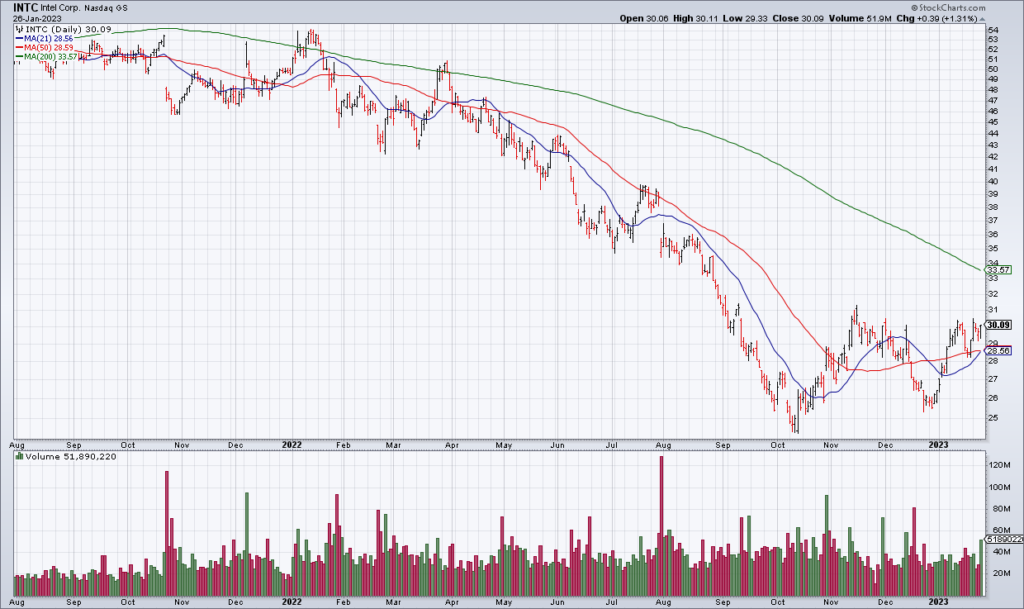

INTC: Look Out Below!

(Click on image to enlarge)

Intel (INTC) just reported a brutal 4Q22. Revenue was -28%, Gross Margin decreased by 1200 basis points and EPS was off 92% to 10 cents. And things are going to get worse. INTC guided 1Q23 revenue to $10.5-$11.5 billion – down 40% at the midpoint year over year. Gross Margin of 39% would be off 1410 basis points. And they are expecting a 15-cent EPS loss.

As a result, shares are currently -10% in the after-hours. Clearly, I was too early when I recommended INTC earlier this month. Thankfully I sold the small position I bought for clients and myself last week.

More By This Author:

KMB’s War For ‘Poop Superiority’, NOC Earnings

COF Confirms Consumer Credit Stress

Stocks Run Up Into Earnings Season As The Fed Considers Pausing