INTC Presents A Good Entry For Those Seeking Value And Current Income

(Click on image to enlarge)

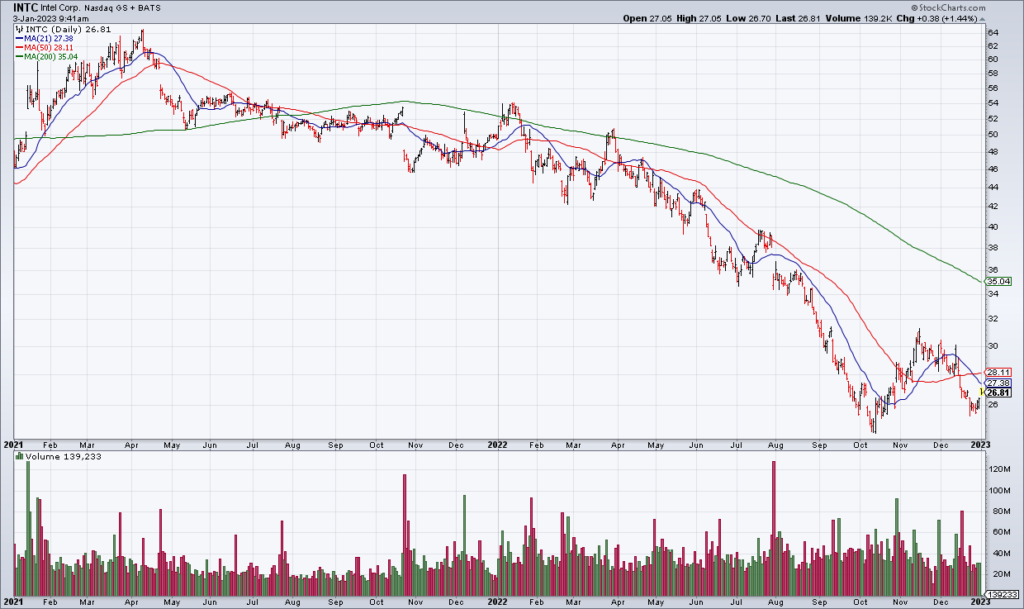

Very few people talk about Intel (INTC) these days but it’s still a great company and after a brutal beatdown the last two years the $110 billion chip maker presents a nice entry – especially for those seeking current income.

INTC is down ~60% since touching $64 in early April 2021 to a current $26.75. And the semiconductor market is under pressure. INTC is guiding 4Q22 revenue to $14-$15 billion – down 30% at the midpoint.

But INTC isn’t going anywhere. While they’re guiding 2022 EPS to $1.95 for a 14x multiple on current earnings, 2021 EPS was $5.47. In other words, 14x is probably based on trough earnings, or perhaps 2023 will represent the trough. But earnings will come back. There is value here.

Intel's $INTC dividend yield is up to 5.6% (about 170 bps above the 10-year yield) as we end 2022. https://t.co/H4p1RcpNxV pic.twitter.com/n9ac6usgS1

— Bespoke (@bespokeinvest) December 30, 2022

In addition, INTC pays a 36.5 cent quarterly dividend that works out to 5.46% annually. That’s juicy.

Conservative investors seeking value and current income might want to dip their toe in.

More By This Author:

Market Preview Week Of Jan 3-6CALM: Eggs Are Good For Your Portfolio Too

The Market Is Incorrectly Priced For A Soft Landing