Insider Trading: 3 Stocks CEOs Are Buying

Image Source: Pixabay

Investors closely monitor insider buys. But who are ‘insiders’?

An insider is an officer, director, 10% stockholder, or anyone who possesses internal information because of their relationship with the company. It’s critical to note that insiders have a longer holding period than most, and many strict rules apply.

Several companies – Intel (INTC - Free Report), Yum China (YUM - Free Report), and Energy Transfer (ET - Free Report) – have all seen recent insider activity, with the CEO of each recently scooping up shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

Video Length: 00:01:02

Intel Shares Disappoint

Intel shares have largely been disappointing in 2024, unable to fully join the semiconductor trade and down nearly 60%. The stock remains a Zacks Rank #4 (Sell), with earnings expectations shifting bearishly across the board following its latest set of quarterly results.

Image Source: Zacks Investment Research

Still, CEO Pat Gelsinger made a splash following the release of the above-mentioned quarterly results, buying 12.5k shares at a total transaction value of roughly $250k.

After the disappointing period, he remains positive, stating, ‘Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies while accelerating our IDM 2.0 transformation,’

He continued, ‘These actions, combined with the launch of Intel 18A next year to regain process technology leadership, will strengthen our position in the market, improve our profitability and create shareholder value.’

Nonetheless, investors should stay on the sideline until positive earnings estimate revisions roll in, which would signal a meaningful change in sentiment.

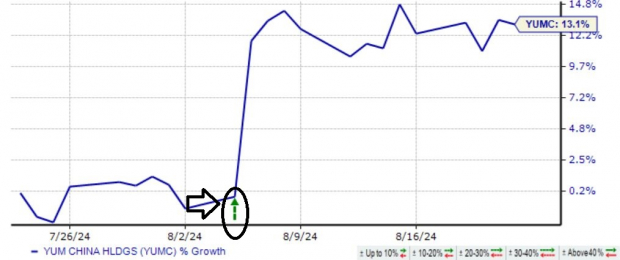

Yum China Shares Soar

Yum China became an independent and publicly traded company after its spin-off from Yum! Brands back in late 2016. Joey Wat, CEO, recently purchased 3.8k shares at a total transaction value of $130k, now holding roughly 270k shares overall.

Shares have been hot over the last month, gaining 13% on the back of its latest quarterly release. Adjusted EPS shot 18% higher, whereas sales also saw a 1% climb.

Image Source: Zacks Investment Research

The latest quarterly release was overall filled with positivity, with the company enjoying record Q2 sales, operating profit, and EPS. The stock remains a Zacks Rank #3 (Hold).

Energy Transfer CEO Dives in

Energy Transfer owns and operates diversified portfolios of energy assets primarily in the United States. Co-CEO Thomas Long recently purchased 20k shares at a total transaction value of $313k.

Shares have been strong in 2024, gaining 23% and regularly seeing post-earnings positivity.

The stock is currently a Zacks Rank #3 (Hold), but the downward earnings estimate revisions do warrant caution among investors. Favorable revisions hitting the tape would make the stock’s outlook much more bullish.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, as they can provide insight into the longer-term picture. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?

All stocks above – Intel, Yum China, and Energy Transfer – have seen recent insider activity, with the CEO of each recently swooping in.

More By This Author:

3 Companies Unlocking Higher Profits: KMB, DECK, WMT

3 Companies Reporting Remarkable Results: Walmart, Eli Lilly, Cardinal Health

Home Depot Earnings: Good Or Bad?