3 Companies Reporting Remarkable Results: Walmart, Eli Lilly, Cardinal Health

Image: Bigstock

The 2024 Q2 earnings season is slowly grinding to a halt, with the vast majority of S&P 500 companies already delivering quarterly results. Peeking a bit ahead, earnings for the current period (2024 Q3) are expected to be up 4.3% on 4.6% higher revenues, chaining together consecutive periods of positivity.

Below is a chart illustrating earnings expectations for the coming and recent periods.

Image Source: Zacks Investment Research

Several companies have stolen the spotlight throughout the period, including Walmart (WMT - Free Report), Cardinal Health (CAH - Free Report), and Eli Lilly (LLY - Free Report). All three posted robust results and upped guidance, as shares of each experienced bullish activity post earnings.

Let’s take a closer look at each.

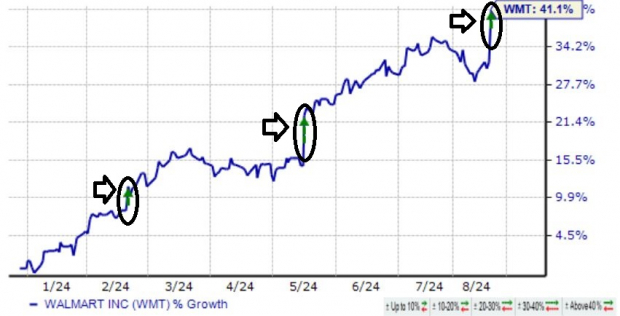

Walmart Shares Keep Climbing

Concerning headline figures, retail titan Walmart posted 22% EPS growth on nearly 5% higher sales, with both items exceeding consensus expectations. The company has consistently seen its shares benefit from quarterly prints throughout the year, as shown below.

Image Source: Zacks Investment Research

The company was firing on all cylinders throughout the period, seeing its gross margin improve by 43 basis points and highlighting a notable improvement in its operating income. Importantly, e-commerce penetration also continues to provide tailwinds, which was higher across all segments throughout the period.

Image Source: Walmart Investor Relations

Walmart’s digital efforts have been a great source of growth for the company, consistently posting robust results over recent periods. Global e-commerce sales melted 21% higher, with customers increasingly opting for fulfilled pickup and delivery.

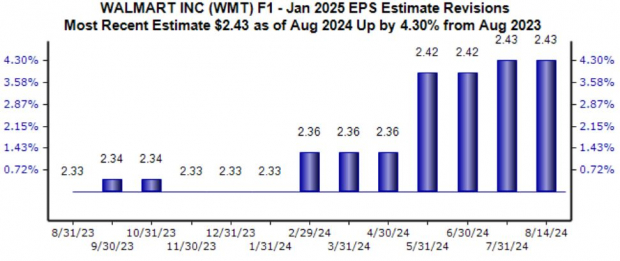

Walmart increased its FY25 net sales and adjusted operating income guidance following the print, explaining the positive reaction post-earnings. The earnings outlook for its current fiscal year was already bullish heading into the release, with expectations likely to continue moving higher following the updated outlook.

Image Source: Zacks Investment Research

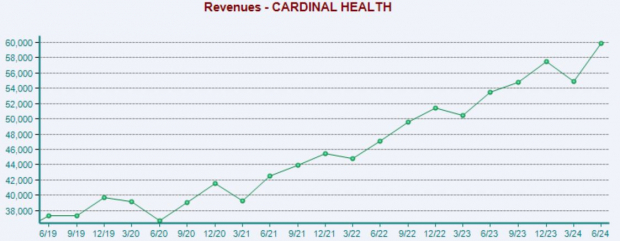

Cardinal Health Generates Record Cash Flows

Cardinal Health continued its earnings positivity, posting a 7% beat relative to the Zacks Consensus EPS estimate and reporting sales 2% ahead of expectations. Earnings shot 29% higher, whereas sales were up 12% from the same period last year.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Notably, the company’s cash-generating abilities saw a big boost, with Cardinal Health posting record operating and free cash flow of $3.8 and $3.9 billion, respectively.

Jason Hollar, CEO, said, ‘We delivered robust cash flow generation, continued profit growth in the Pharmaceutical and Specialty Solutions segment and significant improvement driven by our GMPD Improvement Plan. We enter the new fiscal year with momentum and confidence, evidenced by our raised fiscal year 2025 guidance.’

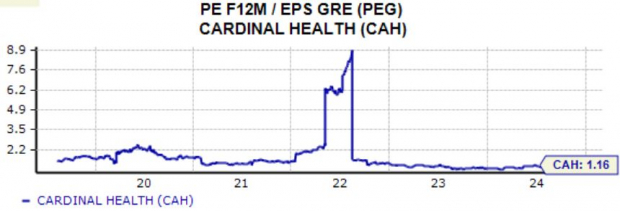

The valuation picture isn’t rich for the stock, with the recent 13.9X forward 12-month earnings multiple primarily in line with historical averages over the past few years. In addition, the recent PEG ratio works out to 1.1X, reflecting that investors are paying a fair price for the forecasted growth.

Image Source: Zacks Investment Research

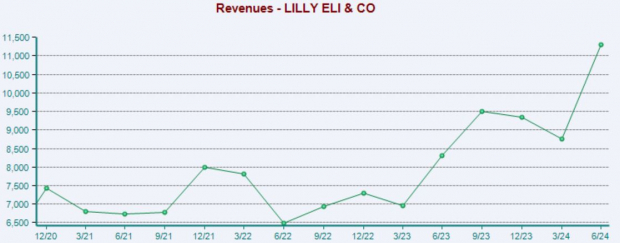

Mounjaro Demand Soars for Eli Lilly

Eli Lilly shares have been red-hot in 2024 thanks to robust results stemming from unrelenting demand, up nearly 60% and widely outperforming relative to the S&P 500. Shares popped following its latest release, with earnings and sales climbing 85% and 35%, respectively.

Following the print, the company upgraded its current year sales guidance by a sizable $3 billion.

Image Source: Zacks Investment Research

The story behind Eli Lilly has been driven by its diabetes drug Mounjaro and its weight loss injection Zepbound, which have seen unrelenting demand among consumers. Mounjaro sales jumped 216% year-over-year, whereas Zepbound sales of $1.2 billion also reflected strong demand.

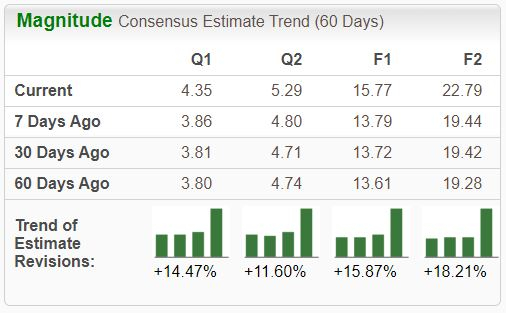

Earnings expectations have shot higher across the board following the release, with Eli Lilly sporting a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

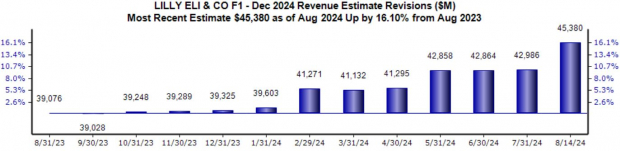

Sales expectations for its current fiscal year have also been adjusted accordingly among analysts, with the now $45 billion expected suggesting 35% year-over-year growth.

Image Source: Zacks Investment Research

Bottom Line

The 2024 Q2 earnings season is slowly winding down, with a small chunk of S&P 500 companies remaining to report.

So far, we’ve been greeted by positivity from several companies, including Walmart (WMT - Free Report), Cardinal Health (CAH - Free Report), and Eli Lilly (LLY - Free Report). All three posted robust results and upped their outlooks, which are bullish signals.

More By This Author:

Home Depot Earnings: Good Or Bad?3 Buy Rated Finance Stocks Flashing Relative Strength: HRTG, ERIE, EZPW

2 Companies Actually Benefiting From AI: Palantir, Meta Platforms