3 Companies Unlocking Higher Profits: KMB, DECK, WMT

Image Source: Pexels

The 2024 Q2 earnings season is slowly winding down, with a vast majority of companies already delivering their quarterly releases.

And throughout the period, several companies unlocked higher profitability amid margin expansion, including Deckers Outdoor (DECK - Free Report), Kimberly Clark (KMB - Free Report), and Walmart (WMT - Free Report). Let’s take a closer look at each quarterly release.

Deckers Outdoor Enjoys Brand Momentum

Deckers Outdoor posted a strong quarter yet again, exceeding both earnings and revenue expectations handily and continuing its streak of earnings positivity. EPS grew a staggering 90% year-over-year, whereas sales shot 22% higher from the year-ago period.

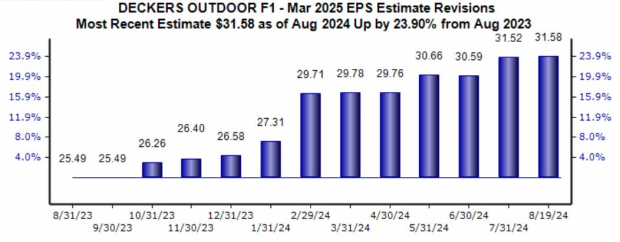

Continued brand momentum among UGG and Hoka shoes aided the robust results, leading the company to up its current fiscal year outlook. Analysts have updated their outlook for the company’s current fiscal year accordingly following the print, with the $31.58 Zacks Consensus EPS estimate suggesting 8% growth year-over-year.

Image Source: Zacks Investment Research

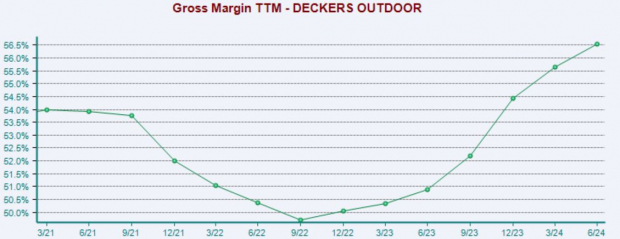

The company has been enjoying margin expansion, aiding its profitability picture nicely. And it enjoyed the same throughout its latest release, with its gross margin expanding to 56.9% vs 51.3% in the year-ago period.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Kimberly-Clark Flexes Defensive Nature

KMB shares have delivered a strong performance year-to-date, gaining more than 15%. The company carries a defensive nature thanks to its placement in the consumer staples sector, as these companies’ products have an advantageous ability to generate consistent demand in the face of many economic situations.

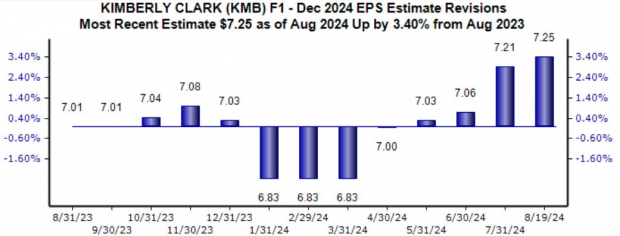

The stock sports a Zacks Rank #2 (Buy), with earnings expectations for its current fiscal year drifting higher following a guidance upgrade.

Image Source: Zacks Investment Research

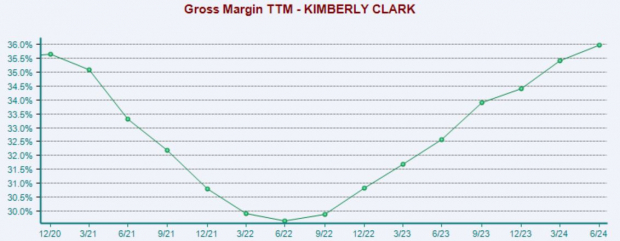

Cost management practices have aided the company’s profitability in a big way, with adjusted EPS of $1.96 throughout its latest quarter seeing a 20% climb year-over-year. Margin expansion has also kept investors happy, as we can see illustrated below.

Please keep in mind that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Walmart Enjoys Higher Profits

Concerning headline figures, retail titan Walmart posted 22% EPS growth on nearly 5% higher sales, with both items exceeding consensus expectations.

The retail giant was firing on all cylinders throughout the period, seeing its gross margin improve by 43 basis points and enjoying a boost to its operating income. Importantly, eCommerce penetration also continues to provide tailwinds, which was higher across all segments throughout the period.

Below is a chart illustrating the company’s gross margin on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Walmart’s digital efforts have been a great source of growth for the company, consistently posting robust results over recent periods. Global eCommerce sales melted 21% higher, with customers increasingly opting for fulfilled pickup and delivery.

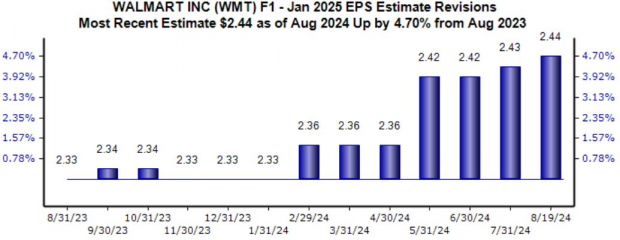

Walmart increased its FY25 net sales and adjusted operating income guidance following the print, explaining the positive reaction post-earnings. Analysts have adjusted their earnings outlook accordingly, with the $2.44 Zacks Consensus EPS estimate suggesting a 10% climb year-over-year.

Image Source: Zacks Investment Research

Bottom Line

All three companies above – Deckers Outdoor, Kimberly Clark, and Walmart – posted strong quarterly releases, with each enjoying margin expansion throughout their respective periods.

More By This Author:

3 Companies Reporting Remarkable Results: Walmart, Eli Lilly, Cardinal HealthHome Depot Earnings: Good Or Bad?

3 Buy Rated Finance Stocks Flashing Relative Strength: HRTG, ERIE, EZPW