How The Market Behaved During Past Government Shutdowns

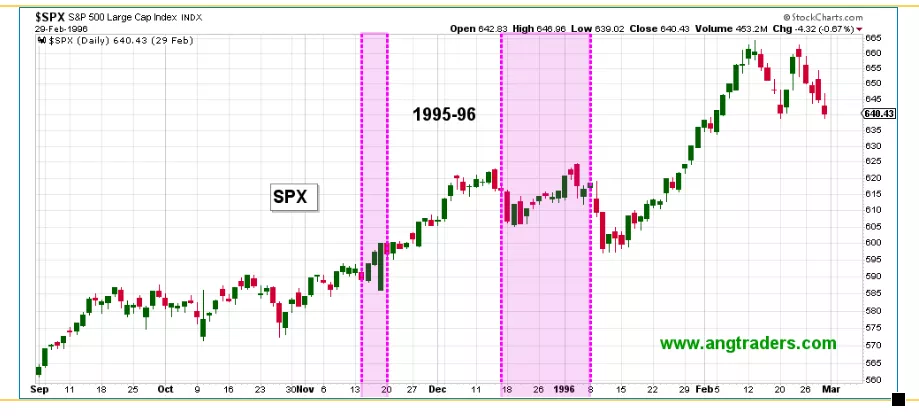

The charts below highlight the SPX during the Government shutdowns back to the 1990s.

As the above charts show, the SPX has tended to drop in anticipation of the shutdown, but then recovered during the actual shutdown. That pattern aligns with our fund-flow analysis and proprietary models which are predicting SPX weakness in the short term. Investors can buy the closure pullback.

More By This Author:

Fear, Greed, And Money Reign Supreme — Even Among The Machines

SPX Weakness Likely For The Next Week

Most Economic Indicators ('Screws') Remain Tight

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!