Most Economic Indicators ('Screws') Remain Tight

Image Source: Pexels

In our December 2025 article (here) that last time we checked on the economic screws, we stated…

"If tariffs (which are taxes on the US consumer) are actually imposed on our trading partners, and if the (at this point, fictitious) DOGE actually recommends $2T of spending-cuts, then recession becomes a very real possibility. However, currently most of the screws are tight, and no recession is predicted for the next 6-months."

Six-months later, the tariffs have been announced but delayed multiple times and DOGE has been released into the wilds of the Federal Government but no spending-cuts are evident at this point (in fact, the cost of DOGE seem to be greater than the saves)... and there is no recession in site. We now report on the current state of the economic screws that hold the economy together.

The Screws Holding the Economy Together

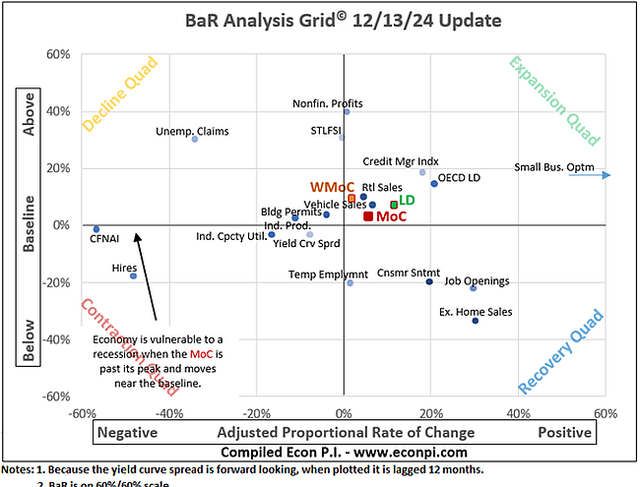

The first chart below is the BaR grid (from econ p.i.) dated Dec. 13, 2024, and the second chart is the most recent chart dated June 27, 2025.

Notice that the MoC (mean of coordinates), the WMoC (weighted mean of coordinates), and the LD (leading indicators) remain in the expansion quadrant and approximately in the same position. This means that the average of economic measures continue to show economic growth. This screw is tight enough.

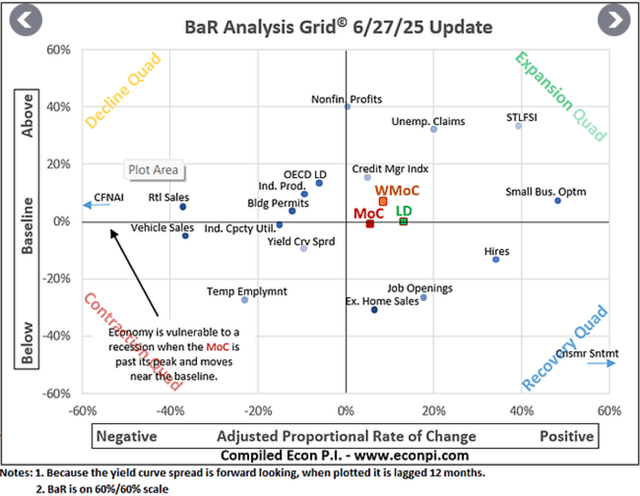

The GDPNow estimate of Q2 2025 is averaging 2.5% (compared to 3.3% last December). This screw is looser, but still tight (chart below).

Atlanta Fed

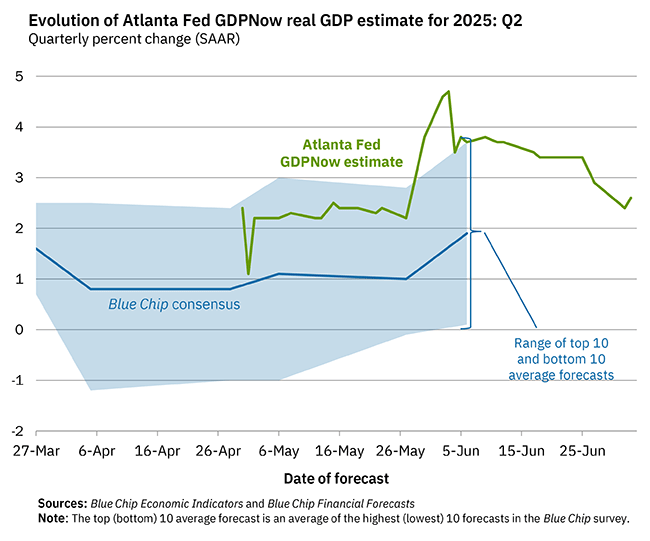

Industrial Production of the United States has increased over the last 6-months. This screw is tight (chart below).

Trading Economics

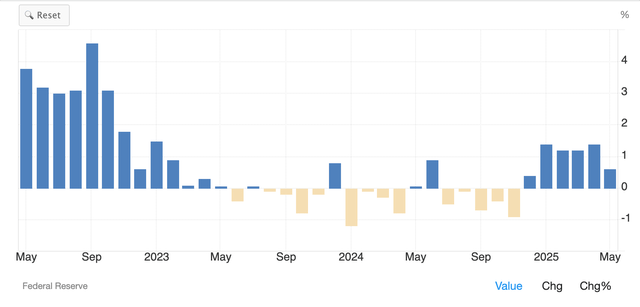

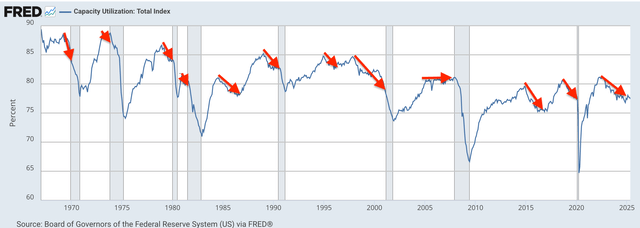

Capacity utilization either stalls or drops ahead of recessions. However, it is a necessary condition, but not sufficient for a recession; no recessions resulted following the drop in capacity utilization in 1985, 1995, 1997, and 2015. Capacity utilization has been decreasing, making this screw looser than we would like to see.

FRED

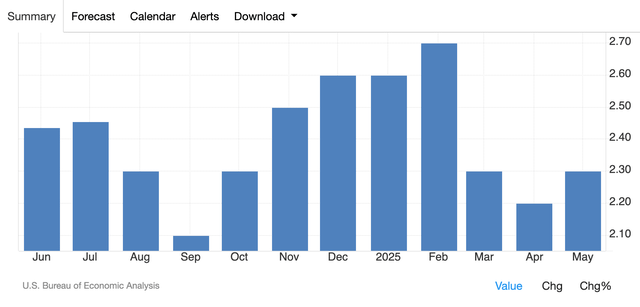

PCE (personal consumption expense), which is the Fed's preferred gauge of inflation, has been trending lower for the last 3-months. This screw is tight (chart below).

Trading Economics

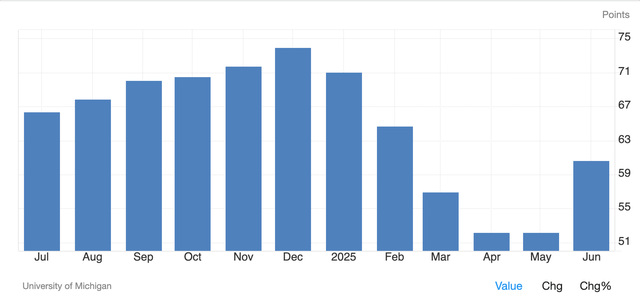

The University of Michigan consumer sentiment for the US has been trending lower since last December This screw is loose.

Trading Economics

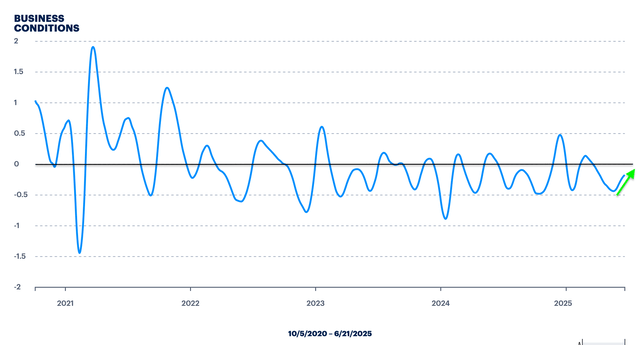

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. The average value of the ADS index is zero. Bigger positive values indicate progressively better-than-average conditions, and bigger negative values indicate progressively worse than average conditions. The index shows that business conditions are still slightly worse than average, but have improved recently (green arrow) which makes it a tightening economic screw (chart below).

philadelphiafed.org

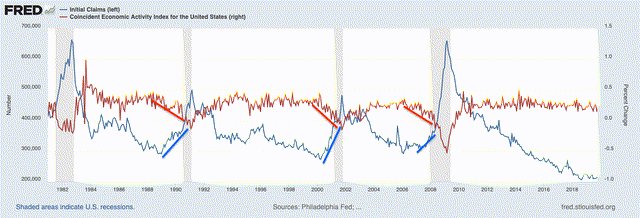

Initial jobless claims [blue] rise for a year ahead of recessions, while business activity [red] falls (chart below).

FRED

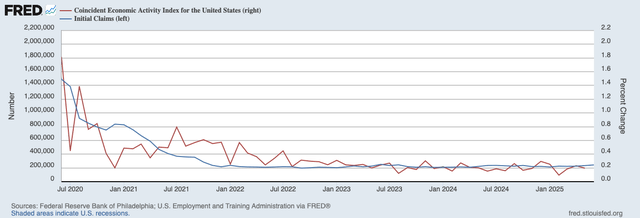

Since 2022, initial claims and business activity have been stable. These are both tight economic screws (chart below).

FRED

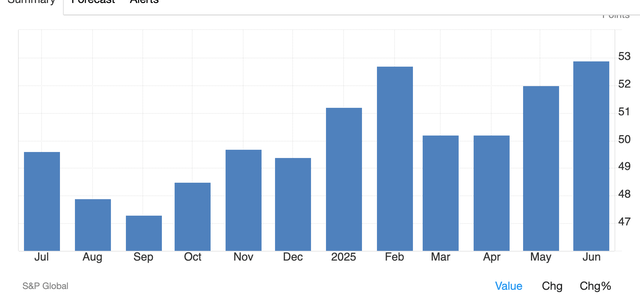

Manufacturing PMI for the US has been growing (above 50) for six-months. This screw is tight (chart below).

Tradingeconomics

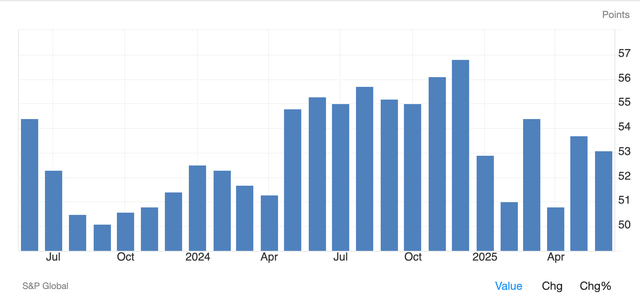

Services PMI is showing weak growth in the services sector since December 2024. This screw is still tight enough, but getting looser (chart below).

Treadingeconomics

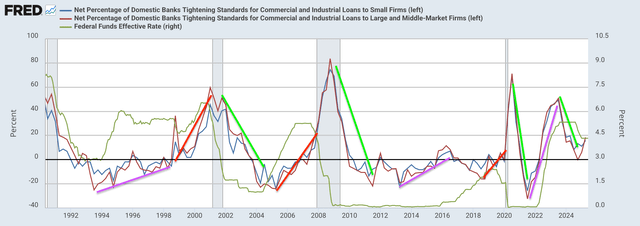

Banks tightening lending-standards always precedes recessions (red-lines below), but tightening lending-standards does not always lead to recessions (purple-lines below); e.g., 1994-1999 and 2014-2016, and 2021-2022. Lending-standards continue to be relaxed (green-line below). This screw is tight.

FRED

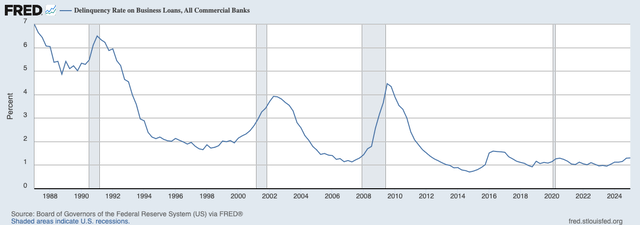

Recessions occur when delinquency-rates are rising. Currently, delinquency-rates are at historically low levels. This screw is tight.

FRED

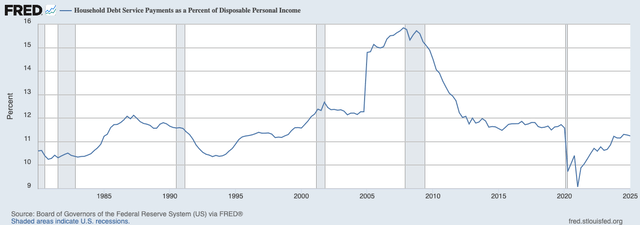

Household debt service as a percent of disposable income is above historic lows, but below the pre-pandemic average. This screw is tight.

FRED

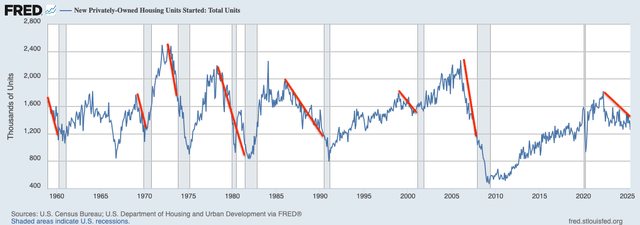

Recessions are always preceded by at least two-years of falling housing starts. Housing starts had been falling since 2022. This screw is loose.

FRED

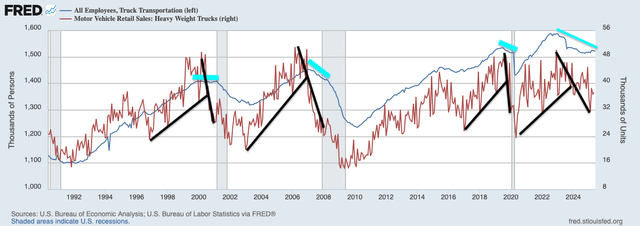

Truck transport employment (blue-line below) stops growing or declines, and heavy truck sales (red-line) collapse for more than a year ahead of recessions. Truck transport employment has come down from all-time highs (blue-line) and truck sales have dropped below the up-trend line (black). This is a loose economic screw.

FRED

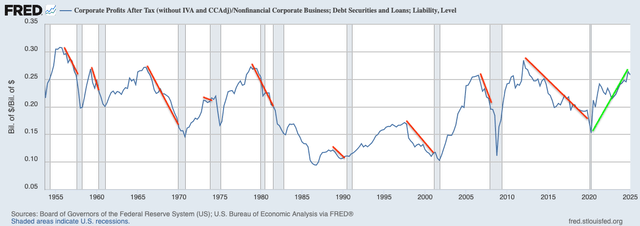

Corporate profits tend to decline (red), sometimes for years, ahead of recessions. Profits continue to rise from the pandemic lows. This is a tight screw.

FRED

The Most Important Screw of All

Money drives both the economy and the stock market, but most people simply do not understand what money is or where it comes from.

Money can be anything that we agree is capable of releasing real-resources, like labor and materials. It is not a physical entity, and today's money is not fixed to anything physical; Richard Nixon took the US dollar off the gold-standard in 1971. The US dollar is created by Congressional spending-laws, and is destroyed by taxation (by-the-way, taxation is what forces everyone in the US to use the US dollar as currency). Taxpayers need to earn US dollars before they can pay their taxes. Taxpayers cannot create US dollars--that would be counterfeiting. All US dollars are created by Government spending. The Federal Government is "self-funding."

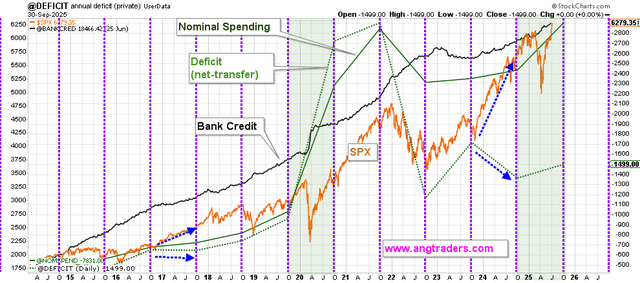

Net spending is the difference between nominal-spending and taxation. If the Government spends (creates) more US dollars than it taxes back, then we say it has a deficit; it has deposited more money in private bank accounts than it has taxed back.

Government deficit = private surplus

Government deficits correlate positively with the SPX (chart below). This makes sense, since bigger economies (and higher stock markets) require more money in the system.

So far, the fiscal-2025 annualized run-rate of the nominal-spending is higher than during the COVID stimulus and the deficit is currently higher than two of the last three years. This could improve further now that the spending bill has passed with a potential $5T increase to the money supply. This is supporting the stock market in a spectacular way. The "deficit-spending" screw is tight.

ANG Traders, Stockcharts

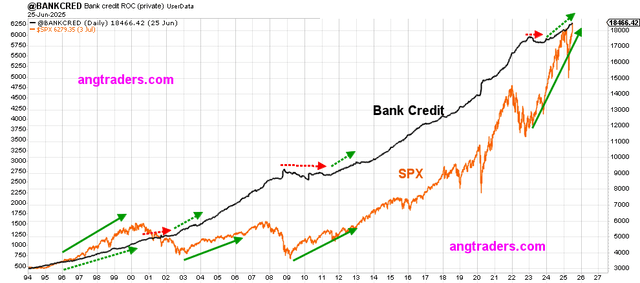

The other source of money-creation is bank credit. Chartered banks create deposits when they make loans (they do not lend out deposits).

Although loan-funds are only a form of temporary money--they must be paid back and cancelled, unlike money created by government spending which does not have to all be taxed back and cancelled--loan funds have a similar impact as deficit-spending on the economy, at least in the near term. Bank credit-creation has moved to new highs after the year-long pullback of 2023. The "bank credit" screw is tight.

ANG Traders, Stockcharts

In the December "check on the screws," we wrote:

It remains to be seen how the next administration manages the economy. If tariffs (which are taxes on the US consumer) are actually imposed on our trading partners, and if the (at this point, fictitious) DOGE actually recommends $2T of spending-cuts, then recession becomes a very real possibility. However, currently most of the screws are tight, and no recession is predicted for the next 6-months.

So far, tariffs have been repeatedly delayed--only $20B/month have been collected--and DOGE have not resulted in any spending-cuts. Net money-creation continues at a higher rate than last year, and although the BBB spending bill removes resources from the poor and gives them to the rich, the increased deficit-spending ($5T over 10-years) should support the stock market and keep the primary bull trend in place over the next year.

In conclusion, most of the economic screws are tight, and as long as net-money-creation continues at a higher rate than last year, then no recession is predicted in the next 12-months.

Investors can stay long the stock market through technology ETF such as SOXX, AIQ and XT, as well as broad spectrum ETFs such as SPY and QQQ.

More By This Author:

A Summary Of The "Seven Innocent Frauds Of Economic Policy"

Tesla Has No Clothes

DeepSeek Is Not About To 'Deep-Six' The West's AI Technology.