How Did Momentum Investing Perform After The Previous Two Valuation Peaks?

Near the end of 2021, I wrote an article noting that value portfolios looked historically cheap based on valuation spreads. I found that in the next five years (after the peak), Value investing performed quite well.(1)

Following that post, I have received numerous questions related to the following question:

How did Momentum investing perform after the previous two valuation peaks?

This article answers this question.

Key finding: Momentum investing also performed well following episodes when value stocks were cheap. Of course, momentum portfolios did not perform nearly as well as value portfolios, but they did still beat the generic market.

We dig into the details below.

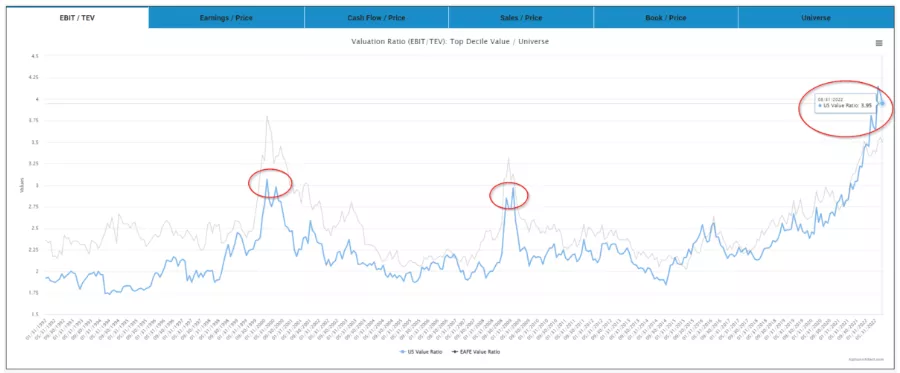

Current Valuation Spreads

Our website has a tool, the Visual Value Factors module, that allows individuals to see how cheap/expensive Value portfolios are on various measures.

What does our tool say about current valuations?

We use EBIT/TEV (our preferred valuation measure) to see how cheap/expensive a Value portfolio formed on EBIT/TEV is compared to the market.

U.S. Market:

Source: https://alphaarchitect.com/visualfactors/

International Developed Markets:

Source: https://alphaarchitect.com/visualfactors/

We note a few things:

- The two prior peaks were near 12/31/1999 and 12/31/2008

- Current spreads are as high (International) or higher (U.S.) than the past valuation peaks.

- Year-to-date, valuation spreads have not dropped significantly (in the U.S., on EBIT/TEV, it went up!).

These results are similar to AQR’s results.

So, let’s answer the question–How did Momentum investing perform after the previous two valuation peaks?

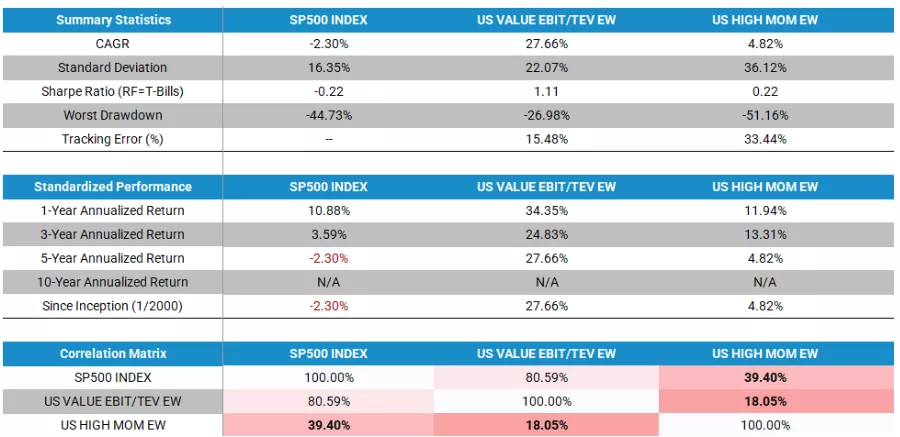

Momentum Investing from 1/1/2000-12/31/2004

We examine both a Momentum and a Value portfolio in the U.S. markets:

- The top decile on EBIT/TEV from our Factor Database (Value).

- The top decile on Momentum (12_2) from our Factor Database (Momentum).

The starting universe in either the U.S. or international markets is the 1,500 largest stocks in each market. So the top decile is a portfolio of ~ 150 mid/large-cap stocks. For the main results, the portfolios are equal-weighted.(2)

Below are the returns against the S&P 500 index. All returns are gross of any fees or transaction costs. Our value portfolios here are equal-weighted.

1/1/2000-12/31/2004 U.S. market:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index. Please see a list of descriptions and a list of disclosures here.

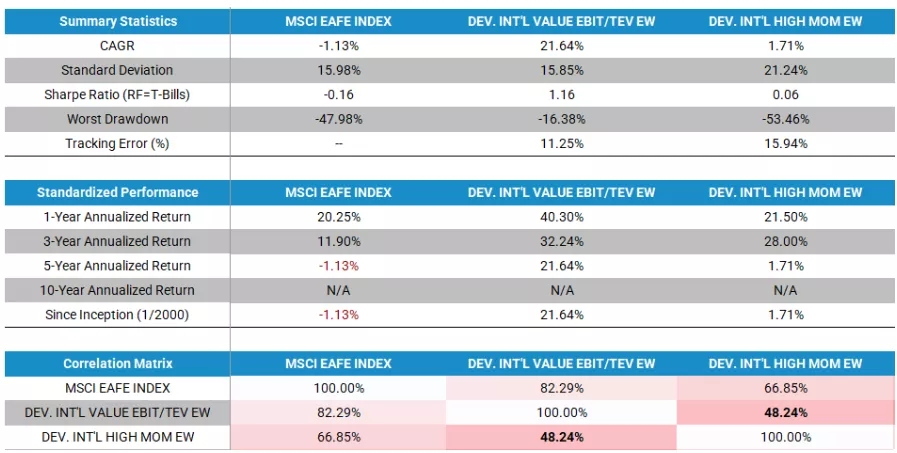

What about International markets?

Below we perform the same exercise against the MSCI EAFE index. All returns are gross of any fees or transaction costs. Our value portfolios here are equal-weighted.

1/1/2000-12/31/2004 developed international markets:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index. Please see a list of descriptions and a list of disclosures here.

In both markets, we find the following results:

- Momentum investing performed better than the market.

- Momentum investing did not perform as well as Value investing.

- Value and Momentum investing had very low correlations over this time period!

Let’s move on to the next valuation peak–12/31/2008.

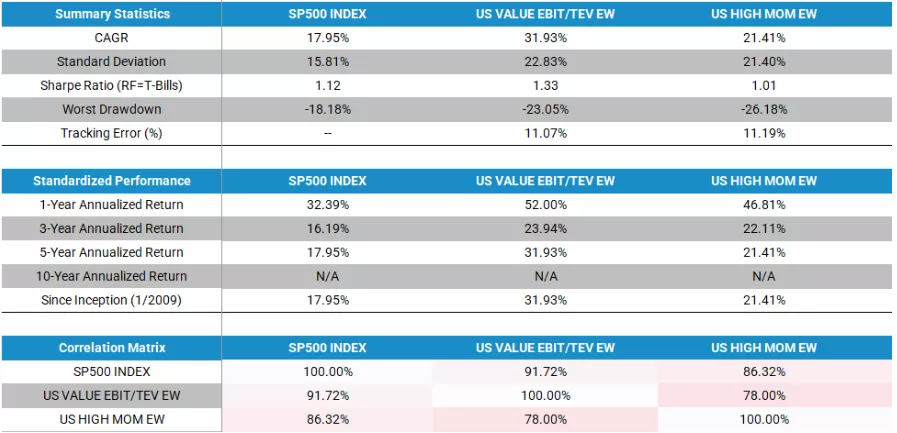

Momentum Investing from 1/1/2009-12/31/2013

We perform the same analysis over a new five-year stretch.

1/1/2009-12/31/2013 U.S. market:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index. Please see a list of descriptions and a list of disclosures here.

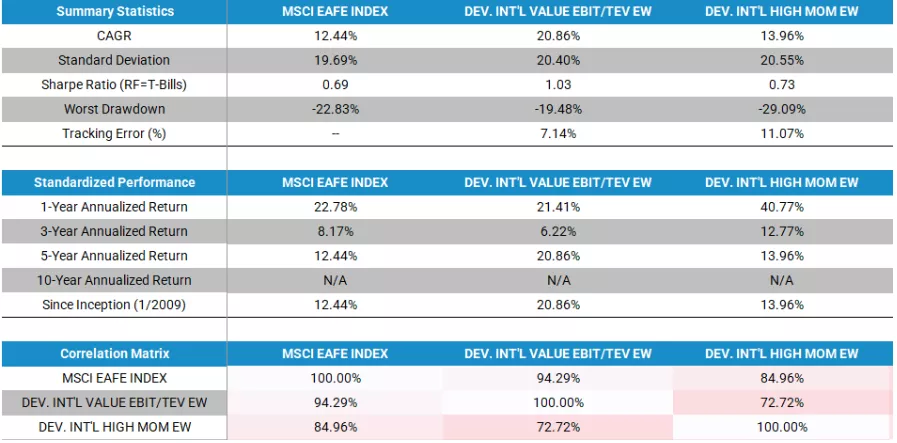

1/1/2009-12/31/2013 developed international markets:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index. Please see a list of descriptions and a list of disclosures here.

In both markets, we find the following results:

- Momentum investing performed better than the market.

- Momentum investing did not perform as well as Value investing.

- Value and Momentum investing had lower correlations than Momentum and the market portfolio.

Conclusions on Momentum Investing and Valuation Peaks

With the caveat that no one can predict the future, this article outlines how Momentum Investing did after the prior two valuation peaks.

As shown above, the five years after valuation peaks were decent times to be a Momentum investor. These results also highlight the portfolio benefits of combining Value and Momentum investing as seen through the low correlations between Value and Momentum portfolios.

1Of course, nothing is guaranteed in the future

More By This Author:

Is Relative Sentiment An Anomaly?

Emerging Market Investing: Does It Make Sense?

Visualizing The Robustness Of The US Equity ETF Market

Jack Vogel, Ph.D., conducts research in empirical asset pricing and behavioral finance, and is a co-author of DIY FINANCIAL ADVISOR: A Simple Solution to Build and Protect Your ...

more