High Dividend 50: NorthWestern Energy Group

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.3%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Not all high-dividend stocks are created equal. Some have secure dividend payouts while others are in questionable financial condition, leaving shareholders vulnerable to a dividend cut in a downturn.

Finding stocks paying high yields is easier to do in certain areas of the economy than others. Utilities are one such sector as these stocks often payout out very generous yields, making them attractive investment options for those looking for income.

NorthWestern Energy Group Inc. (NWE) is currently yielding just over 5%, which is one of the stock’s highest yields in the last 10 years and has raised its dividend for nearly two decades.

NorthWestern is part of our ‘High Dividend 50’ series, where we cover the 50 highest-yielding stocks in the Sure Analysis Research Database. This article will examine the company and stock as a potential investment.

Business Overview

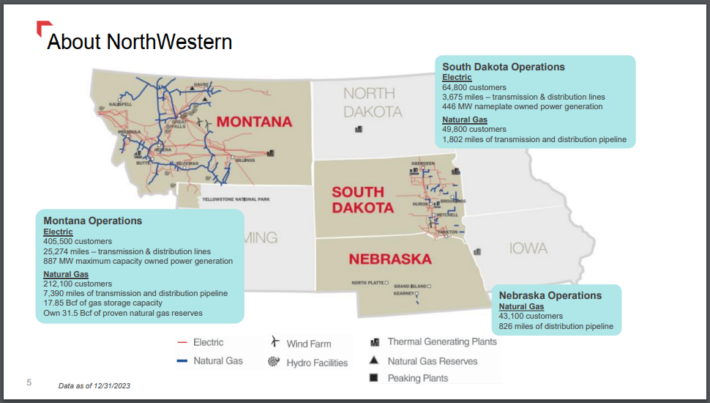

Based in Sioux Falls, South Dakota, NorthWestern is an electricity and gas utility that provides services primarily to Montana and South Dakota. The company also provides natural gas to customers in Nebraska.

NorthWestern is valued at just over $3 billion today.

Source: Investor Relations

NorthWestern has more than 470,000 electric customers and nearly 29,000 miles of transmission and distribution lines.The company also has 305,000 natural gas customers and more than 10,000 miles of pipelines.

NorthWestern reported first quarter earnings results on April 25th, 2024.

The company’s quarterly performance was mixed. Revenue grew 4.6% to $475.3 million and was slightly ahead of what the market had expected. Adjusted earnings-per-share of $1.09 was lower than last year’s $1.13 and was $0.07 below estimates.

Rate bases increases in Montana and South Dakota and gains from electric transmission revenue aided results during the period. However, retail volumes for electric and natural gas were down due to unfavorable weather in Montana and South Dakota. Higher expenses also impacted results.

NorthWestern reaffirmed guidance. Adjusted earnings-per-share are projected to be in a range of $3.42 to $3.62, representing 9.3% growth from 2023 at the midpoint.

Growth Prospects

NorthWestern has struggled to produce growth over the long-term. Earnings-per-share had a compound annual growth rate of just 0.8% annually for the 2014 to 2023 period.

Despite the weak historical track record, management has guided towards earnings-per-share growth of 4% to 6% over the next five years off of the $3.22 that the company earned in 2022.

There are several reasons that growth is projected to be considerably higher going forward than it was over the last decade.

First, rate base increases should play a meaningful role in future results. The company has already seen the benefit of rate increases in its two main areas of operation. These occurred due to the investment that it made in its infrastructure.

NorthWestern has a five-year capital investment plan of $2.5 billion. The company does not expect to have to issue shares to fund the investment plan, instead using cash from operations and secured debt. This is a departure from the past.

Next, the company’s main areas of operation are small population-wise, but they project to have a higher growth rate than the national average over the next five years.

Source: Investor Relations

All three states that the company operates are forecasted to grow above the national average through the end of the decade. Montana, the most important state for the company, should see almost double the average population growth for the country.

This will offer NorthWestern the opportunity to acquire more customers, something it has been more successful at than most utilities. Furthermore, the company’s customer base has an unemployment rate below that of the country as a whole, meaning that utility bills are likely to be paid.

Lastly, NorthWestern has dramatically changed its energy generation fleet. While the company had long relied on coal for the majority of its power production, that has now shifted to renewable energy. Approximately 55% of total combined power generation comes from wind, solar, and hydroelectric sources.

One area of concern is the company’s net debt on its balance sheet, which totaled $2.76 billion as of the most recent quarter. Considering the market capitalization of the company, this is a considerable amount of debt.

Higher interest rates also mean that servicing that debt has become more expensive. NorthWestern has stated that its completed its debt financing needed for 2024, so the total should be stable for the remainder of the year.

Despite this, we believe that the company’s tailwinds should enable NorthWestern to grow its earnings-per-share at 6% per year through 2029, which is the high-end of the company’s projection range.

Competitive Advantages & Recession Performance

Utility companies often act as near monopolies in the areas that they operate. Coupled with the ability to recoup investment capital through rate base increases, these companies typically produce steady earnings growth.

As seen above, this has not always been the case for NorthWestern, though the company does have several positive factors working in its favor that could mean solid gains in the coming years.

NorthWestern has proven to perform quite well under adverse economic conditions. The company produced strong results during the last major economic downturn, the Great Recession of 2007 to 2009.

- 2007 earnings-per-share: $1.45

- 2008 earnings-per-share: $1.78 (23% increase)

- 2009 earnings-per-share: $2.03 (14% increase)

NorthWestern had double-digit earnings growth both years during the worst of this period. The company did see earnings decline more than 13% in 2020 during the worst of the Covid-19 pandemic, but results quickly rebounded to establish a new high for earnings-per-share the very next year.

The company’s results during this difficult periods speaks to the overall strength of its business and the continued demand for services.

Dividend Analysis

NorthWestern’s earnings growth has been lackluster in the past, but the dividend has grown at almost 5% annually since the end of the Great Recession.

Source: Investor Relations

The company’s dividend growth streak is 19 years, though the size of the annual raise has slowed recently as earnings growth has stagnated. For example, investors received just a 1.6% increase earlier this year.

Smaller dividend raises are likely to be the case until the payout ratio returns to NorthWestern’s targeted range of 60% to 70%. For context, the company’s expected payout ratio if 74% for 2024, so we project that earnings growth will outpace dividend growth in the near-term.

Offsetting this weak growth rate is the stock’s current yield of 5.1%. NorthWestern’s average dividend yield since 2014 has been the in low 3.0% to low 4.0% range, so today’s yield is considerably higher than usual.

We find that the dividend is likely safe as the company has guided towards mid-single-digit earnings growth moving forward and the payout ratio is edging closer to the targeted range.

Final Thoughts

Utility companies are often owned for their steady growth and generous yields. Earnings have not moved all that much over the long-term, but NorthWestern has multiple levers it can pull to generate growth above what it has historically produced.

NorthWestern also yields close to four times the average yield of the S&P 500 Index and has a dividend that we believe is safe. Therefore, we rate shares of the company as a buy for income investors looking for exposure from the utility sector.

More By This Author:

High Dividend 50: Truist Financial Corporation

3 Dividend Kings Yielding Over 3%

High Dividend 50: Wesbanco, Inc.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more