High Dividend 50: Ethan Allen Interiors, Inc.

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Ethan Allen Interiors, Inc. (ETD).

With a current dividend yield of 5.8%, Ethan Allen Interiors is part of our ‘High Dividend 50’ series, where we cover the 50 highest-yielding stocks in the Sure Analysis Research Database.

Business Overview

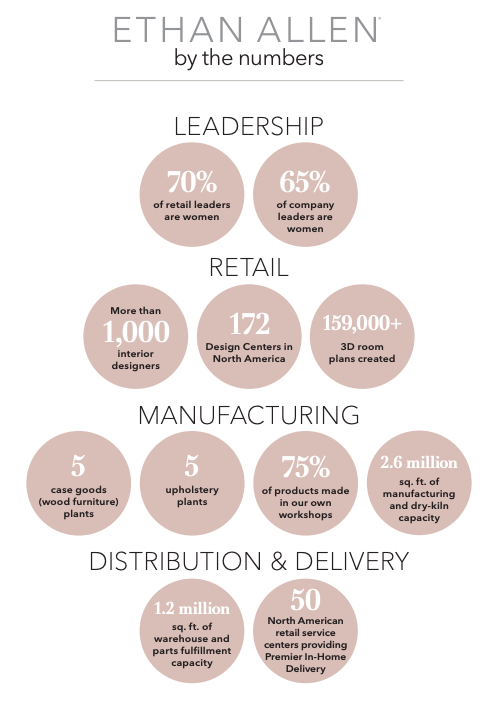

Ethan Allen Interiors is a prominent American furniture company renowned for its classic and contemporary home furnishings and interior design services.

Established in 1932, the company operates a network of design centers across the United States, Canada, and a few international locations, enabling it to offer a personalized and comprehensive approach to home decorating.

Its product line spans furniture, upholstery, accessories, and custom window treatments, all crafted with a focus on quality, craftsmanship, and timeless style. Ethan Allen maintains a distinctive presence in the high-end furniture market by blending traditional techniques with modern innovations.

The company emphasizes a vertically integrated business model, which includes in-house design, manufacturing, and retail distribution. This approach allows Ethan Allen to maintain strict quality control and ensure consistency across its product offerings.

Source: Investor Relations

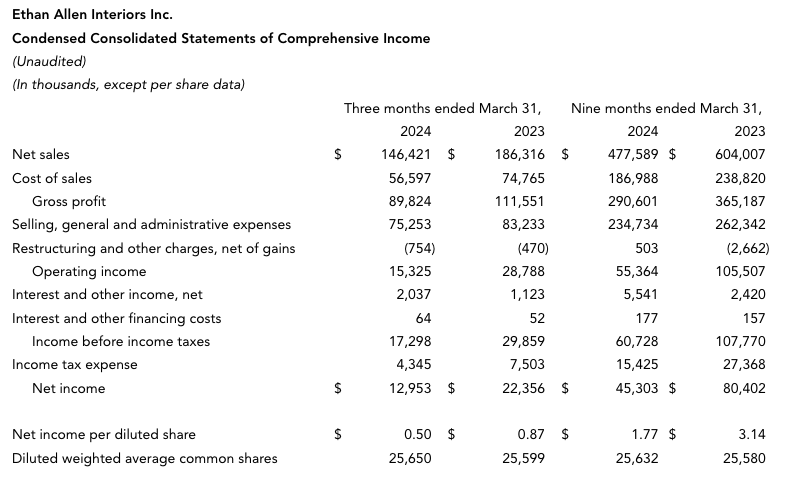

In the fiscal 2024 third quarter, Ethan Allen Interiors Inc. reported consolidated net sales of $146.4 million, marking a 21.4% decrease from the previous year.

Retail net sales dropped by 18.8% to $122.6 million, while wholesale net sales fell by 21.3% to $89.8 million. The company’s retail and wholesale written orders also saw declines of 8.6% and 14.6%, respectively.

Despite these decreases, the consolidated gross margin improved by 140 basis points to 61.3%, attributed to a change in sales mix, lower manufacturing input costs, and reduced headcount, though offset partially by lower unit volumes and higher sales of designer floor samples.

The operating margin stood at 10.5%, with an adjusted operating margin of 10.0%, down from 15.2% the previous year due to fixed cost deleveraging from lower sales.

Source: Investor Relations

Ethan Allen’s diluted EPS for the quarter was $0.50, compared to $0.87 last year, with adjusted diluted EPS at $0.48. It ended the quarter with $181.1 million in cash and investments, maintaining a debt-free position.

It also generated $23.7 million in cash from operating activities, down from $33.4 million a year ago. Inventory levels were reduced by 4.7% to $144.5 million, and the total employee count decreased by 9.6% from the previous year.

Growth Prospects

Ethan Allen Interiors has several growth prospects to capitalize on its market opportunities.

First, the company’s commitment to expanding its digital presence and enhancing its e-commerce capabilities aligns with the growing trend of online shopping.

By investing in technology and digital marketing, Ethan Allen can reach a broader audience and provide a seamless online shopping experience, which is increasingly important in the current retail landscape.

Additionally, Ethan Allen’s focus on sustainability and environmentally friendly practices presents a significant growth opportunity.

Moreover, by leveraging its vertically integrated business model, Ethan Allen can maintain high quality and control over its products, ensuring a strong value proposition.

Expanding its product lines and introducing new, innovative designs that cater to contemporary tastes while maintaining its traditional craftsmanship could further enhance its market appeal and drive future growth.

Overall, we expect the company to grow its annual earnings-per-share by 4% per year over the next five years.

Competitive Advantages & Recession Performance

Ethan Allen Interiors Inc. boasts several competitive advantages in the high-end furniture market. Its vertically integrated business model, encompassing in-house design, manufacturing, and retail distribution, ensures stringent product quality control and consistency.

This model also allows for efficient cost management and quicker response times to market trends. The company’s extensive network of design centers offers personalized interior design services, enhancing customer loyalty and satisfaction.

During economic downturns, Ethan Allen Interiors Inc. has demonstrated resilience, albeit with some impact on sales and profitability.

The company performed poorly during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $2.12

- 2009 earnings-per-share: $-(0.30)

- 2010 earnings-per-share: $-(0.20)

ETD reported net losses during the worst of the recession, although the company bounced back quickly. Its business model clearly suffers during recessions, but recovers during economic expansions.

Furthermore, the company’s strong cash position and debt-free balance sheet provide financial stability and flexibility, enabling it to navigate economic challenges more effectively and emerge stronger post-recession.

Dividend Analysis

Ethan Allen Interiors, Inc.’s annual dividend is $1.56 per share. At $27.12, Ethan Allen Interiors, Inc. has a high yield of 5.8%.

Given Ethan Allen Interiors, Inc.’s outlook for 2024, EPS is expected to be $2.80. As a result, the company is expected to pay out roughly 56% of its EPS to shareholders in dividends.

The dividend appears sustainable, and we estimate the company will grow it at a 2% rate going forward. The 5.8% dividend yield is desirable for investors focusing primarily on income.

Final Thoughts

Ethan Allen is an established name-brand business that sells high-quality furniture. Investors should always be aware of the company’s high vulnerability to recessions.

The economy has slowed down lately due to the aggressive interest rate hikes implemented by the Fed, which is doing its best to lower inflation to its long-term target of around 2%.

Still, the dividend payout appears sustainable at the current EPS level, meaning ETD is an attractive dividend stock for income investors.

More By This Author:

High Dividend 50: Franklin Resources, Inc.

High Dividend 50: Southside Bancshares Inc.

High Dividend 50: Comerica Inc.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more