High Dividend 50: Comerica Inc.

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Comerica Inc. (CMA).

Business Overview

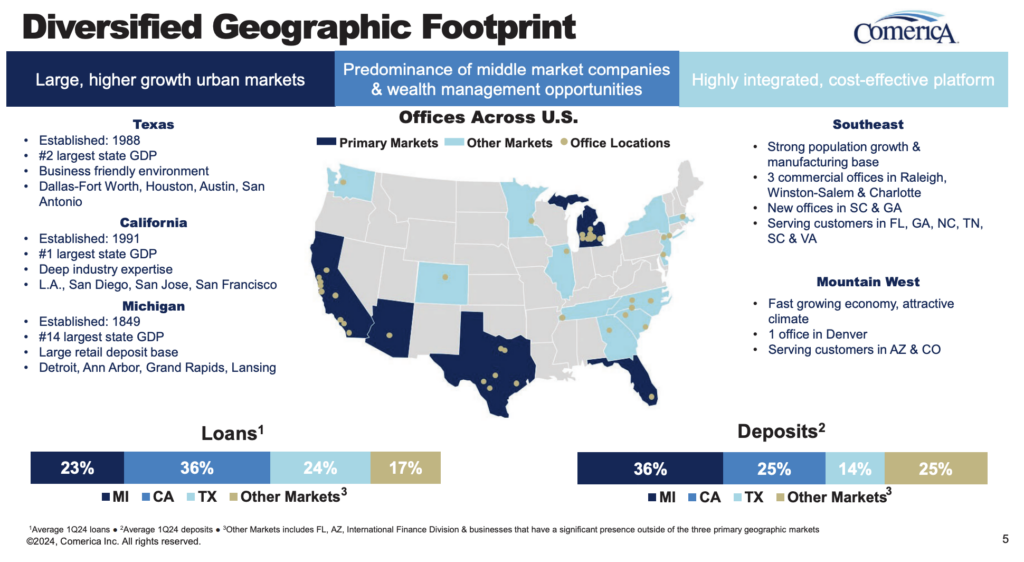

Comerica Inc., a financial services company headquartered in Dallas, Texas, operates primarily within the United States but also extends its reach to Canada and Mexico.

Founded in 1849, the company has grown from a regional bank into a diversified financial services firm, providing a range of commercial, retail, and wealth management services.

Its primary markets are Texas, Arizona, California, Florida, and Michigan, and it operates through three main business segments: The Business Bank, The Retail Bank, and Wealth Management.

These segments offer a variety of services, including commercial loans, personal banking products, and investment management, catering to businesses, individuals, and high-net-worth clients.

(Click on image to enlarge)

Source: Investor Presentation

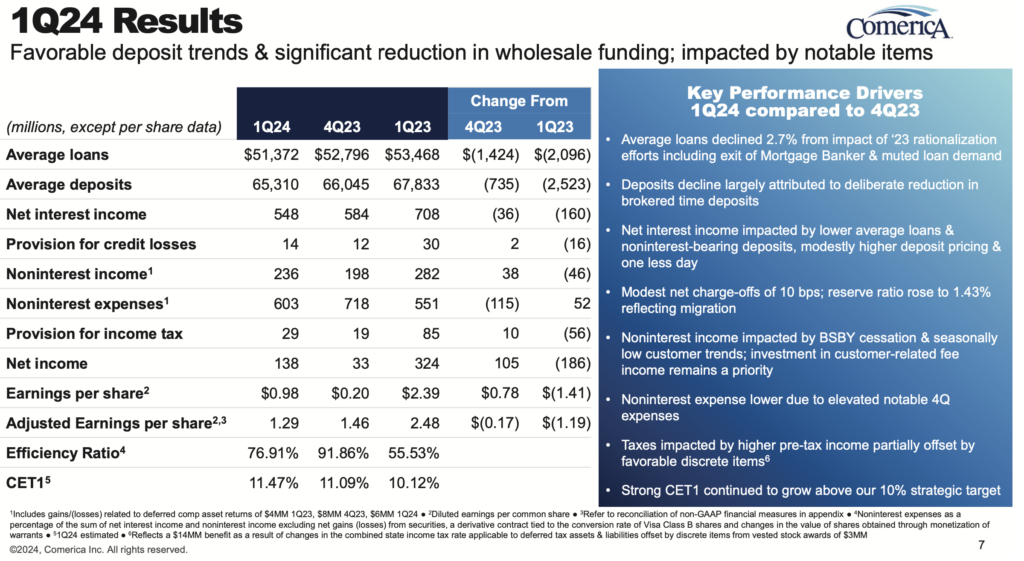

In Q1 2024, Comerica Inc. reported net interest income of $548 million, down from $584 million in Q4 2023 and $708 million in Q1 2023.

Non-interest income was $236 million, up from $198 million last quarter but below $282 million a year ago. Net income improved to $138 million from $33 million last quarter, but down from $324 million a year ago, with earnings per share at $0.98 compared to $0.20 and $2.39, respectively.

Average loans were $51,372 million, down from $52,796 million last quarter and $53,468 million a year ago. Average deposits fell to $65,310 million from $66,045 million and $67,833 million, respectively. Return on assets was 0.66%, up from 0.15% but down from 1.54%. Return on equity was 9.33%, up from 2.17% but down from 24.20%.

The net interest margin dropped to 2.80% from 2.91% and 3.57%. The efficiency ratio improved to 76.91% from 91.86% but worsened from 55.53%. The estimated common equity Tier 1 capital ratio rose to 11.47% from 11.09%, and the Tier 1 capital ratio increased to 12.01% from 11.60%.

(Click on image to enlarge)

Source: Investor Presentation

Growth Prospects

Comerica Inc. has strong growth prospects driven by its investments in digital transformation and market expansion. Enhancing online and mobile banking capabilities, along with leveraging data analytics, aims to attract tech-savvy customers and improve efficiency.

Additionally, the company’s focus on expanding its footprint in primary and new markets, combined with strategic acquisitions, is set to increase its market share.

Comerica’s commercial banking expertise positions it well to benefit from economic growth, while its wealth management services cater to the increasing demand from high-net-worth clients.

Operational efficiency improvements are a key growth driver, enabling Comerica to reduce costs and reinvest savings into growth initiatives. An improving economic environment can further boost lending activity and interest income.

Moreover, Comerica’s commitment to corporate social responsibility and sustainability enhances its brand reputation and customer loyalty, supporting long-term growth.

Despite economic and regulatory challenges, Comerica’s proactive strategies and solid market position ensure it is well-equipped to capitalize on emerging opportunities in the financial services industry.

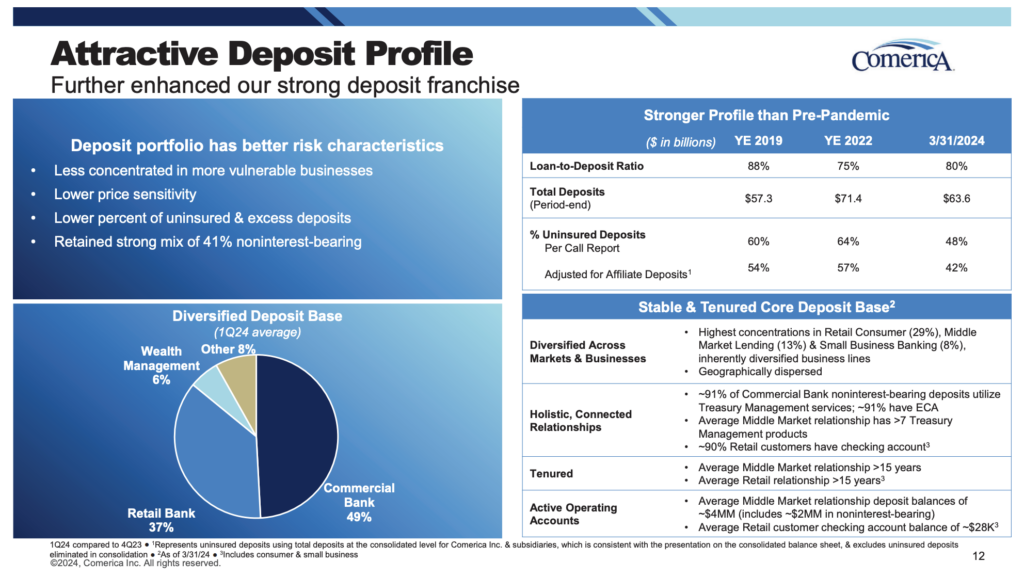

(Click on image to enlarge)

Source: Investor Presentation

Competitive Advantages & Recession Performance

Comerica Inc. boasts several competitive advantages, including its strong focus on commercial banking and deep relationships with small and mid-sized businesses.

Its expertise in providing tailored financial solutions and a comprehensive suite of services, such as loans, lines of credit, and cash management, positions it as a preferred partner for businesses.

Additionally, Comerica’s investment in digital transformation enhances customer experience and operational efficiency, allowing it to stay competitive in the rapidly evolving financial landscape. Its wealth management segment further differentiates it by offering specialized services to high-net-worth individuals and institutions.

During recessions, Comerica’s performance can be challenged by reduced loan demand and potential increases in credit losses. However, its diversified revenue streams, including noninterest income from fees and service charges, provide some resilience.

The company’s strong capital ratios and prudent risk management practices also help mitigate the impact of economic downturns.

Historically, Comerica has demonstrated an ability to adapt to challenging environments by maintaining a strong balance sheet and focusing on operational efficiency, which supports its stability and long-term performance even during economic downturns.

The company performed poorly during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $1.41

- 2009 earnings-per-share: $(0.80)

- 2010 earnings-per-share: $0.88

Dividend Analysis

Comerica Inc.’s current annual dividend is $2.84 per share. At $47.14, Comerica has a high yield of 6.02%.

Given Comerica’s outlook for 2024, EPS is expected to be $5.25. As a result, the company is expected to pay out roughly 57% of its EPS to shareholders in dividends.

The dividend appears to be sustainable, and we estimate the company will not grow the dividend as it has not increased its dividend since 2020.

The 6.0% dividend yield is desirable for investors who focus primarily on income.

Final Thoughts

Shares of Comerica have declined by 16% year-to-date, which compares unfavorably to the gain of the S&P 500 Index.

The high 6.0% dividend yield and the 5.0% earnings-per-share growth give the company a total return potential of over 10% per year. As a result, CMA has a buy rating and appears to have a sustainable dividend payout.

More By This Author:

High Dividend 50: Clearway Energy Inc.

High Dividend 50: UGI Corporation

High Dividend 50: Ames National Corporation

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more